Immunotherapy Drugs Market

Immunotherapy drugs harness or modulate the body’s immune system to prevent, control, or eradicate disease, with oncology remaining the flagship domain while autoimmune, inflammatory, and infectious diseases advance rapidly. Core modalities span monoclonal and bispecific antibodies, checkpoint inhibitors, cytokines and fusion proteins, cancer vaccines, oncolytic viruses, adoptive cell therapies (e.g., CAR-T, TCR-T, TIL), and emerging in-vivo immune cell reprogramming approaches. Top end-uses concentrate in tertiary hospitals, comprehensive cancer centers, specialty clinics/infusion suites, and increasingly home-based or community settings via subcutaneous and long-acting formulations. Recent trends include perioperative (neo/adjuvant) use, tumor-agnostic labels driven by biomarkers, rational IO-IO and IO-targeted combinations, fixed-dose and SC conversions to ease capacity constraints, and digital/real-world evidence frameworks to expand eligible populations. Growth is propelled by expanding indications into earlier lines of therapy, biomarker testing penetration, manufacturing scale-up for complex modalities, and payer acceptance supported by outcomes data and innovative contracting. The competitive landscape features large biopharma incumbents with deep IO portfolios, mid-cap innovators advancing novel targets and cell therapies, and a robust ecosystem of CDMOs, diagnostic partners, and platform technology firms. Intensifying headwinds include access and affordability pressures, site-of-care bottlenecks, toxicity management and survivorship needs, trial design complexity for combination regimens, and the advent of mAb biosimilars resetting price points. Over the next planning cycle, differentiation will hinge on precision patient selection, regimen simplification, manufacturing reliability, and convincing health-economic value propositions aligned to regional reimbursement realities.Immunotherapy Drugs Market Key Insights

- Modality mix is diversifying beyond checkpoint anchors. While PD-(L)1 backbones dominate many regimens, momentum is shifting to bispecific antibodies (T-cell engagers), cell therapies, and engineered cytokines that can unlock non-inflamed tumors. Sponsors prioritize assets with better tissue penetration, controllable immune activation, and modularity for combinations, seeking durable responses with more predictable safety and streamlined delivery pathways across hospital and ambulatory sites.

- Indication expansion is moving earlier in the care continuum. Trials are pushing into neoadjuvant and adjuvant settings, minimal residual disease, and maintenance where cure potential and long-term benefit are most visible. This elevates requirements for companion diagnostics, pathology turnaround, and perioperative coordination, while intensifying scrutiny of long-term immune-related AEs, quality-of-life outcomes, and supportive-care protocols to sustain adherence outside of advanced metastatic cohorts.

- Biomarker-driven patient selection is a decisive lever. PD-L1, MSI-H/dMMR, TMB, and emerging signatures (gene expression, spatial/immune phenotypes) are guiding therapy choices and pricing power. Scalable testing infrastructure, reflex pathways, and path-lab integration increasingly determine real-world uptake. Vendors investing in co-development with diagnostic partners and pragmatic RWE studies are converting trial efficacy into consistent community-level effectiveness.

- Combination strategies seek breadth and depth of response. IO-IO, IO-TKI, and IO-ADC combinations are engineered to remodel the tumor microenvironment, overcome primary/secondary resistance, and extend benefit to cold tumors. Operational complexity rises - dose sequencing, toxicity attribution, and cumulative costs - demanding adaptive trial designs, Bayesian statistics, and robust pharmacovigilance to balance incremental efficacy with manageable safety and payer-acceptable total cost of care.

- Route of administration and regimen simplicity are competitive differentiators. Fixed-dose, subcutaneous, and long-acting formulations relieve infusion chair constraints and broaden access in community oncology. Self-administration models and nurse-led pathways support capacity-limited regions. Simplifying premedication, monitoring, and steroid management protocols reduces hidden system costs and improves patient experience, strengthening formulary favorability and persistence.

- Cell therapy is industrializing but must standardize. Autologous CAR-T has proven transformative in select hematologic malignancies; focus is shifting to allogeneic platforms, faster vein-to-vein, in-process controls, and supply-chain digitalization. Networked manufacturing, cryologistics resilience, and release testing automation are as strategic as clinical data. Centers of excellence and payer centers-of-care models gate real-world diffusion and margin realization.

- Safety management and survivorship frameworks are market access essentials. Immune-related adverse events, CRS/ICANS in cell therapy, and chronic toxicities require standardized algorithms, rapid escalation pathways, and multidisciplinary coordination. Providers that institutionalize training, tele-triage, and PRO-based monitoring achieve fewer interruptions and rehospitalizations, which resonates with value-based purchasing and strengthens long-term adoption narratives.

- Biosimilars and next-gen engineering are reshaping economics. mAb biosimilars expand access and re-benchmark price corridors, while innovators counter with engineered antibodies, bispecifics, and conditionally active constructs offering differentiated profiles. Portfolio strategies increasingly mix premium, novel agents with cost-efficient backbones; contracting blends outcomes commitments, site-neutral policies, and pathway placement to protect share in crowded classes.

- Real-world evidence is pivotal for lifecycle and reimbursement. Post-approval registries, claims-EMR linkages, and decentralized follow-up capture long-horizon outcomes, rare toxicities, and utilization patterns. Credible RWE underpins label expansions, supports HTA submissions, and informs optimal sequencing. Companies that operationalize data governance and analytics with providers can iteratively refine positioning and sustain guideline momentum.

- Globalization of clinical development and supply is accelerating. Sponsors are expanding trial footprints into Asia and Latin America to access diverse genotypes and faster enrollment, while fortifying dual-sourcing for critical inputs (viral vectors, resins, single-use systems). Technology-transfer discipline, GMP readiness, and regional regulatory fluency determine launch velocity, quality consistency, and resilience against geopolitical or logistics shocks.

Immunotherapy Drugs Market Reginal Analysis

North America:

High diagnostic penetration, mature reimbursement frameworks, and a dense network of comprehensive cancer centers make this the bellwether market for launches and perioperative adoption. Pathway committees, integrated delivery networks, and payer-provider collaborations prioritize regimens with clear operational simplicity and predictable toxicity. Biosimilar dynamics are reshaping budget impact models, while community oncology expansion and SC conversions relieve infusion capacity constraints.Europe

HTA rigor and country-specific value assessments drive careful patient selection and negotiated access, often with managed entry or outcomes-based agreements. Strong academic consortia support neoadjuvant/adjuvant trials and translational biomarker research. Hospital financing models favor regimens that minimize inpatient burden; cross-border reference pricing and biosimilars exert sustained pressure on list prices, pushing differentiation through genuine clinical meaningfulness.Asia-Pacific

Rapid growth stems from rising cancer incidence awareness, improving pathology/diagnostics infrastructure, and regional manufacturing investments for biologics and cell therapy. Japan, South Korea, Australia, and China lead in early adoption and trial activity, while Southeast Asia scales through public-private partnerships. Local guideline inclusion, domestic biopharma entrants, and cost-sensitive procurement decisions reward platforms that combine robust efficacy with pragmatic delivery models.Middle East & Africa

Specialized centers in GCC countries anchor adoption, complemented by government initiatives to localize biomanufacturing and upgrade oncology pathways. Access varies widely; centralized procurement, medical tourism, and reference center networks shape utilization. Training for immune-related AE management and expansion of pathology capabilities are priorities, with formulary placement favoring regimens with simplified administration and clear quality-of-life benefits.South & Central America

Public payer constraints and heterogeneous diagnostic access require tailored launch sequences and risk-sharing to achieve scale. Regional reference centers and private hospital groups serve as early adopters, cascading protocols to broader networks as affordability improves. Local fill-finish capacity, named-patient programs, and partnerships with pathology chains accelerate uptake, while clinician education on toxicity algorithms underpins sustainable, guideline-aligned use.Immunotherapy Drugs Market Segmentation

By Type

- Monoclonal Antibodies

- Immunomodulators

- Vaccines

By Indication

- Cancer

- Autoimmune Diseases

- Infectious Diseases

- Others

Key Market players

Merck & Co. (MSD), Bristol Myers Squibb, Roche (Genentech), Novartis, Johnson & Johnson (Janssen), AstraZeneca, Pfizer, Amgen, Sanofi, Regeneron Pharmaceuticals, Merck KGaA (EMD Serono), Gilead Sciences (Kite Pharma), AbbVie, Eli Lilly and Company, Takeda Pharmaceutical CompanyImmunotherapy Drugs Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Immunotherapy Drugs Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Immunotherapy Drugs market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Immunotherapy Drugs market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Immunotherapy Drugs market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Immunotherapy Drugs market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Immunotherapy Drugs market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Immunotherapy Drugs value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Immunotherapy Drugs industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Immunotherapy Drugs Market Report

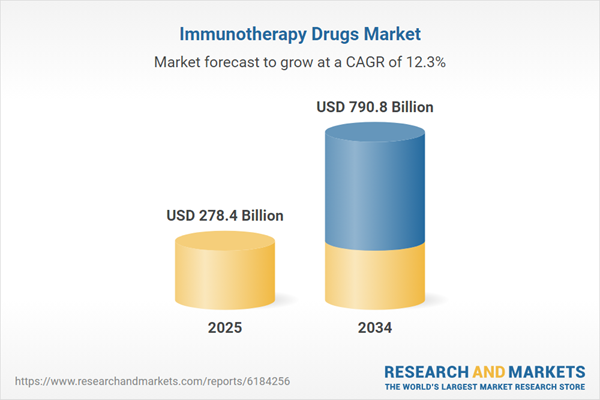

- Global Immunotherapy Drugs market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Immunotherapy Drugs trade, costs, and supply chains

- Immunotherapy Drugs market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Immunotherapy Drugs market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Immunotherapy Drugs market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Immunotherapy Drugs supply chain analysis

- Immunotherapy Drugs trade analysis, Immunotherapy Drugs market price analysis, and Immunotherapy Drugs supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Immunotherapy Drugs market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Merck & Co. (MSD)

- Bristol Myers Squibb

- Roche (Genentech)

- Novartis

- Johnson & Johnson (Janssen)

- AstraZeneca

- Pfizer

- Amgen

- Sanofi

- Regeneron Pharmaceuticals

- Merck KGaA (EMD Serono)

- Gilead Sciences (Kite Pharma)

- AbbVie

- Eli Lilly and Company

- Takeda Pharmaceutical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 278.4 Billion |

| Forecasted Market Value ( USD | $ 790.8 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |