Lithium Cobalt Oxide Market

The lithium cobalt oxide market centers on the production and supply of LiCoO₂ cathode material used mainly in high-energy-density lithium-ion batteries for portable and premium electronics. LCO offers a well-understood chemistry, reliable cycle life for consumer duty cycles, and excellent volumetric energy density, which is why it remains the default choice in smartphones, tablets, laptops, wearables, cameras, drones, and selected medical and defense devices. Market development is shaped by two opposing forces: on one side, consumer devices keep demanding thinner, longer-lasting batteries, sustaining LCO; on the other, EV and stationary storage markets are pulling the broader battery industry toward lower-cobalt or cobalt-free chemistries. That means LCO’s growth is less about vehicles and more about holding and upgrading its stronghold in personal electronics, premium small devices, and specialized, safety-critical applications. On the supply side, producers focus on high-purity cobalt sourcing, tight particle-size and coating control, and surface modifications that improve safety and cycle stability at higher voltages. Key challenges include cobalt price volatility, ESG scrutiny of cobalt mining, and the need to ensure traceable, responsible supply for global OEMs. As device makers look for safer, higher-capacity cells without redesigning products, LCO suppliers that can deliver coated, doped, or blended LCO grades, along with recycling/reuse pathways, will be better positioned.Lithium Cobalt Oxide Market Key Insights

- Portable electronics remain the core demand. Phones, laptops, wearables and high-end consumer devices continue to favor LCO for its energy density and mature supply chain.

- Energy-density upgrades keep LCO relevant. Surface coatings, particle engineering and dopants enable slightly higher voltage and better cycle life without abandoning the chemistry.

- ESG and traceability are rising requirements. OEMs want cobalt from responsible, auditable sources and often ask for supplier-level certifications and chain-of-custody documentation.

- Price and supply of cobalt are structural risks. Any disruption or spike pushes device makers to evaluate lower-cobalt or blended cathode options, so stable supply contracts are valuable.

- Competition from alternative chemistries is selective. NMC, NCA and LFP are taking share in EVs and some notebooks, but for slim, premium, space-limited devices, LCO still delivers the best package.

- Recycling and black-mass recovery create circular supply. Collecting spent consumer batteries to recover cobalt and lithium helps offset primary supply risk and improves sustainability narratives.

- Safety and thermal performance remain procurement gates. Enhanced LCO grades with coatings and additives that improve thermal stability are favored for aviation, medical and defense devices.

- Localization of cathode production is increasing. To meet industrial policy goals and reduce logistics risk, some regions want LCO or precursor production closer to cell factories and device assembly.

- Integration with advanced anodes matters. Pairing LCO with high-capacity or silicon-containing anodes lets OEMs stretch device runtime without fully changing cathode families.

- Service and co-development win key accounts. Suppliers that work directly with cell makers and device OEMs on custom specs, testing and qualification cycles can lock in multi-generation programs.

Lithium Cobalt Oxide Market Reginal Analysis

North America

Demand is tied to consumer electronics, medical devices and some defense and aerospace systems that require proven, high-energy cells. Buyers focus on responsible cobalt, regional or friend-shored cathode supply, and strong safety data. Policies encouraging local battery chains are creating interest in nearer-term LCO production.Europe

Electronics, medical and industrial OEMs value traceable, low-impurity LCO with strong ESG credentials. As EU-level battery regulations tighten, suppliers able to document material origin, recycled content and carbon footprint will gain share. Some demand is shifting toward lower-cobalt chemistries, but premium portable devices still pull LCO.Asia-Pacific

The volume center, driven by large-scale consumer electronics, cell manufacturing, and cobalt processing capabilities. Chinese, Korean and Japanese cell makers continue to use LCO for phones, wearables and cameras, while experimenting with modified LCO to raise voltage. Proximity to cobalt refining and precursor facilities supports competitive pricing.Middle East & Africa

Direct LCO consumption is smaller, but the region is important as a source and transit area for cobalt and related materials. Growing electronics assembly and renewable/IoT device manufacturing in some Gulf states may create niche demand for high-quality imported LCO.South & Central America

Mostly an import-dependent market for finished batteries used in consumer electronics and medical equipment. Interest in battery material projects and cooperation with global players is emerging, but for now LCO demand follows device imports; buyers look for reliable, certified material when local pack assembly is involved.Key Market players

Umicore N.V., Nichia Corporation, L&F Co. Ltd., TODA Kogyo Corp., Showa Denko Materials Co. Ltd. (ex-Hitachi Chemical), Sumitomo Metal Mining Co. Ltd., BASF Battery Materials, Zhejiang Shanshan Technology Co. Ltd., Beijing Easpring Material Technology Co. Ltd., Pulead Technology Industry Co. Ltd., Tianjin Bamo Science & Technology Co. Ltd., Shenzhen Dynanonic Co. Ltd., Hunan Reshine New Material Co. Ltd., Xiamen Tungsten Co. Ltd., CNGR Advanced Materials Co. LtdLithium Cobalt Oxide Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Lithium Cobalt Oxide Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Lithium Cobalt Oxide market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Lithium Cobalt Oxide market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Lithium Cobalt Oxide market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Lithium Cobalt Oxide market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Lithium Cobalt Oxide market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Lithium Cobalt Oxide value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Lithium Cobalt Oxide industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Lithium Cobalt Oxide Market Report

- Global Lithium Cobalt Oxide market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Lithium Cobalt Oxide trade, costs, and supply chains

- Lithium Cobalt Oxide market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Lithium Cobalt Oxide market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Lithium Cobalt Oxide market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Lithium Cobalt Oxide supply chain analysis

- Lithium Cobalt Oxide trade analysis, Lithium Cobalt Oxide market price analysis, and Lithium Cobalt Oxide supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Lithium Cobalt Oxide market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Umicore N.V.

- Nichia Corporation

- L&F Co. Ltd.

- TODA Kogyo Corp.

- Showa Denko Materials Co. Ltd. (ex-Hitachi Chemical)

- Sumitomo Metal Mining Co. Ltd.

- BASF Battery Materials

- Zhejiang Shanshan Technology Co. Ltd.

- Beijing Easpring Material Technology Co. Ltd.

- Pulead Technology Industry Co. Ltd.

- Tianjin Bamo Science & Technology Co. Ltd.

- Shenzhen Dynanonic Co. Ltd.

- Hunan Reshine New Material Co. Ltd.

- Xiamen Tungsten Co. Ltd.

- CNGR Advanced Materials Co. Ltd.

Table Information

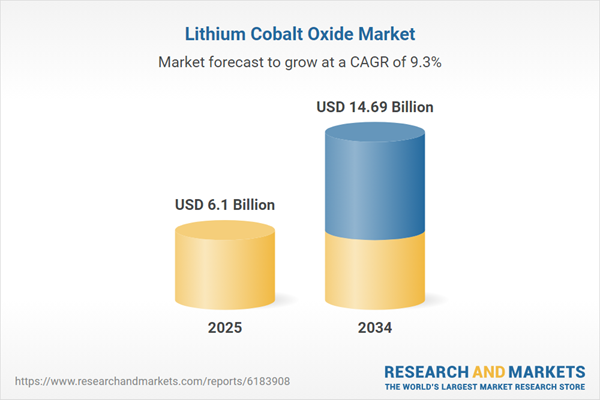

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.1 Billion |

| Forecasted Market Value ( USD | $ 14.69 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |