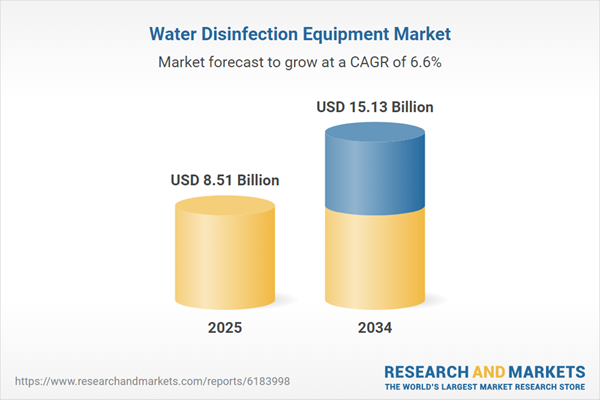

Water Disinfection Equipment Market

The Water Disinfection Equipment Market is transitioning from stand-alone disinfection units to integrated, sensor-driven barriers embedded across municipal, industrial, and decentralized systems. Solutions span UV reactors, ozone generators, electrochlorination and on-site hypochlorite systems, advanced oxidation modules, and point-of-use/point-of-entry devices. Top applications include municipal drinking water and reuse polishing, wastewater effluent disinfection, industrial process water in food and beverage, microelectronics, pharmaceuticals, cooling towers, and buildings’ secondary water systems. Key trends include multi-barrier architectures that combine physical separation with chemical or photolytic steps, UV-LED maturation for compact and low-energy units, catalytic and low-chlorate electrochemical systems, smart dosing via real-time sensors, and modular skids that retrofit legacy plants. Drivers center on tightening microbial standards, emerging pathogen vigilance, reuse ambitions, and building-water health programs. The competitive landscape blends diversified water technology majors, UV/ozone specialists, electrochemical innovators, and EPC integrators offering outcome-based service models. As utilities and enterprises digitize operations, disinfection is evolving into a controllable, auditable risk-management layer - with analytics, remote monitoring, and validated safety interlocks minimizing by-products while ensuring resilient, cost-predictable operations.Water Disinfection Equipment Market Key Insights

- Regulatory ratcheting and reuse agendas elevate disinfection from a compliance step to a strategic resilience layer. Utilities and plants deploy multi-barrier trains that maintain log-inactivation targets under seasonal flux, storms, or process upsets, reducing boil-water and recall risks through validated redundancy and rapid recovery protocols.

- UV technology diversifies beyond legacy mercury lamps. Medium-pressure systems support high-flow municipal halls with robust control of protozoa; low-pressure high-output units drive energy efficiency; UV-LEDs unlock compact, instant-on modules for decentralized and building applications, with lamp aging analytics enabling predictive maintenance and uptime guarantees.

- Chemical disinfection is being re-engineered for sustainability. On-site hypochlorite and electrochlorination avoid hazardous bulk deliveries, cut transportation risks, and enable chloramine control strategies; advanced chlorination monitoring mitigates DBPs while maintaining residuals across distribution or building risers.

- Ozone and catalytic pathways expand coverage for taste, odor, and micropollutants. Modern generators with higher current efficiencies and better gas-liquid transfer reduce specific energy while supporting multi-objective treatment trains that pair oxidation with biofiltration for stable downstream performance and reduced chemical cleaning.

- Digital twins and closed-loop controls optimize dose to demand. Online UVT, ORP, free/total chlorine, CT calculators, and surrogate microbial indicators feed model-predictive control; systems pace energy and reagents to actual load, lowering OPEX and curbing by-product formation without compromising public-health safety margins.

- Building-water programs bring disinfection inside the meter. Healthcare, hospitality, and commercial real estate adopt secondary disinfection with smart residual management to curb Legionella and opportunistic pathogens. Integrated BMS links coordinate temperature, flow, and disinfection, transforming compliance into continuous assurance.

- Modular and retrofit-friendly designs accelerate adoption. Skid packages with standardized piping, controls, and validation speed permitting and commissioning, slotting into crowded galleries and enabling phased capacity growth without long shutdowns or civil overhauls.

- Service and performance contracting shift economics. Per-m³ treated, uptime SLAs, and chemistry-as-a-service models de-risk technology choice. Remote diagnostics, spare-kit standardization, and operator training programs stabilize lifecycle costs and sustain performance through staffing turnover.

- Safety and by-product stewardship are now core differentiators. Vendors emphasize interlocks for gas/chemical handling, degassing, quench steps, and continuous monitoring of chlorite, bromate, and THMs/HAAs, ensuring primary inactivation gains are not offset by secondary risks across diverse source waters.

- Supply-chain resilience and localization matter. Standardized controllers, multi-source LEDs/lamps, and regional assembly reduce lead-time exposure. Designs tolerant to power variability and harsh climates maintain reliability for rural utilities, industrial estates, and emergency deployments.

Water Disinfection Equipment Market Reginal Analysis

North America

Adoption is propelled by stringent microbial rules, distribution-system residual requirements, and a growing focus on building-water safety. Utilities prioritize retrofit-friendly UV halls, on-site hypochlorite for hazard reduction, and digital controls to manage seasonal turbidity and source blending. Industrial users favor modular skids, remote monitoring, and validated CT calculators; risk-sharing service contracts and cyber-secure SCADA integrations influence procurement.Europe

A precautionary, multi-barrier philosophy favors UV and ozone-biofiltration pairings that minimize chemical inventories and by-products while meeting rigorous drinking water and reuse criteria. Energy efficiency, LCA metrics, and material sustainability shape tenders. Advanced monitoring, data logging, and certification readiness are emphasized for regulatory audits; industrial clusters seek harmonized solutions across multi-site portfolios.Asia-Pacific

Rapid urbanization and industrial growth drive large municipal UV and ozone installations alongside compact systems for decentralized communities. Water reuse targets and variable raw-water quality heighten interest in adaptive, sensor-guided dosing. In high-tech manufacturing hubs, ultrapure and process-water disinfection demand tight control, redundancy, and fast service response; localized manufacturing and reagent supply improve uptime.Middle East & Africa

Water scarcity and desalination reliance prioritize robust, low-fouling disinfection integrated with pretreatment and distribution residual management. Designs emphasize corrosion resistance, high-temperature operation, and energy-efficient UV/ozone trains. Municipal and industrial users value turnkey packages with remote diagnostics, operator training, and vendor-managed inventories to sustain performance under challenging logistics.South & Central America

Budget constraints and variable source waters steer utilities toward modular, easily financed UV and on-site chemical systems that retrofit conventional plants. Emphasis is on taste-and-odor events, pathogen spikes during storms, and resilience against outages. Industrial adopters in food, beverage, and mining focus on compliance, reuse readiness, and reliable aftersales support; local service networks and parts availability are decisive.Water Disinfection Equipment Market Segmentation

By Technology Type

- Chemical Disinfection

- Physical Disinfection

- Plasma Disinfection

- Photocatalytic Disinfection (TiO₂ + UV)

- Ultrasonic Disinfection

By Application

- Municipal Water Treatment

- Industrial Applications

- Commercial & Residential

- Emergency & Mobile Systems

By System Capacity

- < 100 m³/day

- 100-1

- 000 m³/day

- >1

- 000 m³/day

By End-User Industry

- Water Utilities

- Healthcare Facilities

- Hospitality Industry

- Agriculture & Aquaculture

Key Market players

Xylem (Wedeco & Evoqua), Trojan Technologies (Veralto), Veolia Water Technologies & Solutions, SUEZ, De Nora, Kurita Water Industries, Ecolab (Nalco Water), ProMinent, Nuvonic (Halma), Atlantium Technologies, Metawater, Mitsubishi Electric, Toshiba Infrastructure Systems & Solutions, Pentair, GrundfosWater Disinfection Equipment Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Water Disinfection Equipment Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Water Disinfection Equipment market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Water Disinfection Equipment market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Water Disinfection Equipment market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Water Disinfection Equipment market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Water Disinfection Equipment market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Water Disinfection Equipment value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Water Disinfection Equipment industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Water Disinfection Equipment Market Report

- Global Water Disinfection Equipment market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Water Disinfection Equipment trade, costs, and supply chains

- Water Disinfection Equipment market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Water Disinfection Equipment market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Water Disinfection Equipment market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Water Disinfection Equipment supply chain analysis

- Water Disinfection Equipment trade analysis, Water Disinfection Equipment market price analysis, and Water Disinfection Equipment supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Water Disinfection Equipment market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Xylem (Wedeco & Evoqua)

- Trojan Technologies (Veralto)

- Veolia Water Technologies & Solutions

- SUEZ

- De Nora

- Kurita Water Industries

- Ecolab (Nalco Water)

- ProMinent

- Nuvonic (Halma)

- Atlantium Technologies

- Metawater

- Mitsubishi Electric

- Toshiba Infrastructure Systems & Solutions

- Pentair

- Grundfos

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.51 Billion |

| Forecasted Market Value ( USD | $ 15.13 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |