Speak directly to the analyst to clarify any post sales queries you may have.

A concise orientation to the evolving dermal filler sector highlighting convergence of material science, clinician standards, and patient expectations

The dermal filler landscape sits at the intersection of aesthetic innovation, minimally invasive medical practice, and evolving patient expectations. Recent years have seen rapid advancement in biomaterials, injection techniques, and clinical protocols, all of which have reshaped practitioner decision-making and consumer preferences. Clinicians increasingly emphasize safety profiles, reversibility where applicable, and longer-lasting outcomes, while patients prioritize natural-looking results, reduced downtime, and treatments that align with holistic wellness trends.Consequently, market participants must balance scientific rigor with clear communication, ensuring that product claims are supported by peer-reviewed evidence and real-world performance data. Regulatory scrutiny and professional society guidance have heightened the importance of post-market surveillance and clinician training. As a result, companies that invest in education, transparent clinical data, and robust supply chain resilience are positioned to build trust with both providers and patients, reinforcing long-term brand credibility and clinical adoption.

How material innovations, procedural refinements, and evolving consumer expectations are redefining competitive advantage in the dermal filler arena

The dermal filler environment is undergoing transformative shifts driven by material innovation, procedural refinement, and a broader move toward personalized aesthetics. Biomaterials research has expanded the palette available to clinicians, with novel biodegradable polymers and refined cross-linking technologies enabling diverse rheological profiles that better match anatomical targets. Simultaneously, injection technique has advanced, as practitioners adopt cannula-based approaches and precision volumization strategies to reduce adverse events and enhance predictability.These technological and clinical shifts coincide with changing consumer behavior: patients increasingly seek subtle, age-appropriate enhancements rather than dramatic alteration. Digital tools such as 3D imaging and outcome simulators are improving consultation quality and informed consent. Regulatory emphasis on clinician competency and product traceability has encouraged manufacturers to prioritize training programs and supply chain transparency. Taken together, these dynamics are reshaping competitive positioning and creating opportunities for differentiated value propositions anchored in safety, education, and evidence-based outcomes.

How recent United States tariff policy adjustments in 2025 reshaped supply decisions, sourcing strategies, and clinical procurement behaviors across the dermal filler value chain

The introduction of new tariff measures by the United States in 2025 has exerted a multifaceted influence on the dermal filler supply chain, procurement strategies, and commercial behavior. Tariff adjustments increased landed costs for certain imported components and finished products, prompting manufacturers and distributors to reassess sourcing footprints and inventory strategies. In response, several stakeholders accelerated diversification of supplier bases and increased nearshoring efforts to mitigate exposure to import duty volatility and shipping delays.Beyond direct cost implications, tariffs intensified focus on contractual terms and inventory management practices. Clinicians and purchasing entities prioritized reliable supply over marginal price gains, resulting in longer-term agreements and strategic stockholding. Manufacturers responded by optimizing packaging and shipment consolidation to reduce per-unit duty impact, and by pursuing tariff classifications that more accurately reflect component origin and processing to limit duty liabilities.

Furthermore, tariff-driven cost pressures highlighted the importance of clinical differentiation as a means to sustain pricing power. Companies that reinforced clinician training, demonstrated superior safety data, and offered bundled services such as starter kits and practice support were better able to maintain value-based pricing while absorbing part of the incremental cost. Finally, the policy shift accelerated conversations around regulatory alignment and trade policy advocacy, as industry groups sought clearer guidance and harmonized classification standards to reduce future supply disruptions.

Comprehensive segmentation-driven insights that map product materials, procedural modalities, applications, channels, and end users into actionable commercialization pathways

Key segmentation insights reveal how product attributes, delivery modalities, clinical indications, application areas, distribution methods, and end user settings each influence adoption pathways and provider selection criteria. Based on product type, the market differentiates between biodegradable options such as Calcium Hydroxylapatite, Hyaluronic Acid, Poly-L-Lactic Acid, and Polycaprolactone, and non-biodegradable options exemplified by Polymethylmethacrylate; this distinction drives not only clinical choice but also inventory rotation and long-term patient planning. Based on injection instrument, the procedural debate between cannula and needle techniques affects perceived safety, bruising risk, and recovery time, which in turn shapes training priorities and messaging for both practitioners and patients.Based on procedure type, aesthetic treatments prioritize natural contouring and rejuvenation, whereas reconstructive and medical procedures emphasize functional restoration and scar management, creating separate pathways for reimbursement considerations and clinical evidence generation. Based on application, anatomical targets range from cheek and midface augmentation, chin and jawline contouring, facial lines and wrinkles including crow's feet, forehead lines, glabellar lines, marionette lines, nasolabial folds, and perioral lines, to hand rejuvenation, lip enhancement with border definition, hydration and volume objectives, nose reshaping, scar revision addressing acne and atrophic scars, tear trough correction, and temple augmentation; the diversity of these applications necessitates tailored rheological profiles, injection depth protocols, and aftercare guidance.

Based on distribution channel, the contrast between offline sales and online sales shapes procurement convenience and the role of direct-to-practice education. Finally, based on end user, the landscape encompasses dental clinics, dermatology clinics, hospitals, medical spas and aesthetic clinics, and plastic surgery centers, each bringing distinct purchasing cycles, clinical competencies, and patient demographics. By integrating these segmentation lenses, suppliers can better align product design, clinical training programs, and commercial models to meet differentiated needs across the continuum of care.

Regional demand patterns, regulatory diversity, and practice norms across the Americas, Europe Middle East & Africa, and Asia-Pacific that inform tailored go-to-market strategies

Regional dynamics continue to shape strategic priorities as demand drivers, regulatory regimes, and clinical practice norms vary across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, established clinical infrastructures and high patient awareness support premium product positioning and a strong emphasis on clinician-led education and safety protocols. Reimbursement variability and aesthetic culture differences across markets mean that tailored messaging and localized training partnerships are essential for penetration beyond major metropolitan centers.The Europe Middle East & Africa region demonstrates a heterogeneous regulatory environment with varying standards for device and injectable oversight, necessitating rigorous clinical documentation and flexible regulatory strategies. Long-standing professional societies and cross-border thought leadership conferences provide platforms for clinician education and for building reputable evidence bases. In contrast, the Asia-Pacific region exhibits rapid procedural uptake, a younger demographic driving demand for preventive aesthetics, and agile distribution channels that favor both clinical and boutique aesthetic settings. Across all regions, logistical resilience, localized training, and culturally attuned marketing significantly influence adoption patterns, while cross-regional collaboration around safety standards and post-market surveillance continues to gain importance.

How leading companies leverage clinical evidence generation, clinician engagement, and supply chain excellence to establish durable competitive advantage in dermal fillers

Competitive dynamics center on technological differentiation, clinician engagement, and post-market support services. Leading companies invest in product portfolios that span diverse rheological properties and indications, coupled with structured training academies to drive correct technique adoption and reduce complication rates. Strategic alliances with distributor networks and key opinion leaders amplify market education and build clinical credibility, while partnerships with academic centers bolster peer-reviewed evidence and facilitate real-world outcome studies.Operational excellence also emerges as a differentiator: firms that demonstrate supply chain transparency, robust quality systems, and responsive logistics command greater trust from institutional purchasers and high-volume providers. In addition, companies that integrate digital tools-such as patient education platforms, virtual consultation aids, and outcome monitoring systems-enhance customer experience and create recurring engagement opportunities. Finally, corporate strategies that combine targeted clinical evidence generation, flexible commercial models, and investment in clinician support enable sustained penetration across both aesthetic and reconstructive segments.

Actionable strategic playbook for market leaders to align product innovation, clinician training, and supply chain resilience for sustained commercial success

Industry leaders should prioritize an integrated approach that combines product differentiation, clinician education, and supply chain robustness to capture durable clinical and commercial value. First, invest in developing and communicating distinct material profiles that align rheology with specific anatomical targets and long-term outcome expectations, thereby reducing off-label use and enhancing clinical predictability. Second, implement comprehensive training programs that cover cannula and needle techniques, complication management, and informed consent to raise procedural standards and patient safety.Third, strengthen supplier diversification and nearshoring where feasible to mitigate tariff and shipping risk, while negotiating flexible contractual terms with distributors to ensure continuity of supply. Fourth, expand digital engagement tools that support pre-procedure simulation, post-procedure follow-up, and outcomes tracking to improve patient satisfaction and provide real-world evidence to clinicians and payers. Finally, pursue collaborative research with academic partners and professional societies to generate comparative effectiveness data and to support jurisdictional regulatory requirements, thereby reinforcing clinical trust and enabling premium positioning.

A rigorous mixed-methods research design combining clinical evidence review, expert consultations, and supply chain analysis to ensure practical and validated insights

The research methodology underpinning these insights integrates qualitative expert interviews, clinical literature review, healthcare policy analysis, and supply chain evaluation to create a multidimensional view of the dermal filler landscape. Expert interviews included practicing clinicians across dermatology, plastic surgery, and dental aesthetic practices, as well as regulatory specialists and supply chain managers, furnishing practical perspectives on procedural trends, material preferences, and procurement challenges. A systematic review of peer-reviewed clinical studies and consensus statements provided evidence for safety profiles, technique recommendations, and indication-specific outcomes, while regulatory documents informed jurisdictional differences and compliance considerations.Supply chain assessment incorporated import-export data, tariff schedules, and logistics lead-time analysis to understand sourcing vulnerabilities and mitigation strategies. Finally, triangulation across data sources and iterative validation with clinical experts ensured that thematic findings resonated with frontline experience and operational realities. This mixed-methods approach balances clinical rigor with commercial applicability, delivering insights that are both evidence-based and actionable for strategy development.

Strategic synthesis of clinical, commercial, and operational imperatives that defines the next phase of sustainable growth and safety in dermal fillers

In conclusion, the dermal filler sector is maturing into a more sophisticated, safety-focused, and clinically nuanced market where material science, procedural skill, and supply resilience define differentiation. Companies that align product development with clear clinical indications, invest in comprehensive clinician training, and build adaptive supply chains will be better positioned to navigate regulatory complexity and policy-driven cost pressures. Meanwhile, the clinical community benefits from improved tools and techniques that enable predictable, patient-centered outcomes across aesthetic and reconstructive use cases.Looking forward, collaboration among manufacturers, clinicians, and regulators will remain essential to sustain innovation while ensuring patient safety. By grounding commercial strategies in robust clinical evidence and operational excellence, stakeholders can translate evolving technical capabilities into scalable, trusted solutions that meet the diverse needs of providers and patients.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Biodegradable

- Calcium Hydroxylapatite

- Fat fillers

- Hyaluronic Acid

- Poly-L-Lactic Acid

- Polycaprolactone

- Non-Biodegradable

- Polyacrylamide Hydrogel

- Polymethyl Methacrylate

- Biodegradable

- Procedure Type

- Aesthetic

- Reconstructive / Medical

- Category

- Branded

- Generic

- Treatment Frequency

- Maintenance Touch-Ups

- Series Of Sessions

- Single Session

- Indication

- Facial Contouring / Definition

- Lip Augmentation

- Scar Correction

- Skin Quality / Hydration

- Volume Restoration

- Wrinkle Correction

- End User

- Dermatology Clinics

- Hospitals

- Medical Spas / Aesthetic Clinics

- Plastic Surgery Centers

- Distribution Channel

- Offline Sales

- Online Sales

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- AbbVie Inc.

- Galderma S.A.

- Adoderm GmbH

- Beijing IMEIK Technology Development Co., Ltd.

- Bio Plus Co., Ltd.

- BioScience GmbH

- Bioxis Pharmaceuticals SAS

- BMI KOREA CO., LTD.

- Bohus BioTech AB

- Croma-Pharma GmbH

- Daewoong Pharmaceutical Co., Ltd.

- Dr. Korman Laboratories Ltd.

- Evolus, Inc.

- HUGEL, Inc.

- KORU Pharma Co., LTD.

- Laboratoires VIVACY SAS

- Laboratories Hyamed SA

- LG Chem, Ltd.

- Medytox Inc.

- Merz Pharma GmbH & Co. KGaA

- Prollenium Medical Technologies Inc.

- Revance Therapeutics, Inc by Crown Laboratories, Inc.,

- Shandong Urway Biotechnology Co., Ltd.

- Sinclair Pharma Limited

- SYMATESE GROUP

- TEOXANE SA

- Tiger Aesthetics Medical, LLC

- Zimmer MedizinSysteme GmbH

- ZK MediGroup Co. LTD

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Dermal Filler market report include:- AbbVie Inc.

- Galderma S.A.

- Adoderm GmbH

- Beijing IMEIK Technology Development Co., Ltd.

- Bio Plus Co., Ltd.

- BioScience GmbH

- Bioxis Pharmaceuticals SAS

- BMI KOREA CO., LTD.

- Bohus BioTech AB

- Croma-Pharma GmbH

- Daewoong Pharmaceutical Co., Ltd.

- Dr. Korman Laboratories Ltd.

- Evolus, Inc.

- HUGEL, Inc.

- KORU Pharma Co., LTD.

- Laboratoires VIVACY SAS

- Laboratories Hyamed SA

- LG Chem, Ltd.

- Medytox Inc.

- Merz Pharma GmbH & Co. KGaA

- Prollenium Medical Technologies Inc.

- Revance Therapeutics, Inc by Crown Laboratories, Inc.,

- Shandong Urway Biotechnology Co., Ltd.

- Sinclair Pharma Limited

- SYMATESE GROUP

- TEOXANE SA

- Tiger Aesthetics Medical, LLC

- Zimmer MedizinSysteme GmbH

- ZK MediGroup Co. LTD

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | November 2025 |

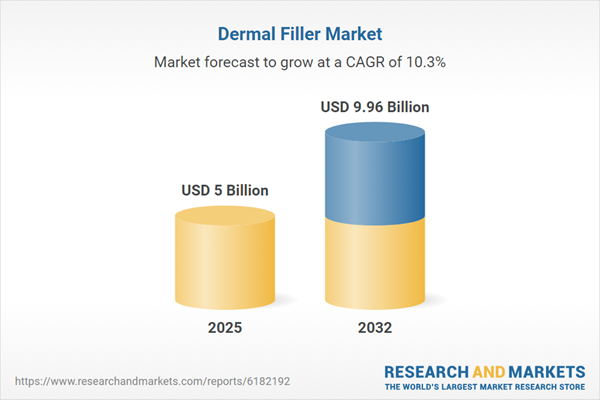

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 5 Billion |

| Forecasted Market Value ( USD | $ 9.96 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |