Heat Treated Flour Market

Heat treated flour is thermally processed to reduce microbial load and tailor functionality, enabling safe use in ready-to-eat, no-bake, and short-process applications. It is widely adopted across edible cookie doughs, bakery fillings and toppings, batter & breading systems, sauces and gravies, confectionery inclusions, dusting flour, and premium instant mixes. On the technology side, suppliers deploy validated dry-heat, steam, infrared, drum-drying, and extrusion-based systems to deliver lethality while dialing in water absorption, viscosity, oil-binding, and enzyme inactivation for consistent performance. Demand is propelled by food safety expectations, FSMA/HACCP-driven preventive controls, the rise of direct-to-consumer baking kits, and the expansion of clean-label snacks that avoid chemical sterilants. Formulators are shifting toward specialty bases - gluten-free (rice, oat, corn), ancient grains, and pulse flours - seeking label-friendly thickening and texture with stable shelf life. Competitive intensity is increasing as global millers add dedicated thermal lines, smaller specialists target high-value segments, and private-label co-manufacturers standardize kill-step validation as a procurement requirement. Differentiation hinges on robust validation data, batch-to-batch functional tightness, allergen-segregated plants, and rapid customization for customer-specific particle sizes and hydration curves. Sustainability is emerging through energy-efficient kilns, heat-recovery loops, and responsible wheat and alternative-grain sourcing. Overall, the market is transitioning from “niche risk-mitigation ingredient” to “multi-functional platform,” embedded in new product pipelines for safe indulgence, convenient meal solutions, and premium texture systems across retail, foodservice, and industrial channels.Heat Treated Flour Market Key Insights

- Safety-led adoption: Brand owners increasingly specify heat treated flour where no post-mix kill step exists. Validated thermal processes, environmental monitoring, and tight specification controls are now standard gatekeepers for vendor approval in RTE doughs, inclusions, and dusting applications. This institutionalizes demand beyond episodic safety reactions.

- Functionality as a value lever: Beyond lethality, processors tune denatured protein and starch behavior to achieve target viscosity, reduced stickiness, better machinability, and controlled water activity. The ability to guarantee these functional endpoints batch-after-batch is a prime reason formulators lock in supply contracts.

- Portfolio broadening to non-wheat: Growth in gluten-free and better-for-you launches accelerates adoption of heat treated rice, oat, corn, sorghum, and pulse flours. These options provide clean-label thickening and binding, enabling allergen-managed lines and expanding addressable use cases in snacks and instant meals.

- Premiumization in bakery and dessert kits: Edible cookie doughs, cake and brownie kits, and spoonable desserts depend on heat treated flour for safe consumption without baking. Co-manufacturers emphasize smooth mouthfeel and controlled particle size distribution, creating a quality ladder within premium private label.

- Advances in processing technology: Suppliers invest in continuous dry-heat, steam, and infrared systems with precise residence-time/temperature controls and inline monitoring. New lines focus on faster changeovers, segregated allergen flow, and energy recovery to reduce per-ton processing footprints and downtime.

- Regulatory and QA differentiation: FSMA-aligned validation, HACCP plans, and strong traceability are decisive in audits. Suppliers that provide documented lethality data, environmental monitoring trends, and application-specific guidance shorten customers’ commercialization timelines and win repeat business.

- Clean-label and reformulation tailwinds: As formulators retire chemical sterilants and reduce modified starches, heat treated flour fills both safety and texturizing roles. This supports “no artificial additives” and short-ingredient lists while maintaining viscosity and freeze-thaw stability in sauces and fillings.

- Foodservice and QSR use cases: Batter & breading systems, par-fried items, and finishing dusts rely on low-pathogen risk and consistent pickup/adhesion. Central kitchens value predictable hydration and reduced clumping, cutting waste and improving line speed across large-scale operations.

- Supply assurance and customization: Buyers prioritize dual-sourcing, geographic redundancy, and rapid cutover between wheat classes and alternative grains. Customized specs - granulation, absorption, and viscosity windows - are increasingly written into SLAs, embedding suppliers deeper in R&D and procurement workflows.

- Sustainability and cost discipline: Energy-efficient kilns, heat-recovery, and responsible grain sourcing bolster ESG narratives while stabilizing cost-to-serve. Packaging optimization for smaller e-commerce formats and bulk industrial packs reduces logistics complexity and supports omnichannel growth.

Heat Treated Flour Market Reginal Analysis

North America

Adoption is entrenched in edible cookie doughs, premium baking kits, and QSR breading systems, supported by rigorous retailer/private-label standards. Large millers operate validated thermal lines with allergen-segregated plants, offering rapid prototyping and technical service to accelerate commercialization. Clean-label reformulation and removal of chemical sterilants favor heat treated flour as a dual-purpose safety and texture solution. Foodservice distribution networks enable broad penetration into commissaries and central kitchens. Sustainability initiatives emphasize heat-recovery and renewable energy at milling and thermal sites to meet customer ESG scorecards.Europe

Demand is shaped by stringent retailer audits, precautionary food safety culture, and strong private-label penetration. Multigrain, organic, and ancient-grain programs align with consumer preferences for minimally processed, traceable ingredients. Manufacturers emphasize continuous processes and documentation depth, including allergen control and environmental monitoring. Heat treated flour supports pastry, confectionery, and dessert inclusions where no post-bake lethal step exists. Energy efficiency and decarbonization of thermal processes are procurement differentiators, with suppliers piloting electrified or hybrid heating technologies.Asia-Pacific

Fast-growing adoption is driven by modern trade expansion, ready-to-eat snacking, and growth in bakery café chains. Regional suppliers scale steam and infrared systems to serve diversified bases including wheat, rice, and oat, meeting gluten-free and localized taste profiles. Governments’ food safety modernization and large brand investments in validation uplift baseline specifications. Co-manufacturing ecosystems support agile SKU launches in desserts, instant mixes, and snack coatings. Export-oriented producers leverage cost-competitive capacity and documented quality systems to win multinational contracts.Middle East & Africa

Market development centers on industrial bakeries, confectionery, and quick-service formats, with increasing reliance on imported wheat and regionally milled alternatives. Heat treated flour helps standardize quality under varying ambient conditions, improving dough handling and shelf stability. International brands and regional co-packers adopt validated ingredients to meet franchise and audit requirements. Capacity additions focus on flexible lines capable of fast changeovers and tight microbiological standards. Training and technical service from global suppliers support application uptake across sauces, breadings, and dessert mixes.South & Central America

Growth is led by modern bakery, confectionery, and frozen foods where safe, short-process production is expanding. Suppliers emphasize documentation, traceability, and consistent functionality to satisfy retailer audits and export ambitions. Heat treated wheat and regional grains (e.g., corn) address clean-label thickening and texture needs in sauces and snacks. As foodservice chains scale, batter & breading systems benefit from predictable pickup and reduced clumping under humid conditions. Sustainability investments in energy efficiency and packaging rationalization aid cost control and broaden acceptance among multinational buyers.Heat Treated Flour Market Segmentation

By Type

- Organic

- Conventional

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Key Market players

Ardent Mills, ADM Milling, Bay State Milling Company, Grain Craft, Siemer Specialty Ingredients (Siemer Milling Company), The Mennel Milling Company, Miller Milling Company, Limagrain Ingredients, GoodMills Group, Dossche Mills, Whitworth Bros., Grands Moulins de Paris (VIVESCIA), Nisshin Seifun Group, NIPPN (Nippon Flour Mills), Showa SangyoHeat Treated Flour Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Heat Treated Flour Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Heat Treated Flour market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Heat Treated Flour market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Heat Treated Flour market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Heat Treated Flour market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Heat Treated Flour market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Heat Treated Flour value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Heat Treated Flour industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Heat Treated Flour Market Report

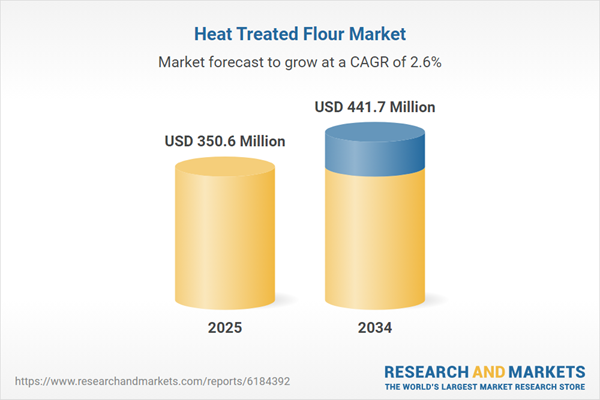

- Global Heat Treated Flour market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Heat Treated Flour trade, costs, and supply chains

- Heat Treated Flour market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Heat Treated Flour market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Heat Treated Flour market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Heat Treated Flour supply chain analysis

- Heat Treated Flour trade analysis, Heat Treated Flour market price analysis, and Heat Treated Flour supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Heat Treated Flour market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ardent Mills

- ADM Milling

- Bay State Milling Company

- Grain Craft

- Siemer Specialty Ingredients (Siemer Milling Company)

- The Mennel Milling Company

- Miller Milling Company

- Limagrain Ingredients

- GoodMills Group

- Dossche Mills

- Whitworth Bros.

- Grands Moulins de Paris (VIVESCIA)

- Nisshin Seifun Group

- NIPPN (Nippon Flour Mills)

- Showa Sangyo

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 350.6 Million |

| Forecasted Market Value ( USD | $ 441.7 Million |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |