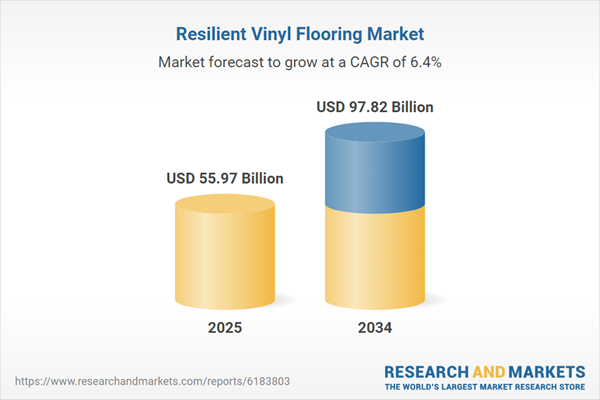

Resilient Vinyl Flooring Market

Resilient vinyl flooring spans flexible and rigid formats - including LVT/LVP, SPC, WPC, heterogeneous/homogeneous sheet, and vinyl composition tile - engineered for durability, design versatility, and cost-in-use advantages. Core end-uses are residential new build and renovation (single-family, multifamily), and commercial segments such as retail, healthcare, hospitality, offices, education, public buildings, and transport interiors. Recent trends emphasize rigid core penetration for subfloor forgiveness, digitally printed wear layers with emboss-in-register realism, antimicrobial and stain-resistant topcoats, pre-attached acoustical underlays, and glue-down/click systems optimized for speed and rework. Sustainability is moving from marketing to specification, with low-VOC formulations, phthalate-free plasticizers, recycled content, bio-attributed PVC, transparency reporting, and pilots for take-back and closed-loop granulate streams. Demand is propelled by water resistance relative to wood and laminate, ease of installation for pro and DIY channels, favorable lifecycle maintenance versus natural materials, and design breadth that aligns with fast remodeling cycles in retail and hospitality. The competitive landscape blends global flooring majors and regional specialists with vertically integrated Asian OEMs supplying private label programs; differentiation hinges on scratch/scuff performance, telegraphing control, acoustics over concrete slabs, dimensional stability under temperature swings, and reliability of large-format tiles and planks. Execution challenges include resin and additive price volatility, regulatory scrutiny on plasticizers and indoor air quality, end-of-life management, and the need for installer training to uphold warranties. Overall, resilient vinyl continues to win share by pairing aesthetic fidelity and performance with predictable installed costs, while sustainability and circularity shape next-generation portfolios.Resilient Vinyl Flooring Market Key Insights

- Rigid core is the category’s growth engine. SPC leads with dimensional stability and dent resistance, reducing telegraphing on imperfect substrates and accelerating tenant-turn renovations. Tighter click profiles, painted bevels, and EIR textures close the realism gap with wood and stone. Pre-attached pads simplify acoustics compliance in multifamily and office retrofits. Thermal compatibility improvements broaden radiant heat usage. Retailers favor curated rigid-core planograms for simpler selling.

- Glue-down and loose-lay remain essential for heavy traffic. In healthcare, education, and grocery, glue-down LVT and heterogeneous sheet deliver rolling-load performance, cove-up hygiene, and seam minimization. Loose-lay tiles support phased renovations and access flooring with minimal downtime. Specifiers value chemical resistance and hot-weld seam integrity for sanitation protocols. Long-term maintenance plans emphasize polish-optional wear layers to manage total cost. Product families now align across click and glue-down visuals for seamless zoning.

- Design realism is driven by print resolution and texture sync. High-fidelity imaging, variable décor bands, and long plank repeats reduce pattern fatigue in large spaces. EIR matches grain to texture, improving perceived depth under raking light. Matte-gloss control mitigates plastic sheen while protecting cleanability. Large-format tiles enable stone looks without grout upkeep. Coordinated trims and stair nosings complete ADA-compliant transitions and visual continuity.

- Indoor air quality and transparency are gating criteria. Low-VOC certifications and restricted substance compliance are increasingly mandated in public tenders and corporate standards. Buyers scrutinize plasticizer choices, residual monomers, and emissions under real-world conditions. Robust documentation - emission reports, HPDs, and ingredient disclosures - supports risk management. Manufacturers invest in process control to ensure consistent results across plants and OEM partners. Third-party audits strengthen brand trust.

- Acoustics and occupant comfort decide multifamily specs. Pre-attached underlays, multi-layer cores, and tuned click interfaces target impact sound performance over concrete. Spec sheets now present lab and field data with clear subfloor build-ups to manage expectations. Thermal comfort, slip resistance, and light reflectance are balanced against maintenance. In offices, underfoot fatigue and chair-castor wear guide product selection. Edge sealing and moisture mitigation protect long-term performance.

- Moisture management and subfloor prep remain risk centers. Rigid core tolerates minor imperfections, but vapor emission and hydrostatic pressure still demand mitigation strategies. Primer/skim workflows and moisture barriers are paired with manufacturer-approved adhesives where applicable. Clear installation playbooks and certified installer programs reduce claim rates. Jobsite acclimation and expansion gap discipline remain critical for temperature-swing environments. Warranty language increasingly ties coverage to documented prep steps.

- Digital tools reshape the path to specification. Visualizers, takeoff integrations, and BIM objects shorten design cycles and help owners pre-approve aesthetics. Portfolio simplification and good-better-best architecture improve quoting speed. QR-linked install guides and punch-list apps support onsite crews. For retailers, guided selling filters by room, substrate, traffic, and pet/kid needs. Post-install care apps align cleaning chemistry with warranty-safe routines.

- Circularity pilots inform next-gen materials strategy. Take-back of installation offcuts and post-consumer lift-outs requires sorting discipline and de-contamination to meet re-compound specs. Recycled content targets are balanced with mechanical properties and color control. Bio-attributed feedstocks reduce scope impacts without sacrificing performance. Modular construction and floating systems facilitate future recovery. Transparent communication on what is and isn’t recyclable prevents greenwashing backlash.

- Channel dynamics reward reliable lead times and breadth. Big-box and specialty retail prioritize in-stock core colors and rapid replenishment to capture weekend projects. Commercial distribution values synchronized visuals across formats for zoning and repairability. Private label programs demand strict color control and carton-to-carton consistency. OEM partnerships hinge on resin allocation assurances during supply shocks. Service level is a decisive differentiator in peak seasons.

- Regulatory evolution shapes formulations and messaging. Substance restrictions, labeling norms, and building standards influence additive packages and claims. Public procurement increasingly references durability testing, slip resistance, and maintenance profiles. Fire performance and smoke development remain non-negotiable in code-driven projects. Clear claims around waterproofing, dent resistance, and scratch performance reduce disputes. Proactive compliance readiness insulates brands from sudden market interruptions.

Resilient Vinyl Flooring Market Reginal Analysis

North America

Renovation and tenant-turn cycles sustain demand across multifamily and light commercial, favoring SPC click with pre-attached pads for acoustics. Healthcare and education lean toward glue-down LVT and sheet for hygiene and rolling loads. Buyers emphasize low-VOC credentials, warranty clarity, and installer training. Retailers curate simplified assortments and fast-turn logistics. Moisture mitigation over slabs and basements remains a core specification driver.Europe

Design and sustainability standards steer portfolios to low-emission, phthalate-free, and transparency-forward offerings. Heterogeneous sheet and glue-down LVT are strong in healthcare and transport, while rigid-core gains share in residential retrofit. Acoustic compliance in multi-dwelling buildings shapes underlay choices. Specifiers scrutinize end-of-life options and provenance. Precision trims, stair solutions, and fire performance are critical in public projects.Asia-Pacific

Urban housing growth and commercial fit-outs support rapid adoption of rigid core for speed and subfloor tolerance. Retail and hospitality prize large-format stone looks and durable topcoats for high traffic. Cost-in-use and quick install favor click systems in lease transitions. Humidity and temperature variation require stable cores and moisture-aware install practices. Regional OEM capacity underpins private label programs and broad décor ranges.Middle East & Africa

Hospitality, healthcare expansion, and retail build-outs drive specifications prioritizing heat tolerance, slip resistance, and maintenance ease. Climate conditions elevate adhesive selection, edge sealing, and substrate moisture control. Public projects value hygienic sheet goods and cove-up details. Supply continuity and trained installers are decisive. Premium segments opt for high-realism stone visuals to align with interior design trends.South & Central America

Retail modernization and resilient replacement cycles support LVT and SPC growth, particularly in urban multifamily and small-format commercial. Currency and logistics variability favor reliable local distribution and flexible pack sizes. Moisture and slab conditions steer toward rigid floating systems with sound underlays. Cleanability and scratch resistance rank high for family and pet households. Vendor service and post-install support influence brand loyalty.Resilient Vinyl Flooring Market Segmentation

By Type

- Luxury Vinyl Tile (LVT)

- Vinyl sheet

- Vinyl tile

By End-User

- Residential

- Commercial

Key Market players

Tarkett, Gerflor, Forbo Flooring Systems, Shaw Industries, Mohawk Industries (IVC), Mannington Mills, Karndean Designflooring, AHF Products, Polyflor (James Halstead), LX Hausys, NOX Corporation, Novalis Innovative Flooring, HMTX Industries, CFL Flooring, Beaulieu International Group (Beauflor)Resilient Vinyl Flooring Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Resilient Vinyl Flooring Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Resilient Vinyl Flooring market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Resilient Vinyl Flooring market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Resilient Vinyl Flooring market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Resilient Vinyl Flooring market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Resilient Vinyl Flooring market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Resilient Vinyl Flooring value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Resilient Vinyl Flooring industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Resilient Vinyl Flooring Market Report

- Global Resilient Vinyl Flooring market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Resilient Vinyl Flooring trade, costs, and supply chains

- Resilient Vinyl Flooring market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Resilient Vinyl Flooring market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Resilient Vinyl Flooring market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Resilient Vinyl Flooring supply chain analysis

- Resilient Vinyl Flooring trade analysis, Resilient Vinyl Flooring market price analysis, and Resilient Vinyl Flooring supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Resilient Vinyl Flooring market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tarkett

- Gerflor

- Forbo Flooring Systems

- Shaw Industries

- Mohawk Industries (IVC)

- Mannington Mills

- Karndean Designflooring

- AHF Products

- Polyflor (James Halstead)

- LX Hausys

- NOX Corporation

- Novalis Innovative Flooring

- HMTX Industries

- CFL Flooring

- Beaulieu International Group (Beauflor)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 55.97 Billion |

| Forecasted Market Value ( USD | $ 97.82 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |