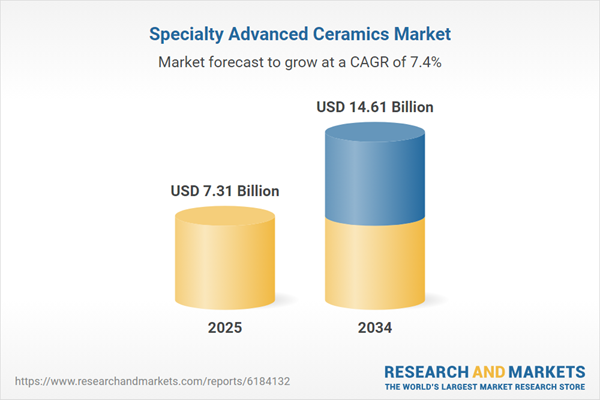

Specialty Advanced Ceramics Market

The Specialty Advanced Ceramics market encompasses high-performance materials such as alumina, zirconia, silicon carbide, silicon nitride, piezoelectrics, ferrites, transparent ceramics, and ceramic matrix composites (CMCs). These materials enable precision, reliability, and durability in harsh environments where metals and polymers underperform. Top applications span semiconductor manufacturing (wafer handling, CMP, lithography components), electrification and e-mobility (inverters, substrates, seals), aerospace and defense (UHTC protection, radomes, CMC hot-section parts), medical (bioceramic implants, dental restorations), industrial wear parts, chemical processing, energy and hydrogen (SOFC/SOEC, membranes), optics, and 5G/RF modules. Key trends include the shift to fine-grain, high-purity powders; adoption of CMCs for weight and temperature advantages; transparent armor and optical ceramics; and rapid advances in near-net-shape forming (gelcasting, binder-jet and stereolithography AM, tape casting) paired with HIP and spark plasma sintering for densification. Drivers are rooted in miniaturization, thermal management, corrosion/erosion resistance, higher operating temperatures, and lifetime-cost reduction under demanding duty cycles. The competitive landscape blends integrated powder-to-part manufacturers, precision ceramic machinists, semiconductor-grade component suppliers, and medical/aero specialists, with differentiation around powder control, microstructure engineering, flaw population reduction, and metrology. Partnerships across OEMs, material formulators, and equipment providers accelerate qualification cycles, while digital twins and process analytics compress iteration times. Headwinds include brittle-fracture risk management, machining cost, powder and precursor availability, and qualification timelines in regulated sectors. Overall, suppliers that combine materials science depth, scalable high-purity processing, advanced metrology, and application-specific design support are positioned to capture growing demand across electronics, mobility, energy, and healthcare.Specialty Advanced Ceramics Market Key Insights

- Semiconductor criticality: Ultra-clean, plasma-resistant ceramics for wafer transport, vacuum hardware, and CMP components are a core growth engine. Surface integrity, particle control, and trace metal purity dominate specifications and supplier selection.

- Electrification & thermal management: High-thermal-conductivity substrates and housings enable compact, efficient power electronics. Ceramic feedthroughs, seals, and bearings meet dielectric strength and corrosion demands in EV and grid hardware.

- CMCs shift high-temp limits: Oxide and non-oxide CMCs reduce weight and extend temperature ceilings in aero and industrial turbines. Design for repairability and oxidation protection coatings are decisive for lifecycle economics.

- Zirconia and bioceramics in care: Stabilized zirconia and alumina-zirconia composites deliver toughness for dental and orthopedic implants, while bioinertness and wear performance underpin longevity and regulatory acceptance.

- Transparent and armor ceramics: Spinel, ALON, and sapphire address lightweight protection and optical windows. Processing routes focus on defect control, transparency retention after shaping, and scalable finishing.

- Manufacturing innovation: Additive manufacturing shortens lead times and unlocks complex channels and lattices; SPS/HIP close pores while preserving microstructure. Statistical process control and in-line NDE reduce scrap and variability.

- Powder engineering as a moat: Tight PSD, morphology, and impurity control translate to predictable sintering and properties. Strategic powder partnerships and in-house synthesis de-risk supply and enable bespoke grades.

- Design-for-ceramics (DfX): Early co-engineering around fillets, wall thickness, and tolerance stacks cuts machining burden and flaw sensitivity. Finite-element modeling of thermal shock and contact stresses speeds qualification.

- Sustainability & circularity: Energy-efficient kilns, recycled green scrap, and powder reclaim lower embodied energy. Longer service life and lower maintenance position ceramics favorably in Scope-3 narratives.

- Qualification & reliability: Proof testing, Weibull analysis, and nondestructive evaluation underpin confidence for mission-critical uses. Digital traceability links powder lot, process window, and in-service performance.

Specialty Advanced Ceramics Market Reginal Analysis

North America

Demand is anchored by semiconductor fabs, aerospace/defense programs, and medical device innovators. Buyers emphasize domestic powder security, contamination control, and rapid prototyping capacity. Qualification rigor, ITAR/EAR compliance, and robust after-sales metrology support are central to awards. CMC and transparent ceramic programs benefit from public-private R&D and localized finishing capabilities.Europe

A strong aerospace, medical, and industrial base prioritizes quality systems, sustainability metrics, and recyclability. OEMs seek partners with advanced forming, HIP, and precision grinding competence, plus documented statistical capability. Energy-transition projects (hydrogen, SOFC/SOEC) and rail/automotive electrification create pull for high-purity substrates and seals. Regulatory and export controls favor established, audit-ready suppliers.Asia-Pacific

APAC leads volume growth with expansive semiconductor, consumer electronics, and EV supply chains. Localized powder production, competitive machining clusters, and fast scale-up underpin cost and lead-time advantages. Japan and Korea drive high-spec materials and metrology; China accelerates vertical integration; India expands medical, electronics, and energy applications with rising quality benchmarks.Middle East & Africa

Emerging opportunities track industrial diversification, advanced manufacturing zones, and defense programs. Projects emphasize technology transfer, local finishing, and training. Harsh-environment energy assets (desalination, petrochem) pull corrosion-resistant ceramics, while selective aerospace and protection programs explore transparent armor and CMCs with global partners.South & Central America

Growth is steady in mining, pulp and paper, and chemical processing where wear and corrosion resistance deliver clear TCO gains. Medical and dental ceramics adoption increases alongside private healthcare investment. Supply strategies favor regional distributors with application engineering, reliable logistics, and serviceable lead times for specialty parts and consumables.Specialty Advanced Ceramics Market Segmentation

By Material

- Alumina Ceramics

- Titanate Ceramics

- Zirconia Ceramics

- Silicon Carbide

- Others

By Type

- Composite Structure Ceramics

- Electrical and Electronic Functional Ceramics

By Application

- Medical

- Aerospace

- Defence

- Security

- Semiconductor

- Energy & Power

- Optics & Industrial Manufacturing

- Others

Key Market players

Kyocera Corporation, CoorsTek, Morgan Advanced Materials, CeramTec, Saint-Gobain, 3M, NGK Spark Plug, Murata Manufacturing, Corning Inc., Rauschert, Advanced Ceramic Materials, McDanel Advanced Ceramic Technologies, Elan Technology, Blasch Precision Ceramics, AmedicaSpecialty Advanced Ceramics Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Specialty Advanced Ceramics Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Specialty Advanced Ceramics market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Specialty Advanced Ceramics market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Specialty Advanced Ceramics market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Specialty Advanced Ceramics market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Specialty Advanced Ceramics market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Specialty Advanced Ceramics value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Specialty Advanced Ceramics industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Specialty Advanced Ceramics Market Report

- Global Specialty Advanced Ceramics market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Specialty Advanced Ceramics trade, costs, and supply chains

- Specialty Advanced Ceramics market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Specialty Advanced Ceramics market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Specialty Advanced Ceramics market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Specialty Advanced Ceramics supply chain analysis

- Specialty Advanced Ceramics trade analysis, Specialty Advanced Ceramics market price analysis, and Specialty Advanced Ceramics supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Specialty Advanced Ceramics market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Kyocera Corporation

- CoorsTek

- Morgan Advanced Materials

- CeramTec

- Saint-Gobain

- 3M

- NGK Spark Plug

- Murata Manufacturing

- Corning Inc.

- Rauschert

- Advanced Ceramic Materials

- McDanel Advanced Ceramic Technologies

- Elan Technology

- Blasch Precision Ceramics

- Amedica

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 7.31 Billion |

| Forecasted Market Value ( USD | $ 14.61 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |