Fortified Sugar Market

The fortified sugar market involves the production and distribution of granulated or refined sugar that has been enhanced with additional micronutrients - such as vitamin A, iron, zinc, folic acid, and iodine - to support public health nutrition objectives in food‑consuming populations. This fortified sugar is used as both a food ingredient (in households, bakeries, confectionery) and a public health intervention vehicle. Key applications include direct household consumption, packaged food & beverage (ready‑to‑eat cereals, baked goods, confectionery, beverages), as well as institutional food programmes (school meals, government rations). Trends in the market include rising adoption of large‑scale fortification programs by governments and NGOs (especially in Africa, Latin America and Asia), increasing incorporation of fortified sugar by food manufacturers to meet clean‑label/health‑credential trends, and growth of technology platforms that ensure stable nutrient addition, shelf‑stability and bioavailability in sugar matrices. Growth is driven by the global public health focus on micronutrient deficiencies (iron‑deficiency anaemia, vitamin A deficiency), rising sugar consumption in emerging economies, increasing food company interest in nutrition value‑addition, and the linkages between sugar fortification and social responsibility/regulatory frameworks. From a competitive perspective, sugar refiners, ingredient‑additive companies, micronutrient blend specialists and logistics/distribution service providers all play a role; success is determined by reliable nutrient‑enrichment processes, regulatory approval, supply‑chain integrity (traceability of fortificant blends), cost‑control and partnerships with government programmes. Additional market dynamics include fluctuating sugar commodity prices (which influence margins), regulatory variation across countries (nutrient mix, labelling), consumer health backlash against sugar consumption (which could constrain growth) and the need to balance sugar reduction/fortification synergies in food‑product development.Fortified Sugar Market Key Insights

- Public health programmes underpin large scale demand: Government mandated fortified sugar programmes in developing economies create assured volume take off and long term contracts, providing scale for refiners who incorporate micronutrient blends in sugar supply.

- Emerging market consumption growth drives scale: Rising sugar demand in Africa, South Asia and Latin America supports growth of fortified sugar, as more households and food manufacturers use granulated sugar in everyday cooking and processing.

- Ingredient value addition appeals to food manufacturers: Food & beverage brands are increasingly seeking differentiated ingredients with nutrition claims; fortified sugar offers a way to retain familiar sweetness while adding micronutrient value, supporting clean label and functional food positioning.

- Technology and stability of nutrient addition matter: Fortification must ensure uniform distribution, stability through storage/transport, bioavailability of micronutrients and compatibility with sugar processing; refiners investing in robust addition systems gain competitive edge.

- Regulatory and nutrition policy frameworks are enabling: Countries setting micronutrient deficiency targets enable sugar fortification via policy, subsidies and institutional procurement, reducing risk for market participants.

- Commodity price volatility introduces margin risk: Sugar price swings impact refiners’ cost base; while fortification adds a premium, margin compression can occur if sugar prices spike unexpectedly.

- Health and sugar reduction campaigns introduce tension: While fortified sugar adds nutrition value, broader public health campaigns to reduce sugar consumption or sugar taxation may constrain volume growth and shift use toward alternative sweeteners.

- Supply chain traceability and quality assurance are differentiators: Requirement for micronutrient certification, audit trails, fortificant blend traceability and shelf life stability mean refiners must invest in quality systems to serve institutional and branded buyers.

- Premium pricing demands value articulation: Although fortified sugar commands a premium over standard sugar, buyers require clear value case (nutrient delivery, regulatory compliance, brand nutrition messaging) to justify cost differential.

- Emerging niche applications are developing: Beyond household sugar, fortified sugar is increasingly used in industrial bakery mixes, confectionery slabs, institutional rations, and meal programme blends - opening specialised volume streams for suppliers.

Fortified Sugar Market Reginal Analysis

North America

In North America, fortified sugar is a smaller niche compared with other regions; the regulatory and nutrition‑landscape is mature, sugar‑consumption patterns relatively static, and consumer scrutiny on sugar intake is high. Growth is mainly in value‑added ingredient channels (e.g., bakery, functional foods) rather than large‑scale household programmes. Suppliers focus on premium food‑industry grades, certification (GMP, ingredient traceability) and supplying ingredient customers rather than mass‑household sugar.Europe

Europe’s market for fortified sugar is moderate, shaped by strict food‑labelling and nutrition‑regulation frameworks, rising consumer awareness about sugar reduction, and strong functional‑ingredient markets. Fortified sugar appeals to branded bakery and confectionery manufacturers seeking nutrition claims, but mass‑household uptake is limited due to sugar‑reduction trends. Market expansion is more value‑led than volume‑led, and suppliers emphasise clean‑label micronutrient integration.Asia‑Pacific

Asia‑Pacific is the fastest‑growing region for fortified sugar, driven by large sugar‑consuming populations, enduring cooking/household sugar use, rising food‑processing industries, and government nutrition programmes in South Asia and Southeast Asia. Countries in this region increasingly adopt national sugar‑fortification mandates or voluntary schemes. Suppliers who localise fortification facilities, manage logistics and collaborate with public‑health agencies perform best.Middle East & Africa

In the Middle East & Africa region, fortified sugar presents significant opportunity - nutrition deficiencies (iron, vitamin A, iodine) are prevalent, institutional food‑supply programmes are expanding, and sugar consumption remains high in many countries. However, infrastructure, regulatory consistency and premium‑pricing sensitivity pose challenges. International suppliers partnering with local refiners or government initiatives have strong access.South & Central America

South & Central America’s fortified sugar market is influenced by a mix of sugar‑exporting countries, rising processed‑food consumption and growing public‑health interest in micronutrient fortification. While household sugar use is significant, price sensitivity is higher and fortified sugar must compete with commodity sugar. Suppliers focusing on institutional programmes (school feeding, fortification mandates) and industrial ingredient channels gain traction.Fortified Sugar Market Segmentation

By Micronutrient

- Vitamins

- Minerals

- Others

By Technology

- Drying

- Extrusion

- Coating & Encapsulation

- Others

By End-User

- Commercial

- Residential

By Sales Channel

- Modern Trades

- Convenience Stores

- Departmental Stores

- Drug Stores

- Online Stores

- Others

Key Market players

Wilmar International, Südzucker, Associated British Foods (AB Sugar), Nordzucker, Mitr Phol, Cosan (Raízen), Tereos, Thai Roong Ruang Group, Cargill, Bunge, Archer Daniels Midland (ADM), Olam (ofi), Tate & Lyle, DSM-Firmenich, BASFFortified Sugar Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Fortified Sugar Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Fortified Sugar market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Fortified Sugar market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Fortified Sugar market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Fortified Sugar market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Fortified Sugar market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Fortified Sugar value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Fortified Sugar industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Fortified Sugar Market Report

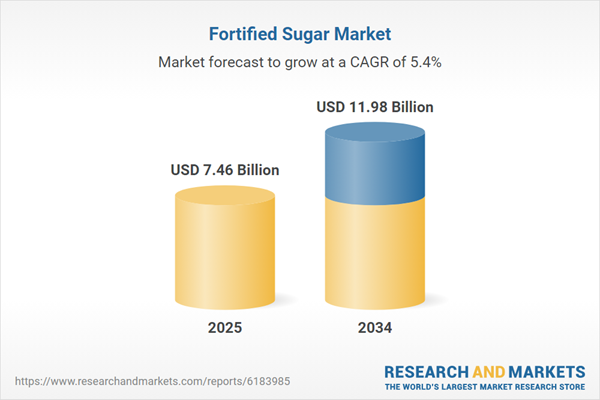

- Global Fortified Sugar market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Fortified Sugar trade, costs, and supply chains

- Fortified Sugar market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Fortified Sugar market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Fortified Sugar market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Fortified Sugar supply chain analysis

- Fortified Sugar trade analysis, Fortified Sugar market price analysis, and Fortified Sugar supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Fortified Sugar market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Wilmar International

- Südzucker

- Associated British Foods (AB Sugar)

- Nordzucker

- Mitr Phol

- Cosan (Raízen)

- Tereos

- Thai Roong Ruang Group

- Cargill

- Bunge

- Archer Daniels Midland (ADM)

- Olam (ofi)

- Tate & Lyle

- DSM-Firmenich

- BASF

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 7.46 Billion |

| Forecasted Market Value ( USD | $ 11.98 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |