Pecans Ingredient Market

The Pecans Ingredient Market is transitioning from a seasonal, bakery-centric nut into a versatile, premium ingredient platform spanning bakery, confectionery, dairy and frozen desserts, cereal and snacks, nut butters and spreads, culinary sauces, and foodservice desserts. Applications are widening: pecan halves and pieces for bakery inclusions and toppings; praline, candied, roasted, chocolate-enrobed and smoke-seasoned formats for confectionery and snacking; pecan meal and flour for gluten-free formulations; cold-pressed pecan oil for dressings and gourmet cooking; and defatted pecan powder for protein-forward and low-fat developments. Trends center on clean-label, premiumization, origin storytelling, and sustainability (regenerative and water stewardship), plus allergen-savvy manufacturing and pathogen-reduction steps. Growth is fueled by the shift to permissible indulgence, plant-forward fats with favorable sensory profiles, and retailer private brands elevating nut ingredient quality. Competitive dynamics feature integrated growers-handlers, specialty processors with advanced sorting/pasteurization, and brand-forward candied/praline specialists. Supply fundamentals remain sensitive to weather, alternate-bearing cycles, and pollination, with origin diversification (U.S., Mexico, South Africa, Australia, China) used to stabilize programs. Technology investments - optical sorting, steam/vapor pasteurization, nitrogen-flush packaging, and oil cold-pressing - are raising consistency and shelf life. B2B buyers prioritize food-safety culture, third-party certifications, and transparent traceability back to orchards. Channel strategies blend industrial contracts, foodservice networks, specialty retail, and fast-growing e-commerce for gourmet formats. Overall, the category’s “culinary luxury meets everyday snacking” positioning underpins a resilient premium tier while enabling value architecture across grades and sizes.Pecans Ingredient Market Key Insights

- From seasonal pie to year-round platform. Demand is broadening from holiday pies to everyday bakery inclusions, bars, granola, and ice-cream add-ins, with candied/praline pecans crossing into snack and salad toppers. Foodservice chefs embrace pecans for Southern-style signatures and modern fusion; CPGs leverage them for premium cues in limited editions. This normalization of usage frequency reduces category seasonality and smooths production schedules, improving plant utilization and retailer on-shelf continuity through the calendar.

- Format proliferation unlocks margin tiers. Beyond halves and pieces, processors monetize meal, flour, butter, brittle, praline fragments, and oil, creating yield streams from each kernel grade. Value-added coatings (maple, chili, espresso), chocolate enrobing, and cluster formats capture gifting and premium snack sets. Defatted flour enables lower-fat baking systems, while pecan oil positions as a culinary alternative with a distinctive sensory profile. These SKUs expand price ladders and defend against raw commodity volatility with brandable innovation.

- Ingredient performance is a decisive spec. R&D teams specify pecan size distribution, roast color, water activity, and inclusion stability to control texture and bloom in bakery and confectionery matrices. Optical sorting, gentle pasteurization, and anti-oxidation packaging reduce rancidity risks in high-oil nuts. Consistency in piece integrity reduces fines and production waste, while pre-diced, pre-roasted options shorten line times. Suppliers who provide application testing and co-development labs win deeper, multi-year contracts.

- Clean-label and provenance storytelling drive trade-up. Shoppers respond to short-ingredient lists and recognizable kitchen processes (roasted, praline). Orchard-level narratives - terroir, varietal (e.g., Desirable, Stuart), and stewardship practices - differentiate on shelf. Certifications around non-GMO-leaning inputs, pesticide management, and worker welfare strengthen premium brands. QR-enabled traceability and pack-level batch transparency enhance trust, especially in specialty retail and e-commerce discovery channels.

- Sourcing resilience is mission-critical. Weather, water availability, and alternate-bearing cycles in key belts influence kernel yields and grade mix. Balanced procurement across U.S. Southeast/Southwest, Mexico, South Africa, Australia, and emerging Asian origins mitigates shocks. Handlers increasingly use forward contracts, quality buffers, and flexible specs to assure year-round programs. B2B buyers reward suppliers that can reallocate origins without sensory drift, protecting brand recipes and label claims.

- Food safety and allergen governance underpin scale. Buyers expect robust allergen segregation, validated lethality steps, environmental monitoring, and third-party certifications. Steam/vapor pasteurization and tight control of moisture and temperature curb microbial risks while preserving texture. Metal detection/X-ray and kernel integrity audits reduce foreign-material incidents. A documented quality culture and rapid trace-back/trace-forward capabilities are now table stakes for national listings and QSR deployments.

- Sustainability moves from marketing to procurement criteria. Water metrics, pollinator-friendly practices, orchard soil health, and shell by-product valorization (smoking chips, filtration media) influence RFP scoring. Regenerative programs and life-cycle insights support retailer ESG goals and foodservice bids. Packaging moves toward recyclable tins, paper pouches with barriers, and nitrogen-flush formats to reduce waste. Suppliers who quantify impact and co-brand retailer sustainability stories gain end-cap visibility and menu callouts.

- Private label premiumization reshapes shelves. Retailers extend premium store brands into candied, praline, and baking mixes with pecan inclusions, demanding national-brand quality at sharper price points. This lifts baseline volume and brings predictable planning but raises cost-to-serve due to specification rigidity and audit cadence. Co-manufacturers with dual capabilities (raw and value-added) secure multi-banner footprints and leverage shared ingredients across clusters and salad topper programs.

- Culinary crossovers expand usage occasions. Pecan butter and praline crumbles migrate into breakfast bowls, cafés’ bakery cases, and dessert toppings. Pecan oil appears on premium salad dressing labels and chef-driven menus. Savory rubs and crusts (herb-pecan, spice-pecan) give meat and plant-protein formats a signature crunch, supporting foodservice LTOs. These crossovers create incremental demand pockets beyond traditional baking, smoothing weekly order volatility and driving higher margin per pound.

- Digital discovery accelerates premium snacks and gifts. Social commerce and marketplaces spotlight artisanal candied pecans, regional pralines, and seasonal assortments. Subscription snack boxes, corporate gifting, and holidays extend reach for smaller brands. Story-rich content (orchard footage, glazing methods) encourages trial, while DTC data informs retail line expansions. Cold-chain isn’t mandatory, but heat-resilient packaging and rapid fulfillment protect quality in warm months and long-haul shipments.

Pecans Ingredient Market Reginal Analysis

North America

The region anchors production and processing scale, with integrated grower-handlers supplying industrial, retail, and foodservice channels. Bakery, ice-cream, and confectionery remain core, while salad toppers, snack clusters, and pecan butter accelerate in natural and conventional grocery. Retailers push premium private label and seasonal limited editions, and QSRs use pecan inclusions for dessert LTOs. Buyers emphasize food safety credentials, year-round programs, and ESG documentation tied to water stewardship and pollinator health.Europe

Demand is concentrated in premium bakery, chocolate, and gourmet snacking, with high expectations on provenance, certifications, and clean-label glazing systems. Northern and Western markets favor responsibly sourced narratives and recyclable packaging, while specialty retailers curate candied/praline SKUs and salad topper blends. Industrial buyers require tight specs on size, roast color, and oxidation control. Competition from other tree nuts is strong; pecans win listings via differentiated flavor, texture, and compelling origin stories.Asia-Pacific

APAC combines producing and consuming markets: Australia contributes origin diversification, while China drives premium gifting, bakery chain inclusions, and e-commerce discovery. Japan and Korea value high-grade halves for confectionery and pâtisserie, demanding meticulous sorting and packaging. Southeast Asia’s café culture and modern trade expand candied and chocolate-coated formats. Authenticity, freshness assurance, and tamper-evident packs are crucial, with digital channels amplifying seasonal and gifting spikes.Middle East & Africa

GCC hospitality, airline catering, and premium retail fuel demand for praline, chocolate-coated, and mixed-nut assortments, complemented by salad toppers in modern trade. Import-reliant buyers require steady programs, heat-resilient packaging, and clear shelf-life guarantees. Foodservice seeks consistent piece sizes for plated desserts and buffets. Sustainability claims and gift-worthy presentation influence premium price realization, while distributors with cold-season logistics experience gain an execution edge.South & Central America

Mexico plays a dual role as a key origin and growing consumer market, supporting industrial bakery and confectionery needs regionally. Retailers introduce candied and snack cluster formats, while local pâtisserie traditions use pecan toppings and fillings. Economic variability makes price-pack architecture important; processors balance value pieces and premium halves to sustain throughput. Buyers favor suppliers offering reliable grading, responsive lead-times, and co-development support for regional flavor profiles.Pecans Ingredient Market Segmentation

By Type

- Powered

- Pieces

- Others

By Application

- Recipe Pecan

- Directly Eat

- Confectionery & Bakery

- Others

Key Market players

John B. Sanfilippo & Son, ADM, Navarro Pecan Company, Green Valley Pecan Company, National Pecan Company, South Georgia Pecan Company, San Saba Pecan Company, Lamar Pecan Company, Hudson Pecan Company, Oliver Pecan Company, Whaley Pecan Company, La Nogalera Group, Sun City Nut Company, Chase Pecan, Millican Pecan CompanyPecans Ingredient Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Pecans Ingredient Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Pecans Ingredient market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Pecans Ingredient market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Pecans Ingredient market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Pecans Ingredient market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Pecans Ingredient market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Pecans Ingredient value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Pecans Ingredient industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Pecans Ingredient Market Report

- Global Pecans Ingredient market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Pecans Ingredient trade, costs, and supply chains

- Pecans Ingredient market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Pecans Ingredient market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Pecans Ingredient market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Pecans Ingredient supply chain analysis

- Pecans Ingredient trade analysis, Pecans Ingredient market price analysis, and Pecans Ingredient supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Pecans Ingredient market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- John B. Sanfilippo & Son

- ADM

- Navarro Pecan Company

- Green Valley Pecan Company

- National Pecan Company

- South Georgia Pecan Company

- San Saba Pecan Company

- Lamar Pecan Company

- Hudson Pecan Company

- Oliver Pecan Company

- Whaley Pecan Company

- La Nogalera Group

- Sun City Nut Company

- Chase Pecan

- Millican Pecan Company

Table Information

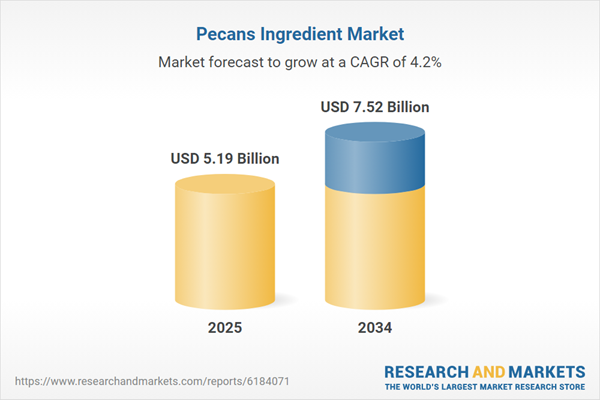

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.19 Billion |

| Forecasted Market Value ( USD | $ 7.52 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |