Speak directly to the analyst to clarify any post sales queries you may have.

A concise orientation to turbocharger technology evolution, regulatory drivers, and strategic supply imperatives shaping OEM and supplier decisions

Turbochargers remain a pivotal propulsion technology that continues to evolve in response to regulatory pressure, efficiency targets, and shifting powertrain architectures. Historically a means to recover exhaust energy and boost engine power density, turbochargers now operate at the intersection of combustion optimization, electrification, and emissions control. As vehicle electrification accelerates, turbo systems are being re-engineered to complement hybridization strategies, reduce transient lag, and enable downsized internal combustion engines to meet stringent pollutant and CO2 regulation.Against this technological backdrop, supply chain resilience and component innovation have become strategic priorities for OEMs and suppliers alike. Material selection, thermal management, and precision manufacturing processes determine durability and performance, while digital controls and calibration strategies increasingly define differentiation. In turn, aftermarket dynamics and industrial applications maintain steady demand for specific turbo types, requiring companies to balance investment across legacy platforms and next-generation solutions.

Transformational technology convergence and commercial restructuring driving the next generation of turbocharger performance, integration, and supplier strategies

Over the past several years, the turbocharger landscape has shifted from incremental hardware improvements toward systemic transformation that blends electrification, advanced materials, and embedded controls. Electrically assisted turbochargers and hybrid-integrated systems are moving from prototype to constrained production as OEMs seek to eliminate low-end torque gaps and reduce transient emissions. Meanwhile, advances in variable geometry mechanisms, lightweight alloys, and additive manufacturing are enabling higher boost pressures, faster spool-up, and longer lifecycle under elevated thermal stress.Concurrently, digitalization has reshaped supplier-OEM relationships. Predictive maintenance enabled by onboard diagnostics, software-driven calibration for multi-fuel strategies, and cloud-based analytics for fleet-level optimization are now important value propositions. These technical trajectories are intersecting with structural market shifts such as supplier consolidation, strategic partnerships between turbo manufacturers and powertrain software firms, and the entrance of new, technologically focused entrants that challenge incumbents on performance and integration capabilities. As a result, established business models are being reevaluated to accommodate service-oriented revenue streams and cross-domain engineering competencies.

How the 2025 tariff environment recalibrated supply networks, procurement strategies, and regionalization priorities across the turbocharger value chain

The cumulative tariff measures implemented in 2025 introduced measurable friction into global procurement and manufacturing strategies for turbocharger components. Tariff coverage that targets imported assemblies, critical raw materials such as specialty steels and aluminum alloys, and certain semiconductor categories has elevated landed costs for some manufacturers and changed sourcing calculus for OEMs. In response, many suppliers accelerated supplier diversification, prioritized local content strategies, and restructured supply contracts to mitigate exposure to duty volatility. These adjustments have also increased the importance of precise tariff classification, origin documentation, and harmonized system (HS) code expertise to minimize unexpected duty liabilities.Beyond direct cost impacts, the tariff environment has amplified strategic behaviors across the value chain. Some OEMs and tier suppliers reprioritized nearshoring or regionalization to reduce lead-time variability and customs complexity, while others engaged in deeper collaboration with logistics partners to optimize bonded warehousing and duty deferral mechanisms. Additionally, the aftermarket and small-volume specialty segments observed asymmetric effects: aftermarket distributors reliant on cross-border parts flows faced higher replenishment costs and longer transit times, whereas some OEMs leveraged long-term supplier relationships to absorb near-term fluctuations. Overall, the tariff episode reinforced that trade policy risk is not merely a cost input but a driver of structural reconfiguration in sourcing, inventory strategy, and supplier selection.

An integrated segmentation analysis explaining how product architecture, fuel applications, and sales channels combine to define differentiated commercial and technical strategies

Segmentation insights reveal where technological innovation and end-use demand intersect to create differentiated opportunities. Based on type, the market encompasses Electric Turbo, Single-Turbo, Twin-Scroll Turbo, Twin-Turbo, Variable Geometry Turbo, and Variable Twin Scroll Turbo configurations, with the Twin-Turbo category further distinguished into Parallel Twin-Turbo and Sequential Twin-Turbo arrangements and the Variable Geometry Turbo subdivided into Moving Wall Variable Geometry Turbocharger, Pivoting Vanes Variable Geometry Turbochargers, and Sliding Ring Variable Geometry Turbocharger variants. This diversity of architectures maps to distinct performance envelopes and integration complexity, so selection depends heavily on thermal requirements, packaging constraints, and transient response targets.Based on fuel type, segmentation differentiates between Diesel and Gasoline applications, each of which has unique calibration, thermal, and emissions control considerations. Based on application, coverage spans Aerospace & Defense, Agricultural Machinery, Automotive, Construction & Mining, Marine, Power Generation, and Railway Engines, and the Automotive segment is further parsed into Commercial Vehicles and Passenger Vehicles, with Commercial Vehicles subdividing into Heavy Commercial Vehicles and Light Commercial Vehicles. These application layers influence design priorities: heavy-duty commercial and marine engines demand long-term reliability and serviceability, whereas passenger and light-commercial contexts prioritize cost, responsiveness, and NVH performance. Based on sales channel, the market is studied across Aftermarket and Original Equipment Manufacturer channels, which differ markedly in lead times, quality expectations, and margin profiles. Taken together, these segmentation vectors clarify how product architecture, fuel platform, end-market dynamics, and channel economics combine to shape R&D focus, production scale, and go-to-market approaches.

A strategic regional assessment revealing how demand patterns, regulatory environments, and manufacturing clusters shape turbocharger adoption across global markets

Regional demand and supply dynamics vary substantially and require tailored strategic responses. The Americas region demonstrates strong adoption of advanced turbocharging solutions in light-vehicle markets and significant aftermarket activity; production hubs and an emphasis on power-density improvements have catalyzed innovation in electrically assisted turbo systems. In contrast, Europe, Middle East & Africa exhibits a pronounced focus on emissions-compliance technologies, with regulatory stringency and diesel heritage driving continued investment in variable geometry systems and precision calibration services. These markets also feature a dense network of engineering centers that accelerate prototype-to-production cycles.Asia-Pacific stands out as a high-volume manufacturing and demand epicenter, with major production clusters in multiple countries supporting both domestic OEMs and global export-oriented supply chains. Rapid urbanization, diverse powertrain adoption across countries, and strong aftermarket ecosystems sustain demand for multiple turbo types. As a result, companies operating across these regions must balance global engineering standards with localized production, adapt to region-specific regulatory trajectories, and optimize logistics footprints to manage cost, lead-time, and tariff exposure effectively.

Competitive landscape and strategic behaviors highlighting how incumbents and innovators align capabilities to capture hardware, software, and lifecycle value

Competitive dynamics reflect a mix of established component manufacturers, specialized niche players, and technology-driven newcomers. Some incumbents leverage scale, long-term OEM contracts, and deep metallurgical expertise to defend position in conventional turbo segments, while newer entrants and spinouts concentrate on electrified turbo concepts, control software, and lightweight manufacturing techniques. Strategic partnerships between component firms and powertrain software providers are becoming increasingly common, enabling faster integration of closed-loop control strategies and predictive maintenance features.Market leaders are also pursuing downstream integration through aftermarket networks, calibration services, and extended warranty offers to capture lifecycle value. At the same time, M&A activity and joint development pacts serve as mechanisms to acquire complementary capabilities, expedite entry into adjacent markets, and secure preferred supplier status with key OEM platforms. For suppliers, investment priorities now frequently include software capabilities, thermal coatings, and advanced bearing systems, supporting both performance differentiation and lifecycle cost reduction.

Actionable strategic priorities for turbocharger suppliers and OEMs that align product innovation, supply resilience, and aftermarket monetization into a coherent roadmap

Industry leaders should prioritize a dual-track investment approach that balances immediate commercial needs with longer-term technological transition. First, accelerate development and validation of electrically assisted turbo technologies and modular platforms that can be adapted across gasoline and diesel powertrains, enabling rapid deployment as hybridization strategies evolve. Complement hardware investment with software and calibration capabilities to provide measurable fuel-economy and emissions benefits, thereby strengthening OEM value propositions.Second, strengthen supply chain resilience through multi-sourcing, local content strategies, and flexible manufacturing cells that permit rapid capacity reallocation. Employ tariff mitigation tools such as origin optimization and bonded inventory management while negotiating long-term agreements that share risk across partners. Finally, expand aftermarket engagement by offering diagnostic-enabled remanufacturing and extended-service packages that monetize field data and enhance customer lifetime value. These combined actions will position firms to capture demand across both legacy and next-generation turbo segments while managing policy and supply chain volatility.

A transparent mixed-methods research framework combining expert primary inputs, technical secondary analysis, and validation processes to deliver robust turbocharger intelligence

The research approach relied on a structured blend of primary and secondary information collection to ensure comprehensive, validated insights. Primary inputs were gathered through in-depth interviews with OEM powertrain engineers, tier-one suppliers, aftermarket distributors, and fleet operators, augmented by expert workshops that explored technology adoption scenarios and supply chain responses to trade policy shifts. These qualitative engagements were designed to capture real-world implementation challenges, calibration constraints, and commercial negotiation dynamics that are not visible in public filings alone.Secondary investigation encompassed technical literature, patent filings, regulatory announcements, customs and shipping data, and publicly available financial disclosures to map manufacturing footprints and trade flows. Data triangulation was employed to reconcile differing viewpoints, and sensitivity analyses were applied to assess how alternations in tariffs, material prices, or regulatory timelines would plausibly affect supplier strategies. Finally, findings were subjected to peer review by independent technical advisors to ensure analytic rigor and to reduce bias in interpretation.

A strategic synthesis emphasizing how technological integration, supply resilience, and service monetization will determine competitive advantage in turbocharging

In sum, the turbocharger landscape is in transition: technological advances in electrification and control are converging with policy-driven imperatives and evolving trade realities to reshape how suppliers and OEMs prioritize investment. Companies that excel will do so by integrating hardware innovation with software controls, by managing supply chain complexity proactively, and by aligning product roadmaps to the nuanced demands of distinct end-use segments. Rapid adaptation will be especially important as tariff regimes and regional manufacturing incentives continue to influence sourcing calculus.Looking forward, success will hinge on an organization's ability to couple technical excellence with commercial agility. Those that can modularize product platforms, secure resilient and cost-effective supply chains, and monetize lifecycle services through diagnostics and aftermarket offerings will be best positioned to capture value across the full spectrum of turbocharger applications.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Type

- Electric Turbo

- Single-Turbo

- Twin-Scroll Turbo

- Twin-Turbo

- Parallel Twin-Turbo

- Sequential Twin-Turbo

- Variable Geometry Turbo

- Moving Wall Variable Geometry Turbocharger

- Pivoting Vanes Variable Geometry Turbochargers

- Sliding Ring Variable Geometry Turbocharger

- Variable Twin Scroll Turbo

- Fuel Type

- Diesel

- Gasoline

- Application

- Aerospace & Defense

- Agricultural Machinery

- Automotive

- Commercial Vehicles

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

- Commercial Vehicles

- Construction & Mining

- Marine

- Power Generation

- Railway Engines

- Sales Channel

- Aftermarket

- Original Equipment Manufacturer (OEM)

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- ABB Ltd.

- BMTS Technology GmbH & Co. KG

- BorgWarner, Inc.

- CARDONE Industries, Inc.

- Cloyes Gear & Products, Inc.

- Continental AG

- Cummins Inc.

- Eaton Corporation PLC

- GARRETT MOTION INC.

- Hartzell Engine Technologies LLC

- Honeywell International Inc.

- IHI Corporation

- Kawasaki Heavy Industries Ltd.

- Keyyang Precision Co., Ltd.

- MAHLE GmbH

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- MTU Friedrichshafen

- Ningbo Motor Industrial Co. Ltd.

- Nissens Automotive A/S

- Robert Bosch GmbH

- Toyota Motor Corporation

- Turbosmart Pty Ltd

- Wabtec Corporation

- Weichai Power Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Turbochargers market report include:- ABB Ltd.

- BMTS Technology GmbH & Co. KG

- BorgWarner, Inc.

- CARDONE Industries, Inc.

- Cloyes Gear & Products, Inc.

- Continental AG

- Cummins Inc.

- Eaton Corporation PLC

- GARRETT MOTION INC.

- Hartzell Engine Technologies LLC

- Honeywell International Inc.

- IHI Corporation

- Kawasaki Heavy Industries Ltd.

- Keyyang Precision Co., Ltd.

- MAHLE GmbH

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- MTU Friedrichshafen

- Ningbo Motor Industrial Co. Ltd.

- Nissens Automotive A/S

- Robert Bosch GmbH

- Toyota Motor Corporation

- Turbosmart Pty Ltd

- Wabtec Corporation

- Weichai Power Co., Ltd.

Table Information

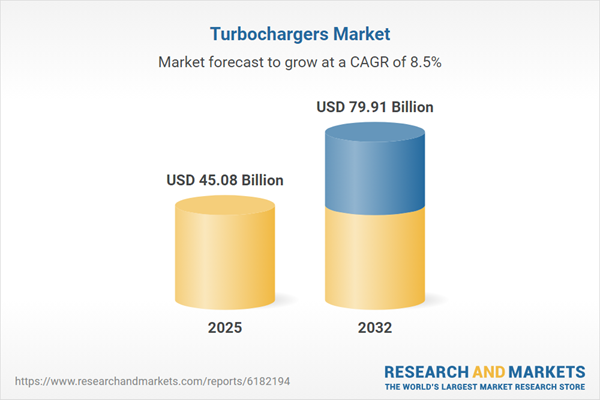

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 45.08 Billion |

| Forecasted Market Value ( USD | $ 79.91 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |