Chocolate Keto Nut and Seed Butter Market

Chocolate keto nut and seed butters sit at the intersection of indulgence and metabolic wellness, pairing cocoa’s sensory appeal with low-sugar, high-fat profiles aligned to ketogenic, paleo, and reduced-carb lifestyles. Core applications span everyday spreads, smoothie boosters, baking and dessert fillings, protein bowls, and on-the-go snack cups or single-serve sachets for portion control. Recent trends include zero-added-sugar formulations using blends of allulose, erythritol, stevia, or monk fruit; clean-label, palm-oil-free emulsification; and expanded bases beyond almond to macadamia, hazelnut, cashew, pecan, pistachio, and seed options such as sunflower, pumpkin, and sesame for allergen-aware consumers. Brands are layering functional cues - MCT oils, added proteins, mineral fortification, and probiotic fibers - alongside sustainability narratives around cocoa sourcing, deforestation-free commitments, and fair-trade premiums. E-commerce and subscription models remain pivotal, complemented by natural/specialty retail, club formats, and private label expansion. Differentiation centers on chocolate quality (cocoa percentage, origin, alkalization), texture (stone-ground vs. ultra-smooth), spreadability at room temperature, and a “clean sweet” taste without cooling or bitterness. Competition spans natural-channel pioneers, sports-nutrition and metabolic-health entrants, gourmet chocolatiers moving into spreads, as well as retailers’ own brands; co-manufacturers and toll roasters enable agile line extensions and seasonal flavors. Growth is underpinned by rising protein-snacking habits, sugar-reduction policies, and social-commerce education, while constraints include price sensitivity to nut and cocoa volatility, label-claim scrutiny on “keto,” and consumer tolerance to sugar alcohols. Overall, the category is professionalizing quickly, with premiumization balanced by private-label value tiers and seed-based inclusivity.Chocolate Keto Nut and Seed Butter Market Key Insights

- Formulation architecture is shifting to sweetener blends. Producers increasingly combine allulose with erythritol and high-purity stevia or monk fruit to smooth sweetness curves, reduce cooling effects, and improve bake stability; chocolate notes are tuned via cocoa butter ratios and roasting profiles to offset sweetener aftertastes and deliver a rounded indulgent finish.

- Texture and spreadability define repeat purchase. Stone-ground and fine-micronized particles enhance mouthfeel, while emulsifier strategies (sunflower lecithin, palm-free systems) and optimized nut-to-oil ratios limit separation; rheology targets ambient spread without graininess, and water-activity control supports shelf stability in jar and sachet formats.

- Bases are diversifying for allergen and cost resilience. Beyond almond, brands lean into macadamia for premium keto positioning and sunflower/pumpkin for nut-free schools and markets; hybrid nut-seed blends lower cost volatility, elevate mineral profiles, and broaden taste/texture options under a single chocolate umbrella.

- Functional add-ins sharpen wellness credentials. MCT oils for rapid energy, plant proteins for satiety, prebiotic fibers for digestive health, and mineral blends (magnesium, potassium) are being layered, with careful sensory masking to avoid grittiness or chalk; claims emphasize blood-sugar friendliness alongside clean ingredients.

- Chocolate quality is a visible trade-up lever. Higher cocoa percentages, origin-specific cacao, and certifications (organic, fair trade, rainforest-friendly) support premium pricing; alkalized vs. natural cocoa choices are calibrated for color, bitterness, and perceived richness across classic, dark, and salted variants.

- Format innovation targets occasions. Squeeze pouches and single-serves win in travel, gym, and lunchbox use; filled cups, wafer sandwich layers, and baking chips/spreads pipelines extend usage beyond bread to dessert kits and home baking, supported by QR-linked recipes and social content.

- Channel mix is omnichannel with DTC muscles. Subscriptions, bundle samplers, and limited-drop flavors power direct-to-consumer; natural/specialty retailers provide discovery, while club stores and marketplace platforms scale velocity; private label is maturing with credible clean-label specs and competitive chocolate cues.

- Regulatory and labeling rigor is rising. “Keto,” “no added sugar,” and “diabetic-friendly” phrasing requires robust carbohydrate accounting and compliant sweeteners per local rules; allergen control (peanut/tree-nut segregation) and cross-contact documentation are key retail gatekeepers.

- Supply risk management is strategic. Cocoa and premium nut inputs face climate and geopolitical volatility; leaders diversify origins, hedge contracts, and deploy seed-heavy blends or seasonal rotations, while investing in sustainable cocoa programs to protect narrative and cost over the long term.

- Competition blends heritage and newcomers. Natural-channel nut-butter pioneers, sports-nutrition brands, metabolic-health specialists, boutique chocolatiers, and retailer brands crowd the shelf; points of difference include sugar-alcohol tolerance solutions, ultra-smooth textures, dessert-like flavors, and transparent sourcing stories.

Chocolate Keto Nut and Seed Butter Market Reginal Analysis

North America

The most mature demand for keto and low-sugar spreads, anchored by strong natural/specialty retail and robust DTC ecosystems. Consumers expect clean labels, palm-oil-free emulsification, and credible “no added sugar” claims. Innovation centers on functional add-ins (MCTs, protein) and dessert-inspired flavors. Club and mass channels expand reach, while private label compresses premium gaps. Allergen-aware seed variants gain traction in school and family households. Retailers scrutinize sweetener systems and taste performance closely.Europe

Sugar-reduction legislation, front-of-pack nutrition schemes, and organic preferences shape formulations. Darker cocoa profiles and shorter ingredient lists resonate, with cautious adoption of newer sweeteners based on country-specific rules. Specialty retailers and e-commerce drive premium discovery, while discounters accelerate private-label value plays. Nut origin transparency and fair-trade cocoa are powerful trust signals. Seed-based chocolate spreads serve nut-allergy and school-policy needs, particularly in Northern and Western markets.Asia-Pacific

Urban wellness shoppers in Australia, New Zealand, Japan, South Korea, and select Southeast Asian cities are early adopters, often via cross-border e-commerce. Taste leans toward balanced sweetness and silky textures; single-serves suit convenience-led snacking. Localized variants (matcha-chocolate, black-sesame-chocolate) appear in premium sets. Regulatory acceptance of sweeteners and import duties influence SKU strategies. Modern grocery and specialty online platforms are main activation points.Middle East & Africa

Premium chocolate cues, gifting, and expatriate communities support the category in Gulf markets, primarily through upscale supermarkets and online channels. Heat stability and oil separation control are critical for logistics. Certifications (halal, clean-label) and nut-allergen management drive retailer acceptance. Broader Africa remains nascent, with opportunity tied to modern retail growth, confectionery culture, and targeted digital education.South & Central America

Chocolate heritage is strong, with growing interest in low-sugar indulgence among upper-income urban consumers. Local nut and seed inputs (e.g., peanuts, cashews, pumpkin seeds) enable cost-effective blends, while origin-story cocoa can premiumize. Regulatory perspectives on sweeteners vary by country, guiding label and formulation choices. E-commerce and boutique natural stores lead awareness; price sensitivity requires tiered ranges and seasonal flavor rotations for excitement without over-engineering cost.Chocolate Keto Nut and Seed Butter Market Segmentation

By Type

- Pili nut butter

- Pecan butter

- Hazelnut butter

- Almond nut butter

- Walnut butter

- Others

By Packaging

- Pouch

- Plastic Jar

- Carton

- Others

By End-User

- Restaurants

- Household

By Distribution Channel

- Online

- Convenient Stores

- Supermarkets

- Others

Key Market players

Perfect Keto, SuperFat, NuttZo, FBOMB (Love You Foods), ChocZero, Lakanto, Legendary Foods, Primal Kitchen, Noosh Brands, Artisana Organics, 88 Acres, Kiss My Keto, Good Good, BHU Foods, House of MacadamiasChocolate Keto Nut and Seed Butter Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Chocolate Keto Nut and Seed Butter Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Chocolate Keto Nut and Seed Butter market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Chocolate Keto Nut and Seed Butter market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Chocolate Keto Nut and Seed Butter market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Chocolate Keto Nut and Seed Butter market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Chocolate Keto Nut and Seed Butter market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Chocolate Keto Nut and Seed Butter value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Chocolate Keto Nut and Seed Butter industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Chocolate Keto Nut and Seed Butter Market Report

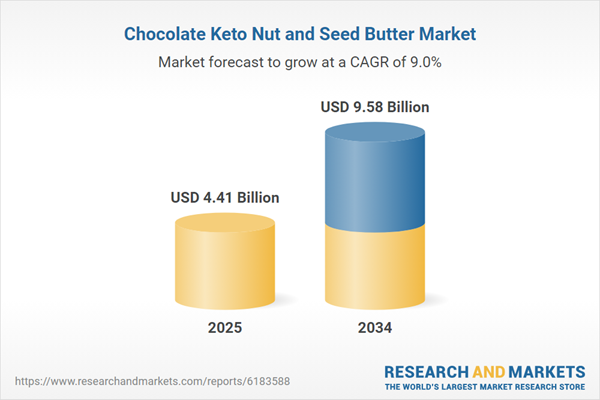

- Global Chocolate Keto Nut and Seed Butter market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Chocolate Keto Nut and Seed Butter trade, costs, and supply chains

- Chocolate Keto Nut and Seed Butter market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Chocolate Keto Nut and Seed Butter market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Chocolate Keto Nut and Seed Butter market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Chocolate Keto Nut and Seed Butter supply chain analysis

- Chocolate Keto Nut and Seed Butter trade analysis, Chocolate Keto Nut and Seed Butter market price analysis, and Chocolate Keto Nut and Seed Butter supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Chocolate Keto Nut and Seed Butter market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Perfect Keto

- SuperFat

- NuttZo

- FBOMB (Love You Foods)

- ChocZero

- Lakanto

- Legendary Foods

- Primal Kitchen

- Noosh Brands

- Artisana Organics

- 88 Acres

- Kiss My Keto

- Good Good

- BHU Foods

- House of Macadamias

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.41 Billion |

| Forecasted Market Value ( USD | $ 9.58 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |