Arginine Supplement Market

The arginine supplements market focuses on dietary products formulated with the amino acid L‑Arginine, often marketed for its roles in nitric‑oxide synthesis, blood‑flow enhancement, cardiovascular support, muscle performance, immune function and general wellness. These supplements typically come in forms such as capsules, tablets, powders, liquids or blended formulations and are targeted at athletes/bodybuilders, ageing consumers looking for cardiovascular or vascular support, and wellness users seeking overall health benefits. Recent trends reveal an uptick in demand for pre‑workout products incorporating arginine (to boost circulation and performance), increasing focus on cardiovascular health and circulatory wellness in ageing populations, and expansion of online direct‑to‑consumer (DTC) channels making arginine more accessible globally. Key growth drivers include rising fitness and gym culture globally, growing awareness of vascular health and nitric oxide‑related benefits, increased disposable incomes especially in emerging markets, and e‑commerce penetration for supplement sales. On the competitive front, the market is served by a mix of large supplement brands, specialist amino‑acid manufacturers and ingredient suppliers, all differentiating by dosage form, purity/grade, claim support (e.g., nitric‑oxide boost, pre‑workout), and certifications (e.g., GMP, non‑GMO). Other dynamics include regulatory scrutiny of supplement claims in some regions, competition from other amino acids or nitric‑oxide precursors (e.g., citrulline), raw‑material cost fluctuations, and the need for timely scientific backing. Overall, the arginine supplements market presents robust growth opportunity - especially in sports nutrition and vascular wellness domains - but success will require strong claims, consumer education and channel optimisation.Arginine Supplement Market Key Insights

- Cardiovascular / vascular positioning: Arginine’s role in nitric oxide production and vasodilation underpins its adoption in supplements aimed at heart health, blood flow support, hypertension and age related circulatory challenges.

- Fitness & performance segment high growth: With increasing gym/fitness culture, arginine is frequently included in pre workout blends or stand alone supplements to support endurance, muscle pump and recovery.

- Format diversification driving access: While capsules and tablets dominate, growth is faster in powders and liquid formats (especially among athletes) and in blended product formats (e.g., arginine + citrulline + BCAAs).

- E commerce and DTC channel expansion: Online channels are becoming a key growth vehicle for arginine supplements, enabling direct brand to consumer relationships, subscription models and access in emerging markets.

- Emerging markets growth tailwinds: Regions like Asia Pacific and Latin America are witnessing rising disposable income, increased health/wellness awareness and gym/fitness scene expansion - creating incremental demand for arginine supplements.

- Regulatory and claim evidence pressure: As arginine moves beyond pure structure function claims, brands face growing demand for clinical data, transparent dosage and safe manufacturing practices - which becomes a differentiator.

- Competitive substitution risk: Arginine competes with other nitric oxide precursors (e.g., citrulline, beet extract) and other amino acid or plant based performance/wellness supplements; differentiation and positioning matter.

- Price sensitivity and raw material cost: While arginine is established, cost pressures, manufacturing scale and brand value impact price positioning especially in price sensitive markets or mainstream retail channels.

- Aging population and wellness segment emerging: Beyond athletes, older adults looking for vascular wellness, circulation support or cognitive/muscular maintenance are becoming a new growth cohort for arginine supplements.

- Brand trust, certification & clean label advantages: Premium supplements emphasise high purity arginine, third party testing, clean formats (vegan friendly, allergen free) and transparent claims - helping capture discerning consumers and justify premium pricing.

Arginine Supplement Market Reginal Analysis

North America

The North American market is mature and leading in both consumption and innovation for arginine supplements. The region benefits from large fitness/health‑conscious populations, strong e‑commerce penetration and high supplement adoption. Brands in the U.S. and Canada have been early to position arginine for cardiovascular and performance markets, while major channel growth is coming from online and speciality retail. Regulatory scrutiny and cost competition in mainstream channels, however, are moderate constraints.Europe

In Europe, arginine supplements are supported by rising preventive‑health awareness, vascular‑wellness trends and established supplement retail infrastructure. Growth is steady, with emphasis on clean‑label, premium positioning and combined ingredient formulations. Fragmentation across countries (regulatory frameworks, retail systems) and relative cost sensitivity in some markets moderate rapid scale expansion.Asia‑Pacific

Asia‑Pacific offers the fastest expansion potential for arginine supplements, driven by increasing gym/fitness culture (in countries like China, India, Australia), rising incomes, expanding online retail and growing interest in wellness and performance nutrition. However, challenges include consumer education gaps, supplement regulation variability and occasional cost sensitivity in emerging markets.Middle East & Africa: This region is at a more nascent stage for arginine supplements, but growth is emerging in urbanised centres with increasing health‑supplement adoption, fitness facility growth and e‑commerce expansion. Import dependence, regulatory/label‑approval hurdles, and price sensitivity remain headwinds.

South & Central America: South and Central America are emerging markets for arginine supplements, with growing interest in fitness, health‑conscious diets and supplement consumption. Key markets such as Brazil and Mexico show increasing gym penetration and online retail adoption. Still, economic volatility, import/logistics challenges and consumer affordability limit full mainstreaming; premium/athlete‑segments will likely lead growth first.

Arginine Supplement Market Segmentation

By Form

- Powder

- Tablets

- Liquid

By Application

- Sports Supplement

- Skin Care

- Hair Care

- Cardiovascular Diseases

- Others

Key Market players

Now Foods, Optimum Nutrition, NutraBio, BulkSupplements, Doctor's Best, Jarrow Formulas, Thorne, GNC, MuscleTech, Cellucor, Dymatize, Myprotein, Solgar, Nature's Bounty, SwansonArginine Supplement Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Arginine Supplement Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Arginine Supplement market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Arginine Supplement market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Arginine Supplement market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Arginine Supplement market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Arginine Supplement market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Arginine Supplement value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Arginine Supplement industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Arginine Supplement Market Report

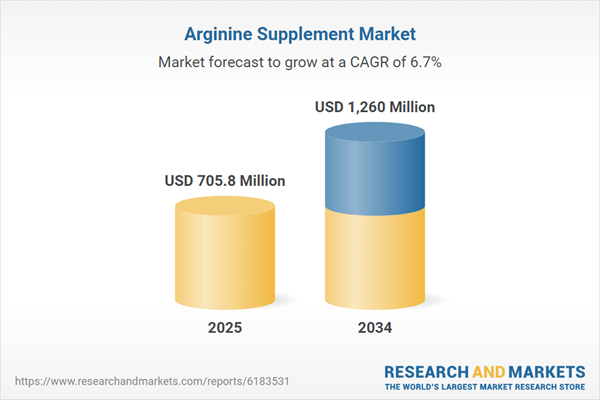

- Global Arginine Supplement market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Arginine Supplement trade, costs, and supply chains

- Arginine Supplement market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Arginine Supplement market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Arginine Supplement market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Arginine Supplement supply chain analysis

- Arginine Supplement trade analysis, Arginine Supplement market price analysis, and Arginine Supplement supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Arginine Supplement market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Now Foods

- Optimum Nutrition

- NutraBio

- BulkSupplements

- Doctor's Best

- Jarrow Formulas

- Thorne

- GNC

- MuscleTech

- Cellucor

- Dymatize

- Myprotein

- Solgar

- Nature's Bounty

- Swanson

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 705.8 Million |

| Forecasted Market Value ( USD | $ 1260 Million |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |