Grafted Polyolefins Market

Grafted polyolefins are polyethylene and polypropylene backbones chemically modified - typically via maleic anhydride, glycidyl methacrylate, acrylic acid, or silanes - to introduce polar functionality while retaining the processability and cost profile of commodity resins. This hybrid polarity makes them the workhorse compatibilizers, tie-layer resins, and adhesion promoters across multilayer packaging, automotive thermoplastic polyolefin systems, glass/mineral-filled and natural-fiber composites, wood-plastic composites, hot-melt adhesives, footwear, pipe and cable, coatings/primers, and polymer recycling/upcycling. Current trends emphasize precision reactive extrusion for narrower graft distribution, low-odor/low-VOC grades for interior use, bio-attributed feedstocks, and tailor-made grades for challenging pairs such as PP-PA, PE-EVOH, and PP-PET. In packaging, they enable barrier structures with EVOH or polyamide while supporting downgauging and easier delamination in emerging design-for-recycling schemes. In mobility, they boost interfacial strength in TPO skins, PP compounds, and fiber-reinforced PP for lightweighting, including EV battery pack and interior applications. Circularity is a rising theme: grafted compatibilizers stabilize blends of virgin and recyclate or mixed-polyolefin streams, preserving mechanicals in closed-loop programs. The competitive landscape spans integrated polyolefin producers, specialty additive houses, and compounders offering application-specific masterbatches; differentiation pivots on graft level control, base resin selection, melt rheology, odor/ash/gel management, and regulatory compliance for food contact or automotive VOC. Execution challenges include feedstock volatility, safe handling of reactive monomers and peroxides, balancing stiffness-toughness at higher graft contents, and proving long-term durability under heat, humidity, and chemicals. Overall, grafted polyolefins remain the “molecular bridge” enabling performance and manufacturability across diverse, increasingly sustainability-driven value chains.Grafted Polyolefins Market Key Insights

- Compatibilization is the core value proposition. By introducing polar anchoring sites on nonpolar PE/PP backbones, grafted grades reduce interfacial tension and improve dispersion in blends with polyamides, polyesters, EVOH, and fillers. The result is higher tensile/impact retention and fewer defects at given loadings. Process windows widen, allowing faster line speeds and broader regrind usage. Application kits now pair resin with process recipes, die designs, and screw profiles. This systems approach shortens scale-up and stabilizes quality.

- Tie-layer resins enable barrier packaging without exotic chemistries. Maleated PE/PP grades bond polyolefin layers to EVOH or PA for pouches, bottles, caps/closures, and thermoformed trays. Narrow graft distribution mitigates bleed and delamination under retort, hot-fill, and freezer cycles. Next-gen formulations target low extractables, taste/odor neutrality, and reliable adhesion after recycled-content dilution. Converter demand is shifting toward fewer SKUs with broader operating windows across blown, cast, and extrusion-coating lines. Gravimetric dosing and in-line rheology improve lot-to-lot consistency.

- Automotive TPOs and composites rely on grafted coupling. In PP-based bumper skins, interior skins, and under-hood parts, grafted polyolefins couple glass, talc, or natural fibers to the matrix, lifting stiffness without sacrificing ductility. Adhesion to paints, foams, and laminates benefits from polar functionality, reducing primers and cycle steps. EV platforms amplify needs around low-odor interiors and thermal stability near battery packs. OEMs increasingly specify VOC and fogging limits that favor clean-graft technologies. Long-term property retention under UV and fluids is a decisive selector.

- Reactive extrusion is moving from art to science. Online torque, peroxide consumption, and spectroscopic proxies allow closed-loop control of graft level and molecular scission. Producers tune melt index, long-chain branching, and comonomer content to balance flow with impact. Stabilizer packages are engineered to protect during grafting and downstream molding. The shift to advanced devolatilization reduces residual monomer and odor. Documented process capability (Cp/Cpk) now features in technical data packs for strategic accounts.

- Low-odor and interior-grade formulations expand use cases. Cabin, appliance, and consumer goods applications demand minimal aldehydes and organic acids post-processing. Suppliers respond with cleaner initiator systems, optimized devolatilization, and scavenger chemistries. Analytical suites quantify odor thresholds and VOC species against stricter buyer specs. These grades often trade peak adhesion for sensory performance, so compound design compensates elsewhere. Clear communication of trade-offs accelerates approval cycles and reduces returns.

- Silane-grafted and moisture-crosslinkable systems target cables and pipes. For wire/cable and hot-water pipe, silane-functional PE enables fast crosslinking with controlled network density. Benefits include thermal creep resistance and environmental stress crack resistance. Moisture-curing kinetics are tuned by catalyst packages and storage protocols. New additive packages limit copper-catalyzed degradation in electrical applications. Field reliability data and accelerated aging underpin adoption in infrastructure programs.

- Recycling and upcycling are strategic growth vectors. Grafted compatibilizers stabilize polyolefin blends contaminated with polar polymers or multilayer flakes, preserving impact and elongation. In PP-PET and PE-PA streams, small additions can convert downcycled mixes into usable compounds for non-critical parts. Brand owners seek recipes that tolerate variable feed while meeting odor and compliance constraints. Playbooks now define dosing ranges, residence times, and venting settings for common MRF scenarios. This closes loops without major capital changeovers.

- Regulatory and disclosure expectations are rising. Food-contact, medical, and interior applications require transparent additive inventories, migration modeling, and global compliance matrices. Buyers scrutinize residual monomer, ash, and gel content, alongside sustainability claims such as bio-attributed or mass-balance feedstocks. Lifecycle documentation supports EPR and eco-design narratives. Suppliers with harmonized dossiers and multi-region registrations accelerate OEM approvals and reduce dual-sourcing friction.

- Supply dynamics reward integration and flexibility. Access to base PE/PP slates, initiators, and graft monomers under volatility is a competitive moat. Producers hedge with multiple peroxide and monomer sources and modular reactive-extrusion lines. Contract structures increasingly incorporate index-linked pricing and service-level commitments on lead time and color/odor stability. Application support and rapid sampling matter as much as raw cost in strategic accounts. Regional tolling adds resilience near converters.

- End-use diversification smooths cycles. Beyond packaging and autos, growth pockets include footwear midsoles, building membranes, wood-plastic decking, appliance housings, and primers/coatings. Each vertical values a different attribute balance - toughness vs rigidity, hydrolysis resistance vs adhesion. Portfolio architecture now maps grades by “function stacks” to avoid proliferation while covering needs. Cross-learning between sectors speeds innovation and mitigates downturns in any single market.

Grafted Polyolefins Market Reginal Analysis

North America

Demand centers on multilayer packaging, automotive TPOs, and recycling programs aligned with design-for-circularity. Converters value low-odor, food-contact-ready tie layers with robust adhesion across thermal cycles. Automotive specifies tight VOC limits and durable adhesion to paints and foams. Resin and additive volatility keeps dual-sourcing and regional inventory critical. Technical service and in-plant trials drive supplier stickiness.Europe

Eco-design and regulatory rigor elevate disclosure and low-emission requirements, pushing clean-graft chemistries and mass-balance feedstocks. Packaging emphasizes barrier performance with recycling-friendly structures, while automotive seeks lightweight PP compounds for interiors. Silane-grafted solutions gain in building and cable where durability and safety standards are stringent. Producers with multi-country registrations and harmonized documentation win specifications. Take-back and recyclate-ready compatibilizers see growing pilots.Asia-Pacific

Scale in packaging, appliances, footwear, and mobility fuels broad adoption, with rapid qualification cycles. Regional OEM capacity supports private-label tie layers and cost-optimized compatibilizers. Humidity and heat drive interest in silane-grafted PE for cable/pipe and in thermal-stable grades for interiors. Recycling infrastructure growth creates demand for compatibilizers tolerant of variable feed. Local technical centers and fast sampling are decisive advantages.Middle East & Africa

Investments in petrochemicals and packaging convertors underpin availability of base resins and integration opportunities. Infrastructure expansion supports cable, pipe, and construction membranes using silane-grafted and adhesion-promoting systems. Buyers prioritize robustness in hot climates and supply certainty. Regulatory frameworks are evolving, so suppliers with turnkey support on compliance and processing win share. Training on reactive extrusion and safe handling is valued.South & Central America

Packaging and consumer goods lead usage, with interest in tie layers that permit downgauging and stable adhesion in hot-fill or retort. Currency variability and logistics favor regional production and flexible MOQs. Recycling initiatives create pull for compatibilizers that stabilize mixed-polyolefin streams. Automotive and appliance clusters adopt low-odor interior grades as specifications tighten. Service reliability and application troubleshooting influence long-term partnerships.Grafted Polyolefins Market Segmentation

By Type

- Maleic Anhydride Grafted PE

- Maleic Anhydride Grafted PP

- Maleic Anhydride Grafted EVA

- Others

By Technology

- Extrusion

- Melt grafting

- Others

By Application

- Adhesion Promotion

- Impact Modification

- Compatibilization

- Bonding

- Others

By End-User

- Automotive

- Packaging

- Construction

- Textiles

- Adhesives & Sealants

- Others

Key Market players

Dow (Bynel), Mitsui Chemicals (Admer), SK Functional Polymer (Orevac), LyondellBasell (Plexar), ExxonMobil Chemical (Exxelor PO), Westlake (Epolene G), Polyram Group (Bondyram), SI Group (Polybond), Clariant (Licocene MA-g-PP), Evonik (VESTOPLAST functionalized PO), Kingfa Science & Technology, Shandong Fine-Blend Polymer, Shanghai PRET Composites, Guangzhou Lushan New Materials, SABICGrafted Polyolefins Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Grafted Polyolefins Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Grafted Polyolefins market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Grafted Polyolefins market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Grafted Polyolefins market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Grafted Polyolefins market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Grafted Polyolefins market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Grafted Polyolefins value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Grafted Polyolefins industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Grafted Polyolefins Market Report

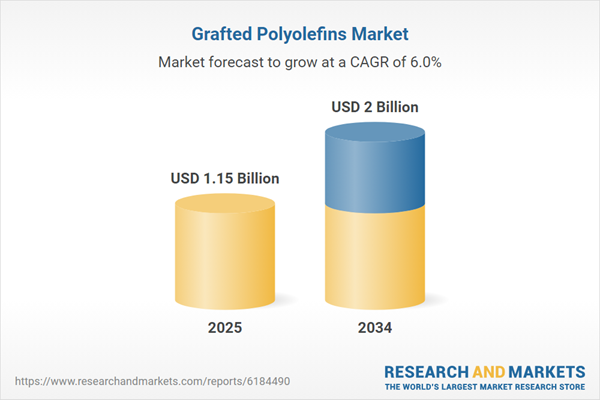

- Global Grafted Polyolefins market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Grafted Polyolefins trade, costs, and supply chains

- Grafted Polyolefins market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Grafted Polyolefins market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Grafted Polyolefins market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Grafted Polyolefins supply chain analysis

- Grafted Polyolefins trade analysis, Grafted Polyolefins market price analysis, and Grafted Polyolefins supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Grafted Polyolefins market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dow (Bynel)

- Mitsui Chemicals (Admer)

- SK Functional Polymer (Orevac)

- LyondellBasell (Plexar)

- ExxonMobil Chemical (Exxelor PO)

- Westlake (Epolene G)

- Polyram Group (Bondyram)

- SI Group (Polybond)

- Clariant (Licocene MA-g-PP)

- Evonik (VESTOPLAST functionalized PO)

- Kingfa Science & Technology

- Shandong Fine-Blend Polymer

- Shanghai PRET Composites

- Guangzhou Lushan New Materials

- SABIC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.15 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |