Sanitary Pumps Market

The sanitary pumps market encompasses hygienic centrifugal and positive displacement designs used across food & beverage, dairy, brewery, pharmaceuticals/bioprocessing, personal care, and cosmetics, with adjacent adoption in nutraceuticals and high-purity water systems. Buyers prioritize cleanability, gentle handling of shear-sensitive products, and assurance of regulatory conformity (3-A, EHEDG, FDA-contact materials), while integrators look for flexible footprints and simplified skid integration. Centrifugal, lobe, twin-screw, progressive cavity, peristaltic, and air-operated double-diaphragm (AODD) architectures dominate, with twin-screw gaining traction for its ability to convey product and perform CIP/SIP on the same line, reducing changeover time and product losses. Design trends include magnetically coupled or seal-less options to minimize contamination risk; tighter surface-finish controls; expanded elastomer portfolios for aggressive chemistries; and low-pulsation solutions for filling/dispensing accuracy. Digitalization is accelerating via smart drives, condition monitoring, and predictive maintenance that tie pump performance to batch quality and OEE. Sustainability is a central specification lever: high-efficiency motors with VFDs, optimized hydraulics for lower kWh/m³, and water-saving CIP strategies are now common bid requirements. Competitive dynamics feature global hygiene specialists and diversified flow-control groups competing on total cost of ownership, validated cleaning, local service density, and lead-time reliability. OEM partnerships (mixing, homogenization, filtration skids) and aftermarket programs (spares, seals, elastomers, upgrades) are core margin engines. M&A continues to consolidate portfolios around high-purity niches, while end users demand modularity to support product proliferation - plant-based formulations, high-viscosity sauces, sterile injectables, and single-use bioprocess trains - keeping sanitary pumps central to process reliability and compliance.Sanitary Pumps Market Key Insights

- End-use mix is broadening beyond traditional dairy and brewery. Food processors specify hygienic pumps for viscous, particulate-laden sauces and confectionery, while beverage producers need low-shear transfer for pulpy juices and craft beer. Pharma/biotech emphasizes sterile boundaries and extractables/leachables control. Cosmetics and personal care require batch-to-batch consistency and fast, validated CIP, pulling demand toward premium hygienic designs.

- Technology shift from lobe to twin-screw is notable in multipurpose plants. Twin-screw handles both product and CIP on one asset, enabling continuous processing and fewer changeovers. Its low-pulsation flow improves downstream measurement and filling accuracy. Although upfront costs can be higher, savings accrue through reduced product losses, shorter cleaning cycles, and lower inventory of spare units.

- Single-use and hybrid bioprocessing are reshaping pharma specifications. Peristaltic and single-use pump heads support sterile fluid paths for upstream/downstream steps, reducing cross-contamination risk and cleaning validation effort. Hybrid lines combine stainless transfer with disposable flow kits near critical steps. Vendors differentiate via gamma-stability, material certificates, and validated flow/pressure envelopes.

- Sealing strategies are central to hygiene and uptime. Mechanical seal choices (single, double, flushed) and seal-less magnetic couplings reduce leakage pathways. Elastomer compatibility with CIP/SIP media and wider temperature windows is a frequent audit point. Quick-release front-loading seals and tool-free disassembly cut mean time to clean and maintain while protecting sanitary surfaces.

- Digitalization ties pumps to batch quality and compliance. Smart drives, torque/temperature sensing, and vibration analytics enable predictive maintenance and automated deviation alerts. Integration with SCADA/MES records cleaning cycles and operating envelopes, supporting e-records for audits. Remote diagnostics helps plants address skills gaps and standardize best-practice setups across sites.

- Energy and water stewardship drive selection and retrofits. High-efficiency motors with VFDs, hydraulic re-rating, and impeller/timing optimization reduce kWh and cavitation risk. CIP optimization - shorter cycles, right-sized flow rates, and recovery loops - cuts water and chemical use. Many buyers evaluate total cost over asset life, rewarding designs that balance efficiency, reliability, and cleanability.

- Materials and surface finish underpin hygienic risk control. 316L stainless remains standard, with tighter Ra finishes and electropolishing where needed. Expanded elastomer portfolios (EPDM, FKM, FFKM, PTFE) address aggressive cleaners and solvents in pharma and cosmetics. Documentation (material traceability, conformity certificates) is a baseline expectation in regulated environments.

- Architecture choice remains application-specific. Centrifugal suits high-flow, low-viscosity transfer and CIP loops; AODD excels in intermittent, self-priming duties and solids. Lobe and twin-screw deliver gentle handling for viscous and particulate media. Progressive cavity and peristaltic provide stable flow for dosing and filtration feed, with peristaltic favored where sterile, disposable paths are required.

- Aftermarket and service density are decisive differentiators. Lead-time reliability, local part stocking, seal/elastomer availability, and certified service partners affect plant uptime. Retrofit kits (efficient motors, new seals, upgraded rotors/screws) extend asset life. Structured service contracts and training reduce variability and lock in vendor relationships.

- Supply-chain resilience and standards convergence shape sourcing. Buyers increasingly dual-source critical sizes and harmonize specs across global plants. Compliance with 3-A, EHEDG, ATEX, and evolving documentation norms simplifies multi-region audits. Vendors with global manufacturing footprints and validated test facilities stand out in enterprise-wide framework agreements.

Sanitary Pumps Market Reginal Analysis

North America

Demand is supported by stringent food safety regulation and an active craft beverage and specialty foods ecosystem that values flexible, small-batch equipment. Pharma/biotech investment remains strong, with emphasis on sterile boundaries, data integrity, and single-use compatibility. Sustainability metrics - energy per batch, water per CIP - feature in capex justifications. Distributors and integrators with 24/7 service coverage and validated spare kits are influential in vendor selection.Europe

A mature hygiene culture and rigorous conformity regimes (3-A/EHEDG, ATEX) set high specification baselines. Twin-screw and magnetically coupled designs see strong adoption in multipurpose plants focused on changeover speed and allergen control. Breweries and dairy producers drive continuous improvement in cleanability and OEE. Local manufacturing, documentation depth, and lifecycle cost models weigh heavily in tenders, alongside decarbonization roadmaps for utilities.Asia-Pacific

Rapid capacity additions in dairy alternatives, snacks, personal care, and pharma elevate demand for scalable, easy-to-operate sanitary pumps. Greenfield projects often specify integrated skids with digital monitoring and remote commissioning to offset skills gaps. Regional buyers seek a balance between global brands and competitive local suppliers, with emphasis on service coverage, lead times, and standards alignment for exports.Middle East & Africa

Investments cluster around beverages, dairy processing, and personal care, often in modernized, energy-efficient plants designed for water stewardship. Hygiene compliance and reliable service support are key, favoring vendors with strong regional partners. Pharma formulations and nutraceuticals are emerging pockets, where single-use and validated cleaning are differentiators for new facilities.South & Central America

Food and beverage expansions - especially juices, dairy, and brewery - anchor demand, with growing interest in hygienic upgrades to legacy lines. Buyers prioritize robust designs that handle variable utilities and raw-material characteristics, plus accessible service and spares. Export-oriented plants aim for documentation and standards parity with North America/Europe, pushing adoption of advanced sealing, CIP validation, and efficiency-focused retrofits.Sanitary Pumps Market Segmentation

By Type

- Kinetic sanitary pumps

- Positive displacement (PD) sanitary pumps

By End-user

- Food and beverage

- Pharmaceutical and biotechnology applications

- Others

Key Market players

Alfa Laval AB, GEA Group AG, SPX FLOW Inc., Fristam Pumps USA, Xylem Inc., PSG Dover Corporation, KSB SE & Co. KGaA, ITT Bornemann GmbH, Grundfos Holding A/S, Tapflo Group, Viking Pump Inc., Ampco Pumps Company, Flowserve Corporation, Watson-Marlow Fluid Technology Group, Verder Liquids.Sanitary Pumps Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Sanitary Pumps Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Sanitary Pumps market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Sanitary Pumps market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Sanitary Pumps market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Sanitary Pumps market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Sanitary Pumps market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Sanitary Pumps value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Sanitary Pumps industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Sanitary Pumps Market Report

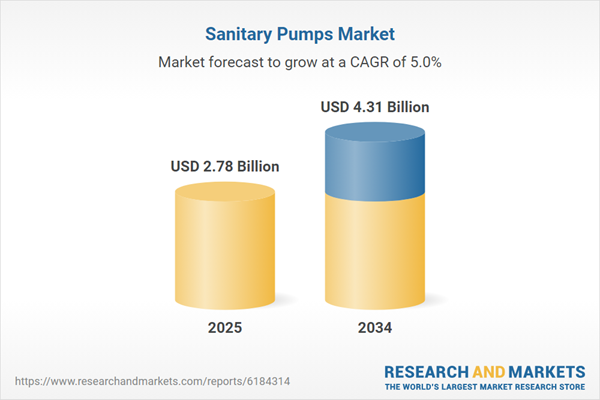

- Global Sanitary Pumps market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Sanitary Pumps trade, costs, and supply chains

- Sanitary Pumps market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Sanitary Pumps market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Sanitary Pumps market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Sanitary Pumps supply chain analysis

- Sanitary Pumps trade analysis, Sanitary Pumps market price analysis, and Sanitary Pumps supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Sanitary Pumps market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Alfa Laval AB

- GEA Group AG

- SPX FLOW Inc.

- Fristam Pumps USA

- Xylem Inc.

- PSG Dover Corporation

- KSB SE & Co. KGaA

- ITT Bornemann GmbH

- Grundfos Holding A/S

- Tapflo Group

- Viking Pump Inc.

- Ampco Pumps Company

- Flowserve Corporation

- Watson-Marlow Fluid Technology Group

- Verder Liquids.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.78 Billion |

| Forecasted Market Value ( USD | $ 4.31 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |