Bitumen Emulsifiers Market

The Bitumen Emulsifiers Market enables room-temperature handling and application of bitumen by stabilizing fine droplets of binder in water, unlocking safer, lower-energy road construction, preservation, and industrial waterproofing workflows. The market spans cationic, anionic, and nonionic chemistries formulated around fatty amines, imidazolines, quaternaries, rosin derivatives, and specialty surfactant blends engineered to match aggregate mineralogy, water quality, and climate. Top applications include surface dressing, chip seal, tack and prime coats, cold and warm mixes, micro-surfacing, slurry seal, fog seals, pavement recycling, and industrial membranes. Trends emphasize fast-setting systems for high-throughput paving, slow-setting grades for mixing and stabilization, and polymer-modified emulsions that elevate elasticity, rut resistance, and crack mitigation. Drivers include decarbonization and worker safety goals, tighter environmental rules on volatile solvents, budget-driven use of in-place recycling, and the need to extend asset life with preventive maintenance. Competitive differentiation centers on robust emulsifier packages that tolerate variable bitumen feed, hard water, and fines, while delivering storage stability, controlled breaking, and strong adhesion on damp or dusty aggregates. Suppliers increasingly pair chemistry with application know-how - lab-to-field formulation support, job-site water conditioning, and mobile test rigs - to de-risk performance for agencies and contractors. Digital tools for emulsion QC, dosage optimization, and weather-aware paving windows are emerging, alongside bio-based and low-toxicity emulsifier options. Looking ahead, advantage accrues to vendors who integrate formulation science with aggregate characterization, offer modular additive toolkits, and back specifications with field data, enabling longer treatment cycles, fewer callbacks, and scalable sustainability outcomes for both preservation and new construction programs.Bitumen Emulsifiers Market Key Insights

- Aggregate-chemistry fit determines field success Emulsifiers must be selected for aggregate surface charge and mineralogy, with cationic systems favoring siliceous stones and tailored adhesion promoters bridging moisture and dust challenges; suppliers that pair petrographic screening with bench tests and on-site trials reduce stripping risk, optimize residual binder, and stabilize job outcomes across varying stone sources and seasons

- Breaking control is a productivity lever Fast, medium, and slow set behaviors are tuned via surfactant architecture, droplet size, and counter-ions to achieve traffic-ready surfaces without pickup or tracking; crews gain laydown speed and smoother schedules when emulsions break predictably under local humidity and wind, minimizing lane closures and rework while preserving chip retention and texture

- Water and fines tolerance protect workability Hard water, clays, and silt raise coalescence risk and destabilize emulsions; formulations that buffer pH, chelate troublesome ions, and manage particle size dispersion maintain pumpability and spray quality, allowing consistent film build and uniform coverage from yard to paver with fewer filter clogs and nozzle fouling events

- Polymer modification lifts life-cycle value Incorporating latexes and elastomers with compatible emulsifiers enhances elasticity, cohesion, and temperature susceptibility, enabling thinner treatments to achieve higher durability; alignment of polymer type, emulsifier, and curing profile ensures cohesive strength develops on schedule - even in marginal weather - supporting early traffic opening

- Cold in-place and full-depth recycling reshape demand Emulsifier systems for reclaimed materials must wet aged binder films and fines while resisting over-break during mixing and compaction; packages tuned for RAP variability produce stable mats and reliable density, expanding recycling windows and reducing dependence on hot mix logistics

- Low-odor and safer profiles gain traction Agencies and contractors prioritize worker exposure reduction and neighborhood acceptance; emulsifier selections with low volatility, reduced sensitizers, and improved biodegradability meet procurement criteria without sacrificing adhesion or set time, helping owners meet environmental commitments

- Process robustness beats lab perfection Real-world performance hinges on emulsifier tolerance to bitumen variability, shear history, and plant upsets; suppliers that deliver broad operating windows, remote QC support, and simple corrective additives keep jobs on spec when feed or weather shifts, lowering risk for contractors

- Specification literacy accelerates approvals Clear guidance on residue recovery, storage stability, sieve tests, and setting time shortens submittals and change orders; vendors that map emulsifier packages to regional specs and provide side-by-side field sections build confidence with owners and inspectors

- Digital and data-enabled paving elevates consistency Integrating weather nowcasts, surface temperature sensors, and dosage tracking with emulsifier selection helps crews choose set grades and spray rates that match conditions, translating laboratory curves into predictable field break and chip embedment

- Supply resilience and service depth decide share Reliable access to surfactant intermediates, responsive local blending, and on-call field technologists outweigh small cost gaps; multi-plant footprints, contingency logistics, and standardized additive kits ensure uptime through seasonal peaks and unplanned outages

Bitumen Emulsifiers Market Reginal Analysis

North America

Adoption is driven by pavement preservation programs, cold recycling, and safety priorities, with cationic grades dominant for siliceous aggregates; agencies emphasize trackless tack, rapid return to traffic, and winter storage stability, while distributors and mobile labs support on-site adjustments to water hardness and fines, and polymer-modified micro-surfacing expands on urban networks and high-volume corridorsEurope

Stringent environmental policy and mature preservation standards favor solvent-free systems and high-performance polymer-modified emulsions; suppliers tailor emulsifiers to diverse aggregates and cool, wet climates to maintain break predictability, with strong focus on life-cycle assessments, low-odor profiles, and surface dressing craft, while national specs harmonize QC methods and field acceptanceAsia-Pacific

Large new-build and rehabilitation pipelines mix tropical, temperate, and arid conditions, requiring broad emulsifier toolkits and climate-specific set profiles; rapid urbanization increases demand for low-disruption treatments and night paving, and recycling with emulsions scales as agencies seek cost and energy savings, supported by local blending capacity and contractor trainingMiddle East & Africa

Hot climates, dust, and variable water quality drive demand for heat-resilient, fines-tolerant emulsifier packages that maintain spray quality and adhesion on marginal surfaces; surface treatments and prime/tack coats support network expansion and maintenance, with distributors providing field tech services and Arabic/French bilingual documentation to streamline approvalsSouth & Central America

Budget-sensitive networks rely on slurry, micro-surfacing, and cold recycling that stretch maintenance dollars, favoring emulsifiers with wide process windows and robust adhesion on damp aggregates; regional blenders partner with agencies to localize formulations for humidity and rainfall patterns, and training on storage, circulation, and sieve control improves consistency from plant to paverBitumen Emulsifiers Market Segmentation

By Type

- Cationic

- Anionic

- and Non-Ionic

By Application

- Spraying Emulsifiers

- Mixing Emulsifiers

By Setting Time

- Slow

- Medium

- Rapid

Key Market players

Nouryon, Arkema (ArrMaz), Ingevity, Evonik Industries, Kao Chemicals, BASF, Dow, Sasol, Croda International, Clariant, Huntsman, Eastman Chemical, Stepan Company, Indorama Ventures (Oxiteno), PCC Exol, Dorf Ketal, Zydex Industries, Lubrizol, Emery Oleochemicals, Indofil IndustriesBitumen Emulsifiers Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Bitumen Emulsifiers Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Bitumen Emulsifiers market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Bitumen Emulsifiers market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Bitumen Emulsifiers market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Bitumen Emulsifiers market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Bitumen Emulsifiers market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Bitumen Emulsifiers value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Bitumen Emulsifiers industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Bitumen Emulsifiers Market Report

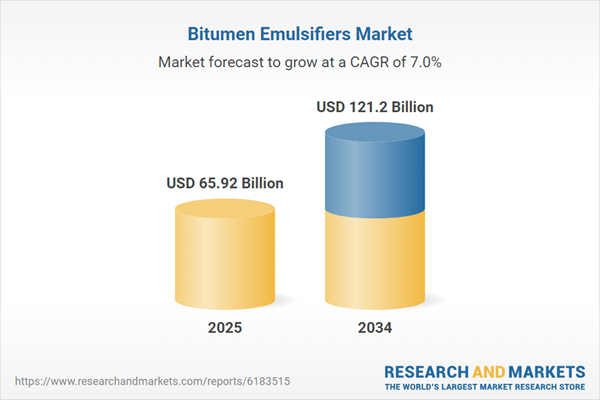

- Global Bitumen Emulsifiers market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Bitumen Emulsifiers trade, costs, and supply chains

- Bitumen Emulsifiers market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Bitumen Emulsifiers market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Bitumen Emulsifiers market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Bitumen Emulsifiers supply chain analysis

- Bitumen Emulsifiers trade analysis, Bitumen Emulsifiers market price analysis, and Bitumen Emulsifiers supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Bitumen Emulsifiers market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nouryon

- Arkema (ArrMaz)

- Ingevity

- Evonik Industries

- Kao Chemicals

- BASF

- Dow

- Sasol

- Croda International

- Clariant

- Huntsman

- Eastman Chemical

- Stepan Company

- Indorama Ventures (Oxiteno)

- PCC Exol

- Dorf Ketal

- Zydex Industries

- Lubrizol

- Emery Oleochemicals

- Indofil Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 65.92 Billion |

| Forecasted Market Value ( USD | $ 121.2 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |