Diabetic Foot Ulcer Biologics Market

The Diabetic Foot Ulcer Biologics Market comprises advanced therapies that actively modulate repair in chronic, hard-to-heal DFUs beyond standard care. Core applications include outpatient wound centers, hospital clinics, podiatry practices, integrated delivery networks, and specialty long-term care, where biologics are used after debridement, moisture balance, infection control, and offloading are established. Product modalities span cellular and tissue-based products (CTPs) with living or devitalized matrices; decellularized dermal/intestinal ECM scaffolds; placental/amniotic allografts (dehydrated or cryopreserved); topical growth factors; autologous options such as PRP and cell-enriched preparations; and emerging peptide, nitric-oxide, collagen/HA, and antimicrobial matrix technologies. Key trends include protocolized escalation (introducing biologics after inadequate progress on standard care), real-world evidence registries, point-of-care preparation kits, and packaging that cuts chair time (pre-sized sheets, on-contact adherence, simplified thaw/hydration). Drivers encompass rising diabetes prevalence, limb-salvage programs, payer attention to total cost of care, and guideline endorsement for earlier use in non-advancing wounds. Competitive dynamics feature diversified wound-care multinationals, tissue banks, device companies with biologic lines, and biotech entrants; differentiation rests on head-to-head outcomes, handling efficiency, episode cost, reimbursement strength, and supply reliability. Operational watchpoints include cold-chain for living tissues, sterility and donor-screening transparency, coding/coverage variation by site of care, and the need to pair biologics with strict offloading and infection management. Overall, the market is transitioning from niche rescue therapy to algorithm-driven, multidisciplinary care where biologics are deployed earlier to accelerate closure, reduce infections, limit amputations, and improve functional outcomes.Diabetic Foot Ulcer Biologics Market Key Insights

- Algorithmic escalation drives consistency: Clear thresholds (e.g., stalled healing despite optimized standard care) reduce variability, align with payers, and improve clinic throughput while avoiding overuse.

- CTPs vs. ECM trade-offs: Living constructs can speed granulation and epithelialization but demand cold chain and delicate handling; decellularized ECM offers shelf stability, broad clinic fit, and simpler logistics.

- Placental allografts scale access: Dehydrated and cryopreserved amnion/chorion deliver growth factors and a barrier; sourcing controls, adhesion, and conformability determine reapplication intervals and staff preference.

- Autologous biologics gain structure: Standardized PRP/cellular kits enhance reproducibility; documentation of adjunct measures (offloading, infection control) is critical for outcomes and reimbursement.

- Adjunct device synergy: NPWT prepares wound beds and secures grafts; total-contact casts/boots and edema control are non-negotiable co-interventions that influence biologic success rates.

- Evidence & RWE as currency: Prospective trials plus registry data on closure time, recurrence, infections, and amputations increasingly shape formularies, tenders, and pathway placement.

- Economics and wastage control: Pre-sized sheets, multi-use kits, and predictable resupply reduce wastage; products with clear coding and streamlined documentation accelerate payment cycles.

- Handling & workflow matter: Short thaw/hydration, tacky surfaces, and minimal fixation lower chair time; intuitive IFUs and nurse education reduce variability across multi-site networks.

- Risk and safety stewardship: Robust donor screening, sterilization/decell transparency, and antimicrobial strategies mitigate pathogen risk; vigilance on bioburden and endotoxin supports repeat use.

- Pipeline broadens mechanisms: Antimicrobial peptides, nitric-oxide donors, immune-modulating matrices, and bioactive collagen/HA hybrids target infection control and stalled inflammatory phases.

Diabetic Foot Ulcer Biologics Market Reginal Analysis

North America

Adoption is propelled by outpatient wound centers, podiatry networks, and integrated systems that use pathway-based escalation and buy-and-bill models. Strong emphasis on documentation, coding accuracy, and prior authorization rewards products with clear billing pathways and minimal wastage. Real-world registries, pharmacist support, and offloading compliance programs underpin payer engagement. Cold-chain readiness and clinic workflow efficiency influence brand rotation.Europe

HTA scrutiny and hospital formulary governance prioritize clinical evidence, infection reduction, and episode-of-care efficiency. Public systems emphasize standardized pathways with early debridement, antimicrobial control, and selective biologic use for non-advancing wounds. Tendering favors shelf-stable ECM and placental products with robust quality dossiers and competitive total cost. Multidisciplinary diabetic foot clinics drive consistent adoption.Asia-Pacific

Rising diabetes prevalence and expanding wound-care infrastructure create demand for scalable, easy-to-handle biologics. Private hospitals and specialty clinics lead early uptake, while public sector adoption grows via pilot programs. Shelf-stable matrices and point-of-care autologous kits suit diverse climates and logistics. Education on offloading and infection control improves outcomes; reimbursement pathways evolve by market.Middle East & Africa

Tertiary centers and private hospitals anchor demand, focusing on limb-salvage programs and rapid healing to reduce inpatient burden. Procurement values shelf-stable products, strong infection-control profiles, and vendor training. Harsh climate logistics elevate packaging durability and cold-chain discipline where required. Growing diabetic clinics and tele-wound consults support pathway standardization.South & Central America

Adoption concentrates in urban hospitals and private clinics with access to specialized wound teams. Budget sensitivity favors shelf-stable ECM and amniotic products with clear coding and predictable resupply. Training on debridement, offloading, and infection management is essential to realize biologic benefits. Public-private partnerships and local distribution strengthen access and continuity of care.Diabetic Foot Ulcer Biologics Market Segmentation

By Product

- Skin Substitutes

- Growth Factors

- Tissue-Engineered Products

By Indication

- Neuro-ischemic Ulcers

- Neuropathic Diabetic Foot Ulcer

- Ischemic Diabetic Foot Ulcer

By End-User

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Long-Term Care Settings

- Others

Key Market players

Organogenesis, Smith+Nephew, Integra LifeSciences, MiMedx Group, Coloplast (Kerecis), ConvaTec, Tides Medical, Sanara MedTech, MTF Biologics, Reapplix, Aziyo Biologics, Celularity, LifeNet Health, Amniox Medical, Osiris TherapeuticsDiabetic Foot Ulcer Biologics Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Diabetic Foot Ulcer Biologics Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Diabetic Foot Ulcer Biologics market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Diabetic Foot Ulcer Biologics market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Diabetic Foot Ulcer Biologics market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Diabetic Foot Ulcer Biologics market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Diabetic Foot Ulcer Biologics market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Diabetic Foot Ulcer Biologics value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Diabetic Foot Ulcer Biologics industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Diabetic Foot Ulcer Biologics Market Report

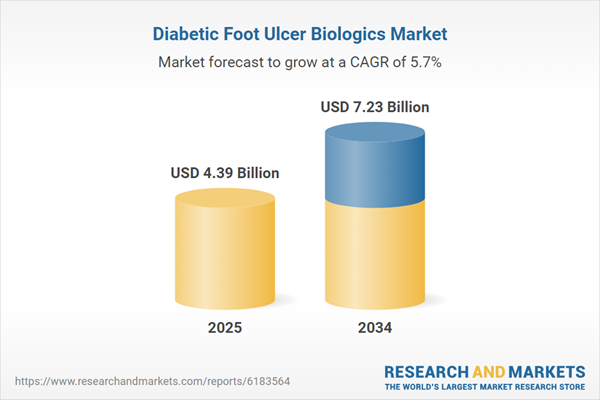

- Global Diabetic Foot Ulcer Biologics market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Diabetic Foot Ulcer Biologics trade, costs, and supply chains

- Diabetic Foot Ulcer Biologics market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Diabetic Foot Ulcer Biologics market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Diabetic Foot Ulcer Biologics market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Diabetic Foot Ulcer Biologics supply chain analysis

- Diabetic Foot Ulcer Biologics trade analysis, Diabetic Foot Ulcer Biologics market price analysis, and Diabetic Foot Ulcer Biologics supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Diabetic Foot Ulcer Biologics market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Organogenesis

- Smith+Nephew

- Integra LifeSciences

- MiMedx Group

- Coloplast (Kerecis)

- ConvaTec

- Tides Medical

- Sanara MedTech

- MTF Biologics

- Reapplix

- Aziyo Biologics

- Celularity

- LifeNet Health

- Amniox Medical

- Osiris Therapeutics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.39 Billion |

| Forecasted Market Value ( USD | $ 7.23 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |