AI API market

The AI API Market delivers model capabilities - language, vision, speech, multimodal, search/ranking, embeddings, vectorization, translation, code, and agent tooling - through consumption-based endpoints that slot into apps, data platforms, and workflows. Buyers span digital natives shipping AI features weekly and large enterprises operationalizing copilots, retrieval-augmented generation (RAG), analytics assistants, and automated contact flows. Architecturally, the stack is consolidating around three patterns: (1) foundation-model providers exposing hosted inference, fine-tuning, and safety controls; (2) hyperscale clouds bundling models with data, security, and MLOps; and (3) aggregators/orchestrators that route across multiple models for price/performance, region, and capability. Differentiation hinges on latency/throughput at scale, cost per 1K tokens or per second of audio, long-context reliability, structured outputs (JSON/function calling), evals/observability, and enterprise guardrails (PII redaction, content filters, jailbreak resistance). Data governance is decisive: retention opt-outs, “no training on customer prompts,” private fine-tunes, and regional/sovereign hosting. As AI moves from demos to production, demand shifts to SLAs, steady-state cost control (batch, caching, distillation), and lifecycle features - versioning, rollback, deterministic decoding, and policy-as-code. Emerging needs include domain-tuned small models for low-latency edge, multimodal agents that call tools and APIs, vector/graph retrieval for provenance, and compliant audit trails. Headwinds include model commoditization, inference hardware scarcity, rapidly changing benchmarks, and evolving policy (AI safety, copyright, data transfers). Tailwinds include embedded AI in SaaS, automation in support and ops, and co-pilot patterns for knowledge workers. Winners pair state-of-the-art models with predictable cost, strong security posture, rich SDKs, and evidence that their APIs improve business KPIs - not just benchmarks.AI API market Key Insights

- From model quality to system quality

- Cost control is a product, not an afterthought

- Enterprise trust = privacy + provenance + policy

- Multimodality and tool use become default

- RAG is the bridge from generic to enterprise-grade

- Model plurality beats single-vendor lock-in

- Small, specialized models matter at the edge

- Safety and brand protection shift left

- Developer experience is a revenue lever

- Commercials evolve beyond PAYG

AI API market Reginal Analysis

North America

The deepest enterprise spend and platform-engineering maturity. Buyers favor APIs with strong governance (no-train by default, audit trails), robust RAG toolchains, and fine-tuning for domain lexicons (healthcare, financial services, public sector). Procurement expects SOC/ISO, HIPAA/PCI alignment, SSO/SCIM, and multi-region SLAs. Cost control features - batch, caching, hybrid routing - are decisive for scaling copilots across thousands of users.Europe

Data sovereignty and the emerging regulatory regime elevate regional hosting, model registries with auditability, and privacy-centric design. Open standards, on-prem/sovereign options, and explainability win government and industrial accounts. Multi-language quality (especially low-resource EU languages) and lifecycle governance (retention, DPA terms) are essential for cross-border teams.Asia-Pacific

Explosive developer ecosystems and super-app innovation drive demand for low-latency, mobile-first APIs and voice/multimodal features. Price sensitivity favors model routing and compact models at the edge. Localization (scripts, ASR for tonal languages), partner ecosystems with regional clouds, and fintech/commerce integrations shape competitive wins in Japan, Korea, India, and Southeast Asia.Middle East & Africa

Public-sector modernization and financial services seek secure APIs with Arabic and African language support, on-prem or sovereign hosting, and strong vendor services. Energy and smart-city projects need agent/tooling APIs tied to IoT and analytics. Long sales cycles reward providers with local partners, training, and clear compliance posture.South & Central America

Growing adoption across fintech, customer support, and SMB SaaS. Buyers prioritize Spanish/Portuguese quality, transparent pricing, and ease of integration with existing cloud/data stacks. Regional latency, intermittent connectivity, and budget constraints boost interest in small models, batch processing, and committed-use discounts via local resellers and MSPs.AI API market Segmentation

By Type

- Computer Vision Apis

- Speech/Voice Apis

- Translation Apis

- Text Apis

- Document Parsing Apis

- Generative Ai Apis

- Others

By Deployment

- Cloud

- On-Premises

By Technology

- Generative Ai

- Others

By Functionality

- Pre-Trained Models

- Customizable Models

By End-User

- BFSI

- Media & Entertainment

- Telecommunications

- Government & Public Sector

- Healthcare & Life Sciences

- Manufacturing

- Retail & Ecommerce

- Technology & Software

- Travel & Hospitality

Key Market players

OpenAI, Google Cloud AI, Microsoft Azure AI, Amazon Web Services (AWS AI), Anthropic, Meta (Llama), Cohere, Mistral AI, IBM Watsonx, NVIDIA AI, Stability AI, Hugging Face, Together AI, AI21 Labs, Replicate, AssemblyAI, ElevenLabs, Clarifai, DeepL, OpenRouterAI API Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

AI API Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - AI API market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - AI API market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - AI API market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - AI API market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - AI API market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the AI API value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the AI API industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the AI API Market Report

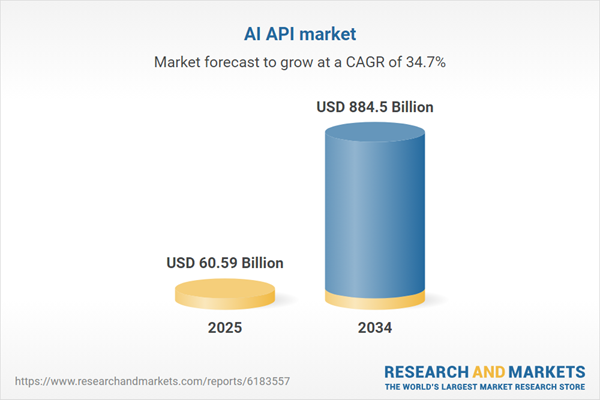

- Global AI API market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on AI API trade, costs, and supply chains

- AI API market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- AI API market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term AI API market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and AI API supply chain analysis

- AI API trade analysis, AI API market price analysis, and AI API supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest AI API market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- OpenAI

- Google Cloud AI

- Microsoft Azure AI

- Amazon Web Services (AWS AI)

- Anthropic

- Meta (Llama)

- Cohere

- Mistral AI

- IBM Watsonx

- NVIDIA AI

- Stability AI

- Hugging Face

- Together AI

- AI21 Labs

- Replicate

- AssemblyAI

- ElevenLabs

- Clarifai

- DeepL

- OpenRouter

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 60.59 Billion |

| Forecasted Market Value ( USD | $ 884.5 Billion |

| Compound Annual Growth Rate | 34.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |