Processed Tree Nuts Market

The Processed Tree Nuts Market is transitioning from commodity supply to an innovation-led, experience-driven category that blends indulgence with clean nutrition and rigorous quality systems. Core end-uses include roasted and seasoned snacks, nut butters and spreads, confectionery inclusions, bakery and breakfast formats, culinary oils and pastes, and plant-based dairy and desserts. Growth is propelled by clean-label expectations, plant-forward eating, and functional narratives around satiety, heart health, and sustained energy. Processors are upgrading capabilities in blanching, precision roasting, cold-press extraction, grinding and micronization, and lipid stabilization to optimize flavor, color, and shelf life under strict allergen and microbiological controls. Packaging advances - high-barrier laminates, light and oxygen management, and robust resealability - protect freshness across omnichannel distribution, including e-commerce and convenience channels. Competitive dynamics span vertically integrated growers, specialty roasters, global snack brands, and elevated private labels, each competing on provenance, certifications, sustainability, and sensory excellence. Supply-chain strategies address climate and yield variability through multi-origin portfolios, forward contracts, near-origin processing, and digital quality traceability. Flavor platforms emphasize culinary-grade seasonings, sugar-aware coatings, and premium chocolate pairings, while short ingredient lists maintain label discipline. Foodservice recovery is expanding menu placements in bakery, dessert, café, and travel catering, with co-manufacturing partnerships improving repeatability and speed-to-market. Sustainability priorities - water stewardship, agroforestry initiatives, waste valorization, renewable energy, and recyclable packaging - are increasingly central to brand equity and retailer scorecards. Overall, the category’s evolution reflects a shift toward curated, premium propositions that deliver consistent crunch, creaminess, and nutrition, enabling manufacturers and retailers to capture durable premiums and differentiate assortments year-round.Processed Tree Nuts Market Key Insights

- Premiumization with provenance. Origin-specific varieties, curated roast profiles, and transparent farmer partnerships allow brands to command premiums while reinforcing trust and differentiation across retail and e-commerce channels.

- Format expansion multiplies occasions. Value migrates beyond plain kernels to seasoned mixes, thin-coated pieces, filled bites, butters, milks, culinary oils, and nut flours - unlocking breakfast, baking, snacking, and gifting moments.

- Plant-forward momentum. Tree nuts underpin “better-for-you indulgence” in bars, bakery, dairy alternatives, and desserts, complementing or replacing animal fats without sacrificing richness, crunch, or mouthfeel.

- Processing precision = consistency. Blanching, tailored roast curves, controlled grinding, and lipid stabilization deliver repeatable flavor, color, and texture under tight allergen and microbiological specifications.

- Packaging protects freshness. High-barrier films, oxygen/light control, and dependable resealability extend shelf life and crunch, enabling club sizes, portion pouches, and e-commerce fulfillment with minimal quality loss.

- Responsible sourcing as a must-have. Certifications, water stewardship, and agroforestry programs move from marketing claims to audited practices, shaping retailer listings and long-term supplier partnerships.

- Omnichannel reshapes assortments. Mass, club, specialty, and D2C each demand tailored packs and stories; private label elevation increases price-value pressure while pushing higher quality baselines.

- Risk management professionalizes. Multi-origin sourcing, forward contracts, aflatoxin controls, and near-origin processing reduce crop volatility impacts while holding specifications steady.

- Clean-label flavor science. Culinary-grade seasonings and sugar-aware coatings deliver excitement with short ingredient lists; co-manufacturing standardizes recipes for scalable, repeatable runs.

- Adjacencies diversify demand. Nut oils, pastes, flours, and inclusions expand into sauces, gelato, pastry, spreads, and premium snacking, increasing utilization of every fraction of the kernel.

Processed Tree Nuts Market Reginal Analysis

North America

Demand centers on wellness-oriented snacking, premium chocolate pairings, nut butters, and plant-based dairy. Retailers emphasize clean labels, portion control, and elevated private labels. Large processors invest in precision roasting, allergen segregation, and traceability to support national distribution and e-commerce. Sourcing blends domestic and imported origins to buffer climate variability. Packaging favors high-barrier, resealable formats for club, mass, and online channels, while pilot plants streamline commercial rollouts across bars and bakery.Europe

Sustainability leadership, organic certification, and transparent origin stories shape category growth. Specialty roasters and chocolatiers refine sensory profiles; artisan bakeries integrate nut flours and inclusions for texture and nutrition. Regulatory rigor drives stringent aflatoxin and microbiological controls. Retailers promote minimal packaging and seasonal provenance narratives. Culinary oils, praline pastes, and nut creams gain traction in pastry, gelato, and spreads, with curated subscriptions complementing grocers.Asia-Pacific

Rising middle-income households and culinary curiosity fuel innovation in beverages, bakery, desserts, and gifting. Japan, Korea, and Australia prioritize refined flavor balance and clean labels; India and Southeast Asia focus on affordability, freshness, and versatile formats. Blending hubs tailor particle size, seasoning, and color to local preferences. Supply strategies mix regional cultivation with imports for continuity. Convenience chains and cafés expand portion pouches and toppings, while premium chocolate pairings grow in modern trade.Middle East & Africa

Café culture and bakery modernization lift consumption of pistachio, almond, and cashew formats in both traditional and contemporary recipes. Hospitality and travel catering drive premium assortments and portion-controlled packs. Import reliance heightens attention to logistics reliability, shelf-life control, and rigorous allergen and aflatoxin management. Regional roasting hubs near ports improve freshness and flavor consistency. Retailers leverage origin storytelling and simple ingredient decks to build trust.South & Central America

Regional producers promote distinctive varieties and agroforestry narratives, while confectionery, bakery, and snack bars gain visibility in modern retail. Export-focused processors pursue certifications to access premium destinations and hedge domestic volatility. Local roasting and grinding enhance freshness and flavor; diversified sourcing and resilient packaging mitigate climate and logistics risks. Foodservice and café channels adopt inclusions, toppings, and spreads, with heritage-driven marketing encouraging trial and repeat purchase.Processed Tree Nuts Market Segmentation

By Type

- Almonds

- Hazelnuts

- Pistachio Nuts

- Cashews

- Macadamia

- Walnuts

- Others

By Application

- Confectioneries

- Dairy Products

- Bakery Products

- Snacks & Bars

- Cereals

- Others

Key Market players

ofi (Olam Food Ingredients), Blue Diamond Growers, Wonderful Pistachios & Almonds (The Wonderful Company), John B. Sanfilippo & Son (Fisher Nuts), Select Harvests, Mariani Nut Company, Setton Pistachio of Terra Bella (Setton Farms), Borges Agricultural & Industrial Nuts (BAIN), Importaco (including Besana), Intersnack Group (KP Nuts/Ültje), Harris Woolf Almonds, Treehouse California Almonds, Keenan Farms, Tadım, Qiaqia Food (ChaCha)Processed Tree Nuts Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Processed Tree Nuts Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Processed Tree Nuts market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Processed Tree Nuts market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Processed Tree Nuts market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Processed Tree Nuts market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Processed Tree Nuts market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Processed Tree Nuts value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Processed Tree Nuts industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Processed Tree Nuts Market Report

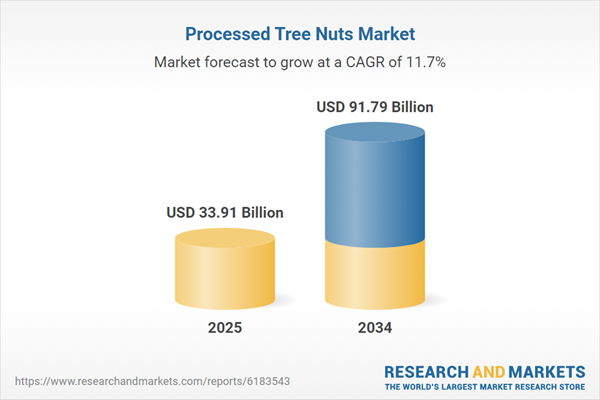

- Global Processed Tree Nuts market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Processed Tree Nuts trade, costs, and supply chains

- Processed Tree Nuts market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Processed Tree Nuts market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Processed Tree Nuts market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Processed Tree Nuts supply chain analysis

- Processed Tree Nuts trade analysis, Processed Tree Nuts market price analysis, and Processed Tree Nuts supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Processed Tree Nuts market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ofi (Olam Food Ingredients)

- Blue Diamond Growers

- Wonderful Pistachios & Almonds (The Wonderful Company)

- John B. Sanfilippo & Son (Fisher Nuts)

- Select Harvests

- Mariani Nut Company

- Setton Pistachio of Terra Bella (Setton Farms)

- Borges Agricultural & Industrial Nuts (BAIN)

- Importaco (including Besana)

- Intersnack Group (KP Nuts/Ültje)

- Harris Woolf Almonds

- Treehouse California Almonds

- Keenan Farms

- Tadım

- Qiaqia Food (ChaCha)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 33.91 Billion |

| Forecasted Market Value ( USD | $ 91.79 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |