Trypsin Market

The Trypsin market comprises serine proteases sourced from porcine/bovine pancreas and increasingly from recombinant, animal-origin-free (AOF) and microbial platforms. Products span research-grade, sequencing-grade, GMP/Ph. Eur./USP compliant, immobilized/encapsulated formats, and ready-to-use solutions for cell culture. Core applications include cell detachment and subculture in adherent bioprocessing, upstream processing for vaccines and viral vector production, proteomic digestion for LC-MS/MS, peptide mapping and QC of biotherapeutics, tissue dissociation in diagnostics, and specialized food/industrial uses. Trends center on AOF recombinant trypsin to mitigate TSE/BSE and supply-chain risks; low-autolysis and enhanced specificity variants; immobilized trypsin for rapid, high-throughput digestion; single-use, closed-system packs for cleanroom operations; and mass-spec-optimized grades with ultra-low chymotryptic activity. Growth is propelled by expansion of biologics and cell/gene therapies (with strict raw-material controls), scaling of proteomics in biomarker discovery and QC, and the shift to intensified/perfusion processes where frequent, gentle passaging and virus production steps are enzyme-dependent. The competitive landscape blends enzyme specialists, bioprocess suppliers bundling media + enzymes, analytical reagent leaders, and CDMOs/private-label formulators. Differentiation hinges on activity and specificity control, autolysis resistance, endotoxin/bioburden and host-cell protein limits, traceable documentation (TSE/BSE statements, CoAs, DMFs), viral inactivation/filtration steps, and packaging that supports aseptic dispensing. Procurement increasingly favors vendors that demonstrate process fit - consistent detachment kinetics on microcarriers, reproducible peptide maps for LC-MS, and validated performance in GMP suites - backed by robust change-control and global logistics.Trypsin Market Key Insights

- Animal-origin-free is becoming default. Recombinant trypsin reduces regulatory friction in vaccines, CGT, and monoclonals; suppliers win with DMF support, viral safety steps, and equivalence data versus animal sources.

- Autolysis-resistant and ultra-specific variants matter. Chemically modified or recombinant point-mutant trypsins minimize autolysis and chymotryptic side activity, improving peptide-map reproducibility and sequence coverage.

- Immobilized and rapid-digest workflows scale QC. Bead- or monolith-bound trypsin enables minutes-scale digests, inline cleanup, and cartridge swaps - ideal for release testing and high-throughput analytics.

- Closed-system, single-use packaging grows. Sterile, gamma-irradiated pouches/bags and ready-diluted concentrates reduce contamination and operator exposure in ISO-classified suites and biosafety labs.

- Cell culture performance is application-specific. Gentle, consistent detachment with preserved viability is critical for stem/primary cells; recombinant blends with EDTA and defined inhibitors control over-digestion.

- Proteomics drives premium grades. Sequencing-grade trypsin with low missed-cleavage rates and minimal keratin/peptide contaminants underpins robust LC-MS pipelines and automatable sample prep.

- Regulatory and documentation depth decide access. Full CoA/CoO, TSE/BSE statements, residual solvent profiles, change-control, and lot-to-lot comparability studies shorten audits and tech transfer.

- Formulation and stabilization are moats. Proprietary lyophilization, sugar/alcohol matrices, and pH-controlled diluents extend shelf life and preserve activity at room-temp handling windows.

- Bundling with media and buffers locks share. Platform vendors offer enzyme + neutralizers + media kits validated in customer unit ops, reducing qualification time and variability.

- Supply resilience is scrutinized. Dual-site manufacturing, recombinant capacity, and regional inventories mitigate shocks from animal-supply swings, export controls, and cold-chain constraints.

Trypsin Market Reginal Analysis

North America

Large biologics and CGT footprints drive demand for AOF/GMP trypsin in cell expansion, viral vector production, and QC peptide mapping. Buyers emphasize DMFs, robust change-control, and closed-system packaging. Proteomics labs adopt immobilized and rapid-digest kits for high-throughput LC-MS. Vendor selection often favors platform alignment with media and single-use ecosystems.Europe

Strict raw-material and animal-origin policies accelerate the shift to recombinant/AOF grades with pharmacopeial alignment. Biopharma sites prioritize viral safety validation and data-rich CoAs. National proteomics networks and pharma QC labs standardize on sequencing-grade trypsin for regulated assays. Sustainability and supplier transparency influence tenders.Asia-Pacific

Fast-growing biomanufacturing hubs in China, India, Korea, and ASEAN scale demand across vaccines, biosimilars, and CGT; cost-effective recombinant grades gain share. Japan/Korea lead in mass-spec applications requiring ultra-clean digests. Local fill-finish and distribution partnerships reduce lead times; halal considerations appear in select markets.Middle East & Africa

Emerging vaccine/biologic initiatives and reference labs expand demand for GMP and research-grade trypsin. Import reliance makes supply assurance, shelf-life stability, and training support important. Government health projects and free-zone bioclusters favor bundled solutions and strong documentation, including Arabic/French labeling.South & Central America

Biosimilar and vaccine programs adopt AOF trypsin for upstream and QC workflows. Academic proteomics and clinical labs grow steadily, emphasizing reliable sequencing-grade supply. Currency and logistics variability favor regional inventory, technical support in Spanish/Portuguese, and flexible MOQs; regulatory documentation streamlines public tenders.Trypsin Market Segmentation

By Source

- Porcine

- Bovine

- Others

By Application

- Pharmaceutical Companies

- Food Industry

- Personal Care

- Waste Treatment

- Others

By End-User

- Research

- Diagnostics

- Industrial use

Key Market players

Thermo Fisher Scientific, Merck (Sigma-Aldrich), Promega Corporation, Cytiva, Corning Incorporated, Lonza Group, Worthington Biochemical Corporation, Takara Bio Inc., FUJIFILM Wako Pure Chemical Corporation, HiMedia Laboratories, MP Biomedicals, GenScript Biotech Corporation, Avantor (VWR), Nacalai Tesque, PanReac AppliChem (ITW Reagents)Trypsin Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Trypsin Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Trypsin market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Trypsin market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Trypsin market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Trypsin market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Trypsin market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Trypsin value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Trypsin industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Trypsin Market Report

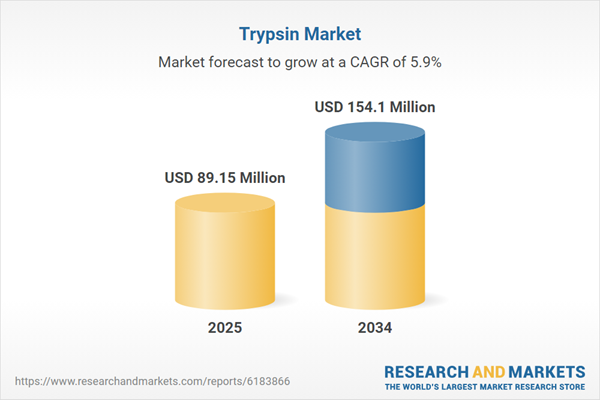

- Global Trypsin market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Trypsin trade, costs, and supply chains

- Trypsin market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Trypsin market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Trypsin market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Trypsin supply chain analysis

- Trypsin trade analysis, Trypsin market price analysis, and Trypsin supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Trypsin market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Thermo Fisher Scientific

- Merck (Sigma-Aldrich)

- Promega Corporation

- Cytiva

- Corning Incorporated

- Lonza Group

- Worthington Biochemical Corporation

- Takara Bio Inc.

- FUJIFILM Wako Pure Chemical Corporation

- HiMedia Laboratories

- MP Biomedicals

- GenScript Biotech Corporation

- Avantor (VWR)

- Nacalai Tesque

- PanReac AppliChem (ITW Reagents)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 89.15 Million |

| Forecasted Market Value ( USD | $ 154.1 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |