Endoscopy Operative Devices Market

The endoscopy operative devices market spans therapeutic tools used through flexible and rigid endoscopes to dissect, resect, seal, dilate, retrieve, sample, and close tissue across gastroenterology, pulmonology, urology, gynecology, general surgery, ENT, and orthopedics. Portfolios include energy instruments (bipolar/advanced RF, ultrasonic), snares and graspers, endoscopic staplers and clip appliers, dilators and balloons, needle knives and ESD/EMR kits, hemostasis sprays and powders, retrieval nets/baskets, stone management systems, stents and deployment catheters, suturing/anchoring platforms, and closure/defect coverage solutions. Trends emphasize organ-preserving, minimally invasive therapies that shift care to ambulatory settings, with growing adoption of advanced GI resections (ESD/EFTR), bariatric endoscopy, endobariatric suturing, POEM for achalasia, third-space procedures, and natural orifice/transluminal approaches. Design priorities include slimmer profiles with higher torque and pushability, controlled energy delivery with thermal protection, single-use or semi-disposable pathways to reduce infection risk, and integrated visualization through-chip (CO₂ insufflation, waterjet, smoke evacuation). Drivers include rising GI cancer screening, obesity and metabolic disease prevalence, gallstone and biliary disease burden, urolithiasis, and the need to reduce LOS and anesthesia time. Competitive intensity blends diversified med-tech leaders, specialty innovators in suturing/closure and hemostasis, and value entrants supplying commodity tools. Differentiation rests on procedure-enabling kits, reliability in tortuous anatomy, ease-of-use that shortens learning curves, and comprehensive service - education, proctoring, reprocessing guidance, and digital case support. Key challenges are reprocessing complexity, device cost pressures, supply resilience for polymers/metals, and generating robust evidence for newer indications. Suppliers coupling proven performance with training ecosystems and workflow integration are best positioned as therapeutic endoscopy expands.Endoscopy Operative Devices Market Key Insights

- Therapeutic endoscopy expands beyond diagnostics

- Closure and defect management are growth engines

- Energy with thermal safety

- Hemostasis evolves to multi-modal toolkits

- Stone and stricture therapies broaden in urology/GI

- Bariatric and metabolic endoscopy

- Single-use where contamination risk is high

- Ambulatory shift demands efficiency

- Digital case support and training

- Supply resilience and cost stewardship

Endoscopy Operative Devices Market Reginal Analysis

North America

High adoption of advanced therapeutic endoscopy is supported by robust screening programs, bariatric centers, and strong ASC infrastructure. Hospitals value systems that reduce OR time and readmissions; single-use tools gain where reprocessing is a bottleneck. Procurement emphasizes training access, service response, and evidence for new indications.Europe

Guideline-driven practice and public procurement favor evidence-backed devices and robust reprocessing protocols. Growth areas include ESD in expert centers, POEM, and defect closure with clips and suturing. Ecolabel and sustainability expectations influence packaging and device reusability; multi-language IFUs and MDR documentation are mandatory.Asia-Pacific

Large procedure volumes and expanding tertiary centers accelerate uptake of ESD/POEM, stone management, and biliary therapy. Japan and Korea lead in advanced GI techniques; China and India scale training through centers of excellence. Price tiers range from premium suturing systems to value snares and accessories; local distributor support is decisive.Middle East & Africa

Investment in endoscopy suites at private hospitals and referral centers drives demand for reliable hemostasis, stone retrieval, and closure devices. Hot-climate logistics and staff training support from vendors are important. Public-private partnerships and visiting-proctor programs help build capabilities in complex procedures.South & Central America

Urban referral hospitals expand therapeutic portfolios in GI and urology; ASCs grow in major cities. Value-oriented procurement balances reusables with targeted single-use items. Vendor-provided education, bilingual documentation, and dependable supply chains influence awards; financing options help standardize kits across hospital groups.Endoscopy Operative Devices Market Segmentation

By Product

- Energy Systems

- Access Devices

- Suction & Irrigation Systems

- Hand Instruments

- Wound Retractors

- Snares

By Application

- Gastrointestinal (GI) Endoscopy

- Bronchoscopy

- Obstetrics/Gynecology Endoscopy

- Arthroscopy

- Laparoscopy

- Urology Endoscopy (Cystoscopy)

- Mediastinoscopy

- Otoscopy

- Laryngoscopy

- Others

Key Market players

Olympus, Boston Scientific, Medtronic, Ethicon (Johnson & Johnson), Stryker, Karl Storz, Fujifilm, Cook Medical, CONMED, PENTAX Medical (HOYA), ERBE Elektromedizin, Teleflex, Micro-Tech (Nanjing), Ovesco Endoscopy, STERIS (US Endoscopy).Endoscopy Operative Devices Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Endoscopy Operative Devices Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Endoscopy Operative Devices market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Endoscopy Operative Devices market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Endoscopy Operative Devices market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Endoscopy Operative Devices market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Endoscopy Operative Devices market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Endoscopy Operative Devices value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Endoscopy Operative Devices industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Endoscopy Operative Devices Market Report

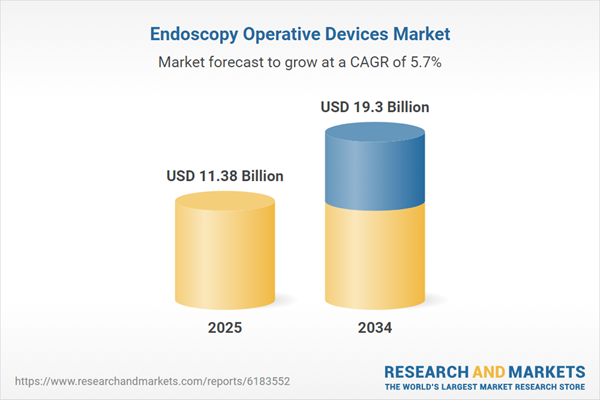

- Global Endoscopy Operative Devices market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Endoscopy Operative Devices trade, costs, and supply chains

- Endoscopy Operative Devices market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Endoscopy Operative Devices market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Endoscopy Operative Devices market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Endoscopy Operative Devices supply chain analysis

- Endoscopy Operative Devices trade analysis, Endoscopy Operative Devices market price analysis, and Endoscopy Operative Devices supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Endoscopy Operative Devices market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Olympus

- Boston Scientific

- Medtronic

- Ethicon (Johnson & Johnson)

- Stryker

- Karl Storz

- Fujifilm

- Cook Medical

- CONMED

- PENTAX Medical (HOYA)

- ERBE Elektromedizin

- Teleflex

- Micro-Tech (Nanjing)

- Ovesco Endoscopy

- STERIS (US Endoscopy).

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 11.38 Billion |

| Forecasted Market Value ( USD | $ 19.3 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |