Speak directly to the analyst to clarify any post sales queries you may have.

A comprehensive introduction explaining how LiDAR simulation evolved into a mission-critical capability that shortens validation cycles and strengthens cross-disciplinary engineering workflows

LiDAR simulation has moved beyond a niche engineering tool to become a core capability for organizations developing perception systems, autonomous platforms, and smart infrastructure. The convergence of high-fidelity sensor models, physics-based rendering, and scalable compute environments has enabled earlier verification cycles, reduced reliance on costly field trials, and accelerated software-in-the-loop and hardware-in-the-loop integration. As a result, engineering teams are reorienting workflows so that virtual testing and synthetic-data generation form the backbone of validation pipelines.Transitioning from concept to deployment, simulation environments now serve multiple stakeholders simultaneously: sensor designers refine optical and timing characteristics; system integrators validate multi-sensor fusion under edge-case scenarios; and safety engineers quantify behavior in conditions that would be impractical or hazardous to recreate in the physical world. These parallel activities foster cross-disciplinary learning and shorten iteration loops, which in turn inform procurement, regulatory engagement, and operational planning.

Moreover, the ecosystem supporting LiDAR simulation continues to diversify. Open standards and interoperable toolchains are encouraging collaboration between software providers, hardware vendors, and end users. This landscape shift places a premium on platforms that balance fidelity, scalability, and repeatability. Consequently, organizations that embed simulation early in product development gain sustained advantages in quality, reliability, and time to market, especially when they couple simulation outputs with rigorous validation processes and traceable test artifacts.

Critical transformative forces reshaping LiDAR simulation including compute scalability, sensor architecture evolution, and the rising importance of simulation in regulatory and safety validation

The LiDAR simulation landscape is experiencing transformative shifts driven by advances in compute infrastructure, changes in LiDAR hardware design, and evolving regulatory expectations. High-performance GPUs and cloud-native architectures are enabling simulations at scales that were previously infeasible, allowing thousands of scenario runs to be executed in parallel and feeding more representative synthetic datasets into machine learning pipelines. As a consequence, teams can explore broader operational design domains and probe rare edge cases with statistical rigor.Simultaneously, the push from mechanical scanning architectures toward solid-state designs is reshaping how simulation models represent sensor dynamics and failure modes. Solid-state LiDAR often presents unique optical, electronic, and thermal profiles that require different modeling approaches compared to mechanical scanners. This hardware evolution compels simulation vendors to offer modular, extensible models that reflect real-world sensor idiosyncrasies while remaining computationally tractable.

In addition, regulatory bodies and safety frameworks are increasingly recognizing simulation as a legitimate component of verification evidence when paired with structured test plans and traceable data artifacts. This recognition is fostering closer alignment between simulation outputs and compliance requirements, driving demand for reproducibility, provenance, and explainability within simulation platforms. Taken together, these shifts reconfigure the value chain, incentivize strategic partnerships, and place a premium on platforms that can demonstrate both technical fidelity and governance-ready processes.

How 2025 tariff actions created supply chain stress tests and prompted strategic sourcing, localization, and scenario-driven procurement planning across the LiDAR simulation ecosystem

United States tariff actions in 2025 forged a new set of operational and strategic considerations for participants in the LiDAR simulation ecosystem. Supply chain participants reassessed component sourcing, logistics strategies, and contractual terms to mitigate tariff-driven cost volatility. In response, many firms accelerated localization efforts for critical subsystems and prioritized supplier diversification to reduce exposure to tariff fluctuations.These shifts had ripple effects beyond direct hardware procurement. Software providers and systems integrators evaluated deployment models to balance on-premise compute investments against cloud-based options that could insulate some procurement risks. Procurement teams also reexamined total cost of ownership constructs to include customs compliance, duties, and the operational overhead associated with multi-jurisdictional supplier networks.

Importantly, the tariff environment incentivized closer collaboration between original equipment manufacturers, embedded sensor suppliers, and simulation platform vendors. Organizations sought contractual mechanisms and joint innovation programs that shared risk and aligned incentives for localized assembly, firmware optimization, and joint certification activities. At the same time, the situation underscored the importance of scenario-driven simulation for stress-testing supply chain contingencies and validating interoperability across regionally sourced components. Consequently, firms that integrated scenario-based procurement simulation into strategic planning were better positioned to absorb tariff impacts without compromising development timelines or safety objectives.

Deep segmentation analysis connecting components, dimensional modeling, sensor classes, deployment modalities, and application verticals to strategic adoption and integration patterns

Segment-level insights reveal how product architecture, dimensional modeling, sensor type, deployment modality, and application domains each shape investment priorities and adoption trajectories. Based on Component, market is studied across Hardware, Services, and Software, with Services further studied across Consulting, Integration And Deployment, and Training And Support; this structure highlights that services play an outsized role in translating platform capabilities into operational outcomes, especially when complex integration and domain-specific tuning are required.Based on Dimension, market is studied across 2-Dimension and 3-Dimension; while 2-Dimension simulation remains relevant for certain perception pipelines and legacy workflows, 3-Dimension environments capture spatial interactions, occlusions, and volumetric effects that are essential for modern autonomous systems and infrastructure planning. Based on LiDAR Type, market is studied across Mechanical LiDAR and Solid-State LiDAR, and the divergence between these sensor classes affects both model fidelity and validation strategies because mechanical scanners exhibit distinct motion artifacts whereas solid-state devices often require nuanced electronic and optical modeling.

Based on Deployment Mode, market is studied across Cloud Based and On Premise; each mode has trade-offs around latency, data governance, and cost predictability, which influence adoption among automotive OEMs, defense integrators, and telecom infrastructure planners. Based on Application, market is studied across Agriculture Automation, Autonomous Vehicles, Defense & Aerospace, Drones & UAVs, Mapping & Surveying, Maritime & Rail Transport, Robotics, and Smart Infrastructure, and within Robotics the segmentation further distinguishes Industrial Robots and Service Robots. These application domains demonstrate varying tolerances for simulation realism, regulatory scrutiny, and deployment cadence, thereby driving differentiated requirements for scenario libraries, sensor models, and integration services.

Comparative regional dynamics explaining how distinct regulatory regimes, industrial clusters, and deployment priorities drive differentiated adoption trajectories across global markets

Regional dynamics shape technology adoption paths, partnership models, and talent availability, and these geographic patterns merit close attention when planning deployment or commercialization strategies. In the Americas, concentrated clusters of automotive OEMs, technology startups, and systems integrators create a vibrant ecosystem for pilot programs and early production deployments; strong venture activity and established supply chains support rapid iteration, while regulatory frameworks are evolving to incorporate virtual validation methods.In Europe, Middle East & Africa, the landscape emphasizes stringent safety standards, cross-border collaboration, and diversified industrial use cases that include defense, rail transport, and smart infrastructure projects. This region places a high premium on data sovereignty and traceability, prompting many organizations to favor hybrid deployment models that combine on-premise validation with cloud-scale synthetic data generation. Meanwhile, government-led initiatives and consortiums often catalyze standards adoption and joint validation facilities that reduce duplication of effort.

Across Asia-Pacific, rapid urbanization, dense deployment opportunities for smart infrastructure, and a strong manufacturing base accelerate experimentation with LiDAR-enabled systems at scale. Regional suppliers frequently lead in hardware innovation, and close ties between manufacturers and integrators support verticalized deployments. However, heterogeneous regulatory regimes and linguistic diversity create unique localization requirements for scenario content, object libraries, and training datasets, making regional partnerships and adaptable simulation architectures critical for commercial success.

Key competitive behaviors and partnership strategies revealing how specialization, integrations, and service-led delivery models define leadership in LiDAR simulation capabilities

Competitive dynamics in the LiDAR simulation space are characterized by a blend of specialized simulation vendors, sensor manufacturers integrating their own modeling toolchains, and systems integrators that combine domain expertise with platform services. Strategic behaviors include vertical integration, whereby hardware suppliers embed simulation capabilities for hardware-in-the-loop validation, and horizontal partnerships that assemble best-of-breed stacks across perception, physics engines, and scenario management.Investment in IP around sensor modeling, photorealistic rendering, and terrain or atmospheric effects is a common differentiator, as is the ability to deliver reproducible test cases with traceable provenance. Firms that excel at building extensible ecosystems through SDKs, APIs, and plug-in architectures tend to attract larger customer footprints because they enable smoother integration with proprietary perception stacks. Service-oriented firms that deliver consulting, integration and deployment, and training and support bridge the gap between platform capability and operational readiness, which is especially valuable for enterprise customers transitioning from pilot to production.

Mergers, alliances, and targeted acquisitions are typical as incumbents and challengers seek to broaden their value propositions. In parallel, partnerships with academic institutions and standards bodies help firms validate modeling approaches and contribute to interoperable formats, which reduces friction for multi-vendor validation campaigns. Ultimately, competitive advantage accrues to organizations that combine technical fidelity, enterprise-grade governance, and a clear roadmap for supporting emerging sensor types and regulatory requirements.

Actionable recommendations for technology and program leaders to integrate simulation early, build modular architectures, and strengthen governance and partnership capabilities for sustained advantage

Industry leaders should adopt a multi-pronged strategy that aligns technical investment with organizational capability and market engagement. First, embed simulation early across the development lifecycle to reduce downstream risk and to accelerate iteration; leaders should mandate simulation-driven gate criteria and maintain libraries of parameterized scenarios that reflect real-world variability. This approach ensures that software and hardware teams converge on reproducible metrics and that test artifacts remain traceable for audits and certification.Second, prioritize modular, open architectures that enable rapid integration of new sensor models and third-party components. By adopting interoperable data formats and APIs, organizations can avoid vendor lock-in and incrementally incorporate advances in rendering, physics modeling, and synthetic data generation. Coupled with this technical posture, invest in service competencies-consulting, integration and deployment, and training and support-that translate platform potential into operational outcomes for diverse application domains.

Third, develop robust governance practices covering data provenance, scenario validation, and model explainability so that simulation artifacts can support regulatory submissions and safety cases. These practices should be complemented by strategic supply chain planning that accounts for regional procurement constraints, potential tariff exposures, and the need for local validation resources. Finally, pursue partnerships with domain experts, standards organizations, and research institutions to stay ahead of methodological advances and to co-develop benchmarks that accelerate industry-wide adoption.

Transparent and reproducible research methodology detailing primary interviews, technical literature review, capability mapping, and scenario-driven validation to support rigorous insights

The research methodology combines qualitative and quantitative approaches designed to deliver a rigorous, reproducible assessment of LiDAR simulation dynamics. Primary data gathering included structured interviews with product leaders, systems engineers, and procurement specialists across relevant end-use domains to capture real-world validation practices, platform selection criteria, and integration pain points. Secondary research incorporated a review of technical literature, patent filings, standardization efforts, and publicly available engineering documentation to identify methodological trends and technology roadmaps.Analytical frameworks focused on capability mapping, where platform features were assessed against fidelity, scalability, interoperability, and governance attributes. Use-case analysis examined representative workflows for autonomous vehicles, robotics, mapping, and smart infrastructure to surface domain-specific requirements for scenario complexity, latency, and repeatability. Supply chain and policy analysis evaluated the potential operational impacts of trade actions and regional regulatory stances on procurement and deployment strategies.

Throughout the process, emphasis was placed on transparency and traceability: scenario definitions, model assumptions, and data provenance were documented to enable reproducibility of key findings. Limitations and assumptions are explicitly recorded, and sensitivity checks were performed to test the robustness of insights across plausible variations in technology adoption pathways and policy environments.

Conclusive synthesis highlighting why prioritizing simulation fidelity, governance, and cross-value-chain partnerships will define successful LiDAR deployments and validation strategies

In summary, LiDAR simulation stands at a pivotal moment where advances in compute infrastructure, sensor diversification, and regulatory recognition converge to expand its strategic value. Organizations that treat simulation as an integral element of product development-rather than a supplementary testing activity-unlock faster iteration, stronger safety evidence, and reduced reliance on costly physical trials. The interplay between hardware evolution and software capabilities underscores the need for modular, interoperable platforms and for services that accelerate integration.Regional dynamics and trade policy developments further underscore the importance of flexible procurement strategies and localized validation resources. Competitive advantage accrues to firms that combine technical fidelity with enterprise-grade governance and that cultivate partnerships across the value chain. Looking ahead, the maturation of standards, coupled with improved model explainability and traceability, will make simulation outputs increasingly central to certification and operational assurance. Stakeholders who align resources now to build scenario libraries, rigorous governance practices, and open integrations will be best positioned to capitalize on the growing reliance on virtual validation for complex sensor systems.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Component

- Hardware

- Services

- Consulting

- Integration And Deployment

- Training And Support

- Software

- Dimension

- 2-Dimension

- 3-Dimension

- LiDAR Type

- Mechanical LiDAR

- Solid-State LiDAR

- Deployment Mode

- Cloud Based

- On Premise

- Application

- Agriculture Automation

- Autonomous Vehicles

- Defense & Aerospace

- Drones & UAVs

- Mapping & Surveying

- Maritime & Rail Transport

- Robotics

- Industrial Robots

- Service Robots

- Smart Infrastructure

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Ansys, Inc.

- Outsight S.A.

- AEye Holdings, Inc

- Applied Intuition, Inc.

- Astos Solutions GmbH

- AVL

- Cepton, Inc.

- Cognata Ltd.

- dSPACE GmbH

- ESI Group by Keysight Technologies

- Foretellix

- G2V Optics Inc.

- IPG Automotive GmbH

- Konrad GmbH

- LeddarTech

- Livox

- MathWorks

- NVIDIA Corporation

- Ontar Corporation

- Persival GmbH

- Siemens AG

- Unity Technologies

- Vector Informatik GmbH

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this LiDAR Simulation market report include:- Ansys, Inc.

- Outsight S.A.

- AEye Holdings, Inc

- Applied Intuition, Inc.

- Astos Solutions GmbH

- AVL

- Cepton, Inc.

- Cognata Ltd.

- dSPACE GmbH

- ESI Group by Keysight Technologies

- Foretellix

- G2V Optics Inc.

- IPG Automotive GmbH

- Konrad GmbH

- LeddarTech

- Livox

- MathWorks

- NVIDIA Corporation

- Ontar Corporation

- Persival GmbH

- Siemens AG

- Unity Technologies

- Vector Informatik GmbH

Table Information

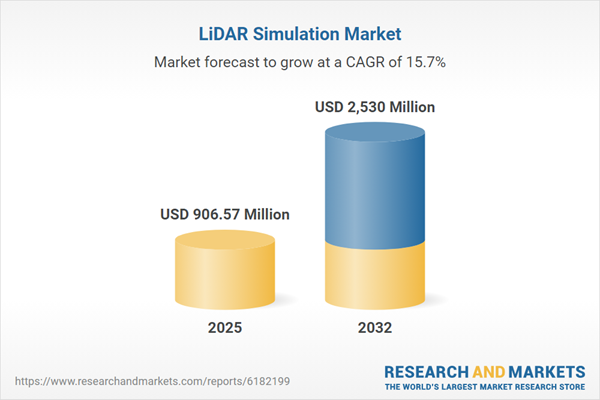

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 906.57 Million |

| Forecasted Market Value ( USD | $ 2530 Million |

| Compound Annual Growth Rate | 15.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |