Pea Protein Concentrate Market

Pea protein concentrate (PPC) is a mid-protein, functional ingredient derived mainly from yellow peas via dry fractionation and, in some cases, wet processing. It delivers a balanced amino profile, clean label positioning, and allergen-friendly credentials, making it a versatile choice across plant-based meat analogs and texturized vegetable proteins, sports nutrition powders and RTD beverages, bakery and snacks fortification, dairy alternatives (yogurt, cheese spreads, frozen desserts), culinary sauces, and premium pet nutrition. Current product development emphasizes improved taste neutrality, solubility, and emulsification - supported by enzymatic debittering, fermentation pre-treatments, agglomeration/instantization, and advanced extrusion for fibrous textures. Demand is propelled by flexitarian eating, retailer commitments to reformulation, rising protein fortification in mainstream foods, and corporate sustainability targets favoring pulse crops’ agronomic benefits. Supply chains are maturing as processors co-locate near pea-growing belts to secure identity-preserved inputs and valorize co-products (starch, fiber). The competitive landscape comprises global starch/protein processors and agile regional specialists expanding capacity, launching organic and neutral-taste grades, and offering tailored particle size, functionality, and certification sets (halal, kosher, organic, non-GMO). Partnerships with co-manufacturers and brand owners are deepening to deliver application-specific systems (PPC plus texturates, binders, and flavors). Key challenges include crop yield variability, off-note management, price competition with soy and whey, margin pressure in plant-based meats, and evolving regulatory guidance on protein quality claims. Even so, PPC’s cost-to-function advantage versus isolates, its compatibility in blends (pea-rice, pea-fava), and steady uptake in everyday bakery, cereals, and pets underpin resilient multi-category growth.Pea Protein Concentrate Market Key Insights

- Application mix is broadening. Beyond meat analogs, PPC is gaining steady traction in mainstream bakery, cereals, snacks, and culinary lines where protein fortification and clean labels matter, diversifying demand away from cyclic plant-meat dynamics.

- Functionality upgrades drive stickiness. Enzymatic de-flavoring, fermentation pre-treatments, and agglomeration improve dispersibility and taste, reducing formulation complexity and repeat masking costs across shakes and RTD beverages.

- Texturate synergy. PPC used with pea-based texturized proteins (dry or high-moisture extrusion) delivers improved bite and succulence; suppliers increasingly bundle PPC with texturates and binders as turnkey systems for faster scale-up.

- Blend strategies win on nutrition and cost. Pea-rice and pea-fava blends balance amino profiles, lighten flavor, and stabilize supply; brand owners use PPC as the backbone, topping up with complementary proteins for label and margin goals.

- Clean label and allergen avoidance. PPC supports soy- and dairy-free claims and short ingredient lists, aligning with retailer reformulation scorecards and school/healthcare procurement preferences.

- Sustainability as a purchase driver. Pulses’ nitrogen-fixing role supports regenerative rotations and lower embedded footprints; brands leverage origin-verified peas and farm-gate programs for credible ESG narratives.

- Supply proximity reduces volatility. Capacity additions near pulse belts and identity-preserved sourcing improve availability, shorten lead times, and reduce logistics risk; co-product valorization supports processor economics.

- Organic and specialty grades expand. Growth in organic, low-sodium, and neutral-taste PPC grades enables premium positioning in infant-adjacent, clinical, and lifestyle nutrition without reformulation penalties.

- Regulatory and claims landscape evolves. Protein quality, front-of-pack labeling, and additive scrutiny favor minimally processed inputs; PPC’s processing route and documentation ease retail acceptance.

- Pet nutrition remains a quiet engine. Grain-free and limited-ingredient recipes rely on PPC for digestible protein and functionality, offering steady volumes with less promotional intensity than human foods.

Pea Protein Concentrate Market Reginal Analysis

North America

Brand-led innovation and retailer mandates keep PPC embedded across sports nutrition, meal-replacement, and frozen plant-based entrées. Canadian prairie pea supply underpins identity-preserved programs and closer-to-crop processing, improving reliability and cost. Co-manufacturing networks enable rapid private-label and challenger brand launches. Clean label and allergen-free positioning remain strong, with growing interest in organic PPC for premium beverages and snacks. Pet food formulators prioritize PPC for digestibility and amino balance, sustaining baseline demand across economic cycles.Europe

A mature meat-free category and strong bakery/snack fortification culture support PPC’s everyday applications. Retailers emphasize short ingredient lists and sustainability narratives, encouraging pulse-based reformulation in chilled and ambient lines. Local pea cultivation and processor investments in France, the Nordics, and CEE improve origin assurance and reduce transport emissions. Private-label programs accelerate value-tier penetration, while organic and specialty grades address DACH and Nordics. Regulatory rigor on nutrition and claims favors minimally processed proteins with robust documentation.Asia-Pacific

Demand is shaped by diversified use cases: performance nutrition in Australia and New Zealand, premium pet food and beverages in China, convenience formats in Japan and Korea, and value-centric fortified staples in Southeast Asia. Domestic processors in China and India expand capacity, while import flows complement local harvests for consistent quality. Brands lean on PPC blends to balance taste and solubility in RTD teas, coffees, and smoothies. Growing interest in origin-verified and non-GMO lines supports premiumization and export-ready SKUs.Middle East & Africa

Protein-fortified bakery, ambient beverages, and dairy alternatives find a foothold in the Gulf through modern retail and foodservice. Halal certification and heat-stable functionality are critical in long-shelf-life applications. Reliance on imports is offset by hub-based blending, repacking, and application centers that tailor PPC systems to local sensory profiles. Government nutrition programs and hospitality projects drive institutional demand, while price sensitivity encourages PPC use over isolates in cost-optimized recipes.South & Central America

Sports nutrition, on-the-go beverages, and fortified bakery lines are primary PPC corridors, with developing interest in plant-based meats in urban centers. Processors partner with local co-packers to manage currency and logistics risk while ensuring consistent sensory profiles. Retailers expand private-label protein-fortified SKUs, balancing affordability and clean label. Emerging pulse cultivation initiatives and trade agreements aim to stabilize supply, while pet nutrition brands adopt PPC for premium dry and wet formulations across key markets.Pea Protein Concentrate Market Segmentation

By Application

- Food

- Beverage

- Others

By Form

- Dry

- Wet

By Source

- Chickpeas

- Yellow Split Peas

- Lentils

By Processing Method

- Dry

- Wet

Key Market players

Roquette, Cosucra, PURIS, Ingredion, ADM, Cargill, Kerry, Emsland Group, Axiom Foods, Yantai Shuangta, Shandong Jianyuan, AGT Foods, Merit Functional Foods, Glanbia Nutritionals, IFFPea Protein Concentrate Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Pea Protein Concentrate Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Pea Protein Concentrate market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Pea Protein Concentrate market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Pea Protein Concentrate market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Pea Protein Concentrate market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Pea Protein Concentrate market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Pea Protein Concentrate value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Pea Protein Concentrate industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Pea Protein Concentrate Market Report

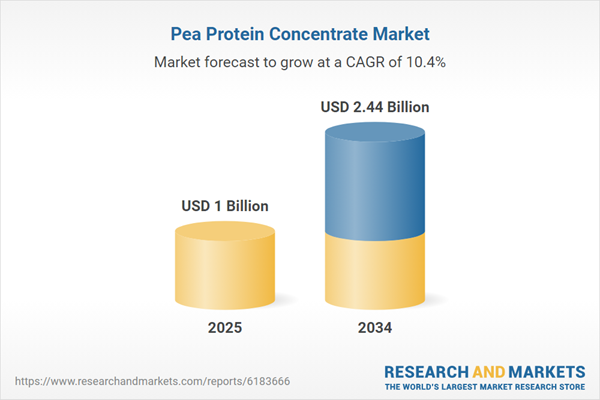

- Global Pea Protein Concentrate market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Pea Protein Concentrate trade, costs, and supply chains

- Pea Protein Concentrate market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Pea Protein Concentrate market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Pea Protein Concentrate market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Pea Protein Concentrate supply chain analysis

- Pea Protein Concentrate trade analysis, Pea Protein Concentrate market price analysis, and Pea Protein Concentrate supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Pea Protein Concentrate market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Roquette

- Cosucra

- PURIS

- Ingredion

- ADM

- Cargill

- Kerry

- Emsland Group

- Axiom Foods

- Yantai Shuangta

- Shandong Jianyuan

- AGT Foods

- Merit Functional Foods

- Glanbia Nutritionals

- IFF

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1 Billion |

| Forecasted Market Value ( USD | $ 2.44 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |