Clean Beauty Market

The Clean Beauty Market comprises skincare, haircare, color cosmetics, body care, sun protection, baby/pregnancy-safe lines, and personal hygiene positioned around ingredient safety, transparency, and environmental responsibility. Top applications/end-uses include daily face and body routines, sensitive-skin dermocosmetics, mineral and hybrid suncare, scalp/skin microbiome care, and multi-functional makeup with skincare actives. The latest trends emphasize shorter INCI lists, allergen-aware fragrance strategies, reef-conscious UV filters, microbiome-friendly surfactants, and refillable or concentrated formats that cut packaging. Brands invest in life-cycle assessments, traceable natural and biotech-derived actives, and third-party clean standards or retailer “free-from” frameworks. Driving factors include rising consumer literacy, dermatology-influenced education, social media transparency, retailer curation, and corporate sustainability targets that embed eco-design into portfolios. The competitive landscape blends global beauty houses expanding “conscious” lines, pharmacy dermocosmetic leaders, indie naturals, private labels, and specialty contract manufacturers with green chemistry and fermentation capabilities. Differentiation centers on credible safety substantiation, clinically tested efficacy, elegant sensorials, and packaging circularity (recyclable mono-materials, refills). Challenges persist: greenwashing scrutiny, regulatory divergence across regions, cost and supply volatility for certified inputs, preservation efficacy in low-synthetic systems, and stability for mineral filters and waterless formats. M&A and retailer exclusives accelerate scale and internationalization, while digital channels enable education and subscription replenishment. Overall, clean beauty is shifting from “free-from” lists to science-anchored, performance-first products that balance skin tolerance, measurable results, and lower environmental impact across the full product life cycle.Clean Beauty Market Key Insights

- From “free-from” to “proof-of-safe.” Brands move beyond negative lists toward toxicology dossiers, cumulative exposure thinking, and transparent safety margins - reducing greenwashing risk while satisfying retailer audits.

- Dermocosmetic credibility rises. Sensitive-skin, acne-prone, and rosacea-friendly lines pair low-irritancy bases with evidence-backed actives (niacinamide, ceramides, PHA). Clinical imagery and instrumental data drive conversion.

- Biotech as a clean engine. Fermented and bio-identical actives offer potency with lower land/water use; precision fermentation mitigates crop variability and supports vegan claims without purity trade-offs.

- Mineral & hybrid suncare improves wear. Micro-treated pigments, film formers, and emulsion design reduce white cast and pilling; photo-stability and blue-light narratives broaden daily use beyond beach contexts.

- Microbiome-aware cleansing. Mild surfactants, balanced pH, and pre/postbiotics protect barrier function - key to long-term adherence and reduced sensitivity complaints in clean portfolios.

- Waterless & concentrated formats. Solids, sticks, and powders cut transport emissions and plastic; success depends on sensorial excellence, dissolution behavior, and preservation in low-water systems.

- Packaging circularity matures. Refillable pods, aluminum/mono-material bottles, and PCR plastics progress; design for disassembly and pump compatibility determine real-world recyclability.

- Retailer standards shape assortments. Store-specific “clean” frameworks and ingredient blacklists influence formulation roadmaps; harmonizing claims across geographies becomes a core regulatory skill.

- Inclusive shade and texture design. Clean color cosmetics expand shade ranges and sweat-/mask-resistance; haircare addresses textured hair with silicone-light slip systems and build-up control.

- Supply resilience is strategic. Dual-sourcing botanicals, authenticated supply chains, and standardized extracts stabilize quality; digital batch traceability supports claims and recall readiness.

Clean Beauty Market Reginal Analysis

North America

Retailer “clean” badges and dermatologist-led education shape assortments across specialty and mass channels. Consumers demand fragrance-moderated, sensitive-skin options with clinical receipts. DTC and marketplaces drive discovery; subscriptions and minis power trial. Sustainability expectations emphasize PCR packaging and refills, while litigation risk elevates claim substantiation and allergen transparency.Europe

Stringent safety and environmental norms favor conservative fragrance use, allergen disclosure, and eco-design. Pharmacy dermocosmetics and grocery/drug chains blend premium and private-label clean lines. Life-cycle data, recyclability, and refill infrastructure influence listings. Mineral suncare and sensitive-skin routines dominate in urban markets, with strong interest in certified natural and vegan portfolios.Asia-Pacific

High skincare literacy and fast innovation cycles accelerate biotech actives, lightweight textures, and layering-friendly formats. Korea/Japan set sensorial standards; China’s digital commerce scales education and community reviews. Humid climates favor non-comedogenic, quick-absorb products; Australia/New Zealand emphasize reef-minded suncare. Local CMOs advance fermentation and refill systems at competitive cost.Middle East & Africa

GCC premium retail prioritizes clinically substantiated, heat-stable formulas with fragrance control and robust packaging. Arid climates drive hydration-forward routines and high-SPF daily wear. Multilingual labeling and halal/vegan positioning support inclusivity. Broader MEA adoption hinges on affordability, distribution partnerships, and education on routine building.South & Central America

Modern trade and marketplaces expand reach; consumers balance value with clean credentials and performance. Urban heat and humidity prompt mattifying yet barrier-friendly skincare and scalp care. Regulatory pathways favor clear allergen labeling and stability for high-temperature logistics. Installment pricing, bundles, and local botanical stories enhance relevance and repeat.Clean Beauty Market Segmentation

By Product

- Skincare

- Face care

- Body care

- Haircare

- Color cosmetics

By End-User

- Men

- Women

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Online

- Others

Key Market players

Beautycounter, The Honest Company, Drunk Elephant, Ilia Beauty, Tata Harper, Kosas, Saie, Herbivore Botanicals, Biossance, The Ordinary (DECIEM), REN Clean Skincare, Juice Beauty, Pacifica Beauty, Supergoop!, Burt’s BeesClean Beauty Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Clean Beauty Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Clean Beauty market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Clean Beauty market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Clean Beauty market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Clean Beauty market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Clean Beauty market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Clean Beauty value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Clean Beauty industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Clean Beauty Market Report

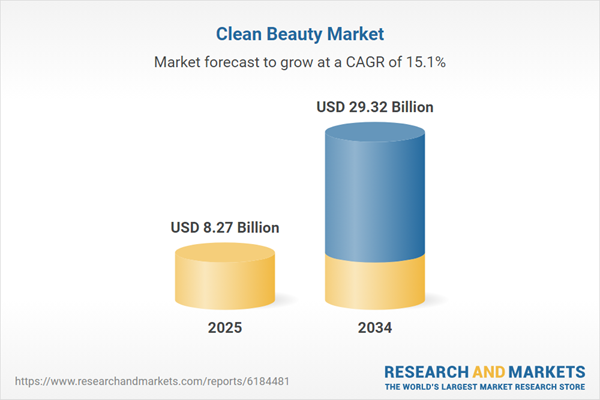

- Global Clean Beauty market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Clean Beauty trade, costs, and supply chains

- Clean Beauty market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Clean Beauty market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Clean Beauty market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Clean Beauty supply chain analysis

- Clean Beauty trade analysis, Clean Beauty market price analysis, and Clean Beauty supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Clean Beauty market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Beautycounter

- The Honest Company

- Drunk Elephant

- Ilia Beauty

- Tata Harper

- Kosas

- Saie

- Herbivore Botanicals

- Biossance

- The Ordinary (DECIEM)

- REN Clean Skincare

- Juice Beauty

- Pacifica Beauty

- Supergoop!

- Burt’s Bees

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.27 Billion |

| Forecasted Market Value ( USD | $ 29.32 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |