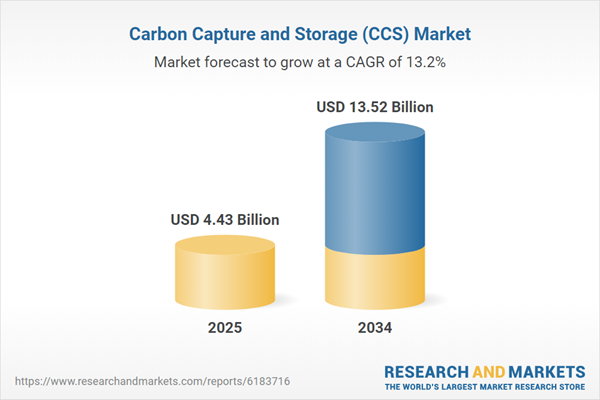

Carbon Capture and Storage (CCS) Market

Carbon Capture and Storage (CCS) has evolved from pilot demonstrations to an investable decarbonization pathway across hard-to-abate sectors. The primary applications span coal/gas power, cement, iron & steel, refining, petrochemicals, fertilizer/ammonia, waste-to-energy, and emerging blue hydrogen and bio-CCS. Post-combustion solvent systems dominate near term for retrofitability, while pre-combustion, oxy-fuel, solid sorbents, membranes, and modular DAC-to-storage are accelerating through incremental performance gains and cost learning. Momentum is reinforced by policy incentives, carbon pricing, and offtake frameworks, alongside corporate net-zero commitments and product decarbonization (e.g., low-carbon cement/steel, blue hydrogen). The market structure is shifting toward shared “hub-and-cluster” models that pool capture from multiple emitters into common transport and storage (T&S) infrastructure, with pipelines and growing CO₂ shipping tying emitters to saline aquifers and depleted hydrocarbon fields. Competitive dynamics feature a mix of capture technology licensors, process OEMs, EPCs, midstream developers, subsurface specialists, and integrated energy majors building full-chain capabilities. Key success factors include bankable measurement, reporting & verification (MRV), reliable T&S access, long-term liability frameworks, and standardized commercial contracts that derisk utilization rates and credit monetization. Execution risks remain: permitting timelines, pore-space access, public acceptance, supply-chain bottlenecks (amines, compressors), power and steam intensity, and carbon price volatility. Nevertheless, learning rates, modularization, and offtake innovation are improving project economics, positioning CCS as a critical complement to electrification, renewables, efficiency, and circularity in industrial decarbonization roadmaps.Carbon Capture and Storage (CCS) Market Key Insights

- Applications & end-uses are diversifying. Beyond power, the most resilient pipelines are in cement, steel, refining, chemicals, blue hydrogen, and waste-to-energy where process emissions are unavoidable. Bio-CCS supports negative emissions claims and product differentiation, creating premium markets for low-carbon materials and fuels.

- Hub-and-cluster models unlock scale. Shared T&S networks reduce unit costs, shorten schedules, and derisk individual emitters. Anchor projects in industrial corridors prove bankability, with phased build-outs adding satellite emitters via lateral lines or CO₂ shipping as volumes ramp.

- Technology performance is steadily improving. Advanced amine blends, heat-stable salt management, and high-efficiency heat integration reduce energy penalties. Parallel progress in solid sorbents, membranes, and oxy-fuel expands fit-for-purpose options, while DAC pilots drive learning for future scale.

- MRV and digitalization are becoming license-to-operate. Continuous monitoring, fiber-optic sensing, and data platforms underpin credit issuance and storage assurance. Providers that offer auditable MRV stacks integrated with control systems gain financing and offtake advantages.

- Transport optionality is strategic. Regional pipeline spines will dominate baseload flows, but flexible ship-based CO₂ routes open access for coastal emitters and early-stage volumes. Equipment standardization (temperatures/pressures, intermediate terminals) enables multi-modal logistics.

- Storage access is a competitive moat. Operators controlling high-quality saline formations and depleted fields with characterized injectivity and containment command premium positions. Long-term liability, pore-space rights, and well integrity programs determine bankability.

- Evolving commercial models improve bankability. Take-or-pay capture fees, CfD-style floors for carbon value, and long-tenor service agreements stabilize revenues. Tax credit transferability and third-party monetization expand sponsor and lender participation.

- Supply-chain readiness is pivotal. Lead times for compressors, large heat exchangers, specialty solvents, and drilling services can constrain schedules. Vendors with modular skid designs, local fabrication, and field-service depth win EPC and O&M mandates.

- Stakeholder and permitting dynamics can dominate timelines. Transparent community engagement, induced seismicity management, and careful site characterization reduce approval risk. Early alignment with regulators on MRV and liability terms prevents re-work.

- Integration beats standalone optimization. Projects that co-optimize steam/power, waste-heat recovery, and utility islands achieve superior capture cost. Coupling CCS with hydrogen, e-fuels, or negative emissions portfolios creates portfolio hedges and premium offtakes.

Carbon Capture and Storage (CCS) Market Reginal Analysis

North America

Strong fiscal incentives and credit monetization are catalyzing a wave of capture FIDs across ethanol, fertilizer, blue hydrogen, and gas power. Mature midstream expertise and subsurface data accelerate T&S build-out, while community engagement and Class VI permitting remain schedule-critical. CO₂ pipeline expansions and Gulf Coast storage hubs underpin multi-user systems, and merchant service providers are emerging with standardized contracts.Europe

Carbon pricing, industrial decarbonization mandates, and cross-border frameworks drive demand, especially in cement, waste-to-energy, and refining. CO₂ shipping enables early volumes from dispersed emitters, connecting to North Sea and Atlantic storage hubs. Public funding blends with private capital under evolving state-aid and CfD structures, while permitting, seabed access, and liability frameworks shape project pacing and operator selection.Asia-Pacific

Decarbonization roadmaps in Japan, Korea, Australia, and parts of Southeast Asia prioritize blue hydrogen/ammonia and hard-to-abate industry. Australia and regional offshore basins offer storage options; shipping corridors support export-oriented value chains. In China and India, industrial pilots scale toward clusters, with domestic equipment ecosystems and cost engineering improving affordability over time.Middle East & Africa

Resource-rich economies are integrating CCS with blue hydrogen/ammonia and low-carbon fuels to protect export competitiveness. Large point sources, existing oil & gas infrastructure, and subsurface capability support rapid scaling. Policy toolkits are broadening from demonstration support to commercial frameworks, while water, power integration, and cross-border offtakes define project viability.South & Central America

Refining, cement, and petrochemicals provide anchor emitters, with offshore and onshore formations offering storage potential. National oil companies and utilities are evaluating CCS within broader decarbonization and energy transition strategies. Financing blends development banks, export credit, and private sponsors, while regulatory clarity on storage rights and MRV will unlock multi-user networks.Carbon Capture and Storage (CCS) Market Segmentation

By Type

- Capture

- Post-Combustion

- Oxy-Fuel

- Pre-combustion

- Bioenergy CCS

- Direct Air Capture (Transportation

- Storage

- Oil and Gas Reservoirs

- Un Mineable Coal beds

- Saline Aquifers

- Deep Ocean Storage) Technology (Chemical Looping

- Solvents and Sorbents

- Membranes

- Others) Application (Oil and Gas

- Power Generation

- Chemical and Petrochemical

- Cement

- Iron and Steel

- Others

Key Market players

Shell, ExxonMobil, BP, TotalEnergies, Equinor, Occidental (Oxy Low Carbon Ventures), Chevron, ADNOC, Mitsubishi Heavy Industries, Aker Carbon Capture, Fluor Corporation, Technip Energies, SLB (Schlumberger), Baker Hughes, Honeywell UOP, Linde, Air Liquide, Carbon Clean, Svante, CalixCarbon Capture and Storage (CCS) Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Carbon Capture and Storage (CCS) Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Carbon Capture and Storage (CCS) market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Carbon Capture and Storage (CCS) market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Carbon Capture and Storage (CCS) market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Carbon Capture and Storage (CCS) market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Carbon Capture and Storage (CCS) market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Carbon Capture and Storage (CCS) value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Carbon Capture and Storage (CCS) industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Carbon Capture and Storage (CCS) Market Report

- Global Carbon Capture and Storage (CCS) market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Carbon Capture and Storage (CCS) trade, costs, and supply chains

- Carbon Capture and Storage (CCS) market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Carbon Capture and Storage (CCS) market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Carbon Capture and Storage (CCS) market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Carbon Capture and Storage (CCS) supply chain analysis

- Carbon Capture and Storage (CCS) trade analysis, Carbon Capture and Storage (CCS) market price analysis, and Carbon Capture and Storage (CCS) supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Carbon Capture and Storage (CCS) market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Shell

- ExxonMobil

- BP

- TotalEnergies

- Equinor

- Occidental (Oxy Low Carbon Ventures)

- Chevron

- ADNOC

- Mitsubishi Heavy Industries

- Aker Carbon Capture

- Fluor Corporation

- Technip Energies

- SLB (Schlumberger)

- Baker Hughes

- Honeywell UOP

- Linde

- Air Liquide

- Carbon Clean

- Svante

- Calix

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.43 Billion |

| Forecasted Market Value ( USD | $ 13.52 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |