Fire Resistant Lubricants Market

The fire resistant lubricants (FRL) market covers fluids engineered to minimize ignition risk and flame propagation in high-energy environments where leaks or aerosolized mists could contact hot surfaces. Core chemistries include water-containing types (HFA/HFB/HFC water-glycol), anhydrous synthetics (HFDU polyol/complex esters, HFDR phosphate esters), specialty fluorinated fluids for extreme duty, and emerging bio-based ester systems. End-uses span steel and aluminum mills (hydraulic systems near casting lines), underground and longwall mining, die casting and forging presses, power generation and turbines, marine and offshore, aviation ground support, and critical manufacturing with hot zones. Buyers prioritize a balance of fire performance (self-extinguishing, high auto-ignition), wear protection, seal compatibility, corrosion control, and long fluid life under shear and thermal stress. Trends include migration from older phosphate esters toward ashless, zinc-free HFDU esters with improved biodegradability; reformulation to address toxicology and operator exposure; and tighter mist-control via low-volatility, higher VI basestocks. Digital condition monitoring (particle, water, TAN, MPC varnish metrics) shortens reaction time and supports predictive maintenance. Standards and certifications - ISO 12922, OEM steel-mill lists, mining approvals, marine class society notations, FM/Factory Mutual spray-fire tests - govern specification and audits. Competition spans integrated oil majors, specialty lubricant formulators, and additive suppliers; differentiation hinges on field reliability in severe duty, cleanliness (varnish/oxidation), power efficiency, and service depth (flush protocols, filtration, root-cause analysis). Supply risks focus on ester raw materials, additive availability, and fluorinated polymer scrutiny. As plants raise safety and ESG ambitions, FRLs move from niche safety consumables to strategic fluids embedded in risk, energy, and uptime programs.Fire Resistant Lubricants Market Key Insights

- Safety performance must coexist with mechanical integrity

- Shift from phosphate esters to ashless ester HFDU

- Water-glycol remains the workhorse in steel and mining

- Varnish and oxidation control drive uptime

- Energy efficiency becomes a selection criterion

- Seal, paint, and hose compatibility is non-negotiable

- Contamination control is the hidden moat

- Compliance and approvals steer procurement

- ESG and exposure narratives matter

- Service capability defines winners

Fire Resistant Lubricants Market Reginal Analysis

North America

Safety culture in steel, aluminum, paper, and mining sustains FRL adoption in hydraulics near hot surfaces and open flames. Plants favor HFDU ester upgrades for cleanliness and energy gains, while HFC dominates legacy mills. Procurement emphasizes FM/ISO approvals, OEM list presence, and service SLAs (on-site flushing, rapid lab turnaround). Cold/heat extremes drive viscosity-temperature robustness and mist-control packages in outdoor yards and casthouses.Europe

Strong regulatory emphasis on worker exposure, emissions, and environmental protection accelerates zinc-free, biodegradable ester platforms and tight mist management. Steel and automotive press shops specify OEM-approved fluids with low varnish propensity for servo accuracy. Energy-efficiency metrics and circular programs (re-refining, tote re-use) appear in tenders. Water-glycol remains entrenched in mills, supported by disciplined inhibitor management and micro control.Asia-Pacific

Large installed base in steel, non-ferrous, and die casting drives volume across HFC and HFDU. Rapid capacity additions create greenfield opportunities to standardize on ashless esters with modern filtration/cooling skids. Mining in Australia and ASEAN values fire safety under high ambient temperatures; service networks and quick lab diagnostics influence awards. Localization of ester raw materials and additive supply improves resilience.Middle East & Africa

Aluminum smelters, steel projects, and power/water infrastructure require FRLs with high thermal stability and strong anti-wear at elevated ambient conditions. Procurement favors robust OEM approvals, high-flash chemistries, and vendor field support for contamination and varnish control. Offshore and marine applications adopt class-approved fluids, with logistics reliability and heat tolerance critical for uptime.South & Central America

Metals, mining, and pulp & paper rely on FRLs for safety and regulatory compliance in hot processes. Buyers balance HFC cost efficiency with HFDU cleanliness and equipment protection. Regional partners that provide flushing, filtration upgrades, and operator training gain share. Supply chain and customs variability make local stocks, reclaim options, and rapid testing valuable to maintain continuity.Fire Resistant Lubricants Market Segmentation

By Type

- HFA

- HFB

- HFC

- HFDU

- HFDR

By End-User

- Metal Processing

- Mining

- Power Generation

- Aerospace

- Marine

- Construction

- Others

Key Market players

Quaker Houghton, FUCHS, TotalEnergies, Shell, Castrol (BP), Petro-Canada Lubricants (HF Sinclair), PETROFER, CONDAT, MORESCO, LANXESS (Reolube), Eastman (Skydrol), ICL Group (Fyrquel), Solvay (Fomblin PFPE), Chemours (Krytox PFPE), Klüber LubricationFire Resistant Lubricants Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Fire Resistant Lubricants Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Fire Resistant Lubricants market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Fire Resistant Lubricants market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Fire Resistant Lubricants market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Fire Resistant Lubricants market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Fire Resistant Lubricants market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Fire Resistant Lubricants value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Fire Resistant Lubricants industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Fire Resistant Lubricants Market Report

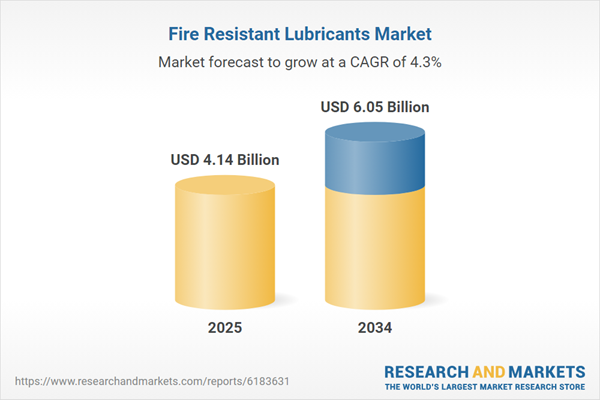

- Global Fire Resistant Lubricants market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Fire Resistant Lubricants trade, costs, and supply chains

- Fire Resistant Lubricants market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Fire Resistant Lubricants market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Fire Resistant Lubricants market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Fire Resistant Lubricants supply chain analysis

- Fire Resistant Lubricants trade analysis, Fire Resistant Lubricants market price analysis, and Fire Resistant Lubricants supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Fire Resistant Lubricants market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Quaker Houghton

- FUCHS

- TotalEnergies

- Shell

- Castrol (BP)

- Petro-Canada Lubricants (HF Sinclair)

- PETROFER

- CONDAT

- MORESCO

- LANXESS (Reolube)

- Eastman (Skydrol)

- ICL Group (Fyrquel)

- Solvay (Fomblin PFPE)

- Chemours (Krytox PFPE)

- Klüber Lubrication

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.14 Billion |

| Forecasted Market Value ( USD | $ 6.05 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |