HVAC Rooftop Units Market

Rooftop units (RTUs) remain the workhorse of packaged HVAC for low- to mid-rise commercial buildings - retail, schools, offices, restaurants, logistics hubs - thanks to simple installation on existing curbs, factory integration of heating/ cooling/ventilation, and straightforward service access. The portfolio spans constant-volume entry models to high-efficiency, variable-speed systems with heat pump capability, dedicated outdoor air systems (DOAS), energy recovery, demand-controlled ventilation, and advanced controls. Market momentum reflects three converging demands: lower lifecycle energy, healthier indoor air, and lower carbon. Variable-speed compressors and fans, adaptive economizers, ERVs/HRVs, and tighter outdoor-air control drive real efficiency gains; IAQ features - enhanced filtration, needlepoint/bipolar ionization options, UV-C provisions, and verifiable ventilation - are now common bid requirements. Electrification accelerates the shift from gas heat to heat-pump RTUs, including cold-climate designs with vapor-injection and intelligent defrost. Refrigerant transitions toward lower-GWP A2L blends, tighter building codes, and grid programs (demand response, fault detection & diagnostics) push specification depth and software integration. Procurement is increasingly TCO-driven: owners weigh part-load efficiency, serviceability, curb adapter compatibility, controller openness, and remote monitoring against first cost. Supply dynamics include compressor and electronics availability, regional assembly footprints, and installer capacity; vendors respond with configurable platforms, standardized controls, and factory-installed options to cut labor and commissioning time. Overall, the category is shifting from commodity tonnage to systemized, connected RTUs that deliver measured ventilation, flexible heat-pump performance, and auditable savings across large portfolios.HVAC Rooftop Units Market Key Insights

- From constant-volume to variable everything. Variable-speed compressors, ECM fans, and smart expansion devices deliver part-load gains where buildings actually operate; adaptive control loops stabilize temperature, humidity, and acoustics.

- Electrification pushes heat-pump RTUs mainstream. Cold-climate variants with vapor-injection, enhanced defrost, and supplemental electric or hydronic trim heat replace gas heat in many specs, aligning with decarbonization plans.

- DOAS and energy recovery de-risk IAQ and codes. Packaged ERV/HRV modules and sensible/latent wheels let designers meet higher outdoor-air rates without oversized cooling, improving comfort and operating cost.

- A2L refrigerant transition reshapes designs. Cabinets, airflow paths, and controls are re-engineered for new safety envelopes; contractors prioritize clear handling procedures, leak detection support, and factory charging accuracy.

- Controls are the moat. Open-protocol BAS integration, cloud connectivity, FDD, and demand-response readiness turn RTUs into grid-interactive assets; portfolio dashboards standardize setpoints and reduce drift.

- Retrofit economics hinge on curb compatibility. Adapter kits, footprint match, and electrical re-use minimize crane time and roof work - critical for retail and school upgrades with tight changeover windows.

- Verified ventilation beats nameplate claims. In-unit airflow measurement, CO₂/PM sensing, and commissioning workflows document delivered CFM, supporting IAQ policies and utility incentive requirements.

- Serviceability drives uptime. Swing-out panels, plug-and-play boards, standardized filters, and onboard diagnostics reduce callbacks; parts commonality across tonnages simplifies truck stock.

- Acoustics and dehumidification matter. Low-sone fans, optimized blade geometry, and reheat/Hot-Gas Reheat options improve occupant satisfaction in classrooms, restaurants, and open offices.

- Sustainability is now scored. Low-GWP refrigerants, high-recycle content, EPDs, and energy reporting influence public bids; owners seek documented savings and pathway to future upgrades via firmware and modular options.

HVAC Rooftop Units Market Reginal Analysis

North America

Replacement cycles in retail, education, and light commercial dominate, with strong pull for variable-speed heat-pump RTUs, DOAS with energy recovery, and open controls for enterprise portfolios. Utility programs and performance contracts reward verified ventilation and part-load efficiency. School and municipal work values curb-adapter retrofits to compress crane time. Cold-climate specs emphasize defrost logic, vapor-injection heat pumps, and remote FDD to reduce winter service calls.Europe

Tighter energy and carbon frameworks favor high-efficiency heat-pump rooftops, heat recovery, and advanced dehumidification for mixed climates. Integration with building management systems and metering is mandatory; acoustics and low-profile units matter in dense urban sites. Gas-free designs and low-GWP refrigerants align with electrification and sustainability requirements. Retail parks and logistics hubs specify demand-controlled ventilation and ERVs to balance IAQ with operating costs.Asia-Pacific

New construction scale meets rapid modernization of retail and logistics. Hot-humid markets prioritize latent control, corrosion-resistant coils, and ERV-equipped DOAS; temperate zones adopt variable-speed heat-pump rooftops with economizers. Large chains seek common platforms across countries, valuing service networks and parts availability. Factory-configured controls and multilingual commissioning apps shorten install and handover.Middle East & Africa

High ambient temperatures and dust drive selection of robust coils, high-static fans, and enhanced filtration. Projects favor high-efficiency cooling with sensible/latent control and heat-recovery in malls, schools, and mixed-use developments. Owners value remote monitoring, sand-resistant designs, and quick-change filter systems. Import reliance elevates distributor capability, spare-parts stocking, and rapid service response.South & Central America

Urban retail, education, and hospitality upgrades lead demand; coastal sites require corrosion protection and durable finishes. Buyers balance first cost with TCO, favoring variable-speed packages, DOAS add-ons, and open controls for multi-site oversight. Logistics and light industrial growth add large-tonnage rooftops with ERV and demand-response readiness. Currency and freight variability increase appeal of local assembly and standardized platforms with flexible options.HVAC Rooftop Units Market Segmentation

By Capacity

- Upto 3 Tons

- 3 to 7 Tons

- 7 to 15 Tons

- 15 to 25 Tons

- 25 to 45 Tons

- Above 45 Tons

By Application

- Commercial

- -Supermarkets & Hypermarkets

- Industrial

- Residential

By Distribution Channel

- New Installation

- Replacement

Key Market players

Trane Technologies, Carrier Global Corporation, Daikin Industries Ltd., Lennox International Inc., Johnson Controls, LG Electronics, Mitsubishi Electric Corporation, Rheem Manufacturing, Bosch Thermotechnology, York International, Hitachi Ltd., Panasonic Corporation, Fujitsu General, Dunham-Bush, AAON Inc.HVAC Rooftop Units Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

HVAC Rooftop Units Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - HVAC Rooftop Units market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - HVAC Rooftop Units market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - HVAC Rooftop Units market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - HVAC Rooftop Units market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - HVAC Rooftop Units market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the HVAC Rooftop Units value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the HVAC Rooftop Units industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the HVAC Rooftop Units Market Report

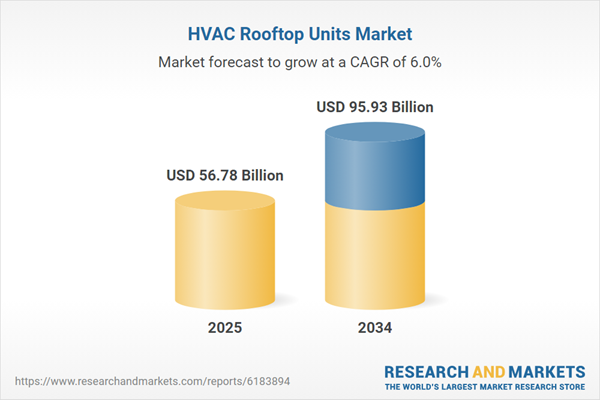

- Global HVAC Rooftop Units market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on HVAC Rooftop Units trade, costs, and supply chains

- HVAC Rooftop Units market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- HVAC Rooftop Units market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term HVAC Rooftop Units market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and HVAC Rooftop Units supply chain analysis

- HVAC Rooftop Units trade analysis, HVAC Rooftop Units market price analysis, and HVAC Rooftop Units supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest HVAC Rooftop Units market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Trane Technologies

- Carrier Global Corporation

- Daikin Industries Ltd.

- Lennox International Inc.

- Johnson Controls

- LG Electronics

- Mitsubishi Electric Corporation

- Rheem Manufacturing

- Bosch Thermotechnology

- York International

- Hitachi Ltd.

- Panasonic Corporation

- Fujitsu General

- Dunham-Bush

- AAON Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 56.78 Billion |

| Forecasted Market Value ( USD | $ 95.93 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |