Metal Shim Market

The Metal Shim Market comprises precision spacing, leveling, and alignment products used to compensate tolerances, correct stack-ups, and stabilize assemblies across aerospace, automotive/EV, heavy equipment, machine tools, energy, construction, and electronics. Core materials include stainless and carbon steels for strength and corrosion resistance, aluminum for weight-sensitive assemblies, and copper/brass for conductivity and conformability; specialty alloys (Inconel, titanium) address high-temperature or corrosive environments. Formats span slotted and tabbed shims, laminated/peelable shims for on-site thickness tuning, pre-cut kits for maintenance crews, and custom parts produced via stamping, laser/waterjet cutting, and photo-etching for fine features. Key trends include tighter flatness/burr standards for automated assembly, kitting with part traceability, and digital ordering with CAD-to-quote workflows. Demand is sustained by OEM platform refreshes, EV drivetrain/thermal systems, semiconductor and medical equipment builds, and uptime-critical MRO where shims enable rapid, repeatable alignment. Competitive dynamics feature global precision converters, regional stampers, and value-added distributors offering same-day ship of standard sizes plus quick-turn custom programs. Differentiation centers on material pedigree (mill certs), dimensional accuracy, surface finish, cleanliness, packaging for cleanroom or field use, and documentation (PPAP, AS9100, IATF) to meet regulated sector requirements. Headwinds include strip and coil price volatility, lead-time swings in specialty alloys, and the cost of maintaining diverse inventories across thicknesses and grades. Overall, suppliers combining responsive conversion capacity, broad certified materials, laminated/peelable technologies, and logistics agility are positioned to win as manufacturers tighten tolerance budgets and pursue faster, more reliable assembly.Metal Shim Market Key Insights

- Tolerance control as a value driver: As assemblies densify, shims deliver micron-level stack-up correction without re-machining. OEMs push for tighter gauge steps, low burrs, and certified flatness to avoid downstream rework.

- Laminated/peelable adoption: Layered composites (metal-foil stacks with bond film) allow on-site thickness tuning, compressing service time and inventory. Peel integrity, residue control, and uniform layer thickness are key qualifiers.

- Process diversification: Stamping rules high-volume repeat parts; laser and waterjet handle thicker gauges and short runs; photo-etching serves fine-feature, burr-free profiles for electronics and medical. Hybrid shops capture mixed demand.

- Documentation & compliance: Aerospace, medical, and automotive buyers require lot traceability, PPAP/FAI, and AS9100/IATF systems. Cleanliness, edge quality, and packaging specs (FOD control) are becoming award gatekeepers.

- Kitting and VMI programs: Pre-assorted kits by thickness and geometry reduce downtime in field alignment and TPM programs. Vendor-managed inventory and Kanban replenishment stabilize small-part availability.

- Material engineering: Shift toward SS 300/400, coated steels, Al 5xxx/6xxx, and Cu/Brass grades tailored for conductivity or galling resistance. Specialty alloys grow in turbines, hydrogen, and corrosive process equipment.

- EV and electronics pull-through: Motor, gearbox, battery enclosure, and thermal module builds require tight stack control; cleanroom-friendly shims with low particulates and protective films gain traction in semicon tools.

- Sustainability & scrap recovery: Recyclable metals, segregated scrap streams, and buy-back programs support ESG targets while offsetting input volatility. Minimal-waste nesting and near-net conversion improve yields.

- Lead-time agility as a moat: Quick-turn custom, stocked standards, and regional service centers counter project slippages and maintenance outages. CAD-to-quote portals and DFM support accelerate approvals.

- Risk management: Dual-sourcing of strip, wider gauge equivalency tables, and approved substitute alloys mitigate shortages. Suppliers invest in metrology, coil slitting accuracy, and SPC to lock consistency.

Metal Shim Market Reginal Analysis

North America

Demand is anchored by aerospace, semiconductor capital equipment, off-highway machinery, and EV programs. Buyers emphasize AS9100/PPAP documentation, short lead times for custom profiles, and laminated shims for MRO efficiency. Distributors with deep stock of stainless, carbon steel, and aluminum gauges plus same-day kitting win share. Nearshoring trends favor regional converters with robust metrology and clean packaging.Europe

Precision manufacturing in aerospace, medical, rail, and high-end machinery sustains a quality-first market. REACH/ROHS compliance, tight burr/flatness controls, and sustainability credentials influence awards. Photo-etched copper/brass and thin-gauge stainless serve electronics and instrumentation. OEMs value DFM collaboration, cleanroom packaging, and lifecycle documentation for regulated sectors.Asia-Pacific

APAC scales on electronics, automotive/EV, and machinery exports. China and Southeast Asia drive volume in stamped standards; Japan/Korea emphasize ultra-precise, burr-free thin shims for optics and semicon tools. Regional players pair competitive pricing with rapid tooling and laser capacity. Local coil supply depth helps buffer alloy volatility and support quick-turn customs.Middle East & Africa

Industrial diversification, energy projects, and expanding maintenance hubs create steady pull for durable shims in turbines, compressors, and rotating equipment. Customers prioritize corrosion-resistant materials, laminated kits for field alignment, and robust packaging against dust and heat. Partnerships with global converters support training, QA, and documentation for emerging regulated applications.South & Central America

Mining, pulp & paper, food processing, and power sectors depend on shims for uptime-critical alignment and rebuilds. Procurement favors reliable availability of standard sizes, rugged packaging, and regional service partners for quick-turn customs. Currency and logistics variability elevate interest in VMI programs, substitution flexibility across grades, and scrap-recovery offsets.Metal Shim Market Segmentation

By Material

- Aluminum

- Stainless Steel

- Brass

- Copper

- Plastic

- Others

By Product

- Slotted Shim

- Shim Stock/Sheet

- Arbor Shim

- Custom Shim

- Others

By Application

- Automotive

- Aerospace & Defense

- Construction

- Manufacturing & Industrial Machinery

- Others

Key Market players

SPIROL, AccuTrex Products, Phoenix Specialty, Boker’s Inc., Robertshaw, Stephens Gaskets, American Metal Shims, Maudlin Products, Custom Shims, Artus Corporation, Accurate Metal Shims, Phoenix Shims, Paragon Manufacturing, Shimco North America, State EnterprisesMetal Shim Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Metal Shim Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Metal Shim market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Metal Shim market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Metal Shim market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Metal Shim market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Metal Shim market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Metal Shim value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Metal Shim industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Metal Shim Market Report

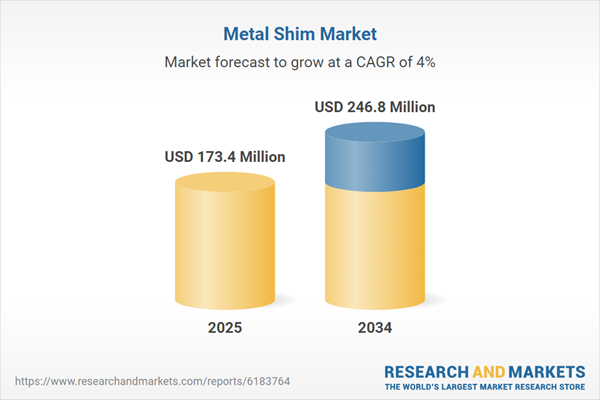

- Global Metal Shim market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Metal Shim trade, costs, and supply chains

- Metal Shim market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Metal Shim market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Metal Shim market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Metal Shim supply chain analysis

- Metal Shim trade analysis, Metal Shim market price analysis, and Metal Shim supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Metal Shim market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- SPIROL

- AccuTrex Products

- Phoenix Specialty

- Boker’s Inc.

- Robertshaw

- Stephens Gaskets

- American Metal Shims

- Maudlin Products

- Custom Shims

- Artus Corporation

- Accurate Metal Shims

- Phoenix Shims

- Paragon Manufacturing

- Shimco North America

- State Enterprises

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 173.4 Million |

| Forecasted Market Value ( USD | $ 246.8 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |