Chemical Management Services Market

Chemical Management Services (CMS) deliver outcome-based programs that design, source, deliver, store, monitor, use, reclaim, and dispose of chemicals for industrial clients under performance contracts. Rather than buying drums or gallons, customers procure availability, quality, compliance, and reduced total cost of ownership across the chemical lifecycle. Top applications include metalworking and surface treatment in automotive and heavy equipment; precision wet processes in electronics and semiconductors; engine and airframe fluids in aerospace; water and wastewater chemicals in utilities and mining; process aids in pulp and paper; high-purity and cleaning chemistry in healthcare and life sciences; and hygiene and sanitation chemicals in food and beverage. Current trends emphasize digitalized inventories (IoT tank telemetry, RFID/QR traceability), predictive replenishment, chemical leasing/product-as-a-service models, closed-loop recovery, solvent purification, PFAS substitution, green chemistry portfolios, and zero-liquid-discharge integration. Demand is propelled by stricter environmental and worker-safety regulation, decarbonization and water-use targets, quality and yield pressures in advanced manufacturing, and the need to stabilize supply risk and working capital. The competitive landscape spans global chemical producers offering integrated CMS, specialist service firms, and regional distributors with on-site technicians; differentiation hinges on multi-site execution, breadth of approved chemistries, digital dashboards, and verifiable ESG outcomes. Execution challenges include recipe confidentiality, multi-jurisdiction compliance, hazardous-waste liabilities, talent intensity for on-site services, and aligning incentives so vendors are paid for reduced consumption, not volume sold. Overall, CMS is shifting from tactical procurement outsourcing to strategic, cross-functional partnerships that hard-wire compliance, efficiency, and circularity into plant operations.Chemical Management Services Market Key Insights

- Outcome-based contracts realign incentives. Pay-per-output, pay-per-part, or performance KPIs (quality yield, bath life, reject rate, water and energy intensity) replace volume purchasing. This unlocks reductions in consumption without penalizing the provider. Successful programs codify baselines, M&V methods, and gain-share logic. Clear governance maps what is in scope (chemistry, tooling, waste, utilities) and how recipe or production changes alter payments. Multi-year terms stabilize investment in on-site systems.

- Digital twins of chemical lifecycle become the control layer. IoT tank sensors, inline analyzers, and lab LIMS feed dashboards that track concentration, temperature, and contaminants in real time. Rules engines trigger dosing, bath change, or reclamation cycles before quality drifts. SDS, CoA, and lot traceability tie into work orders and EHS workflows. Plants integrate this layer to MES and CMMS, enabling predictive maintenance and fewer unplanned line stops.

- Compliance complexity is a growth engine for CMS. Evolving substance restrictions, hazardous labeling rules, transport requirements, and waste codes elevate administrative burden. Providers pool regulatory expertise and standardize documentation, audits, and manifests. PFAS and solvent emissions agendas drive portfolio redesign and capture/abatement projects. Customers value one accountable party for cradle-to-grave responsibility, minimizing enforcement and reputational risk.

- Circularity and reclamation shift cost curves. Solvent distillation, membrane separations, ion exchange, and crystallization recover value from spent streams, reducing virgin purchases and waste fees. Closed-loop coolants, plating bath metal recovery, and cleaner production audits reveal fast paybacks. Providers increasingly install mobile or modular units to avoid capex friction. Material balance and mass-flow analytics become core to contract scorecards.

- Water stewardship and energy intensity move to board-level KPIs. CMS links chemical optimization with water reuse, corrosion control, and scaling management to protect heat exchangers and chillers. Optimized dosing and monitoring lower pump/equipment energy draw and extend asset life. Zero-liquid-discharge or near-zero concepts bundle chemicals, pretreatment, evaporation, and crystallization under a single performance warranty. Traceable reductions support external reporting.

- Quality and yield in advanced manufacturing raise the bar. Semiconductor wet benches, battery materials, and aerospace coatings require ultra-clean chemistries, micro-contaminant control, and rapid deviation response. CMS providers that manage purity, filtration skids, and cleanroom logistics win higher-value scope. Statistical process control married to chemistry fingerprints tightens Cpk and reduces scrap, directly tying CMS to revenue protection.

- Integrated sourcing plus VMI tame supply disruptions. Vendor-managed inventory, multi-plant pooling, and secondary formulations mitigate force-majeure and shipping volatility. Strategic buffers are sized by consumption variance and lead times rather than blanket days-on-hand. Dual-qualification for critical SKUs and multi-port routing improve resilience. Transparent allocation rules preserve uptime during scarcity, backed by real-time visibility to plant teams.

- On-site talent density differentiates execution. Resident chemists, EHS specialists, and technicians perform titrations, bath make-ups, line sanitation, and emergency response. Standard work, certification paths, and rapid-response playbooks reduce person-dependence. Safety culture, near-miss reporting, and confined-space/HAZMAT competencies are non-negotiables. Providers with strong training academies and retention programs sustain consistency across shifts.

- M&A and ecosystem partnerships expand capabilities. Chemical producers acquire service specialists; engineering firms partner for ZLD and abatement; analytics vendors plug in dashboards and AI anomaly detection. These ecosystems create “one-throat-to-choke” propositions for multi-site clients. Integration success depends on harmonized data models, unified KPIs, and contract structures that share upside while protecting IP and recipes.

- Transparent ESG claims win renewals. Third-party verification of waste diversion, emissions abatement, and safer-chemistry substitutions underpins trust. Chain-of-custody for bio-based inputs and deforestation-free claims matters in automotive and electronics value chains. Narrative evidence - before/after baselines, photos, and operator testimonials - complements quantified improvements. Plants reward providers that translate sustainability into throughput, uptime, and audit readiness.

Chemical Management Services Market Reginal Analysis

North America

Adoption is propelled by stringent EHS enforcement, decarbonization targets in automotive and aerospace, and a tight labor market that favors outsourced technicians. CMS scope typically spans metalworking fluids, pretreatment, cooling-water programs, and solvent management with robust digital dashboards. Multi-site manufacturers seek harmonized KPIs and shared service centers. Waste minimization and PFAS substitution are recurring workstreams, with strong emphasis on documentation and audit trails.Europe

Regulatory leadership and circular-economy policies drive early uptake of chemical leasing, closed-loop recovery, and safer-by-design portfolios. Plants prioritize solvent reclamation, VOC and wastewater compliance, and detailed substance tracking. Energy costs amplify the value of optimized dosing and heat-exchange protection. Cross-border operations require harmonized documentation and multilingual EHS training. Providers with strong REACH competence and transparency win competitive bids.Asia-Pacific

Scale-up in electronics, batteries, and automotive creates demand for purity control, line stability, and rapid expansion support. Governments’ sustainability programs and industrial-park infrastructure enable centralized waste and water schemes integrated with CMS. Price sensitivity favors cost-in-use guarantees and phased scopes that prove ROI quickly. Local supply networks and on-site staffing depth are critical for uptime. Education on best practices lifts adoption among fast-growing mid-caps.Middle East & Africa

Investment in refining, petrochemicals, mining, and utilities opens opportunities for water programs, corrosion control, and hazardous-waste handling. Harsh climates highlight cooling-water chemistry, scale inhibitors, and evaporation-loss management. Industrial zones and free-trade areas enable turnkey CMS with shared facilities. Workforce upskilling and safety culture building are central to performance. Long-horizon public and JV projects value single-point accountability.South & Central America

Process industries - pulp and paper, food and beverage, mining - seek CMS to stabilize quality and compliance amid logistics variability. Currency swings and import dependencies increase interest in reclamation and local formulation. Environmental licensing and water-scarcity issues elevate monitoring and reuse projects. Regional distributors partner with global providers to extend on-site coverage. Contracts that balance savings guarantees with operational continuity gain traction.Chemical Management Services Market Segmentation

By Type

- Procurement

- Delivery/Distribution

- Inventory

- Use

- Others

By Application

- Automotive

- Air Transport

- Electronics

- Heavy Equipment

- Food & Pharmaceutical

- Others

Key Market players

Incora (Haas TCM), Quaker Houghton, Henkel, PPG Industries, Chemico, EWIE Group of Companies (EGC), Chemetall (BASF Surface Treatment), Ecolab, Veolia, Clean Harbors, SGS, Intertek, Sphera, UL Solutions, Enablon (Wolters Kluwer)Chemical Management Services Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Chemical Management Services Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Chemical Management Services market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Chemical Management Services market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Chemical Management Services market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Chemical Management Services market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Chemical Management Services market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Chemical Management Services value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Chemical Management Services industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Chemical Management Services Market Report

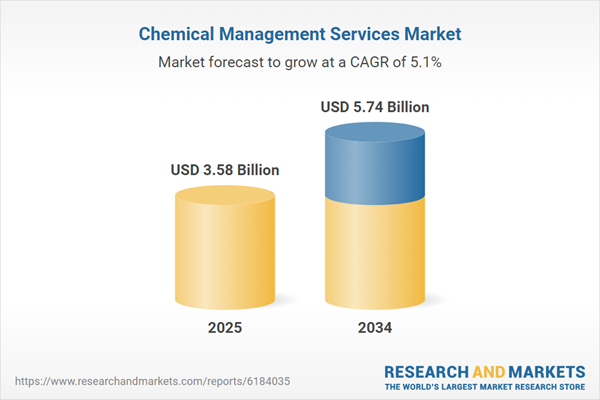

- Global Chemical Management Services market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Chemical Management Services trade, costs, and supply chains

- Chemical Management Services market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Chemical Management Services market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Chemical Management Services market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Chemical Management Services supply chain analysis

- Chemical Management Services trade analysis, Chemical Management Services market price analysis, and Chemical Management Services supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Chemical Management Services market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Incora (Haas TCM)

- Quaker Houghton

- Henkel

- PPG Industries

- Chemico

- EWIE Group of Companies (EGC)

- Chemetall (BASF Surface Treatment)

- Ecolab

- Veolia

- Clean Harbors

- SGS

- Intertek

- Sphera

- UL Solutions

- Enablon (Wolters Kluwer)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.58 Billion |

| Forecasted Market Value ( USD | $ 5.74 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |