Prefabricated Buildings Market

The Prefabricated Buildings market encompasses volumetric modules, panelized systems, hybrid precast/steel frames, and bathroom/kitchen pods delivered through off-site manufacturing and rapid on-site assembly. Adoption spans residential (single-family, multi-family, student housing), social infrastructure (schools, clinics, defense), commercial (hospitality, offices, retail), and industrial/logistics outbuildings. Prefab’s core value proposition - speed, cost predictability, quality consistency, and reduced site disruption - aligns with labor constraints, urban densification, and sustainability mandates. Current trends include design-for-manufacture-and-assembly (DfMA), standardized “kit-of-parts” platforms, digital twins/BIM-to-factory workflows, and integrated MEP services in modules to compress critical paths. Materials are diversifying: light-gauge steel and hot-rolled frames for mid-rise, cross-laminated timber (CLT) and mass timber for low-carbon structures, high-performance precast concrete for durability, and composite envelopes for thermal and acoustic performance. Developers are pairing off-site manufacturing with repeatable building typologies and long-lead procurement to hedge volatility. The competitive landscape blends vertically integrated modular builders, specialty precasters, timber fabricators, and general contractors building off-site capabilities. Differentiation centers on productized platforms, supply-chain control, factory throughput, and warranty-backed performance on fire, acoustics, airtightness, and energy. Headwinds include transport logistics for oversized loads, codes/permitting variance across jurisdictions, perception gaps around design flexibility, and financing models unfamiliar with off-site cash-flow curves. Yet, the market trajectory is reinforced by public programs seeking rapid delivery of social housing and classrooms, corporate ESG targets, and insurers favoring controlled-environment construction. Players combining robust manufacturing discipline, proven systems engineering, and developer partnerships are best positioned as prefab moves from episodic projects to standardized portfolios.Prefabricated Buildings Market Key Insights

- Speed-to-occupancy as a primary ROI: Parallel factory fabrication and site works can cut schedules materially, unlocking earlier revenue for developers and lowering prelims and neighborhood disruption.

- Platformization & DfMA: Repeatable chassis (grid, bay, MEP spine) reduce design churn and procurement risk. Libraries of standardized details improve quality and facilitate multi-factory replication.

- BIM-to-factory integration: Model-driven detailing, CNC nesting, and automated QA/testing connect design, procurement, and production - shrinking rework and enabling reliable logistics sequencing.

- Hybrid structural systems: Combining modules for rooms with panelized cores/shafts or precast podiums optimizes cost, stiffness, and transport. Hybridization broadens height and geometry envelopes.

- Envelope performance & ESG: High-precision factory envelopes boost airtightness and thermal consistency, supporting low-energy standards and embodied-carbon reductions via timber and optimized mixes.

- MEP in-module integration: Pre-installed bathrooms/kitchens and prefitted services reduce site labor interfaces and commissioning time; dry-fit connections and color-coded QA accelerate assembly.

- Finance and risk allocation: Performance guarantees, long warranties, and proven delivery records improve lender comfort; early contractor involvement clarifies interfaces and liquidated damages.

- Permitting and code navigation: Early authority engagement and tested details for fire, acoustics, and egress de-risk approvals; certification pathways and third-party audits build trust.

- Logistics & site choreography: Just-in-time deliveries, rigging studies, and crane time optimization are critical cost and schedule levers; modularization strategies consider transport corridor limits.

- Aftercare & lifecycle: Strong documentation, replaceable components, and platform spares simplify maintenance; standardized parts inventories and digital twins support long-term asset management.

Prefabricated Buildings Market Reginal Analysis

North America

Adoption is driven by housing shortages, disaster recovery, and labor scarcity. Multi-family and student housing benefit from repeatable module platforms; healthcare and education prefer panelized additions for speed. Authorities increasingly recognize modular certification, though local variance persists. Developers value early pricing certainty, factory QA, and warranty frameworks; logistics planning and union collaboration shape delivery models in dense metros.Europe

A mature prefab ecosystem emphasizes energy performance, circularity, and design quality. Mass timber and light-gauge steel dominate low- to mid-rise segments, while precast leads in social infrastructure. Standardized details, EPDs, and fire/acoustic certifications are procurement gatekeepers. Public frameworks for schools and housing provide steady demand. Supply chains focus on multi-factory scalability and cross-border logistics under stringent road limits.Asia-Pacific

Scale and speed needs drive uptake in Australia, Japan, China, and Southeast Asia. Earthquake and cyclone design influence structural choices; bathroom pods and hotel modules are well established. Governments encourage industrialized construction to raise productivity. CLT adoption grows alongside steel and precast; developers prioritize factory reliability, crane logistics, and façade quality under high UV/humidity conditions.Middle East & Africa

Programmatic demand for housing, hospitality, and health/education facilities favors prefab to meet rapid timelines and heat-resilient performance. Concrete and steel panelized systems dominate; volumetric modules support worker accommodations and clinics. Focus areas include thermal performance, sand/dust mitigation, and off-grid services integration. Partnerships and technology transfer with established OEMs help build local capability.South & Central America

Urbanization and infrastructure programs spur interest in standardized schools, clinics, and affordable housing. Precast and light-gauge steel systems provide cost-effective speed; timber grows in select regions. Financing and permitting consistency vary by country, so turnkey EPC approaches, local fabrication, and strong after-sales support are decisive. Supply resilience and logistics planning are critical amid variable transport and customs processes.Prefabricated Buildings Market Segmentation

By Material

- Concrete

- Glass

- Metal

- Timber

- Others

By Application

- Residential

- Commercial

- Others

Key Market players

Laing O’Rourke, Katerra, Skanska, Red Sea Housing, Sekisui House, Lendlease, Algeco Scotsman, Bouygues Construction, CIMC Modular Building Systems, Guerdon Modular Buildings, Fleetwood Australia, Palomar Modular, Balfour Beatty, Vinci Construction, NRB Modular SolutionsPrefabricated Buildings Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Prefabricated Buildings Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Prefabricated Buildings market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Prefabricated Buildings market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Prefabricated Buildings market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Prefabricated Buildings market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Prefabricated Buildings market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Prefabricated Buildings value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Prefabricated Buildings industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Prefabricated Buildings Market Report

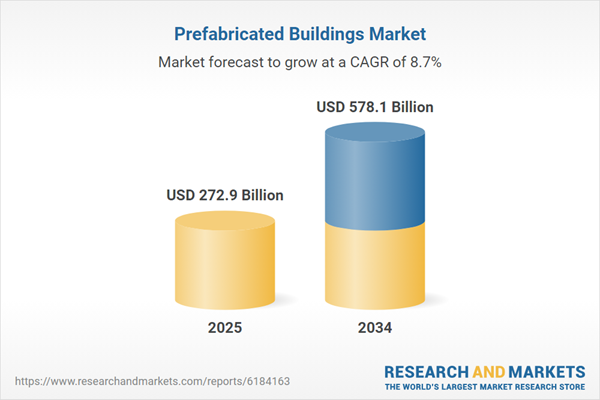

- Global Prefabricated Buildings market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Prefabricated Buildings trade, costs, and supply chains

- Prefabricated Buildings market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Prefabricated Buildings market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Prefabricated Buildings market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Prefabricated Buildings supply chain analysis

- Prefabricated Buildings trade analysis, Prefabricated Buildings market price analysis, and Prefabricated Buildings supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Prefabricated Buildings market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Laing O’Rourke

- Katerra

- Skanska

- Red Sea Housing

- Sekisui House

- Lendlease

- Algeco Scotsman

- Bouygues Construction

- CIMC Modular Building Systems

- Guerdon Modular Buildings

- Fleetwood Australia

- Palomar Modular

- Balfour Beatty

- Vinci Construction

- NRB Modular Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 272.9 Billion |

| Forecasted Market Value ( USD | $ 578.1 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |