Sandwich Market

The Sandwich market spans fresh made-to-order formats, pre-packaged grab-and-go SKUs, frozen heat-and-eat offerings, and foodservice staples across cafés, QSRs, convenience stores, supermarkets, travel hubs, workplaces, and schools. Core end-uses center on breakfast and lunch occasions, late-night snacking, and event catering, with rising traction in healthier lines (whole grains, lean proteins, plant-based fillings) and premium indulgence (artisan breads, international flavors, clean-label condiments). Key trends include menu localization, heat-and-serve formats for hybrid work routines, limited-time global flavors, and functional positioning such as high-protein or low-carb. Growth is propelled by urbanization, on-the-go consumption, cold-chain improvements, and digital ordering that boosts throughput and ticket size. Innovation focuses on bread technology (longer freshness, gluten-free, sourdough), protein diversification (plant-based analogs, rotisserie, slow-cooked, seafood), and packaging that balances shelf life, visibility, and sustainability. The competitive landscape is fragmented: international QSRs and bakery-café chains set format standards; convenience retailers scale private label; regional commissaries supply fresh daily; and premium delis differentiate on provenance and craft. Operators optimize margins through centralized prep, speed-scratch assembly, SKU rationalization, and data-driven planograms. Over the forecast horizon, the market will tilt toward balanced nutrition, culinary mashups, and digitally enabled personalization - paired with automation in prep lines, smart holding equipment, and recyclable packaging. Brands able to deliver consistent food safety, fast service, and credible wellness cues while keeping value propositions resilient to commodity swings will capture share across channels.Sandwich Market Key Insights

- Occasion expansion beyond lunch. Breakfast handhelds and all-day snacking broaden demand, supported by smaller portion sizes, mini sliders, and combo meal structures that raise attachment of beverages and sides while preserving throughput in peak windows.

- Health and functionality premiumize the category. Whole-grain and seeded breads, high-protein fillings, fiber-rich veggies, and reduced-sugar sauces enable “better-for-you” lines without compromising taste. Clear nutrition callouts and clean-label claims strengthen trust.

- Plant-forward, not just plant-based. Consumers adopt hybrid builds - traditional meats paired with roasted vegetables or legume spreads - easing the cost and sensory gap versus full meat analogs and improving menu flexibility across regions.

- Bread as a signature component. Sourdough, brioche, ciabatta, and regional flatbreads elevate perceived value. Advances in fermentation and enzyme systems extend softness and freshness for packaged ranges while protecting crust and crumb integrity.

- Protein and culinary diversity. Rotisserie chicken, slow-cooked beef, smoked meats, seafood salads, and regional sauces (peri-peri, gochujang, chimichurri) fuel rotation and LTOs. Heat-and-eat SKUs leverage sous-vide and controlled-humidity holding for quality.

- Packaging balances safety and sustainability. High-clarity, recyclable or fiber-based packs with anti-fog windows and MAP options extend shelf life and merchandising appeal. Tamper-evident seals and QR traceability reassure safety-conscious buyers.

- Omnichannel and digital acceleration. Pre-order, curbside, and delivery-optimized SKUs (wraps, sealed hot sandwiches) protect texture in transit. Kitchen display systems and predictive make-lines reduce wait times and shrink.

- Operational simplicity and consistency. Speed-scratch kits, pre-portioned proteins, and cross-utilized sauces cut labor variance. Commissary and central kitchen models support scale while enabling local flavor customization.

- Price architecture and value engineering. Tiered menus (value, core, premium) hedge commodity volatility. Bundle pricing, half-sandwich pairs, and seasonal upsizes sustain margin without eroding perceived value.

- Food safety and quality governance. Cold-chain monitoring, allergen segregation, and standardized HACCP playbooks remain critical. Shelf-life modeling and sensory analytics inform rotation, minimizing waste in high-velocity outlets.

Sandwich Market Reginal Analysis

North America

High penetration of QSR and convenience channels supports broad format variety - from breakfast biscuits to deli subs and Tex-Mex wraps. Consumers oscillate between indulgence and “better-for-you,” encouraging dual menus with premium breads and lean proteins. Digital ordering and loyalty apps drive personalization and targeted LTOs. Private-label ranges in grocery expand with café-style positioning, while workplace catering rebounds with boxed assortments and safe-serve packaging.Europe

Bakery heritage underpins quality expectations for bread, while health and provenance cues shape purchasing. Forecourt retail and travel hubs sustain grab-and-go, with strong demand for vegetarian and Mediterranean-inspired options. Artisan bakeries and café chains compete on craft and seasonal ingredients; retailers scale chilled private label with recyclable or fiber-based packaging. Operational focus remains on waste reduction through daily bake schedules and dynamic markdowns.Asia-Pacific

Rapid urbanization and convenience culture propel packaged and fresh-made sandwiches in convenience stores, rail stations, and office districts. Flavor innovation blends local tastes with Western formats - katsu, tandoori, bulgogi, and chili-lime variants. Japan and Korea emphasize premium convenience with meticulous presentation; Southeast Asia leans into spicy and halal-certified offerings. Cold-chain expansion and commissary models enable consistent quality across dense metro networks.Middle East & Africa

Young demographics and modern retail growth expand demand for affordable yet flavorful handhelds. Halal compliance, grilled proteins, and flatbread carriers (pita, khubz) shape menus. Malls, fuel stations, and universities act as key nodes, while delivery platforms extend reach. Operators invest in heat-holding, packaging suited to hot climates, and localized spice profiles; international brands adapt with regional sauces and pickles.South & Central America

Street-food traditions meet modern retail through bakery-café expansion and supermarket chilled cases. Popular formats include grilled cheese, shredded beef, and chicken with herbaceous sauces; gluten-free and whole-grain lines gain niche traction. Inflation sensitivity steers value combos and family bundles, while premium cafés differentiate on artisanal breads and slow-cooked proteins. Cold-chain reliability and supplier partnerships remain central to consistent execution across diverse climates.Sandwich Market Segmentation

By Product

- Fresh sandwiches

- Pre-packaged sandwiches

By Type

- Non-vegetarian

- Vegetarian

By Application

- Household

- HoReCa

Key Market players

Subway, McDonald’s, Panera Bread, Pret A Manger, Greggs, Jimmy John’s, Jersey Mike’s Subs, Firehouse Subs, Arby’s, Quiznos, Tim Hortons, Marks & Spencer (M&S Food), 7-Eleven, Wawa, StarbucksSandwich Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Sandwich Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Sandwich market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Sandwich market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Sandwich market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Sandwich market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Sandwich market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Sandwich value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Sandwich industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Sandwich Market Report

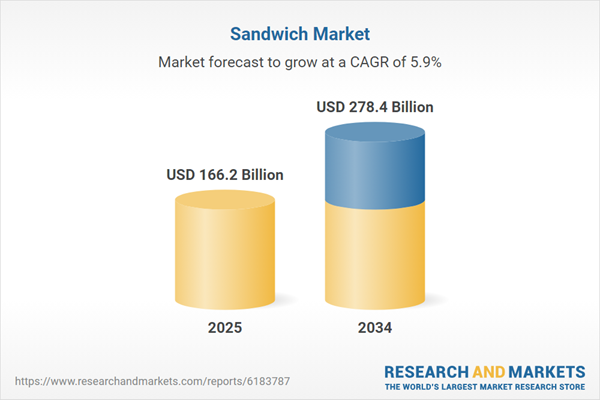

- Global Sandwich market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Sandwich trade, costs, and supply chains

- Sandwich market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Sandwich market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Sandwich market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Sandwich supply chain analysis

- Sandwich trade analysis, Sandwich market price analysis, and Sandwich supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Sandwich market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Subway

- McDonald’s

- Panera Bread

- Pret A Manger

- Greggs

- Jimmy John’s

- Jersey Mike’s Subs

- Firehouse Subs

- Arby’s

- Quiznos

- Tim Hortons

- Marks & Spencer (M&S Food)

- 7-Eleven

- Wawa

- Starbucks

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 166.2 Billion |

| Forecasted Market Value ( USD | $ 278.4 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |