Nuts and Seeds Dietary Fibers Market

The Nuts and Seeds Dietary Fibers Market is moving from niche to mainstream as clean-label, multifunctional ingredients across food, beverage, and nutrition portfolios. Top end-uses span bakery and snacks for water-binding, fat replacement, and crumb softness; beverages and dairy alternatives for mouthfeel and stability; supplements and sports nutrition for satiety and gut health; and plant-based meat and fillings for structure and juiciness. Momentum comes from fiber fortification and sugar reduction agendas, high-protein/low-carb launches, and the upcycling of defatted meals and press-cakes into value-added fiber concentrates. On the supply side, nut processors and oilseed crushers leverage precision milling, air classification, gentle heat, and enzyme-assisted stabilization to manage flavor, rancidity, and microbiological quality while delivering consistent particle sizes. Competitive intensity is increasing as ingredient majors, specialty fiber houses, and regional processors expand portfolios with organic, non-GMO, gluten-free, and allergen-controlled offerings, often co-developed with leading bakery and beverage brands. Differentiation centers on sensory neutrality, soluble/insoluble balance, water-holding capacity, dispersibility, color, and traceability credentials including upcycled content. Regulatory definitions of dietary fiber guide formulation and claims, while allergen labeling for tree nuts and sesame drives segregation and robust QA. Procurement teams prioritize multi-origin coverage to mitigate crop variability, supported by VMI programs and forward contracts. Overall, the category’s evolution reflects maturing formulation science and sustainability narratives, enabling brands to deliver digestive-wellness benefits, caloric dilution, and texture improvement without compromising label simplicity or taste, positioning these fibers as essential building blocks in next-generation clean-label innovation. Technical service and pilot plants accelerate scale-up and application success rates.Nuts and Seeds Dietary Fibers Market Key Insights

- Functional versatility is the core value proposition. Nut and seed fibers deliver water-binding, fat-mimetic, and texturizing functions that stabilize beverages and soften bakery crumbs. They enable sugar reduction and calorie management while preserving indulgent sensory cues.

- Upcycling and sustainability resonate with brands. Converting defatted meals and press-cakes into standardized fibers reduces waste and supports carbon narratives. This improves cost positions and aligns with retailer sustainability scorecards.

- Soluble vs. insoluble balance drives application fit. Psyllium- and chia-forward blends boost viscosity and satiety in nutrition drinks. Almond, sunflower, and pumpkin fibers provide bulking and machinability for doughs and extruded snacks.

- Sensory and flavor management remain pivotal. Mild roasting, deodorization, and lipid stabilization mitigate bitterness and oxidative notes. This expands feasibility in delicate matrices like yogurts and light-colored bakery.

- Clean-label positioning elevates adoption. Single-ingredient, recognizable sources outperform chemically modified alternatives in premium and private-label lines. Certifications such as organic and non-GMO reinforce brand trust.

- Formulation science is professionalizing. Particle-size engineering, agglomeration, and enzyme-assisted processing improve dispersion and rheology. Suppliers increasingly provide application-specific specs and bake-stability data.

- Regulatory clarity shapes claims and labeling. Compliance with dietary-fiber definitions underpins front-of-pack messaging. Allergen disclosures for tree nuts and sesame necessitate strict segregation and validated cleaning.

- Supply security addresses crop variability. Multi-origin sourcing and forward contracting buffer yield swings in almonds, flax, and sesame. Vendor-managed inventory programs support continuity and shelf-life targets.

- Competitive landscape is converging. Ingredient majors, nut specialists, and oilseed processors broaden portfolios with allergen-controlled and gluten-free lines. Co-development with global bakery and beverage brands accelerates adoption.

- Beyond food, adjacencies are opening. Pet and clinical nutrition leverage digestive benefits, while personal care explores fine fractions as natural exfoliants. These outlets diversify demand and valorize co-streams.

Nuts and Seeds Dietary Fibers Market Reginal Analysis

North America

Adoption is driven by strong interest in gut health, low-carb formats, and clean labels across bakery, bars, and ready-to-drink nutrition. Retailer-led reformulation agendas favor fibers that support sugar reduction and calorie control without taste trade-offs. Large nut processors and oilseed facilities valorize co-streams into traceable, consistent fibers, with stringent allergen controls and gluten-free certifications. Collaboration with major CPGs centers on neutral flavor, tight particle-size bands, and bake stability at higher inclusion rates. Private-label expansion intensifies price-performance competition, nudging suppliers toward application-ready blends and just-in-time supply programs.Europe

Brands emphasize organic certification, upcycled inputs, and documented life-cycle benefits, reinforcing sustainability marketing. Artisan and industrial bakeries integrate sunflower, flax, and chia fractions to enhance moisture retention and texture in whole-grain breads and pastries. Regulatory scrutiny encourages evidence-led fiber content claims rather than disease-risk reduction statements. Specialty mills differentiate on clean processing, low residual lipids, and strict microbiological specifications. Premium dairy alternatives and plant-based meats increasingly trial seed-fiber blends to improve mouthfeel, yield, and freeze-thaw performance, supported by pilot-scale trials and technical service.Asia-Pacific

Demand accelerates with rapid innovation in functional beverages, bakery, and nutrition products. Local sourcing of sesame, flax, and chia expands, while Japan, South Korea, and Australia prioritize low-flavor-impact fibers for beverage clarity and confectionery. In India and Southeast Asia, affordability and continuity weigh alongside clean-label cues, prompting interest in upcycled press-cake fibers. Multinationals and regional champions establish blending hubs to tailor viscosity, dispersibility, and color to local preferences. E-commerce channels amplify supplement and sports-nutrition formats, with seed fibers positioned for satiety and digestive comfort.Middle East & Africa

Growth reflects rising awareness of digestive wellness, bakery modernization, and café/snack culture. Sesame’s regional prominence underpins seed-fiber availability, but allergen management and aflatoxin controls remain critical buying criteria. Import reliance for select nuts encourages hybrid sourcing and regional milling to ensure freshness and shelf-life. Hospitality, airline catering, and quick-service operators pilot fiber-enriched breads and wraps. Supplier education on processing, flavor masking, and oxidative stability supports scale-up and repeat purchasing.South & Central America

Local oilseed ecosystems and superfood narratives support adoption of chia and sunflower fibers in artisanal and industrial bakeries. Smoothie and functional beverage brands use seed fibers to add viscosity and satiety without synthetic stabilizers. Export-oriented processors pursue organic and non-GMO certifications to access premium markets. Agricultural variability and logistics complexity encourage diversified origins and near-site processing. Technical service focused on flavor neutrality, lipid stabilization, and particle-size tuning helps expand use in snack bars and fortified staples.Nuts and Seeds Dietary Fibers Market Segmentation

By Type

- Almond

- Peanuts

- Psyllium

- Flaxseed

- Sunflowers

By Application

- Functional Food & Beverages

- Pharmaceuticals

- Feed

- Nutrition

- Others

Key Market players

ADM, Cargill, Ingredion, Tate & Lyle, IFF, Kerry Group, Roquette, Beneo (Südzucker Group), Nexira, ofi (Olam Food Ingredients), Blue Diamond Growers, Glanbia Nutritionals, SunOpta, Bioriginal Food & Science Corp., Taiyo (Sunfiber/PHGG)Nuts and Seeds Dietary Fibers Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Nuts and Seeds Dietary Fibers Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Nuts and Seeds Dietary Fibers market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Nuts and Seeds Dietary Fibers market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Nuts and Seeds Dietary Fibers market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Nuts and Seeds Dietary Fibers market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Nuts and Seeds Dietary Fibers market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Nuts and Seeds Dietary Fibers value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Nuts and Seeds Dietary Fibers industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Nuts and Seeds Dietary Fibers Market Report

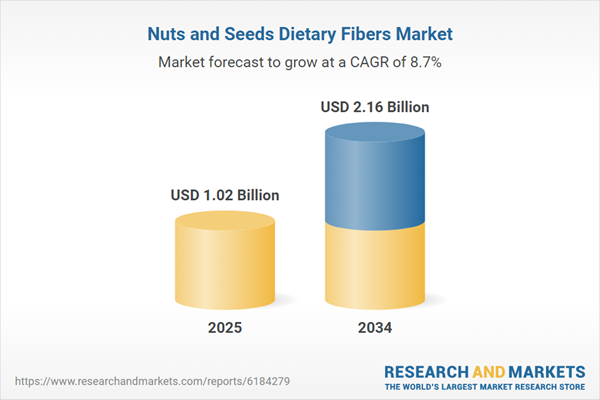

- Global Nuts and Seeds Dietary Fibers market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Nuts and Seeds Dietary Fibers trade, costs, and supply chains

- Nuts and Seeds Dietary Fibers market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Nuts and Seeds Dietary Fibers market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Nuts and Seeds Dietary Fibers market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Nuts and Seeds Dietary Fibers supply chain analysis

- Nuts and Seeds Dietary Fibers trade analysis, Nuts and Seeds Dietary Fibers market price analysis, and Nuts and Seeds Dietary Fibers supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Nuts and Seeds Dietary Fibers market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ADM

- Cargill

- Ingredion

- Tate & Lyle

- IFF

- Kerry Group

- Roquette

- Beneo (Südzucker Group)

- Nexira

- ofi (Olam Food Ingredients)

- Blue Diamond Growers

- Glanbia Nutritionals

- SunOpta

- Bioriginal Food & Science Corp.

- Taiyo (Sunfiber/PHGG)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.02 Billion |

| Forecasted Market Value ( USD | $ 2.16 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |