Antioxidant Supplement Market

Antioxidant supplements span single-ingredient and blended formulations designed to neutralize oxidative stress and support cellular health, immunity, skin vitality, eye health, energy metabolism, and healthy aging. Core actives include vitamins C and E, carotenoids (beta-carotene, lutein, zeaxanthin, lycopene, astaxanthin), polyphenols (resveratrol, quercetin, catechins), coenzyme Q10/ubiquinol, alpha-lipoic acid, selenium, zinc, glutathione precursors, and botanical concentrates (grape seed, pomegranate, curcumin). Formats range from tablets, capsules, softgels, effervescent powders, and liquids/ampoules to functional gummies and shots, sold via pharmacies, mass retail, specialty nutrition, e-commerce/D2C, and practitioner channels. Recent trends emphasize clean-label and vegan delivery, sugar-conscious gummies, clinically standardized extracts, bioavailability boosts (liposomal, phytosomal, micellar), synergy stacks for skin/beauty-from-within and eye strain/blue-light support, and “metabolic resilience” bundles pairing antioxidants with electrolytes or B-complex. Demand is propelled by rising wellness literacy, digital health content, preventive aging mindsets, screen-time and pollution exposure, fitness recovery goals, and physician/esthetician cross-recommendations. The competitive landscape mixes global VMS majors, dermonutrition and eye-health specialists, sports/active brands, private label, and premium D2C entrants; differentiation hinges on substantiated claims, standardized actives, absorption data, taste/texture in gummies, allergen/gelatin-free credentials, and batch-level transparency. Execution challenges include ingredient price volatility, variable botanical potency, regulatory scrutiny on claims and additives, sugar load in confectionery formats, and need for adherence-friendly dosing. Overall, antioxidant supplements have moved from generic multivitamin footnotes to targeted, benefit-led regimens focused on visible outcomes and everyday resilience.Antioxidant Supplement Market Key Insights

- Benefit-led stacks outperform generic antioxidant blends. Formulas are increasingly built around specific outcomes - skin radiance, eye comfort, immune readiness, exercise recovery - using targeted combinations (e.g., astaxanthin + vitamin E for skin lipids; lutein/zeaxanthin + zinc for visual function). Clear use-cases simplify shopper decisions and improve adherence. Brands that translate mechanisms into everyday language win shelf conversion and reduce post-purchase confusion.

- Bioavailability and delivery tech are decisive differentiators. Liposomal vitamin C, phytosomal curcumin, micellar carotenoids, and reduced CoQ10 (ubiquinol) elevate absorption at practical doses. Softgels and oil suspensions improve fat-soluble uptake; sustained-release tablets moderate GI tolerance. Claims increasingly reference pharmacokinetic data rather than headline milligrams. Education clarifies that “better absorbed” can allow fewer caps/day, increasing compliance.

- Gummies and liquids broaden reach but require formulation discipline. Sugar, acid, and heat stress can degrade sensitive actives; pH control, protective coatings, and low-water-activity matrices preserve potency. Sugar-free or low-sugar options with polyols/allulose address metabolic concerns. Texture and flavor quality are now as important as active selection. Transparent “sugar per serving” and dental-friendly guidance improve trust.

- Beauty-from-within and skin barrier support add growth lanes. Astaxanthin, lycopene, collagen-adjacent antioxidants, and ceramide-friendly blends address photoaging and urban stress. Cross-merchandising with sunscreen and topical serums raises basket size. Brands that synchronize oral and topical routines, with seasonally relevant content, see stronger repeat. Clean, fragrance-free positioning resonates with sensitive-skin users.

- Eye strain and digital lifestyles maintain momentum. Lutein/zeaxanthin, astaxanthin, and anthocyanins target screen-time fatigue and light stress. Pairings with electrolytes and B-vitamins fit workday use. Packaging highlights “desk-friendly” dosing and once-daily simplicity. Retailers place SKUs near blue-light glasses and productivity accessories, reinforcing the use-case.

- Active-recovery narratives expand into sport and daily mobility. CoQ10, ALA, tart cherry polyphenols, and quercetin support training consistency and perceived recovery without stimulant reliance. Hydration and electrolyte bundles normalize daily use in hot climates. Clear timing guidance (pre-/post-workout versus with meals) reduces trial-and-error and improves reviews.

- Quality systems and traceability are table stakes. Standardized actives with defined marker compounds, non-GMO and allergen-controlled facilities, and third-party testing (heavy metals, pesticides, oxidation) underpin credibility. QR-linked batch COAs and stability data address skepticism around potency at expiry. Retailers increasingly gatekeep listings via documentation depth.

- Regulatory clarity and conservative claims reduce friction. Education-first copy avoids disease claims and aligns with local guidance. Multi-region formulations anticipate additive, colorant, and sweetener rules. Packaging emphasizes daily value context and safe upper limits, reducing misuse and returns. Preparedness for evolving guidelines prevents reformulation whiplash.

- Price architecture drives trade-up without alienating value seekers. Good-better-best ladders separate standardized single-actives, synergistic blends with delivery tech, and premium beauty/eye bundles. Per-serving cost transparency beats headline bottle price. Subscriptions with flexible cadence match real consumption and reduce “supplement drawer” accumulation.

- Sustainability and ethical sourcing influence RFPs and listings. PCR bottles, aluminum canisters, and refill pouches reduce footprint; mono-material closures aid recyclability. Ethical botanical sourcing and by-product valorization (e.g., lycopene from tomato streams) resonate with conscious buyers. Carbon-aware logistics and minimal outer packaging strengthen retailer partnerships.

Antioxidant Supplement Market Reginal Analysis

North America

Growth is driven by e-commerce discovery, pharmacy/mass visibility, and creator-led education on beauty, eye strain, and recovery. Gummies and flavored powders dominate new-to-category entry; clean-label and vegan credentials matter. Retailers prioritize substantiation, batch transparency, and sugar-per-serving clarity. Cross-category bundling with sun care and hydration boosts basket size. Private label expands, pressuring price while keeping quality bars high.Europe

Regulatory rigor favors conservative claims, standardized extracts, and pharmacy-led trust. Unflavored or lightly flavored capsules/softgels with bioavailability tech perform well. Sustainability (recyclable packs, PCR, provenance) and allergen discipline influence listings. Eye-health and beauty-from-within segments benefit from aging demographics and dermocosmetic channels. Multilingual labeling and clean formulation simplicity are competitive necessities.Asia-Pacific

Large, digitally savvy markets adopt beauty-from-within and screen-time relief rapidly. Liquid shots, sachets, and jelly sticks align with convenience culture; taste and mouthfeel decide repeat. Localized botanicals (green tea catechins, acerola) boost relevance. Live-commerce accelerates trial; K-/J-beauty aesthetics shape packaging. Heat/humidity drive interest in stability-robust formats and small, frequent pack sizes.Middle East & Africa

Urban wellness and premium retail hubs support growth in skin, immunity, and energy-focused antioxidants. Halal compliance, capsule alternatives to gelatin, and clear provenance build trust. Pharmacy and modern trade remain primary channels; e-commerce widens assortment. Heat-resistant stability and tamper-evident packaging are valued. Education on sugar content and dental-friendly gummies improves acceptance.South & Central America

Beauty culture and active lifestyles sustain demand for skin and recovery blends. Currency volatility favors local contract manufacturing and flexible pack sizes. Pharmacies and marketplaces dominate distribution; anti-counterfeit features and batch transparency are important. Tropical flavors in powders/gummies aid adoption, while capsule softgels remain staples. Retailers reward supply reliability and straightforward dosing guidance.Antioxidant Supplement Market Segmentation

By Type

- Medical Grade

- Food Grade

By Application

- Medical

- Food

- Cosmetics

By Distribution Channel

- Online

- Offline

Key Market players

Nature’s Bounty, NOW Foods, Garden of Life, Life Extension, Solgar, Blackmores, NutraÂm¦Bio Laboratories, GNC, Swanson Health Products, Herbalife Nutrition, Pfizer (Centre d’Etudes et de Recherches en Nutriceuticals?), Amway (Nutrilite), i-herb (brands), Jarrow Formulas, Schiff NutritionAntioxidant Supplement Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Antioxidant Supplement Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Antioxidant Supplement market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Antioxidant Supplement market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Antioxidant Supplement market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Antioxidant Supplement market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Antioxidant Supplement market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Antioxidant Supplement value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Antioxidant Supplement industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Antioxidant Supplement Market Report

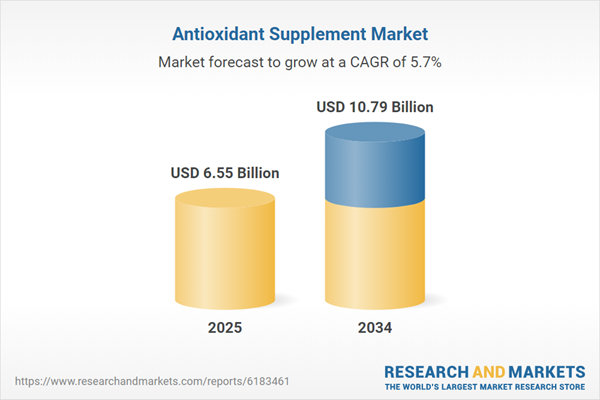

- Global Antioxidant Supplement market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Antioxidant Supplement trade, costs, and supply chains

- Antioxidant Supplement market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Antioxidant Supplement market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Antioxidant Supplement market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Antioxidant Supplement supply chain analysis

- Antioxidant Supplement trade analysis, Antioxidant Supplement market price analysis, and Antioxidant Supplement supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Antioxidant Supplement market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nature’s Bounty

- NOW Foods

- Garden of Life

- Life Extension

- Solgar

- Blackmores

- NutraÂm¦Bio Laboratories

- GNC

- Swanson Health Products

- Herbalife Nutrition

- Pfizer (Centre d’Etudes et de Recherches en Nutriceuticals?)

- Amway (Nutrilite)

- i-herb (brands)

- Jarrow Formulas

- Schiff Nutrition

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.55 Billion |

| Forecasted Market Value ( USD | $ 10.79 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |