Refined Peanut Oil Market

The Refined Peanut Oil Market encompasses refined-bleached-deodorized (RBD) peanut oil produced from shelled kernels and engineered for neutral flavor, low impurities, and a high smoke point suited to deep-frying, sautéing, and snack/bakery processing across retail, foodservice, and industrial channels. Demand is anchored in quick-service restaurants, street-food ecosystems, and packaged snacks seeking heat stability, clean taste, and consistent color, while household adoption follows urbanization and convenience cooking. Product performance hinges on varietal selection (standard vs. high-oleic peanuts), pre-press/expeller vs. solvent extraction, tight controls on moisture/free fatty acids, winterization to prevent cloudiness, and deodorization for low odor. Safety and compliance center on aflatoxin governance from farm to refinery, allergen regulations (with highly refined oils treated differently across jurisdictions), and elimination of legacy trans fats via modern interesterification alternatives. Competitive pressure comes from palm olein, soybean, canola, and sunflower oils - each trading off price, stability, taste neutrality, and label perception; peanut oil differentiates via fry life, sensory delivery, and regional culinary heritage. Brands and bulk suppliers focus on shelf-life protection (antioxidant stewardship, nitrogen blanketing, light/oxygen barriers), packaging (PET/HDPE bottles, tins, bag-in-box), and channel-specific SKUs from retail bottles to tanker/IBC loads. Sustainability narratives emphasize smallholder sourcing, traceability, irrigation efficiency, and waste-to-value for press cake; volatility in peanut harvests, freight, and currency drives dual-origin hedging and nearby refining where available. As foodservice standardizes oil specifications and retailers scrutinize quality documentation, winners pair oxidative stability and sensory consistency with rigorous aflatoxin controls, allergen-aware labeling, and agile supply programs that keep kitchens running through seasonal swings.Refined Peanut Oil Market Key Insights

- High-oleic architectures extend fry life and flavor fidelity

- Aflatoxin risk management is the non-negotiable moat

- Refining pathways tailor oil to climate and channel

- Allergen governance shapes labeling and route-to-market

- Snack and bakery integration rewards consistency over spec sheets

- Competition is a portfolio design question, not a binary

- Packaging and logistics determine real-world quality

- ESG moves upstream: smallholders, water, and waste

- Volatility hedging is part of the value proposition

- Regulatory and quality documentation accelerate listings

Refined Peanut Oil Market Reginal Analysis

North America

Foodservice standards emphasize fry life, low foaming, and consistent color in fried chicken, seafood, and snack plants; allergen communication remains sensitive but manageable with highly refined grades and clear guidance. Private label focuses on neutral taste and light-stable packages; sustainability requests center on smallholder support, waste-oil collection, and PCR bottles. Regional tankage and quick QA release protect service levels during sports and holiday peaks.Europe

Strict contaminant rules and labeling diligence shape procurement; aflatoxin governance and full traceability are prerequisites. Peanut oil competes with high-oleic sunflower and rapeseed on neutrality and sustainability credentials; differentiation leans on fry performance in ethnic/QSR concepts and premium snack manufacture. Winterized retail SKUs prevent chill haze; deposit/return and recyclable formats influence listings alongside detailed change-control.Asia-Pacific

Large street-food and QSR ecosystems sustain bulk demand; regional cuisines value peanut oil’s flavor memory and high smoke point. Supply chains balance domestic crush with imports, managing monsoon-season variability and cold-weather clarity via tailored winterization. Retail growth favors affordable PET and family tins, while snack manufacturers seek high-oleic, low-AV oils with robust filtration guidance to extend fryer life.Middle East & Africa

Hot kitchens and long logistics require oxidation-resilient oils, light/oxygen-barrier packs, and disciplined storage. Foodservice prioritizes fry stability and dependable replenishment during festival seasons; retail buyers seek neutral flavor and clear allergen guidance. Traceable sourcing and aflatoxin assurance are decisive for cross-border trade, while waste-oil collection and PCR packaging rise on modern-trade scorecards.South & Central America

Street-food culture and growing QSR chains underpin demand for stable frying oils; peanut oil competes with soybean and blends on cost and taste delivery. Retail channels emphasize clarity, neutral aroma, and sturdy packaging through warm supply chains. Distributors value nearby refining, rapid QC, and substitution playbooks to navigate crop and currency swings, while snack makers push high-oleic specs to protect flavor through distribution.Refined Peanut Oil Market Segmentation

By Type

- Cold Pressed

- Hot Pressed

By Application

- Personal Care

- Food

- Pharmaceuticals

- Others

Key Market players

Shandong Luhua Group, Wilmar International (Yihai Kerry), COFCO Corporation, Adani Wilmar, Patanjali Foods (Ruchi Soya), Cargill, Bunge, AAK, Olam Food Ingredients (ofi), Golden Peanut and Tree Nuts (ADM), LouAna (Ventura Foods), KTC Edibles, Borges International Group, Lesieur, Nisshin OilliO Group, Lam Soon, Emami Agrotech, Gemini Edibles & Fats India, Gokul Agro Resources, Basso Fedele & FigliRefined Peanut Oil Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Refined Peanut Oil Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Refined Peanut Oil market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Refined Peanut Oil market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Refined Peanut Oil market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Refined Peanut Oil market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Refined Peanut Oil market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Refined Peanut Oil value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Refined Peanut Oil industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Refined Peanut Oil Market Report

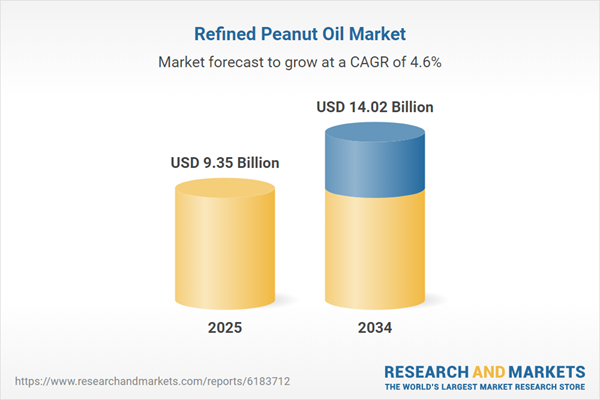

- Global Refined Peanut Oil market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Refined Peanut Oil trade, costs, and supply chains

- Refined Peanut Oil market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Refined Peanut Oil market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Refined Peanut Oil market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Refined Peanut Oil supply chain analysis

- Refined Peanut Oil trade analysis, Refined Peanut Oil market price analysis, and Refined Peanut Oil supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Refined Peanut Oil market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Shandong Luhua Group

- Wilmar International (Yihai Kerry)

- COFCO Corporation

- Adani Wilmar

- Patanjali Foods (Ruchi Soya)

- Cargill

- Bunge

- AAK

- Olam Food Ingredients (ofi)

- Golden Peanut and Tree Nuts (ADM)

- LouAna (Ventura Foods)

- KTC Edibles

- Borges International Group

- Lesieur

- Nisshin OilliO Group

- Lam Soon

- Emami Agrotech

- Gemini Edibles & Fats India

- Gokul Agro Resources

- Basso Fedele & Figli

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.35 Billion |

| Forecasted Market Value ( USD | $ 14.02 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |