Anhydrous Hydrogen Fluoride Market

The Anhydrous Hydrogen Fluoride Market is a critical upstream chemical backbone for fluorochemicals, refrigerants, fluoropolymers, petroleum alkylation, semiconductor wet etching, and metal surface treatments. Demand is synchronized with electronics miniaturization, aluminum smelting fluxes, stainless-steel pickling, and catalyst-grade blends used in high-octane fuel production. Key trends include ongoing feedstock diversification from fluorspar toward fluorosilicic acid routes, selective capacity additions in Asia, and rising investments in logistics resiliency, packaging integrity, and digitalized leak-prevention. Sustainability and regulatory scrutiny are reshaping procurement and licensing, elevating requirements for emissions abatement, worker safety protocols, and cradle-to-gate auditability. End-users increasingly prefer long-term offtake backed by on-site or near-site supply models, ISO-container fleets, telemetry-enabled cylinders, and emergency response coverage. Competitive dynamics balance integrated producers with captive downstream consumption against merchant suppliers emphasizing reliability, purity control, and technical service. Process innovations target lower energy intensity, enhanced scrubbing, and by-product valorization, while packaging advances reduce permeation and improve traceability. Commercial models are shifting toward multi-year indexed contracts, bundled services, and safety training, with qualification cycles and change-control governing supplier switches. Trade flows reflect resource concentration of acid-grade fluorspar, evolving export controls, and regional self-sufficiency programs, prompting portfolio hedging and dual-sourcing. Over the outlook period, differentiation will hinge on safety performance, consistency at electronics-grade specifications, integration with downstream fluorochemicals, and the ability to meet stringent environmental and transport regulations without compromising cost-to-serve. Buyers will favor partners delivering assured continuity during maintenance, transparent quality analytics, rapid incident response, and joint optimization of tank farms, fleets, and on-site storage to minimize delivered risk.Anhydrous Hydrogen Fluoride Market Key Insights

- Ecosystem integration matters. Producers with captive fluorochemical, refrigerant, or fluoropolymer chains de-risk offtake, stabilize utilization, and accelerate product qualification. Merchant suppliers compete on purity assurance, packaging, and responsiveness; alliances help bridge capability gaps.

- Feedstock strategy is pivotal. Exposure to fluorspar mining, beneficiation, and acid-grade supply contracts influences cost stability. Alternative routes from fluorosilicic acid offer diversification, but require investment, permitting alignment, and downstream acceptance testing.

- Electronics-grade purity drives premiums. Tighter metals, moisture, and halide specs require advanced drying, filtration, and analytics. Repeatability across batches and plants underpins long-cycle qualifications in semiconductors and specialty chemicals.

- Safety is a core differentiator. Best-in-class HF handling, operator training, emergency response, and containment technologies reduce incidents and insurance overheads. Visible safety KPIs increasingly feature in audits and long-term awards.

- Logistics resilience protects uptime. ISO-container integrity, telemetry, certified drivers, and redundant lanes mitigate disruptions. On-site storage optimization and vendor-managed inventory reduce turnaround risk for refineries and fabs.

- Regulatory momentum is rising. Air emissions, wastewater, transport, and process safety rules tighten across jurisdictions. Suppliers with abatement, flare minimization, and auditable EH&S systems secure faster approvals.

- Packaging innovation extends reach. Multi-barrier containers, improved valves, and real-time tracking lower permeation and theft/diversion risks. Reconditioning programs and returnables support sustainability and cost control.

- Service and applications support win renewals. Acid-alkylation performance tuning, pickling line optimization, and etch uniformity troubleshooting create measurable value and stickiness beyond commodity pricing.

- Portfolio de-risking via contracts. Multi-year indexed offtake, take-or-pay, and dual-sourcing frameworks align incentives. Change-control procedures govern supplier swaps and protect process stability.

- Regionalization reshapes competition. Local self-sufficiency programs, export controls, and permitting timelines shift investment to demand centers. Proximity to downstream clusters reduces transport exposure and accelerates certification.

Anhydrous Hydrogen Fluoride Market Reginal Analysis

North America

Demand aligns with refinery alkylation turnarounds, stainless-steel finishing, and electronics clusters. Buyers prioritize suppliers with strong process safety records, robust driver training, and audited emergency response. Regulatory oversight on emissions, wastewater, and transport drives abatement investments and transparent incident reporting. Long-term indexed contracts with reliability KPIs are common, with dual-sourcing to mitigate outage risks. Packaging integrity, telemetry, and on-site storage optimization are key evaluation criteria. Integration with downstream fluorochemicals supports qualification speed and supply assurance.Europe

Stringent environmental and process safety frameworks shape investment and operating discipline. Producers emphasize advanced scrubbing, water management, and leak-prevention digitalization to meet permitting expectations. Customers value cradle-to-gate traceability, container reconditioning programs, and supplier participation in safety audits. Proximity to specialty chemicals, aluminum finishing, and precision metalworking clusters supports stable baseloads. Cross-border logistics require harmonized certifications and contingency lanes. Regional programs encouraging circularity and lower-impact feedstocks influence route selection and technology upgrades.Asia-Pacific

The region concentrates incremental capacity tied to fluoropolymer, refrigerant, and electronics growth. Buyers seek consistent electronics-grade purity, rapid qualification support, and scalable ISO-container availability. Governments emphasize domestic self-reliance, encouraging integrated complexes near demand centers. Reliability under variable infrastructure conditions elevates the value of telemetry, preventive maintenance, and local emergency response capabilities. Supplier selection weighs capex discipline, EH&S performance, and ability to align with evolving regulatory frameworks without disrupting cost-to-serve.Middle East Africa

Industrial demand is anchored in refining alkylation projects, metals finishing, and emerging fluorochemical value chains. Logistics excellence - heat-resistant packaging, driver certification, and route redundancies - is crucial in high-temperature environments. Buyers prefer vendors offering on-site storage design, training, and rapid incident response. Regulatory regimes are formalizing, favoring early movers with robust EH&S systems. Partnerships with national champions and free-zone operators help secure permitting, utilities, and land for future expansions.

South & Central America

Consumption follows refining upgrades, metals processing, and specialty chemical investments concentrated in industrial corridors. Import reliance makes supply assurance, container integrity, and customs agility decisive. Customers value vendor-managed inventory, local service partners, and bilingual safety training. Policy initiatives to localize chemical manufacturing could encourage regional projects, contingent on infrastructure and permitting timelines. Suppliers demonstrating transparent quality analytics, emissions control, and responsive field support gain advantage in multi-year awards.Anhydrous Hydrogen Fluoride Market Segmentation

By Type

- Above 99.9% Purity Grade

- Below 99.9% Purity Grade

By Application

- Fluoropolymers

- Fluorogases

- Pesticides

- Others

Key Market players

Solvay SA, Linde plc, Arkema, Honeywell International Inc., Koura (Orbia Fluor & Energy Materials), Daikin Industries Ltd., Navin Fluorine International Limited (NFIL), GFL Limited, Foosung Co., Ltd., Derivados del Fluor S.A., Fluorchemie Dohna GmbH, Fluorsid S.p.A., Foshan Nanhai Double Fluoride Chemical Co., Ltd. (Shuangfu), Fubao Group, LanxessAnhydrous Hydrogen Fluoride Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Anhydrous Hydrogen Fluoride Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Anhydrous Hydrogen Fluoride market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Anhydrous Hydrogen Fluoride market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Anhydrous Hydrogen Fluoride market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Anhydrous Hydrogen Fluoride market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Anhydrous Hydrogen Fluoride market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Anhydrous Hydrogen Fluoride value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Anhydrous Hydrogen Fluoride industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Anhydrous Hydrogen Fluoride Market Report

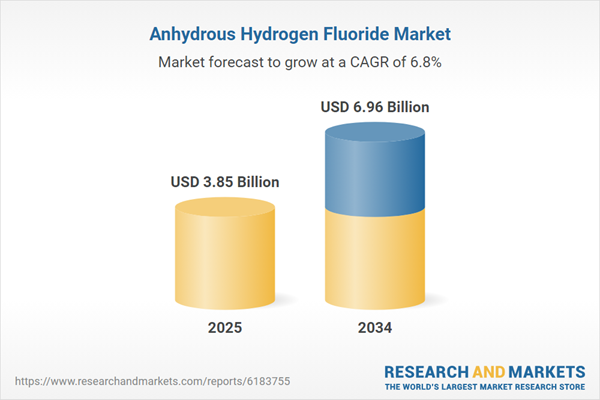

- Global Anhydrous Hydrogen Fluoride market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Anhydrous Hydrogen Fluoride trade, costs, and supply chains

- Anhydrous Hydrogen Fluoride market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Anhydrous Hydrogen Fluoride market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Anhydrous Hydrogen Fluoride market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Anhydrous Hydrogen Fluoride supply chain analysis

- Anhydrous Hydrogen Fluoride trade analysis, Anhydrous Hydrogen Fluoride market price analysis, and Anhydrous Hydrogen Fluoride supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Anhydrous Hydrogen Fluoride market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Solvay SA

- Linde PLC

- Arkema

- Honeywell International Inc.

- Koura (Orbia Fluor & Energy Materials)

- Daikin Industries Ltd.

- Navin Fluorine International Limited (NFIL)

- GFL Limited

- Foosung Co. Ltd.

- Derivados del Fluor S.A.

- Fluorchemie Dohna GmbH

- Fluorsid S.p.A.

- Foshan Nanhai Double Fluoride Chemical Co.

- Ltd. (Shuangfu)

- Fubao Group

- Lanxess

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.85 Billion |

| Forecasted Market Value ( USD | $ 6.96 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |