Wind Turbine Operations and Maintenance Market

The wind turbine O&M market encompasses scheduled and corrective maintenance, major component repair and replacement, condition monitoring, blade inspection and repair, digital diagnostics, spare-parts logistics, balance-of-plant services, and long-term service agreements for onshore and offshore fleets. Demand expands with cumulative installed capacity, repowering, and life-extension programs as projects age beyond initial warranty. Top service scopes include drivetrain and generator overhauls, main bearing and gearbox exchanges, power electronics and converter repairs, SCADA and cybersecurity hardening, pitch/yaw systems, hydraulic upgrades, and blade leading-edge protection. Trends emphasize data-driven maintenance using vibration, oil, and electrical signature analytics; AI-assisted failure prediction; drone/robotic inspection; composite repair standardization; and digital twins that link SCADA, CMS, and work management to reduce downtime. Offshore O&M is professionalizing around high-availability strategies using SOVs, CTVs, logistics hubs, and heavy-lift planning; onshore programs prioritize cost per MWh, parts commonality, and rapid mobilization. Competitive dynamics feature OEM service divisions, independent service providers (ISPs), specialist blade and high-voltage firms, maritime logistics operators, and asset managers bundling performance guarantees. Buyers value demonstrable availability improvements, safety records, regulatory compliance, and transparent KPI reporting. Key challenges include weather-driven access constraints offshore, supply-chain lead times for large components, technician shortages, cyber risk to OT networks, and integrating disparate data systems across mixed fleets. As owners seek predictable output and lower LCOE, the market is shifting from time-based to condition-based strategies, outcome-linked contracts, and lifecycle approaches that balance reliability, spare-parts strategy, and end-of-life decisions.Wind Turbine Operations and Maintenance Market Key Insights

- Availability is the currency. Contracts increasingly tie payments to availability and energy-based KPIs, incentivizing proactive maintenance, strategic spares, and rapid fault clearance.

- Condition monitoring moves center stage. Vibration, oil debris, partial discharge, and electrical signatures feed prognostics that schedule interventions around seasonal wind windows and crane availability.

- Blades drive unplanned downtime. Erosion, lightning, and structural defects require standardized repair methods, protective coatings, and drone/rope access workflows that shorten outage duration.

- Power electronics are a hotspot. Converter and transformer reliability programs - thermal management, component upgrades, and firmware hygiene - cut repeat failures across high-temperature sites.

- Digital twins operationalize data. Linking SCADA, CMS, work orders, and inventory creates asset-specific risk models that prioritize crews and optimize crane campaigns and SOV routes.

- Offshore logistics define cost. Weather windows, transfer systems, and SOV-based “hotel at sea” models increase uptime; port-side hubs and pre-positioned spares compress mean time to repair.

- Repowering and life extension blur O&M. Uprating controls, replacing key components, and structural assessments extend economic life while aligning with evolving grid codes.

- Safety and competence are differentiators. GWO training, LOTO procedures, and high-angle/ HV certifications underpin award decisions; near-miss analytics strengthen safety culture.

- Cybersecurity becomes routine O&M. Patch management, network segmentation, and incident playbooks reduce OT risk and satisfy insurer and regulator expectations.

- Flexible contracting wins. Hybrid models mix OEM expertise for high-risk systems with ISP agility for balance-of-plant, backed by transparent data sharing and clear interface management.

Wind Turbine Operations and Maintenance Market Reginal Analysis

North America

Growth in utility-scale onshore fleets and coastal offshore projects drives demand for condition-based programs, blade protection, and grid-code alignment. Owners prefer mixed-model service portfolios, combining OEM LTSA coverage with ISP blade and HV specialists. Technician pipelines, crane availability, and spares staging near wind corridors are decisive for uptime.Europe

A mature onshore base and rapid offshore expansion emphasize high availability, SOV-enabled logistics, and strict HSE compliance. Data governance, standardized KPIs, and end-of-life planning - including recycling and repowering - shape tenders. Cold-climate packages, leading-edge protection, and power-electronics reliability are recurring focus areas.Asia-Pacific

Large, fast-growing fleets in China and India prioritize scalable, cost-efficient O&M with localized parts manufacturing. Japan, Korea, and Taiwan’s offshore buildouts require advanced marine logistics and port infrastructure. Regional players invest in digital monitoring centers and training academies to address technician gaps and fleet heterogeneity.Middle East & Africa

Utility projects in high-temperature, dusty environments demand filtration, cooling upgrades, and hardened electronics. Remote-site logistics and grid variability drive emphasis on predictive maintenance and inventory strategies. Safety credentials and rapid mobilization capabilities weigh heavily in awards.South & Central America

Wind corridors in Brazil, Mexico, and the Southern Cone expand O&M requirements for drivetrain reliability and HV substation care. Budget sensitivity favors outcome-based contracts with clear availability floors. Regional service hubs, crane partnerships, and standardized spares programs reduce downtime and transport costs.Wind Turbine Operations and Maintenance Market Segmentation

By Location

- Onshore

- Offshore

- By Type (Scheduled

- Unscheduled

- By Turbine Connectivity (Grid-Connected

- Standalone

Key Market players

Vestas, Siemens Gamesa, GE Vernova, Nordex, Enercon, Goldwind, Envision, Suzlon, Ørsted, Vattenfall, RWE Renewables, SSE Renewables, Iberdrola, Siemens Energy, Deutsche Windtechnik, EDF Renewables, Mainstream RP, Acciona EnergiaWind Turbine Operations and Maintenance Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Wind Turbine Operations and Maintenance Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Wind Turbine Operations and Maintenance market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Wind Turbine Operations and Maintenance market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Wind Turbine Operations and Maintenance market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Wind Turbine Operations and Maintenance market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Wind Turbine Operations and Maintenance market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Wind Turbine Operations and Maintenance value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Wind Turbine Operations and Maintenance industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Wind Turbine Operations and Maintenance Market Report

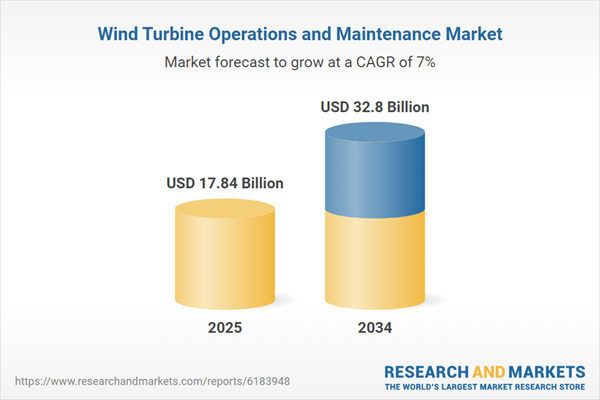

- Global Wind Turbine Operations and Maintenance market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Wind Turbine Operations and Maintenance trade, costs, and supply chains

- Wind Turbine Operations and Maintenance market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Wind Turbine Operations and Maintenance market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Wind Turbine Operations and Maintenance market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Wind Turbine Operations and Maintenance supply chain analysis

- Wind Turbine Operations and Maintenance trade analysis, Wind Turbine Operations and Maintenance market price analysis, and Wind Turbine Operations and Maintenance supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Wind Turbine Operations and Maintenance market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Vestas

- Siemens Gamesa

- GE Vernova

- Nordex

- Enercon

- Goldwind

- Envision

- Suzlon

- Ørsted

- Vattenfall

- RWE Renewables

- SSE Renewables

- Iberdrola

- Siemens Energy

- Deutsche Windtechnik

- EDF Renewables

- Mainstream RP

- Acciona Energia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 17.84 Billion |

| Forecasted Market Value ( USD | $ 32.8 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |