Clinical Trials Matching Software Market

Clinical trials matching software connects eligible participants with open studies by transforming complex protocols into computable criteria and surfacing candidates from EHRs, registries, claims/RWD, genomics reports, and patient communities. Core capabilities span protocol ingestion and criteria normalization; NLP over unstructured notes; computable phenotypes and cohort discovery; real-time prescreening within provider workflows; patient-facing screeners, landing pages, and chat; referral orchestration to sites; and analytics on funnel conversion, screen-fail reasons, and time-to-enroll. Modern platforms integrate with EHRs (FHIR/HL7), CTMS/EDC, eConsent/ePRO, eCOA, LIMS/genomics, and call-center CRM to turn matching into an end-to-end recruitment and retention engine. AI advances focus on criteria parsing, plain-language summaries for patients, de-duplication across data sources, and ranking models that weigh medical fit, location, insurance/logistics, and participant preferences while enforcing fairness and explainability.Market momentum comes from decentralised/hybrid trials, pressure to shorten study start-up, and mandates for representative enrollment across age, race/ethnicity, and rural populations. Sponsors and CROs want site-ready, de-identified prescreens that convert; providers want automated flags and simple referral steps that respect clinic workflows; patient groups want clear value, data control, and navigation help. Compliance and trust are decisive - HIPAA/GDPR, Part 11 auditability for eConsent ties, role-based access, consent tracking, de-identification and re-contact under explicit permissions, and clean-room/tokenization options for privacy-preserving discovery. Differentiation centers on breadth/quality of integrations, accuracy and explainability of matching, ability to operationalize at scale across multi-site networks, diversity tooling, and services (navigators, call centers, community outreach). As sponsors industrialize study feasibility through to randomization, matching software is evolving from a search tool to a governed recruitment platform measured on conversion and representativeness.

Clinical Trials Matching Software Market Key Insights

- Protocol-to-computable is the moat. NLP and rules engines turn free-text I/E criteria into structured logic with value sets (labs, meds, diagnoses). Version control, reason codes, and test harnesses reduce false prescreens and rework.

- EHR-native prescreening wins clinician time. In-workflow alerts, one-click referrals, and auto-populated forms minimize burden. FHIR subscriptions and SMART-on-FHIR apps keep data local while surfacing candidates to study teams.

- Patient experience drives conversion. Plain-language eligibility, mobile prescreeners, multilingual content, and live navigator handoffs raise completion and show-rate; logistics (travel, stipends, childcare) surfaced early reduce late drop-offs.

- Diversity by design. Zip-level outreach, SDOH signals, language and literacy adaptation, and community-partner channels improve representativeness. Dashboards track diversity goals and identify funnel leakage by subgroup.

- Genomics and specialty data unlock hard trials. Direct ingestion of VCF/PDF reports, biomarker registries, and pathology synoptic data enable precision-oncology and rare-disease matching beyond ICD codes.

- Privacy-preserving collaboration scales reach. Tokenization and clean rooms let sponsors query provider/payer datasets without moving PHI; consent orchestration and re-contact registries maintain trust and legal defensibility.

- From feasibility to activation. Study feasibility modules estimate recruitable cohorts per site, then push live prescreens as protocols finalize - shrinking time-to-first-patient and aligning budgets to reality.

- Explainable AI is mandatory. Ranking models provide human-readable rationales (criteria met, missing labs, travel distance), helping coordinators act and auditors review; drift monitoring and bias tests keep models trustworthy.

- Closed-loop analytics. Integrations to CTMS/eConsent capture outcomes (screen fail, randomized, retained) and feed back win/loss reasons, continuously improving criteria interpretation and outreach tactics.

- Software services outperform. Platforms paired with navigators, call centers, and site enablement (templates, SOPs, training) lift conversion - especially in community sites and under-resourced networks.

Clinical Trials Matching Software Market Reginal Analysis

North America

Large integrated delivery networks and academic centers drive EHR-embedded matching with FHIR apps and tokenized data partnerships. Sponsors push for diverse enrollment and DCT support; oncology and rare disease dominate complex criteria use cases. Procurement emphasizes HIPAA/Part 11 controls, IRB-friendly consent flows, and explainable ranking. Strong ecosystem links to CTMS, eConsent, call centers, and patient advocacy groups are table stakes.Europe

GDPR and data sovereignty steer privacy-by-design architectures, on-prem/sovereign hosting, and minimal-data matching. National registries and public systems enable scale but require multilingual content and country-specific ethics processes. Buyers value strong audit trails, role granularity, and interoperability with eID/eConsent and hospital EHRs. Equity and cross-border trials raise needs for standardized criteria libraries and consent portability.Asia-Pacific

Rapid trial growth and mobile-first populations favor patient-facing prescreeners, messaging channels, and lightweight site tools. Data-localization rules and heterogeneous EHRs push for modular connectors and regional clouds. Oncology, vaccines, and metabolic disease dominate; cost-sensitive buyers prefer SaaS with services add-ons for navigator support and community outreach.Middle East & Africa

Emerging research hubs and new medical cities seek turnkey platforms with Arabic/localized UX, sovereign hosting, and strong role control. Cross-border patient flows and rare-disease programs benefit from registry integrations and navigator services. Site enablement, training, and managed outreach are decisive to overcome variable digital infrastructure.South & Central America

Growing site networks and public-private collaborations need WhatsApp-centric outreach, bilingual content, and offline-tolerant workflows. Ethics and fiscal processes vary by country, favoring configurable consent and document packages. Oncology and infectious disease lead demand; local partners for call-center and community engagement improve conversion and retention.Clinical Trials Matching Software Market Segmentation

By Deployment Mode

- Web & Cloud-based

- On-premises

By End-user

- Pharmaceutical & Biotechnology Companies

- CROs

- Medical Device Firms

Key Market players

TrialJectory, Antidote, Deep 6 AI, HealthMatch, Mendel.ai, TriNetX, ConcertAI, H1 (Trial Navigator), Massive Bio, TrialX, Belong.Life, xCures, Clinithink, Merative (formerly IBM Watson Health), TrialSparkClinical Trials Matching Software Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Clinical Trials Matching Software Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Clinical Trials Matching Software market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Clinical Trials Matching Software market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Clinical Trials Matching Software market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Clinical Trials Matching Software market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Clinical Trials Matching Software market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Clinical Trials Matching Software value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Clinical Trials Matching Software industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Clinical Trials Matching Software Market Report

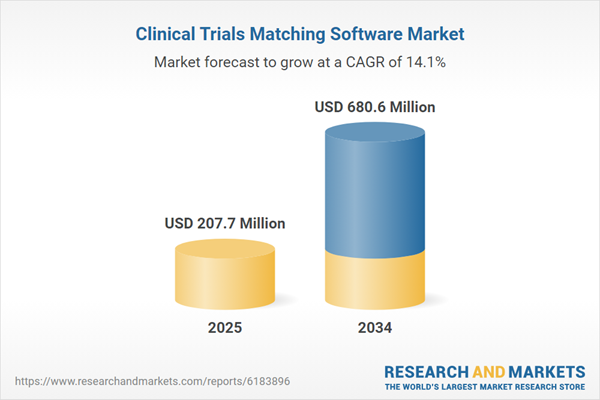

- Global Clinical Trials Matching Software market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Clinical Trials Matching Software trade, costs, and supply chains

- Clinical Trials Matching Software market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Clinical Trials Matching Software market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Clinical Trials Matching Software market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Clinical Trials Matching Software supply chain analysis

- Clinical Trials Matching Software trade analysis, Clinical Trials Matching Software market price analysis, and Clinical Trials Matching Software supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Clinical Trials Matching Software market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- TrialJectory

- Antidote

- Deep 6 AI

- HealthMatch

- Mendel.ai

- TriNetX

- ConcertAI

- H1 (Trial Navigator)

- Massive Bio

- TrialX

- Belong.Life

- xCures

- Clinithink

- Merative (formerly IBM Watson Health)

- TrialSpark

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 207.7 Million |

| Forecasted Market Value ( USD | $ 680.6 Million |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |