Alkyl Polyglucoside Surfactant Market

Alkyl polyglucosides (APGs) are a class of non‑ionic surfactants derived from glucose (typically from starch) and fatty alcohols, offering high biodegradability, low toxicity, mild skin/eye irritation profile and excellent compatibility in formulations. Their appeal lies in replacing more traditional petro‑based or more aggressive surfactants in personal care, home‑care cleaning, industrial detergents and even agrochemical formulations. In applications they are used as primary cleansing/foaming agents (shampoos, body washes, dishwashing liquids), co‑surfactants or stabilisers in mild formulations (baby care, sensitive skin lines), and in industrial cleaning or specialty cleaning where regulatory pressure for greener chemistry is mounting. Recent market trends include the sustainability mandate (consumer and regulatory), growth of bio‑based ingredient claims in personal care and household care, the rise of natural/clean‑label formulations, and the migration of industrial cleaning users toward eco‑friendly chemistries. Key drivers include more stringent environmental and chemical‑regulation regimes (especially in Europe and North America), rising consumer awareness of mild/eco‑friendly products, increasing premiumisation of personal care and home‑care products, and expansion of cleaning/household product penetration in emerging markets. The competitive landscape is characterised by major speciality chemical players (e.g., BASF SE, Clariant AG, Croda International Plc, Huntsman Corporation) that supply APG grades, as well as smaller niche firms and regional producers focusing on cost‑effective or local feed‑stocks. Other market considerations include feed‑stock cost volatility (fatty alcohols, glucose/starch derivatives), scale‑economics of APG production (which historically has been higher cost than conventional surfactants), technical performance parity in more demanding applications (industrial cleaning, heavy soil removal), and regional supply chain variances (emerging market adoption vs mature markets). Overall, the APG surfactant market is at a phase where its premium/eco‑friendly positioning is driving growth, and with further cost‑reductions, production scale‑up and application‑breadth expansion, the market is poised to widen considerably.Alkyl Polyglucoside Surfactant Market Key Insights

- Sustainability credentials are core to value proposition

- Consumer personal care and home care drive demand

- Regulatory/regulatory premiumisation boost adoption

- Emerging markets represent upside potential

- Feed stock and production cost remain barriers

- Industrial cleaning and niche sectors are secondary growth pockets

- Technical performance evolution supports broader use

- Supply chain localisation and regional manufacturing matter

- Premium pricing may narrow as scale increases

- Emerging substitution risk from alternative “green” surfactants

Alkyl Polyglucoside Surfactant Market Reginal Analysis

North America

In North America the APG surfactant market is well‑established in personal‑care and premium home‑care segments. Consumer awareness around “clean ingredients” and strong presence of speciality formulators support uptake. Suppliers benefit from mature feed‑stock markets (fatty alcohols, sugar derivatives) but face cost pressure and increasing value‑based competition. Growth is solid though not as rapid as emerging markets, and premiumisation continues to drive higher ASP (average selling price).Europe

Europe represents one of the most favourable geographies for APG adoption, propelled by strict environmental regulation, strong consumer demand for sustainable products and wide penetration of eco‑certified cleaning/personal‑care brands. Household‑cleaning and personal‑care formulators increasingly specify APGs for “green” credentials. Though margin pressure and feed‑stock cost inflation exist, the region continues to lead in specification and innovation, including niche high‑purity grades.Asia‑Pacific

Asia‑Pacific offers the fastest growth potential for APGs. Rapid urbanisation, rising incomes, expansion of household‑care and personal‑care consumption, and higher environmental/sustainability awareness are combining to drive demand. Countries such as China, India, South‑Korea and Southeast‑Asia are expanding manufacturing and consumption. However, local feed‑stock cost, scale, and awareness are still weaker in many countries, so growth is from a lower base.Middle East & Africa

In the Middle East & Africa region the APG market is still emerging. Demand is driven by high‑end personal‑care imports, increasing household‑cleaning premiumisation in urban centres, and rising regulatory interest in greener chemistry. Constraints include higher import cost, less developed local manufacture, and lower per‑capita spend. Growth will likely be incremental but attractive for regional supplier partnerships.South & Central America

In South & Central America the APG market is developing with increasing demand in household cleaners and personal‑care premium segments in Brazil, Mexico and Argentina. Economic variability, import cost sensitivity and lower formulation‑specification maturity slow pace, but regional formulators are increasingly switching to APGs for green credentials. Local sourcing and cost‑effective grades may unlock growth.Alkyl Polyglucoside Surfactant Market Segmentation

By Primary Function

- Cleansing Agents

- Emulsifying Agents

- Wetting Agents

- Degreasing Agents

- Solubilizing Agents

- Hydrotopes

- Foaming Agents

By Application

- Home Care

- Personal Care

- Industrial & Institutional

Key Market players

BASF, Dow, Clariant, Solvay, Croda, Evonik, Nouryon, Kao Chemicals, Galaxy Surfactants, Seppic, Pilot Chemical, Yangzhou Chenhua New Material, Zhejiang Huangma Chemical, Yixing Jinlan Chemical, Jiangsu Hengxing New MaterialAlkyl Polyglucoside Surfactant Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Alkyl Polyglucoside Surfactant Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Alkyl Polyglucoside Surfactant market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Alkyl Polyglucoside Surfactant market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Alkyl Polyglucoside Surfactant market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Alkyl Polyglucoside Surfactant market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Alkyl Polyglucoside Surfactant market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Alkyl Polyglucoside Surfactant value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Alkyl Polyglucoside Surfactant industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Alkyl Polyglucoside Surfactant Market Report

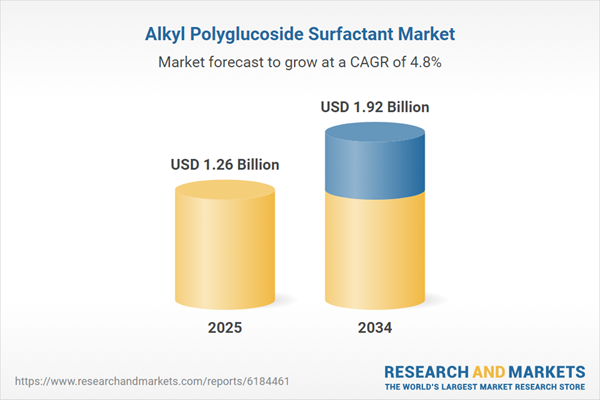

- Global Alkyl Polyglucoside Surfactant market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Alkyl Polyglucoside Surfactant trade, costs, and supply chains

- Alkyl Polyglucoside Surfactant market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Alkyl Polyglucoside Surfactant market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Alkyl Polyglucoside Surfactant market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Alkyl Polyglucoside Surfactant supply chain analysis

- Alkyl Polyglucoside Surfactant trade analysis, Alkyl Polyglucoside Surfactant market price analysis, and Alkyl Polyglucoside Surfactant supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Alkyl Polyglucoside Surfactant market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF

- Dow

- Clariant

- Solvay

- Croda

- Evonik

- Nouryon

- Kao Chemicals

- Galaxy Surfactants

- Seppic

- Pilot Chemical

- Yangzhou Chenhua New Material

- Zhejiang Huangma Chemical

- Yixing Jinlan Chemical

- Jiangsu Hengxing New Material

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.26 Billion |

| Forecasted Market Value ( USD | $ 1.92 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |