Coatings For Medical Devices Industry Market

Coatings for medical devices are engineered surface technologies that enhance biocompatibility, lubricity, antimicrobial performance, corrosion and wear resistance, imaging visibility, and drug-delivery functions across interventional and implantable products. Core applications include vascular access (catheters, guidewires, introducers), structural heart and neurovascular systems, urology and GI devices, orthopedic and dental implants, wound closure, hypodermic needles, syringes, and diagnostics. The portfolio spans hydrophilic and hydrophobic coatings; heparin and other antithrombotic layers; anti-fouling chemistries (PEG, zwitterionic); antimicrobial and anti-biofilm approaches; drug-eluting matrices; and barrier or dielectric films such as parylene, PTFE, silicone, polyurethane, diamond-like carbon, TiN, and hydroxyapatite. Technology development focuses on solvent-free and waterborne systems, robust adhesion on complex substrates (Nitinol, stainless, PEEK, Pebax), abrasion-resistant lubricity for long track lengths, and sterilization-stable performance under gamma, e-beam, and EtO. Manufacturing is shifting toward high-yield, validated processes (reel-to-reel, dip/spin/spray, plasma, UV-cure, sol-gel), in-line metrology, and tighter process controls to meet design history and quality system requirements. Demand is propelled by minimally invasive procedures, growth in chronic disease interventions, single-use device adoption, and hospital infection-prevention priorities. Competitive dynamics include integrated OEMs with captive capabilities and specialized contract coaters offering application development, scale-up, and regulatory documentation support. Challenges include cost and supply assurance for specialty polymers, scrutiny of extractables/leachables, evolving material restrictions (including PFAS debates), and heightened evidentiary requirements under global regulatory regimes. Overall, coatings have become a strategic differentiator - enabling device performance, reducing procedure friction, and extending product life - while aligning with sustainability, sterilization, and risk-management expectations.Coatings For Medical Devices Industry Market Key Insights

- Lubricity is mission-critical. Hydrophilic and hybrid systems reduce insertion force and vessel trauma over long device dwell times. The winning solutions pair high initial lubricity with abrasion resistance and stable performance after repeated articulation and sterilization.

- From passive to functional. The mix is shifting from passive barriers to active functions - antithrombotic, anti-biofilm, and drug-eluting layers - that improve clinical outcomes. Vendors differentiate via controlled release kinetics and coatings that withstand delivery-system crimping.

- Adhesion on mixed substrates. Modern devices blend metals and polymers; primers, plasma activation, and grafting chemistries are essential to prevent delamination at flex points and laser-cut geometries without compromising fatigue life.

- Sterilization resilience as a gate. Coatings must survive EtO, gamma, and e-beam without yellowing, cracking, or loss of lubricity. Formulators prioritize crosslink density, antioxidant packages, and post-cure controls to lock in properties.

- Regulatory evidence deepens. Beyond ISO 10993, buyers expect robust particulate, extractables/leachables, and durability data tied to worst-case use. Documentation packages and process validation now influence supplier selection as much as performance specs.

- Manufacturing yield is value. High first-pass yield, in-line thickness measurement, and SPC reduce scrap on expensive device assemblies. Contract coaters increasingly provide DFM input, pilot runs, and turnkey PPAP-like dossiers.

- Material stewardship matters. Market momentum favors waterborne/solvent-reduced chemistries, PFAS-free pathways where feasible, and recyclability-aware choices - without sacrificing trackability or shelf life.

- Imaging and energy delivery. Coatings tuned for radiopacity, echogenicity, or electrical insulation enable safer navigation and precise ablation or neurostimulation, expanding addressable use-cases for advanced therapies.

- Customization over commodity. OEMs seek application-specific stacks (primer + functional + topcoat), matched to unique kinematics, substrates, and sterilization flows. Responsive tech-service and fast iteration win programs.

- Consolidation and partnerships. Strategic alliances between OEMs, material suppliers, and coaters accelerate qualification timelines, secure capacity, and share risk on novel chemistries and scale-up investments.

Coatings For Medical Devices Industry Market Reginal Analysis

North America

Anchored by a deep interventional cardiology, structural heart, and neurovascular ecosystem, the region emphasizes lubricious and antithrombotic coatings with rigorous durability and particulate controls. Hospital value analysis committees scrutinize evidence for infection prevention and procedure efficiency. OEMs balance captive lines with specialized contract coaters for surge capacity and complex substrates. Sustainability programs and solvent reduction influence material choices, while quality audits prioritize process monitoring, traceability, and robust sterilization studies.Europe

Stringent regulatory expectations and documentation under evolving frameworks raise the bar for biocompatibility, extractables/leachables, and clinical relevance. Adoption of antimicrobial and anti-biofilm strategies is tempered by stewardship policies and careful claims language. REACH-driven material stewardship encourages solvent-lean systems and scrutiny of persistent chemistries. Strong clusters in vascular, orthopedic, and dental devices support demand for parylene, ceramic-like, and hydroxyapatite coatings. Partnerships with research institutes drive next-gen anti-fouling and hemocompatible surfaces.Asia-Pacific

Rapid expansion of manufacturing in China, India, and Southeast Asia drives demand for scalable, high-yield coating lines serving catheters, guidewires, and consumables. Japan and Korea prioritize precision, long-term durability, and miniaturization for advanced interventions and imaging. Local regulators increasingly align on biocompatibility and chemical safety expectations, prompting investment in in-house testing. Cost-optimized, waterborne systems gain traction, while regional contract coaters broaden cleanroom capacity and in-line metrology.Middle East & Africa

Import-reliant health systems adopt coated devices focused on infection prevention, procedural efficiency, and clinician ergonomics. Private hospital growth and center-of-excellence programs increase usage of advanced interventional systems. Procurement emphasizes supplier reliability, sterilization stability under hot climates, and comprehensive documentation. Distributors partner with global coaters for training and post-market surveillance support as utilization of minimally invasive procedures rises.South & Central America

Demand centers on cardiovascular, endourology, and anesthesia/critical care consumables where lubricity and barrier properties improve outcomes and workflow. Regulatory pathways emphasize biocompatibility and manufacturing controls; local testing capacity is expanding for E/L and particulate evaluations. Currency and logistics sensitivities favor partnerships with regional coaters and near-shore assembly. Sustainability and solvent-reduction goals are increasingly reflected in tenders, supporting momentum for waterborne and low-VOC systems.Coatings For Medical Devices Industry Market Segmentation

By Application

- General surgery

- Cardiovascular

- Orthopedics

- Dentistry

- Others

By Type

- Antimicrobial coating

- Drug-eluting coating

- Hydrophilic coating

- Others

Key Market players

Surmodics, Biocoat, Hydromer, DSM Biomedical, Covalon Technologies, Harland Medical Systems, AST Products, Specialty Coating Systems, Precision Coating, Medicoat, Surface Solutions Group, Lubrizol Life Science, Freudenberg Medical, Materion, AculonCoatings For Medical Devices Industry Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Coatings For Medical Devices Industry Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Coatings For Medical Devices Industry market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Coatings For Medical Devices Industry market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Coatings For Medical Devices Industry market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Coatings For Medical Devices Industry market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Coatings For Medical Devices Industry market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Coatings For Medical Devices Industry value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Coatings For Medical Devices Industry industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Coatings For Medical Devices Industry Market Report

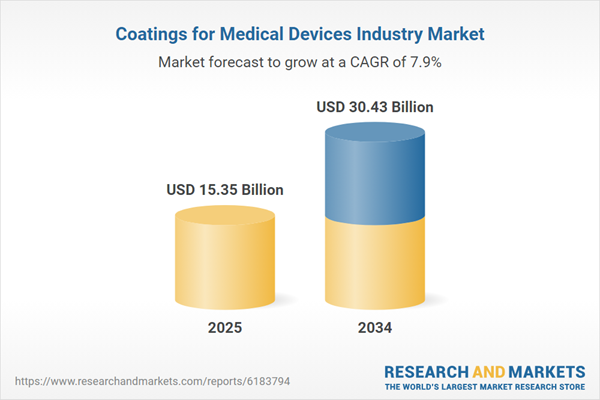

- Global Coatings For Medical Devices Industry market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Coatings For Medical Devices Industry trade, costs, and supply chains

- Coatings For Medical Devices Industry market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Coatings For Medical Devices Industry market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Coatings For Medical Devices Industry market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Coatings For Medical Devices Industry supply chain analysis

- Coatings For Medical Devices Industry trade analysis, Coatings For Medical Devices Industry market price analysis, and Coatings For Medical Devices Industry supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Coatings For Medical Devices Industry market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Surmodics

- Biocoat

- Hydromer

- DSM Biomedical

- Covalon Technologies

- Harland Medical Systems

- AST Products

- Specialty Coating Systems

- Precision Coating

- Medicoat

- Surface Solutions Group

- Lubrizol Life Science

- Freudenberg Medical

- Materion

- Aculon

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 15.35 Billion |

| Forecasted Market Value ( USD | $ 30.43 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |