Robot Cars and Trucks Market

Robot cars and trucks are moving from high-profile pilots to disciplined, lane-by-lane commercialization that targets repeatable use cases: urban robotaxis in defined service areas, airport/campus shuttles, middle-mile store-to-warehouse routes, hub-to-hub highway freight, and yard/port drayage that integrates with existing depot operations. The latest deployment playbooks emphasize tight Operational Design Domains, redundancy-first vehicle platforms, safety-case engineering, and tele-assist/remote operations to manage edge cases and recovery. Technology trends include rapid maturation of perception stacks (sensor fusion with camera, lidar, radar), end-to-end learning that simplifies software, automotive-grade compute with better thermal/power envelopes, and lifecycle management via over-the-air updates, simulation, and curated data engines. Key demand drivers span logistics cost inflation, driver shortages and duty-time limits, safety and Vision-Zero agendas, e-commerce peaks requiring predictable capacity, and sustainability programs that pair autonomy with electric powertrains and depot charging. Competition is coalescing around OEM-ADS alliances for trucks, vertically integrated robotaxi operators in major cities, and specialist middle-mile players monetizing constrained routes ahead of broad urban coverage. Cloud, semiconductor, map/data suppliers, and Tier-1s shape the ecosystem through platform standardization, while insurers and regulators push for transparent safety metrics, incident reporting, and operational governance. Go-to-market models bifurcate between fleet-owned “transport-as-a-service” and “driver-as-a-service” sold into carriers, with SLAs based on availability, on-time performance, and safety. Over the report horizon, the market’s center of gravity shifts from one-off pilots to networked operations, warrantyable uptime, and multi-city lane replication.Robot Cars and Trucks Market Key Insights

- ODD-first scaling beats “anywhere autonomy.” Winners constrain geography, weather, and traffic complexity, then expand service maps once reliability, tele-assist procedures, and maintenance rhythms are proven. This reduces edge-case exposure, accelerates learning cycles, and supports defensible uptime SLAs that carriers and cities can procure with confidence.

- Safety case is the product. Beyond feature lists, buyers and regulators evaluate hazard analyses, fallback behaviors, validation mileage (real + simulated), and post-incident governance. Programs that publish safety rationales, perform phased re-entries after events, and align with functional-safety/SOTIF practices earn durable stakeholder trust and faster permitting.

- Trucking productization pivots on OEM-ADS integration. Autonomous-ready tractors with redundant braking/steering, power, and sensing align to hub-to-hub corridors. Joint roadmaps, service tooling, and dealer network readiness matter as much as software; carriers prefer integrated offerings with clear liability splits and retrofit paths.

- Middle-mile outpaces door-to-door. Store/warehouse loops and depot-to-micro-hub routes provide predictable demand, simpler curb interactions, and better battery/charging economics. These lanes demonstrate commercial viability sooner than broad urban ride-hail while building data moats and operational expertise.

- Perception stacks are simplifying - without skimping on redundancy. End-to-end learning, better pretraining, and self-supervision trim code paths and hand-tuning. At the vehicle level, multi-modal sensing remains favored for adverse weather and long-range detection, paired with improved domain controllers and health monitoring.

- Teleoperations graduate from backup to core workflow. Remote assistance, incident triage, and fleet orchestration are becoming standard operating layers. Clear staffing ratios, human-factors design, and low-latency connectivity are decisive for scaling driver-out operations responsibly.

- Energy and autonomy converge in depots. Autonomy thrives where charging and maintenance are centralized. Smart depot planning (power upgrades, managed charging, battery health analytics) boosts asset utilization, enabling night operations and peak-shaving without sacrificing duty cycles.

- Maps evolve from HD-first to hybrid approaches. Providers blend lightweight priors, on-the-fly mapping, and change detection to reduce map maintenance costs. Robust localization in construction zones and work-zone handoffs remains a differentiator for urban deployments and long-haul routes.

- From pilots to procurement language. Buyers now negotiate uptime, response times, software release cadences, and training. Total cost of autonomy considers insurance, roadside assistance, connectivity, parts commonality, and residual value - not just the driver cost delta.

- Global policy tailwinds with local nuance. National frameworks are broadening, but city/state approvals, data-sharing rules, and incident protocols vary. Vendors that invest early in compliance tooling, reporting interfaces, and community engagement shorten path-to-revenue across regions.

Robot Cars and Trucks Market Reginal Analysis

North America

Commercialization concentrates in selected metro robotaxi zones and Sun Belt freight corridors with favorable weather, strong logistics density, and supportive state frameworks. Truck OEM-ADS programs target hub-to-hub operations and private/leased roads for early driver-out before broader interstate scaling. Utility-style oversight and incident transparency shape passenger services, while carriers demand integrated uptime, service tooling, and warranty terms. Depot-centric energy planning and partnerships with charging providers enable overnight charging and multi-shift asset utilization.Europe

Progress is anchored by clearer type-approval pathways and safety-case rigor, with early emphasis on automated lane keeping and supervised freight pilots. Truck makers leverage extensive Tier-1 ecosystems and dealer networks to prepare autonomous-ready platforms. City policies prioritize Vision-Zero and public acceptance; thus, phased operations, geofenced trials, and strong labor/social dialogue are common. Cross-border freight lanes, motorway upgrades, and digital infrastructure (V2X, secure data spaces) support medium-term scaling.Asia-Pacific

China advances fastest in city-scale robotaxi operations and expanding service maps, supported by municipal programs and integrated digital infrastructure. Japan emphasizes safety-critical shuttles for aging-society mobility and high-reliability logistics, while Australia and parts of Southeast Asia explore resource-corridor and port/yard automation with controlled environments. Regional manufacturing depth helps localize sensors/compute and reduce BOM volatility, with domestic cloud and mapping ecosystems shaping stack choices.Middle East & Africa

Gulf cities are positioning autonomy as a smart-mobility showcase, pairing clear policy intent with modern road infrastructure and public-private partnerships. Early robotaxi services and campus/zone shuttles progress under staged supervision, with logistics pilots in industrial zones and ports where 24/7 demand supports strong utilization. In Africa, activity is nascent and focused on private-site logistics and regulatory exploration, with opportunities around mining haulage, free-zone corridors, and safety-led modernization programs.South & Central America

Public-road autonomy remains early, with momentum in private or semi-private environments such as ports, yards, and industrial parks. National AI/mobility strategies and city-level permitting are developing, guiding initial pilots toward constrained middle-mile routes linked to export logistics. International fleets may introduce corridor-based trucking pilots where enforcement and infrastructure reliability are stronger. Partnerships with telecoms and energy providers will be important to manage connectivity and depot charging at scale.Robot Cars and Trucks Market Segmentation

By Vehicle

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

By Classification

- Level 0

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Technology

- Simultaneous Localization

- Mapping Real-Time Locating System

By Application

- Domestic

- Commercial

- Industrial

Key Market players

Waymo, Cruise, Tesla, Woven by Toyota, Daimler Truck, Torc Robotics, Volvo Autonomous Solutions, PACCAR, Traton Group, Baidu Apollo, Pony.ai, AutoX, WeRide, Zoox, Motional, Aurora Innovation, Kodiak Robotics, Plus, Gatik, EinrideRobot Cars and Trucks Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Robot Cars and Trucks Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Robot Cars and Trucks market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Robot Cars and Trucks market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Robot Cars and Trucks market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Robot Cars and Trucks market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Robot Cars and Trucks market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Robot Cars and Trucks value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Robot Cars and Trucks industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Robot Cars and Trucks Market Report

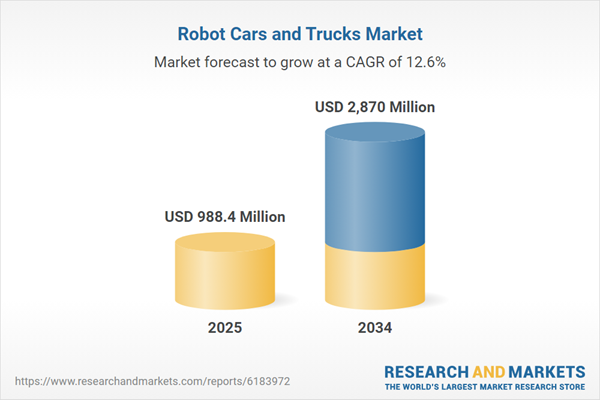

- Global Robot Cars and Trucks market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Robot Cars and Trucks trade, costs, and supply chains

- Robot Cars and Trucks market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Robot Cars and Trucks market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Robot Cars and Trucks market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Robot Cars and Trucks supply chain analysis

- Robot Cars and Trucks trade analysis, Robot Cars and Trucks market price analysis, and Robot Cars and Trucks supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Robot Cars and Trucks market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Waymo

- Cruise

- Tesla

- Woven by Toyota

- Daimler Truck

- Torc Robotics

- Volvo Autonomous Solutions

- PACCAR

- Traton Group

- Baidu Apollo

- Pony.ai

- AutoX

- WeRide

- Zoox

- Motional

- Aurora Innovation

- Kodiak Robotics

- Plus

- Gatik

- Einride

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 988.4 Million |

| Forecasted Market Value ( USD | $ 2870 Million |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |