Ceramic Foundry Sand Market

Ceramic foundry sand (CFS) - engineered, typically bauxite-based spherical media - has become a premium alternative to silica and chromite in molding and core-making because of its high refractoriness, low thermal expansion, consistent sphericity, and excellent reclaimability. Its primary end-uses span automotive and transportation (engine blocks, cylinder heads, transmission cases, brake and chassis parts), general engineering (valves, pumps, housings), energy and heavy equipment (turbine and compressor components), and investment casting for aerospace/medical where surface finish and dimensional stability are critical. Adoption is reinforced by tighter worker-safety and environmental requirements, foundry decarbonization programs, and total-cost reduction targets (lower binder demand, less veining/penetration, reduced scrap, longer tooling life). On the process side, CFS integrates with cold-box, no-bake/furan, shell, and alkaline-phenolic systems, and is increasingly specified for binder-jet additive manufacturing as well as resin-coated applications. Supply is concentrated among integrated producers and regional coaters/distributors, with strategies tilting toward PSD customization, hybrid blends with silica/olivine to balance cost/performance, and service bundles that include reclamation design and core-room optimization. Short-term dynamics are shaped by energy and freight volatility (affecting fused production costs and landed prices), while medium-term growth is tied to lightweighting in mobility, precision casting content in electrified powertrains, and OEM qualification cycles that lock in specifications. Overall, CFS is positioned as a performance material that enables casting quality, yield, and sustainability outcomes rather than a like-for-like commodity swap, making vendor technical support and application engineering decisive in competitive wins.Ceramic Foundry Sand Market Key Insights

- Silica substitution accelerates on compliance and risk management. Worker-safety regulations and litigation risks keep pushing foundries to reduce respirable crystalline silica exposure. CFS helps lower that risk profile while improving cast quality, making the business case compelling beyond raw material price comparisons.

- Performance economics win budgets in core-rooms. Lower thermal expansion and high roundness reduce veining, fins, and penetration - cutting rework and scrap. Lower binder demand and easier knockout/reclamation improve throughput, so procurement decisions increasingly hinge on total casting cost per good part.

- Automotive lightweighting reshapes sand specs. Thin-walled aluminum castings for e-mobility and efficiency require tight dimensional control and superior surface finish. CFS’s stability under thermal cycling supports these designs, helping foundries meet OEM cosmetic and NDT thresholds.

- Investment casting and aerospace raise the bar. Precision components and superalloy applications value CFS for surface finish and shell integrity. Vendor ability to document heat histories, PSD control, and cleanliness is becoming a qualifier for long-cycle aerospace programs.

- Additive manufacturing expands addressable use-cases. Binder-jet and related AM processes benefit from CFS’s flowability and packing density. Material vendors are developing AM-grade PSDs and certification data to move from prototyping into serial production cells.

- Sustainability and circularity drive adoption. Lower binder usage, reduced scrap, and multi-cycle reclamation align with foundry decarbonization roadmaps. Turnkey help on thermal/mechanical reclamation configuration is now a differentiator in bids.

- Supply chain resilience matters. Energy-intensive fusion steps and bauxite availability can swing costs. Buyers diversify suppliers, hedge freight, and qualify dual sources; local resin-coating/tolling mitigates logistics risk and shortens lead times.

- Product innovation focuses on fit-for-purpose grades. Tailored PSDs, hybrid blends, and specialty coatings target specific processes (cold-box vs. no-bake vs. shell) and alloy families (Al, Mg, iron/steel). Technical data packs and on-site trials speed specification.

- Spec-in cycles remain long but sticky. OEM and Tier-1 approvals take time, including shop trials and PPAP-like documentation. Once specified, CFS tends to remain in BOMs across model refreshes, supporting stable, service-led vendor relationships.

- Service ecosystem is a competitive moat. Vendors winning share combine material with process diagnostics - gas evolution, binder compatibility, venting, and reclamation audits - plus operator training and QC protocols to lock in performance gains.

Ceramic Foundry Sand Market Reginal Analysis

North America

Adoption is propelled by stringent worker-safety standards and the push to reduce scrap and rework costs in competitive automotive and off-highway programs. Foundries favor CFS for thin-wall aluminum castings, brake and drivetrain parts, and premium iron castings where surface finish is a KPI. Supply programs emphasize dual-sourcing and regional resin-coating to manage freight and lead times, while reclamation projects are tied to decarbonization and landfill-avoidance goals. Technical partnerships with binder suppliers and AM system OEMs support specification in new product launches across the U.S., Canada, and Mexico.Europe

Environmental policies, energy price sensitivity, and OEM quality protocols make CFS attractive for dimensional stability and lower binder consumption. Precision casting for aerospace, industrial machinery, and e-mobility components relies on consistent PSD and cleanliness, with audits and documentation central to approvals. Imports remain important, so suppliers focus on logistics reliability and local stockholding. Circularity and waste-reduction targets are catalyzing investments in thermal reclamation, while hybrid blends help balance performance with cost in cost-pressured foundries across DACH, Italy, France, Spain, and the Nordics.Asia-Pacific

APAC anchors both supply and demand, with large integrated producers and a dense base of automotive, general engineering, and investment casting foundries. China and Japan lead in specification depth, while India and Southeast Asia are scaling adoption in export-oriented casting clusters. Vendors compete on technical service, AM-grade materials, and tailored PSDs for cold-box/no-bake lines. Domestic policy support for cleaner manufacturing and export competitiveness encourages CFS use, and local resin-coating capacity helps stabilize pricing despite energy and freight variability.Middle East & Africa

A growing footprint of industrial projects and localized manufacturing - particularly in GCC countries - supports gradual CFS penetration in aluminum and iron casting applications. Buyers prioritize consistent quality, technical training, and reclamation guidance to build capabilities. Import reliance shapes procurement, so dependable delivery schedules and buffer inventories are valued. In Africa, established foundry bases focus on equipment, mining, and infrastructure castings, where CFS pilots demonstrate yield and finish improvements that justify premium material choices.South & Central America

Brazil anchors regional foundry activity, supplying automotive, agricultural machinery, and energy sectors. CFS adoption is linked to quality upgrades, rework reduction, and export certification requirements. Currency volatility and freight costs favor local coating/tolling and inventory strategies. Technical collaborations around binder optimization and reclamation help justify life-cycle economics, while OEM and Tier-1 programs increasingly specify higher-performance sands to meet surface finish and dimensional stability targets across the broader Southern Cone and Andean markets.Ceramic Foundry Sand Market Segmentation

By Application

- Resin Coated Sand

- Cold Box Casting

- Low Foam Casting

- Facing Sand

- Others

Key Market players

ITOCHU Ceratech (Cerabeads), Shengquan Group, Henan Sicheng, Zhengzhou Haixu Abrasives, Sibelco, Imerys, Saint-Gobain Abrasives, HA International, CARBO Ceramics, Washington Mills, Henan Kailin Foundry Material, Changxing Refractory, Jinan Junda Industrial, Luoyang Ruiyu, Sinabuddy MineralCeramic Foundry Sand Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Ceramic Foundry Sand Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Ceramic Foundry Sand market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Ceramic Foundry Sand market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Ceramic Foundry Sand market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Ceramic Foundry Sand market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Ceramic Foundry Sand market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Ceramic Foundry Sand value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Ceramic Foundry Sand industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Ceramic Foundry Sand Market Report

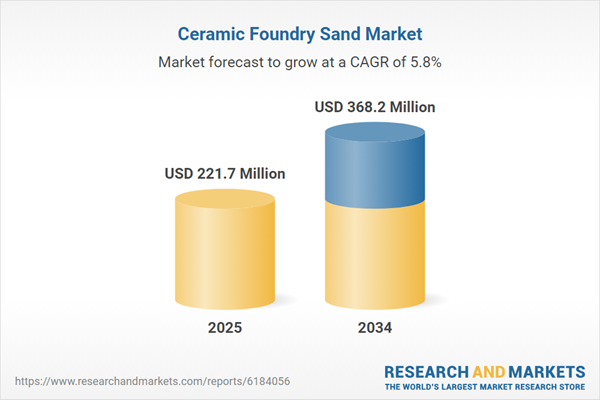

- Global Ceramic Foundry Sand market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Ceramic Foundry Sand trade, costs, and supply chains

- Ceramic Foundry Sand market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Ceramic Foundry Sand market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Ceramic Foundry Sand market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Ceramic Foundry Sand supply chain analysis

- Ceramic Foundry Sand trade analysis, Ceramic Foundry Sand market price analysis, and Ceramic Foundry Sand supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Ceramic Foundry Sand market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ITOCHU Ceratech (Cerabeads)

- Shengquan Group

- Henan Sicheng

- Zhengzhou Haixu Abrasives

- Sibelco

- Imerys

- Saint-Gobain Abrasives

- HA International

- CARBO Ceramics

- Washington Mills

- Henan Kailin Foundry Material

- Changxing Refractory

- Jinan Junda Industrial

- Luoyang Ruiyu

- Sinabuddy Mineral

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 221.7 Million |

| Forecasted Market Value ( USD | $ 368.2 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |