Omega 6 Polyunsaturated Fatty Acids Market

The Omega-6 Polyunsaturated Fatty Acids (PUFAs) market covers a spectrum of long-chain and essential fatty acids - principally linoleic acid (LA), gamma-linolenic acid (GLA), arachidonic acid (ARA), and conjugated linoleic acid (CLA) - sourced from edible oils, microbial fermentation, and specialty seed oils. Top end-uses span functional foods and beverages, infant and clinical nutrition, dietary supplements, cosmetics and personal care, pharmaceuticals, and animal nutrition. Momentum is shaped by clean-label fortification, plant-forward reformulation, and precision nutrition narratives that emphasize fatty-acid profiles and target ratios. On the supply side, advances in high-oleic/linoleic crop breeding, controlled fermentation of ARA/GLA, solvents-free extraction, molecular distillation, and allergen-free encapsulation are lifting quality and stability while meeting regulatory expectations. Demand tailwinds include skin and women’s health claims (GLA), growth and cognitive development (ARA in infant formulas), weight management and body composition (CLA), and functional cosmetics centered on barrier repair and anti-inflammation. Competitive intensity is rising as edible-oil majors, infant-nutrition ingredient specialists, and niche cosmeceutical suppliers expand capacity, secure seed access, and pursue IP around stabilization and bioavailability. Portfolio strategies aim to balance omega-6 potency with oxidative stability, organoleptics, and transparency on origin (organic, non-GMO, allergen-free). Meanwhile, the market is increasingly framed within whole-diet lipid balance; brands are positioning omega-6 ingredients alongside omega-3s and MUFAs to address practitioner expectations on ratios rather than single-nutrient megadosing. Overall, buyers prioritize consistent specifications (acid value, peroxide value, anisidine), neutral taste, compliant claims, and verified sustainability across agricultural inputs and processing footprints.Omega 6 Polyunsaturated Fatty Acids Market Key Insights

- Shift from commodity oils to specification-grade actives. Buyers are moving beyond generic linoleic acid toward standardized GLA, ARA, and CLA concentrates with defined isomer/chain-length profiles. This favors suppliers with tight process control (extraction, distillation, deodorization) and robust stability data. Clear documentation of oxidative markers and residual solvents is now a baseline, not a differentiator, across nutrition, pharma-adjacent, and dermocosmetic channels.

- Plant-forward and allergen-sensitive sourcing. Evening primrose, borage, blackcurrant, and safflower are being repositioned as premium GLA/LA sources, while fermentation-derived ARA supports dairy-free and hypoallergenic formulations. Crop identity preservation, non-GMO/organic certifications, and pesticide residue controls are central to brand risk management. Seed access agreements and agronomic support programs are emerging as key supply-security levers.

- Infant and clinical nutrition anchor demand for ARA. ARA remains pivotal in infant formulas and medical foods, typically paired with complementary LC-PUFAs. Formulators prefer microencapsulated, neutral-taste formats with predictable particle size and excellent dispersion. Evidence dossiers and compliance with stringent contaminant and microbiological specifications are decisive in vendor selection and long-term supply awards.

- Beauty-from-within and topical synergy for GLA/LA. GLA-rich oils are gaining in nutricosmetics and dermocosmetics focused on barrier repair and redness reduction. Brands are pairing ingestible capsules/gummies with topical serums to tell a unified skin-health story. Stability in emulsions, peroxide control, and light/heat protection through packaging are practical differentiators for claims durability.

- CLA repositioned with pragmatic claims. CLA retains relevance in sports and weight-management SKUs but is being reframed with moderate, lifestyle-aligned benefit language. Suppliers emphasize isomer ratios, GI tolerance, and stackability with protein, green tea, or carnitine. Softgel clarity, oxidation limits, and label transparency (non-stimulant) influence retail acceptance and repeat purchase.

- Encapsulation and delivery innovation. Powderized and beadlet formats are enabling higher-load fortification in bars, RTDs, and stick packs without sensory penalties. Controlled-release capsules and lipid-matrix technologies improve bioavailability and reduce reflux. Manufacturers that pair format choice with validated shelf-life models and accelerated-aging data win B2B technical gatekeeper trust.

- Regulatory and claim substantiation discipline. Global divergence in permissible claims, infant-nutrition standards, and contaminant thresholds necessitates meticulous dossier management. Companies invest in post-market surveillance, adverse-event tracking, and pharmacovigilance-style processes. Harmonized internal standards across regions reduce reformulation burden and speed up multinational rollouts.

- Omega-6 within whole-diet lipid strategies. Health-professional guidance increasingly emphasizes balanced omega-6:omega-3 intake rather than restricting omega-6 per se. Successful brands co-position with EPA/DHA or ALA to address ratio narratives and inflammation literacy. Educational content for HCPs and retail associates is becoming a commercial capability, not just a marketing add-on.

- Sustainability and traceability as procurement criteria. Scope 3 reporting, regenerative agriculture pilots, and deforestation-free commitments are moving from “nice to have” to weighted scorecard items in RFQs. Batch-level traceability, LCAs for key SKUs, and solvent-recovery/energy-efficiency investments are used to pre-empt retailer audits and secure preferred-supplier status.

- Convergence of food, pharma, and beauty channels. Blurring boundaries create multi-channel opportunities but also cross-compliance complexity. Vendors that can supply food-grade, pharma-adjacent, and cosmetic-grade materials with harmonized specs and documentation achieve superior asset utilization. Strategic partnerships with CDMOs and brand-owners de-risk launches and expand pipeline visibility.

Omega 6 Polyunsaturated Fatty Acids Market Reginal Analysis

North America

Demand is led by infant formula, women’s health supplements, and performance nutrition, with retailers tightening standards on oxidation indices and label accuracy. Contract manufacturers prioritize microencapsulated ARA/GLA and neutral-taste LA for bars and RTDs. Practitioner channels influence positioning toward lipid balance and skin-health outcomes. Private-label programs in mass retail elevate quality baselines, favoring suppliers with SQF/GFSI certifications, validated shelf-life, and transparent sustainability narratives across seed sourcing and processing utilities.Europe

A sophisticated regulatory environment shapes claim language and contaminant thresholds, pushing suppliers to provide granular technical dossiers and validated methods. Nutricosmetics, dermocosmetics, and specialty bakery fortification drive LA/GLA uptake, while infant-nutrition reformulations maintain ARA relevance. Retailers emphasize organic and non-GMO credentials alongside solvent-free processing. Traceability to farm and audited supply chains are central to procurement; suppliers with regenerative agriculture pilots, solvent recovery, and circular packaging solutions gain preferred-vendor status.Asia-Pacific

Rapid growth stems from expanding middle-class nutrition, infant-formula penetration, and beauty-from-within categories. Local production of edible oils supports LA supply, while partnerships for fermentation-derived ARA serve premium infant brands. E-commerce accelerates supplement adoption; gummies and softgels dominate formats. Regulators tighten oversight on cross-border e-commerce claims, favoring brands with robust documentation. Manufacturers with regional flavor adaptation, heat-stable encapsulation, and halal credentials achieve faster market access and scale.Middle East & Africa

Rising interest in fortified staples, maternal/infant nutrition, and dermatology-linked supplements underpins demand. Import dependence for specification-grade GLA/ARA encourages distributor-led technical support and cold-chain diligence. Government nutrition programs and private hospital networks shape procurement, with a premium on reliability and shelf-life performance in hot climates. Suppliers offering halal compliance, lightweight packaging, and training for pharmacists and dietitians improve penetration and retention.South & Central America

Food-and-beverage fortification and pharmacy-led supplements drive adoption, with growing attention to women’s health and sports categories. Local edible-oil ecosystems provide LA, while higher-value GLA/ARA often rely on imports, necessitating resilient logistics and inventory planning. Regulatory pathways are maturing, and retailers prioritize clean-label, organic, and transparent sourcing. Vendors that support flavor masking, stability in tropical conditions, and co-marketing with healthcare professionals gain shelf space and sustained consumer pull.Omega 6 Polyunsaturated Fatty Acids Market Segmentation

By Type

- Linolenic Acid (LA)

- Arachidonic Acid (AA)

By Application

- Food and Beverages

- Pharmaceuticals

- Animal Food and Feed

Key Market players

ADM, Cargill, Bunge, Wilmar International, AAK AB, IOI Loders Croklaan, Oleon (Avril Group), BASF, dsm-firmenich, Croda International, Stepan Company, Kerry Group, Bioriginal Food & Science Corp., CABIO Biotech (Wuhan) Co., Ltd., Kemin IndustriesOmega 6 Polyunsaturated Fatty Acids Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Omega 6 Polyunsaturated Fatty Acids Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Omega 6 Polyunsaturated Fatty Acids market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Omega 6 Polyunsaturated Fatty Acids market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Omega 6 Polyunsaturated Fatty Acids market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Omega 6 Polyunsaturated Fatty Acids market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Omega 6 Polyunsaturated Fatty Acids market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Omega 6 Polyunsaturated Fatty Acids value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Omega 6 Polyunsaturated Fatty Acids industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Omega 6 Polyunsaturated Fatty Acids Market Report

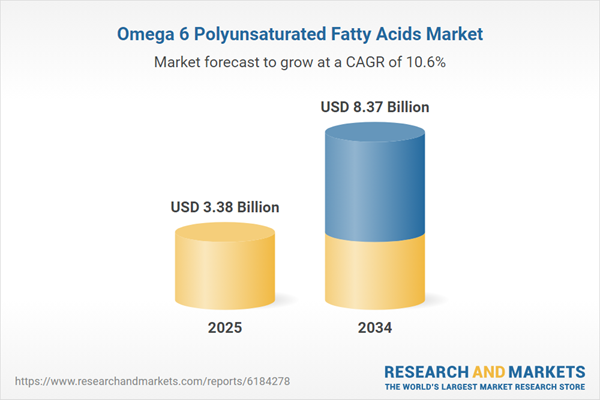

- Global Omega 6 Polyunsaturated Fatty Acids market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Omega 6 Polyunsaturated Fatty Acids trade, costs, and supply chains

- Omega 6 Polyunsaturated Fatty Acids market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Omega 6 Polyunsaturated Fatty Acids market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Omega 6 Polyunsaturated Fatty Acids market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Omega 6 Polyunsaturated Fatty Acids supply chain analysis

- Omega 6 Polyunsaturated Fatty Acids trade analysis, Omega 6 Polyunsaturated Fatty Acids market price analysis, and Omega 6 Polyunsaturated Fatty Acids supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Omega 6 Polyunsaturated Fatty Acids market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ADM

- Cargill

- Bunge

- Wilmar International

- AAK AB

- IOI Loders Croklaan

- Oleon (Avril Group)

- BASF

- dsm-firmenich

- Croda International

- Stepan Company

- Kerry Group

- Bioriginal Food & Science Corp.

- CABIO Biotech (Wuhan) Co. Ltd.

- Kemin Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.38 Billion |

| Forecasted Market Value ( USD | $ 8.37 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |