Concrete Market

Concrete remains the backbone material of global construction, spanning residential, commercial, industrial, and infrastructure projects with diverse formats such as ready-mix, precast, cast-in-place, shotcrete, and emerging 3D-printed solutions. Top end-uses include transportation (roads, bridges, rail, ports), urban real estate and mixed-use complexes, energy and utilities (power, grids, water), industrial/logistics, and social infrastructure (healthcare, education). The latest trends center on decarbonization via supplementary cementitious materials, clinker substitution, calcined clays, carbon capture and utilization, performance-based specifications, and Environmental Product Declarations becoming standard in bids. Digitalization - mix optimization with AI, BIM/digital twins, IoT-enabled batching, e-ticketing, and fleet telematics - improves quality and traceability. Demand is driven by urbanization, resilience retrofits, public-investment programs, industrial re-shoring, and long-life/low-maintenance design preferences. Competitive dynamics span vertically integrated cement-to-ready-mix majors, regional aggregates and precast specialists, admixture and fibers innovators, equipment OEMs, and tech startups enabling low-carbon mixes, recycling, and 3D printing. Procurement increasingly rewards verified low-CO₂ concrete, durability, and speed-to-schedule advantages (precast, modular, slipform). Constraints include energy and fuel volatility, SCM supply shifts (fly ash scarcity), water stress, permitting timelines for quarries, and stricter construction safety and labor availability. Strategic success levers are portfolio breadth across performance tiers, secure SCM and calcined clay supply, robust QA/QC and logistics, credible ESG reporting, and partnerships with designers and contractors to move from prescriptive to performance specs while meeting cost and schedule.Concrete Market Key Insights

- Decarbonization is the primary redesign brief. Producers are scaling clinker reduction, LC³ blends, finely tuned SCM cocktails, and on-site curing enhancements to meet tightening procurement rules. Carbon capture pilots around kilns feed into mineralization and CO₂-cured precast. Low-carbon SKUs win institutional tenders when backed by transparent EPDs. Success depends on consistent performance under local aggregates and climate. Early engagement with specifiers converts pilot approvals into base-spec wins.

- SCM availability reshapes regional mix design. Declining Class F fly ash supplies push substitution toward slag, natural pozzolans, ground limestone, and calcined clays. Blended cement standards and performance specs unlock flexibility. Robust supply agreements with steel mills and clay processors mitigate volatility. Producers invest in beneficiation of marginal ashes and pozzolans. Mix optimization software balances strength gain, heat of hydration, and setting times to keep schedules on track.

- Precast and modular accelerate schedules and quality. Offsite production delivers dimensional accuracy, repeatability, safer working conditions, and faster installation for data centers, warehousing, and social infrastructure. Carbon benefits arise from optimized curing, mix control, and reduced waste. Design-for-manufacture-and-assembly aligns with labor constraints and tighter urban sites. Integration with BIM streamlines connections and logistics. Precasters with turnkey design-install capabilities capture higher margins.

- Admixtures and fibers move from add-ons to core design levers. High-range water reducers, shrinkage reducers, and hydration stabilizers tailor workability and placement windows. Macro/micro synthetic fibers reduce rebar in slabs-on-grade and industrial floors, enhancing crack control and durability. Corrosion-inhibiting systems extend life in marine/transport structures. Rheology modifiers enable slipform and 3D printing. Vendors that co-develop specs with contractors gain pull-through.

- 3D printing and automation carve high-value niches. Layered extrusion is proving viable for low-rise housing, site amenities, and complex formwork, compressing cycles and waste. Robotic rebar tying, autonomous batching, and telematics-optimized delivery reduce labor exposure and variability. Early adopters partner with municipalities and developers to navigate approvals. Materials tuned for printability, build rate, and interlayer bonding differentiate. Proof-of-performance case libraries are critical to scale.

- Durability and resilience shift lifecycle economics. Owners prioritize freeze-thaw resistance, sulfate/ASR mitigation, and chloride ingress control as climate extremes intensify. Ultra-high-performance and fiber-reinforced concretes enable slender, long-span elements and demanding bridge rehab. Pervious and reflective mixes support urban heat mitigation and stormwater mandates. Lifecycle costing models and warranties win public procurements. Preventive maintenance analytics extend asset life.

- Digital integration raises consistency and traceability. Smart batching with automatic moisture compensation, real-time slump/temperature sensors, and e-ticketing reduce disputes and rework. BIM-linked mix libraries standardize submittals and approvals. Predictive dispatch and geofencing improve on-time delivery and CO₂ per cubic meter. Data-backed QA shortens RFI cycles. Producers that share dashboards with contractors and owners deepen preferred-supplier status.

- Regulation and green procurement reframe competition. Public projects increasingly set embodied carbon thresholds and bonus credits for verified low-CO₂ mixes. Extended producer responsibility and waste rules propel recycled aggregates and cementitious fines. Performance specs open the door for innovation while maintaining safety. Compliance-ready documentation and third-party verification become table stakes. Early alignment with codes/certifiers avoids redesigns.

- Aggregates and logistics are margin determinants. Quarry proximity, rail/barge access, and urban plant footprints dictate delivered cost and service reliability. Investments in on-site crushing, wash plants, and reclaimed water systems mitigate resource constraints. Fleet right-sizing and alternative fuels manage fuel risk. Urban emission zones and noise limits require equipment upgrades. Strategic M&A secures reserves near growth corridors.

- Value migration toward services and partnerships. Advisory on low-carbon design, constructability reviews, and preconstruction mix trials create stickiness beyond price. Turnkey offerings - concrete + precast + post-tension + finishing - simplify interfaces for EPCs. Long-term framework agreements stabilize volumes across cycles. Collaboration with insurers and financiers on resilience metrics accelerates approvals. Brand equity grows with transparent ESG narratives and community engagement.

Concrete Market Reginal Analysis

North America

Infrastructure renewal, semiconductor and EV supply-chain investments, and logistics/warehouse expansion underpin steady demand across ready-mix and precast. State and federal procurement increasingly reward low-embodied-carbon submittals with EPDs, pushing SCM optimization and limestone/calcined clay cements. Labor constraints and urban worksite restrictions elevate precast, slipform paving, and pump-optimized mixes. Competition is shaped by vertically integrated majors and strong regional players with advantaged quarries. Wildfire, freeze-thaw, and coastal exposure prioritize durability and specification support.Europe

Decarbonization leadership drives rapid adoption of blended cements, performance-based standards, and carbon disclosure in tenders. Energy costs and carbon pricing sharpen focus on kiln efficiency, alternative fuels, and CCUS pilots. Mature precast markets benefit from modular public buildings and rail programs, while urban densification favors high-performance and self-compacting concretes. Aggregates permitting is tight, elevating recycled content and circularity hubs. Discounter-style procurement in some markets sustains price pressure, rewarding producers with differentiated low-CO₂ portfolios and strong documentation.Asia-Pacific

Mega-urbanization, transit corridors, and industrial parks sustain large volumes, with growing segmentation between value mixes and premium durability solutions for coastal and seismic zones. Governments tighten quality and green-building requirements, encouraging limestone calcined clay cements and performance specs. Precast adoption rises in high-density markets to address labor and site constraints. Quick-setting and pumpable mixes support high-rise cycles, while data centers and renewable energy assets pull UHPC and grouted solutions. Local SCM balance drives significant country-to-country variability.Middle East & Africa

Strategic infrastructure, tourism, and utilities projects lead demand, with harsh climates elevating sulfate resistance, temperature control, and curing strategies. Desalination and energy costs influence cement economics, spurring alternative fuels and optimized grinding. Gulf markets advance precast and modular for speed and repeatability, while parts of Africa focus on essential road and social infrastructure with durable, cost-optimized mixes. Water stewardship and dust/noise controls are increasingly visible in permitting. Logistics resilience and quarry proximity remain decisive.South & Central America

Public works, mining-related infrastructure, and selective urban redevelopment drive demand amid macro volatility. Currency and energy fluctuations emphasize local sourcing and flexible mix design. Blended cements with pozzolans and slag support cost and carbon goals, while precast grows in social housing and schools. Traditional trade channels coexist with professionalized ready-mix networks in major metros. Resilience upgrades for seismic, flood, and coastal exposure inform specification choices, rewarding producers offering lifecycle cost analyses and technical service.Concrete Market Segmentation

By Type

- Ready-mix Concrete

- Precast Products

- Precast Elements

By Application

- Reinforced Concrete

- Non-reinforced Concrete

By End-Use

- Roads and Highways

- Tunnels

- Residential Buildings

- Non-Residential Buildings

- Dams & Power Plants

- Mining

- Others

Key Market players

LafargeHolcim (Holcim Group), HeidelbergCement, Cemex, CRH, China National Petroleum Corporation (CNPC), China National Chemical Corporation (ChemChina), Buzzi Unicem, UltraTech Cement, Dangote Cement, Mitsubishi Materials Corporation, Siam Cement Group (SCG), ACC Limited, J.K. Cement, Asia Cement, Taiheiyo CementConcrete Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Concrete Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Concrete market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Concrete market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Concrete market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Concrete market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Concrete market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Concrete value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Concrete industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Concrete Market Report

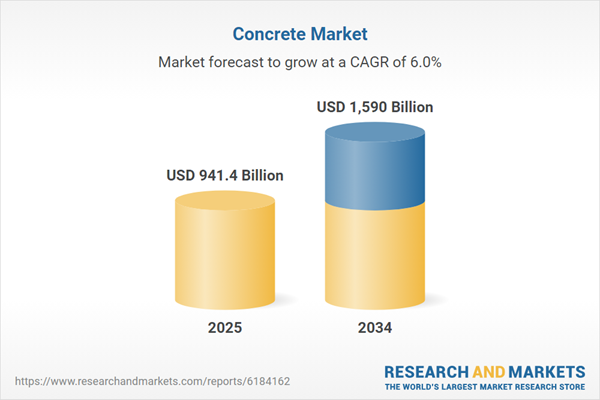

- Global Concrete market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Concrete trade, costs, and supply chains

- Concrete market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Concrete market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Concrete market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Concrete supply chain analysis

- Concrete trade analysis, Concrete market price analysis, and Concrete supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Concrete market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- LafargeHolcim (Holcim Group)

- HeidelbergCement

- Cemex

- CRH

- China National Petroleum Corporation (CNPC)

- China National Chemical Corporation (ChemChina)

- Buzzi Unicem

- UltraTech Cement

- Dangote Cement

- Mitsubishi Materials Corporation

- Siam Cement Group (SCG)

- ACC Limited

- J.K. Cement

- Asia Cement

- Taiheiyo Cement

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 941.4 Billion |

| Forecasted Market Value ( USD | $ 1590 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |