Oxygen Barrier Films and Coatings for Dry Food Market

The Oxygen Barrier Films & Coatings for Dry Food market serves cereals and granola, savory snacks and extrudates, bakery and biscuits, nuts and dried fruit, pasta and pulses, spices and herbs, powdered beverages, infant and clinical nutrition powders, dehydrated meals, and dry pet food. Solutions span coextruded polyolefin structures with EVOH or PVOH, metallized OPP and PET, clear-barrier AlOx/SiOx-coated films, paper-film laminates with dispersion or acrylic barriers, and emerging mono-material PE/PP platforms engineered for recyclability. Current priorities emphasize longer shelf-life under MAP or nitrogen flushing, aroma retention for spice- and oil-rich matrices, e-commerce durability, downgauging without performance loss, and credible end-of-life claims aligned to retailer scorecards. Competitive advantage accrues to converters delivering low OTR at thin gauges, broad sealing windows with seal-through-contamination on dusty lines, abrasion resistance in club/e-commerce formats, high VFFS/HFFS speeds with stable COF, and strong print receptivity for water-based and EB systems. Resin and aluminum price swings, vacuum-deposition and coating capacity, and tie-layer chemistries influence cost-to-serve and continuity. On the regulatory side, recyclability labeling, EPR trajectories, mineral-oil and NIAS scrutiny, PFAS-free processing, and the phase-down of halogenated barriers shape specifications and audit readiness. The full report details material stacks and barrier retention after creasing, machinability benchmarks by pack style, migration and aroma-scalp management, active packaging options, and sourcing playbooks that balance sustainability, line efficiency, and brand protection.Oxygen Barrier Films and Coatings for Dry Food Market Key Insights

- Mono-material architectures are becoming the default brief. Brands increasingly request PE- or PP-based structures with EVOH/PVOH or clear inorganic barriers to meet recyclability targets without compromising shelf-life. Success hinges on stiffness via MDO, zipper compatibility, and seal integrity in the presence of powders and seasonings. Qualification is accelerated when converters demonstrate drop-in runnability on legacy jaws at commercial speeds. Credible on-pack claims require evidence of compatibility with prevailing collection streams. Material simplification also reduces changeover times and SKU complexity across plants.

- EVOH remains the backbone, while clear-barrier coatings close critical gaps. EVOH coextrusions deliver robust oxygen protection but demand humidity-aware design and precise tie-layer selection. AlOx/SiOx coatings add transparency, metal detector compatibility, and premium shelf appeal where windows matter. Water-based acrylic and PVOH coatings enable mono-PE with competitive OTR when paired with protective topcoats. The race is in barrier retention under flex and VFFS abuse, where primer systems and post-deposition lacquers differentiate. Suppliers who validate performance after creasing and simulated distribution earn preferred status.

- Paper-leaning and dispersion-barrier options answer retailer mandates - selectively. Paper-film laminates support tactile branding and recyclability narratives, yet must clear hurdles on grease and aroma for nuts and spices. Heat-seal windows, tear initiation, and moisture interactions can narrow operating latitude on high-speed lines. When well-engineered, hybrid packs reduce plastic mass while maintaining shelf-life for mid-risk dry categories. Clear guidance on disposal and ink/adhesive compliance is vital to avoid returns. Dual-spec paths (paper hybrid and mono-PE) hedge policy shifts without requalifying the product.

- Active oxygen management expands the design space for sensitive dry goods. Integrated scavenging layers, labels, or sachets stabilize volatiles, color, and nutrients in nuts, infant powders, and dehydrated meals. New chemistries embedded in PE reduce consumer touchpoints while preserving recyclability claims. Shelf-life modeling lets teams tune scavenger loading to route and climate. Clear SOPs prevent overdosing and off-notes. The economics strengthen when export, promotions, or long dwell times are routine.

- Machinability is the biggest lever on total cost of ownership. High-barrier films must run fast with low curl, controlled COF, and wide seal windows to limit scrap. Down-gauging lifts risk of pinholes and flex cracking; resin selection, orientation strategy, and coating toughness are therefore pivotal. Antistatic treatments calibrated to coatings prevent charge build-up in spice dosing and chute flow. Converters that pair trials with jaw-profile tuning and real scrap analytics create stickiness. Exact-count change parts and roll mapping further reduce downtime.

- E-commerce and club packs demand tougher barriers and reclose features. Multi-touch distribution amplifies scuffing and corner breaks; reinforced gussets, edge-strengthened laminates, and abrasion-resistant topcoats protect barrier layers. Zippers, sliders, and peel-reseal are moving from premium to standard in family-size formats. Transparent windows push specifications toward AlOx/SiOx rather than metallized PET. Meeting transport protocols without over-spec’ing gauges preserves margin while maintaining shelf aesthetics after delivery.

- Aroma and light protection are decisive even for “dry” matrices. Essential oils and delicate actives in spices and flavored snacks demand aroma barrier beyond oxygen control. Metallized and clear-barrier films provide dual protection, while UV-blocking additives shield color and nutrients. Coffee-adjacent dry mixes may require valves or hybrid structures to manage trapped gases. Sensory parity after accelerated aging is increasingly a gate in vendor approvals. Data-driven aroma-scalp mitigation guides adhesive and ink choices.

- Digital print readiness and solvent-light printrooms cut lead time and risk. Water-based and EB-curable systems lower VOCs and migration concerns while enabling shorter runs and seasonal SKUs. Heat-sensitive coatings call for low-temperature cure to preserve barrier. Variable data supports traceability and anti-tamper features. Converters that integrate prepress, window registration, and compliance dossiers consistently shorten art-to-shelf. Print adhesion on AlOx without haze remains a practiced skill.

- Supply resilience requires dual-path materials and regional assets. EVOH resin tightness, metallization capacity, and aluminum volatility can disrupt launches; qualifying both coex and clear-coated routes stabilizes supply. Regional coating/metallizing footprints compress lead times and reduce transit damage on wide webs. Transparent surcharge frameworks and resin indices improve trust in pricing. Strategic stocking of primers, tie-layers, and zipper profiles prevents small parts from stalling big lines.

- Compliance, labeling, and audits now shape win rates as much as price. Retailer and regulator expectations around recyclability, PFAS, halogens, mineral-oil, and NIAS are pushing portfolios toward safer, simpler stacks. Documented change control, migration testing, and rapid Q&A are bid-critical. Harmonized claims across export destinations reduce relabeling and risk. Lifecycle narratives that combine downgauging, validated shelf-life, and realistic end-of-life pathways resonate in category reviews.

- Product segmentation is widening across shells, formats, and use cases. Acrylic portable tubs dominate premium aesthetics and hydrotherapy performance; roto-molded units attract first-time buyers seeking durability and value; inflatables expand seasonal and rental use; in-ground tubs align with custom landscaping; swim spas address fitness and all-season training. Differentiation hinges on jet architecture, lounger vs. open bench layouts, and noise/vibration mitigation for dense neighborhoods.

- Energy efficiency is now a primary purchase criterion, not a nice-to-have. Multi-layer insulation, full-foam cavities, efficient heaters, and tight thermal covers reduce running costs and address grid/price volatility. App-enabled scheduling, eco modes, and standby settings translate to measurable savings. Brands that publish third-party verified consumption data and offer cold-climate packages win trust with cost-conscious households and property managers.

- Connected, monitored tubs reduce service friction and elevate ownership experience. Wi-Fi controls, fault codes, and push alerts enable proactive maintenance, while dealer portals streamline diagnostics, parts readiness, and first-visit fix rates. Over-the-air firmware, consumables reminders, and chemistry assistants (sensor-guided dosing) cut user errors. Connectivity also supports extended warranties tied to data-backed care compliance.

- Hygiene and water-care innovation shape brand preference. Layered systems - high-flow filtration, UV/ozone oxidation, enzyme aids, and antimicrobial surfaces - limit biofilm buildup and chemical spikes. Quick-change filter cartridges, drain-assist plumbing, and purge cycles simplify turnarounds in hospitality and rentals. Clear communication on chemistry options (chlorine, bromine, mineral/low-chlorine) reduces perceived complexity and increases repeat use.

- Design language and backyard integration matter more to new cohorts. Contemporary skirting, concealed hardware, quiet lids, and flush jets complement modern decks and pergolas. Compact footprints, corner shapes, and privacy solutions expand addressable spaces. Colorways coordinated with outdoor kitchens and fire features support upselling of curated bundles, while lighting/audio packages enhance social use and perceived value.

- Route-to-market agility is decisive in volatile demand cycles. Strong brick-and-mortar dealer coverage ensures demos, financing, and white-glove installs; DTC suits inflatables and some entry roto-molded units; builder/specifier channels dominate in-ground and multifamily. Brands balancing inventory near demand centers, offering rapid delivery windows, and coordinating crane/installation logistics secure higher close rates and referral flywheels.

- Aftermarket, service, and accessories drive lifetime economics. Water-care chemicals, filters, covers, steps, lifters, pergolas, and seasonal tune-ups represent durable annuities. Subscription chemistry and filter programs improve retention and margin mix. Easy-access equipment bays and standardized components lower service labor, while extended warranties and service plans de-risk ownership for first-time buyers.

- Compliance, safety, and local permitting shape specifications and lead times. Electrical bonding, GFCI, barrier requirements, suction/entrapment standards, and cover ratings vary by jurisdiction. Builders and dealers that package permitting, installation, and inspection pass-throughs remove friction. Documented conformity and installer certification are often prerequisites for hospitality bids and multifamily procurements.

- Supply resilience and component integration are competitive moats. Vertical integration across shells, frames, covers, and control packs stabilizes quality and lead times. Dual-sourcing of pumps/heaters, standardized harnesses, and modular control architectures simplify repairs. Freight optimization, knock-down packaging where feasible, and regional assembly strategies mitigate shipping costs and reduce damage rates.

Oxygen Barrier Films and Coatings for Dry Food Market Reginal Analysis

North America

Brand and retailer programs emphasize mono-PE or mono-PP with EVOH or clear-barrier coatings, backed by recognizable recyclability labels. Trials prioritize VFFS/HFFS speed, zipper performance, and seal-through-contamination for powders and cereals. Club and e-commerce formats drive abrasion-resistant topcoats and reinforced gussets. Dry pet food pushes thicker gauges and puncture resistance, while snacks and granola focus on downgauging and high clarity. Converters with nearby coating assets and technical field support win multi-plant awards.Europe

Policy momentum accelerates PVDC substitution, source reduction, and paper-leaning hybrids where performance allows. Migration and mineral-oil scrutiny influences ink, adhesive, and overprint selections, favoring water-based and EB systems. Discounters lean on robust metallized OPP for value tiers, while premium brands adopt AlOx/SiOx for transparency and metal detection compatibility. Legacy equipment fleets require broad COF and seal latitude to maintain speed. Harmonized recyclability claims across markets simplify rollouts.Asia-Pacific

Expansion in packaged snacks, spices, and instant beverages fuels demand for cost-effective metallized OPP, with tier-one brands piloting clear-barrier and mono-PE for export. High humidity and logistics variability raise the bar for strong seals, antistatic tuning, and crease-resistant coatings. Regional resin and converting integration supports fast launches and localization. Exporters adapt specs to destination compliance and recyclability norms. Service reach and on-site line support are decisive for repeat orders.Middle East & Africa

Nuts, dates, spices, and instant beverages anchor adoption, with high ambient temperatures elevating needs for robust aroma and oxygen barriers. Import reliance blends metallized PET/OPP with clear-barrier windows for premium positioning. Retailers value reclose features in family packs and thicker films for repeated openings. Converter proximity, spare-parts availability, and responsive service teams influence vendor selection. Compliance documentation and food-contact assurance remain front-of-mind.South & Central America

Value-centric cereals, snacks, and powdered beverages favor metallized films, while exporters upgrade to AlOx/SiOx or EVOH coex to withstand long routes. Currency and freight volatility increase interest in downgauging and dual-source designs. Larger zipper pouches gain share in modern trade, with reinforced gussets for e-commerce. Local regulatory alignment with major export destinations guides coatings and ink systems. Reliable dealer service and access to consumables underpin brand loyalty.Oxygen Barrier Films and Coatings for Dry Food Market Segmentation

By Type

- Pouches

- Lid Stock

By Application

- Baked Goods

- Confectionary

- Rice

- Pasta and Noodles

- Cereals

- Others

Key Market players

Amcor, Mondi, Sealed Air, Berry Global, Huhtamaki, Coveris, Sonoco, UFlex, Jindal Films, Taghleef Industries, Innovia Films (CCL Industries), Toppan, Dai Nippon Printing (DNP), Kuraray (EVAL/EVOH & PVOH), Mitsubishi Gas Chemical (MXD6), Toray Industries, Toyobo, Mitsubishi Polyester Film, Celanese (PVOH), Michelman (barrier coatings)Oxygen Barrier Films and Coatings for Dry Food Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Oxygen Barrier Films and Coatings for Dry Food Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Oxygen Barrier Films and Coatings for Dry Food market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Oxygen Barrier Films and Coatings for Dry Food market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Oxygen Barrier Films and Coatings for Dry Food market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Oxygen Barrier Films and Coatings for Dry Food market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Oxygen Barrier Films and Coatings for Dry Food market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Oxygen Barrier Films and Coatings for Dry Food value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Oxygen Barrier Films and Coatings for Dry Food industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Oxygen Barrier Films and Coatings for Dry Food Market Report

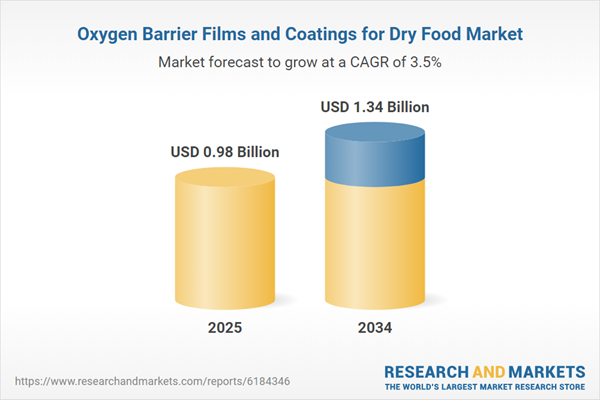

- Global Oxygen Barrier Films and Coatings for Dry Food market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Oxygen Barrier Films and Coatings for Dry Food trade, costs, and supply chains

- Oxygen Barrier Films and Coatings for Dry Food market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Oxygen Barrier Films and Coatings for Dry Food market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Oxygen Barrier Films and Coatings for Dry Food market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Oxygen Barrier Films and Coatings for Dry Food supply chain analysis

- Oxygen Barrier Films and Coatings for Dry Food trade analysis, Oxygen Barrier Films and Coatings for Dry Food market price analysis, and Oxygen Barrier Films and Coatings for Dry Food supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Oxygen Barrier Films and Coatings for Dry Food market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amcor

- Mondi

- Sealed Air

- Berry Global

- Huhtamaki

- Coveris

- Sonoco

- UFlex

- Jindal Films

- Taghleef Industries

- Innovia Films (CCL Industries)

- Toppan

- Dai Nippon Printing (DNP)

- Kuraray (EVAL/EVOH & PVOH)

- Mitsubishi Gas Chemical (MXD6)

- Toray Industries

- Toyobo

- Mitsubishi Polyester Film

- Celanese (PVOH)

- Michelman (barrier coatings)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 0.98 Billion |

| Forecasted Market Value ( USD | $ 1.34 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |