Automotive Embedded Software Market

The automotive embedded software market underpins the transition from hardware-centric vehicles to software-defined platforms. Software stacks span deeply embedded real-time control for powertrain, chassis, body, and thermal domains; domain/zonal controllers orchestrating dozens of ECUs; and high-compute platforms for ADAS/automated driving, infotainment, connectivity, and digital cockpit. Core technologies include AUTOSAR Classic for deterministic control, AUTOSAR Adaptive and POSIX/Linux for high-performance compute, hypervisors for mixed-criticality consolidation, and middleware enabling service-oriented architectures across domain/zonal topologies. Trends emphasize over-the-air (OTA) update pipelines, continuous integration/continuous deployment (CI/CD) adapted to safety-critical contexts, virtualization (SIL/HIL/VIL) for rapid validation, and cybersecurity-by-design aligned to evolving regulations. Demand is propelled by electrification, advanced driver assistance, connected services, and the monetization of features-on-demand, which collectively push OEMs to build internal software organizations and partner with tier-1s, silicon vendors, and platform providers. Competitive dynamics span platform OS vendors, toolchain providers, middleware firms, tier-1 integrators, cloud/DevOps partners, and specialist safety and security consultancies. Differentiation centers on time-determinism and performance per watt, functional safety and cyber compliance, reusable software assets, and tooling that shortens calibration, validation, and homologation cycles across global vehicle programs. Challenges include legacy ECU fragmentation, shortage of embedded and AI talent, integration debt from supplier ecosystems, and managing continuous updates without compromising safety. Overall, winners combine robust real-time foundations with scalable service architectures, dependable update and security lifecycles, and data/AI capabilities that unlock faster development, improved quality, and durable revenue from digital features.Automotive Embedded Software Market Key Insights

- Shift to software-defined vehicle (SDV) architectures. OEMs are consolidating dozens of function-specific ECUs into domain and zonal controllers with centralized compute. This reduces wiring, improves bandwidth, and enables cross-domain orchestration. Embedded stacks evolve toward service-oriented interfaces, enabling feature reuse, faster varianting, and decoupling of hardware refresh cycles from software evolution.

- Mixed-criticality on shared hardware is becoming standard. Hypervisors and containerization allow ASIL-rated tasks to co-exist with non-critical services on single SoCs. Partitioning, time/space isolation, and safety monitors ensure determinism while unlocking cost and weight savings. Tooling must provide end-to-end traceability from model to binary to meet safety cases across consolidated platforms.

- Safety and cybersecurity lifecycles drive architecture. ISO 26262 and ISO/SAE 21434, together with UNECE R155/R156, require continuous risk assessment, secure boot, authenticated updates, and incident response. Secure diagnostics, key management, intrusion detection, and SBOM governance are embedded from program kickoff; post-SOP update governance becomes as critical as pre-SOP validation.

- AUTOSAR Classic + Adaptive coexistence defines near-term stacks. Deterministic Classic platforms persist for control loops, while Adaptive/Posix environments host infotainment, ADAS perception, and data services. Orchestration layers manage inter-partition communication, with SOME/IP, DDS, and Ethernet TSN enabling predictable latency for safety-relevant messaging across domains.

- Model-based development and virtualization compress time-to-SOP. MATLAB/Simulink/Stateflow, AUTOSAR authoring, and code generators feed virtual ECUs for SIL/MIL; cloud HIL farms and sensor simulation accelerate regression. Digital twins allow calibration and corner case exploration early, reducing physical prototype dependence and enabling parallel validation of OTA updates.

- Data pipelines and AI extend beyond ADAS. Edge AI supports perception, cabin monitoring, and predictive maintenance; cloud analytics inform fleet learning, energy optimization, and software quality metrics. On-device optimization (quantization, pruning) improves performance per watt, while data governance and privacy controls secure cross-border deployments.

- OTA and feature-on-demand reshape business models. Differential updates, staged rollouts, canary fleets, and fail-safe A/B partitioning minimize bricking risk. Entitlement management, telemetry-driven quality, and remote diagnostics reduce warranty cost and enable paid upgrades, but require tight coupling of DevOps with type approval and dealership service processes.

- Silicon heterogeneity demands portable abstractions. Vehicle compute mixes MCU, MPU, GPU, DSP, NPU, and FPGA blocks. Abstraction layers, standardized drivers, and performance-aware scheduling are critical to avoid vendor lock-in and to retarget workloads across generations, especially for ADAS and EV power electronics where roadmaps move quickly.

- Compliance and regionalization add complexity. Homologation requires adapting software to regional cybersecurity, privacy, and radio/connectivity rules, while meeting local language and accessibility needs. Build systems, configuration management, and test assets must support market-specific variants without fracturing the codebase or delaying updates.

- Supply-chain resilience hinges on IP reuse and partnerships. Reusable software assets, shared middleware, and long-term support branches reduce integration risk. Strategic alliances with tier-1s, cloud providers, and chip makers, plus clear change-control and security incident processes, are decisive in meeting launch windows and sustaining updates over vehicle lifetimes.

Automotive Embedded Software Market Reginal Analysis

North America

Strong focus on SDV roadmaps, OTA monetization, and premium ADAS feature sets. Startups and tech ecosystems collaborate with established OEMs on centralized compute and cloud-native toolchains. Compliance with cybersecurity and update regulations is embedded in program gates, while talent competition intensifies around AI/embedded hybrids. EV programs drive thermal/energy-aware software and predictive maintenance at scale.Europe

Heritage in safety, calibration, and powertrain control meets rapid moves to zonal architectures and consolidated ECUs. Rigorous functional safety and cyber governance shape supplier selection, with deep AUTOSAR adoption and growing Adaptive/Posix stacks for cockpit/ADAS. Data privacy and lifecycle documentation standards are strict; OTA and feature enablement proceed under cautious, regulator-aligned rollouts.Asia-Pacific

High velocity across EVs, digital cockpits, and connectivity, with strong in-house software pushes by regional OEMs. Cost-optimized domain controllers and rich HMI experiences proliferate, alongside aggressive cadence on ADAS features. Local silicon and module ecosystems enable rapid design turns; homologation and language/localization variants drive complex configuration management and testing at scale.Middle East & Africa

Emerging opportunities tied to smart-city mobility pilots, premium imports, and localized assembly growth. Connectivity and telematics platforms are prioritized for fleet and consumer services; cybersecurity compliance becomes a procurement differentiator. Partnerships with global platform vendors and regional integrators provide rapid deployment while building local service capabilities.South & Central America

Adoption follows connected services, telematics, and safety enhancements suited to mixed road conditions and price points. OTA, remote diagnostics, and fleet features reduce service costs across large geographies. Localization, cost-optimized ECUs, and robust aftersales tooling are important, while regulatory paths for cyber and updates shape timing for advanced ADAS introductions.Automotive Embedded Software Market Segmentation

By Type

- RTOS

- Compilers

- Assemblers

- Debuggers

- Others

By Application

- ADAS and AD

- Powertrain and Chassis

- Body

- Infotainment

- Connected Services

- Others

Key Market players

Robert Bosch GmbH, Continental AG, Denso Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, Infineon Technologies AG, KPIT Technologies Ltd, Tata Elxsi Ltd, ETAS GmbH, Texas Instruments Incorporated, Panasonic Corporation, Mitsubishi Electric Corporation, Tata Technologies Ltd, RT‑RK d.o.o., Link Motion LtdAutomotive Embedded Software Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Automotive Embedded Software Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Automotive Embedded Software market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Automotive Embedded Software market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Automotive Embedded Software market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Automotive Embedded Software market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Automotive Embedded Software market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Automotive Embedded Software value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Automotive Embedded Software industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Automotive Embedded Software Market Report

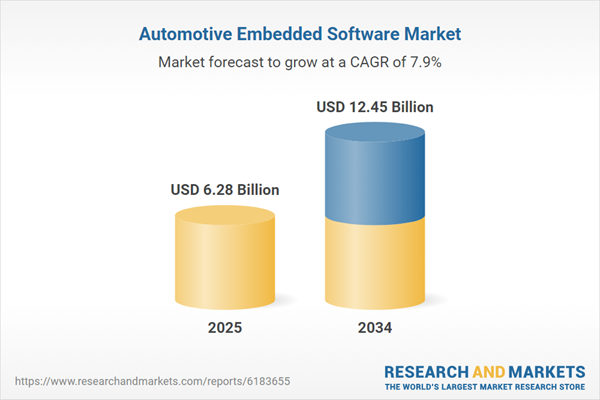

- Global Automotive Embedded Software market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Automotive Embedded Software trade, costs, and supply chains

- Automotive Embedded Software market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Automotive Embedded Software market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Automotive Embedded Software market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Automotive Embedded Software supply chain analysis

- Automotive Embedded Software trade analysis, Automotive Embedded Software market price analysis, and Automotive Embedded Software supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Automotive Embedded Software market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Infineon Technologies AG

- KPIT Technologies Ltd.

- Tata Elxsi Ltd.

- ETAS GmbH

- Texas Instruments Incorporated

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Tata Technologies Ltd.

- RT-RK d.o.o.

- Link Motion Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.28 Billion |

| Forecasted Market Value ( USD | $ 12.45 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |