Vegetable Puree Ingredients Market

The Vegetable Puree Ingredients Market spans processed, pulped, or blended vegetables supplied as aseptic, frozen, chilled, or ambient purées to food, beverage, and foodservice manufacturers. Top applications include baby foods and toddler snacks; soups, sauces, and meal kits; bakery and dairy analogs; beverages and smoothies; and ready-to-eat or heat-and-eat products. Latest trends revolve around clean-label and plant-forward formulation, organic and non-GMO offerings, sodium and sugar reduction via naturally sweet vegetables (e.g., carrot, pumpkin, sweet potato), color and functionality from beetroot/spinach, and packaging advances such as bag-in-box, pouches, and IBCs for operational efficiency. Driving factors include consumers’ wellness orientation, convenience demand, premiumization in infant and family nutrition, retailer private-label expansion, and manufacturers’ shift from in-house prep to outsourced, consistent purée modules. On the technology side, aseptic processing, high-pressure processing, gentle thermal treatments, and vacuum concentration are improving shelf life, flavor fidelity, and total cost of ownership, while digital traceability and farm-to-factory quality programs enhance compliance. The competitive landscape blends global ingredient houses, specialized purée processors, and regional co-manufacturers with capabilities in custom blends, allergen management, and just-in-time logistics. Differentiation centers on raw-material stewardship, varietal breadth, organic certifications, micro/chemical residue controls (critical for infant channels), and service models including contract development and dedicated crop programs. Key challenges include crop yield volatility, seasonality and storage, stringent residue limits, cold-chain economics, and formulation complexity when replacing additives with vegetable-based functionality. Overall, the category is migrating from commodity tomato and carrot bases toward tailored, multi-vegetable solutions enabling cleaner labels, sensory enhancement, and reliable scale for global brands and private labels.Vegetable Puree Ingredients Market Key Insights

- Healthcare-driven and infant-nutrition pull. Baby and toddler formats remain the most specification-intensive use case, demanding tight heavy-metal and pesticide-residue controls, validated hygiene, and traceable sourcing. Suppliers winning here pair dedicated agronomy programs with segregated lines and robust documentation. Success often cascades into family meals and snacks, where “for-all-ages” vegetable credentials strengthen brand portfolios.

- Clean-label reformulation fuels adoption. Purées displace artificial colors, flavors, and texturizers by delivering natural color, body, sweetness, and savory depth. Carrot, pumpkin, sweet potato, and beetroot enable sugar and sodium reduction while maintaining sensory acceptance. As retailers raise the bar on restricted lists, purée-based functionality helps brands hit shorter-ingredient targets without compromising shelf life.

- Shift from commodity to curated varietals. Beyond tomato and carrot, demand is broadening to spinach, butternut, red pepper, pea, beetroot, and kale, often in custom blends for signature flavor notes. Varietal selection tailored to Brix, acidity, and color uniformity reduces batch-to-batch variability. Crop contracting and regional dual-sourcing hedge weather risk and secure continuity.

- Processing technology is a key moat. Aseptic systems, HPP, and optimized thermal curves preserve fresh notes and nutrients while extending ambient stability. Inline analytics, enzymatic control, and low-oxygen handling mitigate browning and flavor drift. Plants offering both aseptic and frozen provide formulation flexibility and resilience to logistics disruptions.

- Format innovation unlocks channels. Bag-in-box and IBCs lower handling costs for industrial kitchens; pouch and cup formats open retail and foodservice. Concentrated purées reduce freight intensity and allow on-site reconstitution. Single-serve bases integrate with co-packing lines for smoothies, baby pouches, and chilled dips, speeding new product launches.

- Quality and compliance are non-negotiable. Infant and school channels require rigorous heavy-metal monitoring, microbiological controls, allergen management, and auditable farm practices. Enhanced traceability - field maps, harvest windows, and serialized batches - supports rapid recalls and retailer audits. Vendors differentiate with proactive risk mapping and transparent supplier scorecards.

- Sustainability moves from message to metric. Growers and processors are quantifying water, energy, and waste footprints; upcycling trimmings into pet food or fermentation substrates reduces waste. Localized sourcing and crop rotation programs improve soil health and shorten supply lines. Lifecycle claims increasingly appear in tenders, favoring operators with verifiable data.

- Private label raises the baseline. Retailers expand vegetable-forward private labels in baby, soups, and chilled meals, pressuring cost while demanding premium specs. Suppliers that offer turnkey development (recipe design, sensory optimization, pack engineering) become strategic partners, not just commodity providers. Long-term awards favor dual-plant redundancy and service levels.

- Beverage and snacking blur category lines. Smoothies, shots, and savory squeezes use vegetable purées for color, fiber, and nutrient density, often blended with fruit for palatability. In baked goods and dairy analogs, purées add moisture and natural sweetness, enabling “no added sugar” claims. This cross-category utility spreads volume across multiple manufacturing calendars.

- Data-enabled agriculture and planning. Weather analytics, satellite crop health, and digital procurement portals improve forecast accuracy and harvest timing. Suppliers integrate ERP/LIMS data with customers’ planning systems to smooth call-offs and minimize write-offs. Those offering VMI, safety-stock strategies, and dual-hemisphere sourcing mitigate seasonality shocks.

Vegetable Puree Ingredients Market Reginal Analysis

North America

Demand is anchored by premium baby food, chilled meals, and better-for-you snacks. Clean-label, organic, and “no added sugar” requirements are entrenched, elevating residue and heavy-metal specifications. Co-manufacturing capacity near retail DCs supports short lead times for private label and challenger brands. Sustainability scorecards and supplier diversity influence awards, while labor and freight costs favor concentrated and aseptic formats.Europe

Stringent food-safety, traceability, and sustainability frameworks shape procurement, with strong adoption in soups, sauces, refrigerated meals, and infant categories. Organic penetration is high, and retailers scrutinize farm practices and packaging recyclability. Heritage plants frequently retrofit with aseptic lines to serve ambient shelves and export hubs. Multi-language labeling and country-specific positive lists require robust regulatory support.Asia-Pacific

Rapid urbanization, rising middle-class consumption, and modern trade expansion drive growth in baby foods, beverages, and convenient meal bases. Local sourcing of carrots, pumpkin, and leafy greens coexists with imports for consistent specs. Price sensitivity encourages concentrated purées and flexible pack sizes. Foodservice chains and cloud kitchens create steady base-load demand for standardized blends.Middle East & Africa

Growth concentrates in GCC markets, supported by premium retail, QSR expansion, and infant/toddler segments. Climatic constraints and water scarcity elevate the role of imports and regional processing hubs with cold-chain strength. Compliance expectations mirror European standards for high-end channels. Value propositions emphasize shelf-stable aseptic formats and reliable year-round availability.South & Central America

Abundant agriculture underpins competitive sourcing for tomato, pumpkin, and carrot, with export opportunities into North America and Europe. Domestic demand is led by soups, sauces, and emerging baby food lines, with private label gaining traction. Currency swings and logistics variability favor localized processing and crop contracts. Sustainability narratives tied to smallholder programs and waste reduction resonate with retailers.Vegetable Puree Ingredients Market Segmentation

By Type

- Single Vegetable

- Mixed Vegetables

By Application

- Business to Business

- Business to Consumers

Key Market players

Ingredion Incorporated, Döhler GmbH, Del Monte Foods, SVZ Industrial Fruit & Vegetable Ingredients, Kiril Mischeff Ltd., Nikken Foods Co. Ltd., Kagome Co. Ltd., Astral Foods Ltd., Sun Impex International, Conagra Brands Inc., Nestlé S.A., General Mills Inc., McCain Foods Ltd., BRF S.A., Baby Gourmet Foods Inc.Vegetable Puree Ingredients Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Vegetable Puree Ingredients Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Vegetable Puree Ingredients market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Vegetable Puree Ingredients market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Vegetable Puree Ingredients market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Vegetable Puree Ingredients market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Vegetable Puree Ingredients market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Vegetable Puree Ingredients value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Vegetable Puree Ingredients industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Vegetable Puree Ingredients Market Report

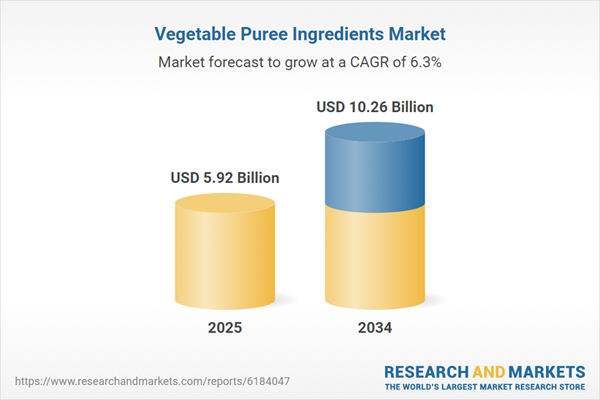

- Global Vegetable Puree Ingredients market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Vegetable Puree Ingredients trade, costs, and supply chains

- Vegetable Puree Ingredients market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Vegetable Puree Ingredients market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Vegetable Puree Ingredients market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Vegetable Puree Ingredients supply chain analysis

- Vegetable Puree Ingredients trade analysis, Vegetable Puree Ingredients market price analysis, and Vegetable Puree Ingredients supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Vegetable Puree Ingredients market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ingredion Incorporated

- Döhler GmbH

- Del Monte Foods

- SVZ Industrial Fruit & Vegetable Ingredients

- Kiril Mischeff Ltd.

- Nikken Foods Co. Ltd.

- Kagome Co. Ltd.

- Astral Foods Ltd.

- Sun Impex International

- Conagra Brands Inc.

- Nestlé S.A.

- General Mills Inc.

- McCain Foods Ltd.

- BRF S.A.

- Baby Gourmet Foods Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.92 Billion |

| Forecasted Market Value ( USD | $ 10.26 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |