Brake Friction Products Market

The brake friction products market spans pads, shoes/linings, discs/rotors, drums, and calipers supplied to OEM and aftermarket channels across passenger cars, commercial vehicles, two-wheelers, off-highway equipment, and rail. Demand is underpinned by global vehicle parc expansion, high replacement rates, and stricter safety expectations in both mature and emerging fleets. On the technology front, compound innovation is accelerating - OEMs and Tier-1s are shifting from semi-metallic toward low-metallic NAO and ceramic formulations to reduce dust, noise, and wear while maintaining pedal feel and fade resistance. Electrification is reshaping design requirements: regenerative braking lowers average friction duty but raises corrosion risk and cold-bite needs, prompting coated rotors, alternative alloys, and new binder systems. NVH optimization, copper-free compliance, and sustainability (recycled steel, low-VOC binders, reduced antimony) are core development themes. The supply side features a mix of global integrators and regional specialists, with differentiation via compound IP, dyno and vehicle-level validation, and application engineering for platforms spanning ICE, hybrids, and EVs. Aftermarket competition intensifies through multi-tier branding, e-commerce distribution, telematics-enabled maintenance programs, and remanufactured components. Fleet operators and brake service networks increasingly prioritize total cost of ownership, warranty support, and friction consistency across duty cycles rather than headline performance alone. Regulatory scrutiny on particulate emissions, material disclosure, and brake system performance standards continues to tighten, driving platform refreshes and cross-regional certification strategies. In parallel, advanced ADAS penetration (ESC, AEB) elevates requirements for friction stability and thermal management, while data-driven quality control and traceability become standard expectations from OEMs and professional installers.Brake Friction Products Market Key Insights

- Electrification resets duty cycles. Regenerative braking reduces average pad engagement yet demands strong initial bite at low temperatures and corrosion resistance during long idle periods; compounds and rotors are being re-engineered for EV-specific profiles and heavier curb weights.

- NVH and dust minimization as table stakes. Low-dust, low-noise NAO and ceramic pads are gaining share in premium and mass segments; shim design, slot/chamfer geometry, and damping layers are co-optimized to meet tighter acoustic targets under real-world cycles.

- Copper-free and low-emission materials. Compliance with emerging material restrictions pushes reformulation toward alternative fibers, eco-binders, and reduced heavy-metal content, with sustained testing to preserve fade resistance and rotor friendliness.

- Coated and high-durability rotors. Anti-corrosion coatings and surface treatments mitigate EV-related flash rust and uneven deposits; high-carbon and alloyed rotors support thermal stability for larger, heavier vehicles and towing applications.

- Thermal management and fade control. Vent geometry, vane designs, and pad thermal conductivity are tuned for repeated high-energy stops, while caliper stiffness and fluid management limit pedal travel growth under severe duty.

- Aftermarket stratification and e-commerce. Multi-line portfolios (good-better-best) and channel partnerships with online retailers, quick-fit kits, and platform-coded SKUs improve installer productivity and reduce comebacks.

- Fleet and CV focus on lifecycle cost. Long-haul, transit bus, and vocational fleets weigh price per mile, rotor wear rates, and drum-to-disc conversions; telematics data inform predictive replacement and compound selection by route profile.

- Quality assurance and traceability. End-to-end barcoding, compound lot tracking, and expanded dyno/vehicle correlation testing are becoming OEM mandates, narrowing the gap between validation labs and field performance.

- Regionalization of supply chains. Localized production of pads and rotors de-risks logistics, while near-shoring of key inputs (steel, resins, fibers) balances cost volatility and lead times for OEM platform launches.

- Integration with ADAS braking. Consistent friction coefficients support stability control and automatic emergency braking logic; suppliers collaborate earlier in the platform cycle to align pad/rotor characteristics with control algorithms.

Brake Friction Products Market Reginal Analysis

North America

A large, diverse vehicle parc sustains robust aftermarket demand, with pickup/SUV and commercial fleets emphasizing durability, towing performance, and rotor longevity. EV adoption is prompting wider use of coated rotors and revised compounds for low-temperature bite. Installer ecosystems value quick-fit hardware and low comebacks, reinforcing preference for validated, application-specific kits. Regulatory momentum on particulate emissions and material content steers copper-free transitions, while OES and private-label programs intensify competition among tiered suppliers.Europe

Stringent safety and environmental frameworks shape compound chemistry and brake dust management, accelerating copper-free and low-emission designs. High ADAS penetration and growing BEV mix require friction stability and corrosion resistance in mixed urban cycles. Premium and performance segments drive demand for high-carbon rotors, advanced shims, and precision NVH tuning. Consolidated distribution and strong independent aftermarket networks reward brands with OE lineage, ECE approvals, and consistent fitment data across diverse regional platforms.Asia-Pacific

OEM production scale and a rapidly expanding vehicle parc underpin long-term growth, with strong two-wheeler and entry car segments in South and Southeast Asia and higher content per vehicle in China, Japan, and Korea. Local champions and global suppliers invest in compound R&D centers close to OEMs, supporting fast platform cycles. Electrification pilots broaden EV-specific friction offerings, while cost-optimized lines address price-sensitive applications. E-commerce and app-based service models widen access to branded components.Middle East & Africa

Harsh climates and heavy-duty usage patterns prioritize thermal robustness, dust sealing, and corrosion protection. Commercial fleets, mining, and construction equipment create stable demand for high-durability linings, drums, and discs, with service availability and parts interchangeability critical to uptime. Distributors balance premium imported lines with regional manufacturing for cost control. Regulatory frameworks are evolving, with growing attention to safety standards and professionalized workshop practices.South & Central America

Macroeconomic volatility favors value-tier and remanufactured options, yet urban fleets and ride-hailing push requirements for low-noise, low-dust pads to reduce service callbacks. Local manufacturing and regional distribution hubs help manage currency swings and lead times. Gradual adoption of advanced safety systems and new platform launches from regional OEMs nudge demand toward better-validated compounds and coated rotors. Partnerships with installer networks and training programs differentiate brands at point of fitment.Brake Friction Products Market Segmentation

By Product

- Brake Discs

- Brake Pads

- Drum Brakes

- Brake Shoes

- Brake Liners

By Vehicle

- Passenger Cars

- LCVs

- Trucks

- Buses

By Application

- Agricultural Tractors

- Construction & Mining Equipment

Key Market players

Aisin Corporation (ADVICS), ZF Friedrichshafen AG (TRW), Brembo S.p.A., Tenneco Inc. (Ferodo, Abex), Nisshinbo Holdings Inc. (TMD Friction), Robert Bosch GmbH, Akebono Brake Industry Co., Ltd., Continental AG, ITT Inc. (Motion Technologies), Fras-le S.A., Sangsin Brake Co., Ltd., Knorr-Bremse AG (Bendix CVS), Meritor, Inc. (Cummins), Brakes India Pvt. Ltd., ICER Brakes S.A.Brake Friction Products Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Brake Friction Products Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Brake Friction Products market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Brake Friction Products market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Brake Friction Products market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Brake Friction Products market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Brake Friction Products market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Brake Friction Products value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Brake Friction Products industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Brake Friction Products Market Report

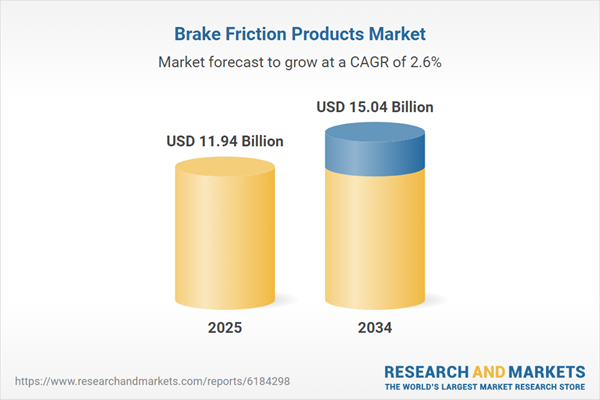

- Global Brake Friction Products market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Brake Friction Products trade, costs, and supply chains

- Brake Friction Products market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Brake Friction Products market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Brake Friction Products market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Brake Friction Products supply chain analysis

- Brake Friction Products trade analysis, Brake Friction Products market price analysis, and Brake Friction Products supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Brake Friction Products market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Aisin Corporation (ADVICS)

- ZF Friedrichshafen AG (TRW)

- Brembo S.p.A.

- Tenneco Inc. (Ferodo Abex)

- Nisshinbo Holdings Inc. (TMD Friction)

- Robert Bosch GmbH

- Akebono Brake Industry Co. Ltd.

- Continental AG

- ITT Inc. (Motion Technologies)

- Fras-le S.A.

- Sangsin Brake Co. Ltd.

- Knorr-Bremse AG (Bendix CVS)

- Meritor

- Inc. (Cummins)

- Brakes India Pvt. Ltd.

- ICER Brakes S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 11.94 Billion |

| Forecasted Market Value ( USD | $ 15.04 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |