Poultry Food Animal Eubiotics Market

Poultry eubiotics - encompassing probiotics, prebiotics, synbiotics, organic acids, phytogenics/essential oils, and postbiotics - are now central to antibiotic-reduction strategies in broilers, layers, and breeders. Deployed via compound feed, premixes, concentrates, top-dress, and water-soluble formats, these solutions target gut integrity, microbial balance, nutrient utilization, and resilience under commercial stressors. Top applications include AGP replacement programs, necrotic enteritis risk mitigation, coccidiosis support, Salmonella/Campylobacter control, heat-stress management, and performance optimization across starter, grower, and finisher phases. Current trends feature multi-strain consortia, spore-forming probiotics for pelleting stability, encapsulated acids and essential oils for site-specific release, precision nutrition with data-backed dosing, and the emergence of postbiotics for consistent shelf-life and claims. Demand is propelled by retailer and processor policies on responsible antibiotic use, export-market requirements, welfare standards, and the economics of feed conversion and livability. Competitive intensity is high, with global feed-additive majors, specialty biotech firms, and integrated feed mills advancing portfolios that bundle enzymes, mycotoxin controls, and vitamins with eubiotics. Differentiation is shifting from single-ingredient claims to programmatic solutions - starter kits, rotation schemes, and litter/water hygiene combinations validated by field trials. Key execution challenges include variability of botanical actives, music-licensing-like complexity in strain IP/registrations across jurisdictions, on-farm adherence to dosing, and demonstrating consistent return across diverse genetics, feed grains, and climates. Overall, the category is moving from “nice-to-have” supplements to standardized pillars of poultry health programs in both conventional and value-added production systems.Poultry Food Animal Eubiotics Market Key Insights

- AGP transition is structural and program-driven. Eubiotics adoption is no longer a tactical swap but a multi-component program aligned to starter/grower/finisher goals. Integrators combine probiotics, acids, and phytogenics with biosecurity and litter management. Rotation schemes reduce adaptation risk and sustain efficacy. Verification hinges on consistent FCR, uniformity, and mortality markers. Procurement increasingly evaluates total program ROI, not individual SKU prices.

- Mode-of-action stacking underpins performance resilience. Spore-formers aid pelleting stability and colonization; lactic strains modulate pH and metabolites; mannan-rich prebiotics block pathogen adhesion; organic acids suppress Gram-negative loads; essential oils target upper gut. Encapsulation improves site-specific release while minimizing palatability drag. Blends designed around diet (corn/soy vs. wheat/barley) and coccidiosis vaccination status deliver more predictable outcomes across complexes.

- Postbiotics and metabolites reduce variability. Fermentation-derived cell-free fractions provide heat stability, cleaner label narratives, and batch-to-batch consistency. They complement live microbes in challenging water or high-temperature pelleting environments. Measurable endpoints include villus morphology, tight-junction integrity, and short-chain fatty acid profiles. Formulators employ multi-omics readouts to refine inclusion rates and cofactor combinations with trace minerals and vitamins.

- Microbiome analytics professionalize formulation. Field trials increasingly pair performance KPIs with amplicon/metagenomic datasets to map responder cohorts. Platforms translate diversity, evenness, and specific taxa shifts into decision rules for product selection. Integrators build strain libraries linked to geography, season, and feed matrix. Data closes the loop on dose titration, rotation timing, and early intervention when dysbiosis signals appear.

- Water-line eubiotics are strategic in hot climates. Acidifiers and water-soluble probiotics offer rapid deployment during heat waves, feed outages, or post-vaccination windows. Attention to water hardness, biofilm load, and sanitizer compatibility is essential for live strain survival. Portable dosing and inline proportioners improve adherence at contract farms. Programs often pair water treatments with electrolytes and antioxidants for resilience.

- Coccidiosis and enteritis programs rely on synergy. Eubiotics support oocyst cycling with milder inflammation, complementing vaccines and ionophore/shuttle strategies. Butyrate donors and coated acids help maintain duodenal and jejunal integrity, limiting secondary Clostridial blooms. Seasonally adjusted blends and litter management reduce flare-ups. Documentation for auditors and customers increasingly requires program logic and records.

- Regulatory nuance shapes labels and speed-to-market. Jurisdictional differences in claims (performance vs. gut health), strain registration, and botanical residue standards influence portfolio design. Companies pre-clear dossiers and invest in local trials to accelerate approvals. Harmonized nomenclature and transparent COAs build trust with integrators. Compliance by design - traceability, stability, and contaminant controls - becomes a sales differentiator.

- Supply chain and cost volatility need hedging. Botanical active content varies by harvest, origin, and extraction; firms respond with standardized chemotypes and dual sourcing. Organic acids face input price swings tied to petrochemicals and fermentation feedstocks. Encapsulation materials and logistics affect landed costs. Long-term agreements with integrators stabilize volumes while allowing formulation tweaks within spec.

- Go-to-market is consolidating around solution selling. Bundled health packs, on-farm advisory, and diagnostics create stickier relationships than standalone SKUs. Cross-selling with enzymes, toxin binders, and vitamin/mineral packs increases share of wallet. Digital tools - batch calculators, water-line compatibility checkers, and barn-condition dashboards - improve execution. Success correlates with technical service depth and rapid troubleshooting.

- ESG and brand promises pull eubiotics through the chain. Retailer pledges on responsible antibiotic use and animal welfare steer specifications upstream. Transparent audit trails and third-party validations help processors defend claims. Lower residue risks support export ambitions. Waste minimization via improved conversion and survivability supports sustainability reporting. Storytelling around science and stewardship strengthens brand equity.

Poultry Food Animal Eubiotics Market Reginal Analysis

North America

Adoption is anchored by integrators’ formal AGP-reduction roadmaps and retailer requirements. Programs emphasize spore-forming probiotics for pelleting, coated butyrates, and peri-challenge water acidification. Technical service teams use barn data to fine-tune inclusion by season and grain basis. Verification via processor KPIs supports continued budget allocation. Private-label blends by major feed mills intensify competition but expand access.Europe

Longstanding AGP restrictions created a sophisticated market for organic acids, phytogenics, and synbiotics. Buyers prioritize documented trials, transparent strain pedigrees, and compliance with strict residue and labeling norms. Welfare and sustainability frameworks drive attention to gut integrity over simple performance claims. Localization matters - formulas adapt to wheat/barley diets and colder barn conditions. Partnerships with breeders and vaccine providers enable integrated health protocols.Asia-Pacific

Scale, growth in poultry proteins, and rising stewardship policies fuel rapid uptake, with strong variance by country. Mobile technical teams and distributor education are essential for smallholder penetration. Heat stress, variable water quality, and diverse feed ingredients favor water-line acidifiers, stable spores, and standardized botanicals. Local manufacturing and toll blends reduce landed costs and speed response to seasonal disease pressures.Middle East & Africa

Expansion follows improving feed milling capacity and commercial integration. High ambient temperatures and water constraints elevate demand for heat-resilience programs and compatible water treatments. Halal-oriented processors and export ambitions support AGP-reduction commitments. Training on dosing equipment and biosecurity is pivotal for consistent outcomes. Logistics-ready, dust-controlled formats gain preference in arid environments.South & Central America

Export-oriented producers emphasize food safety and salmonella control alongside performance. Diets centered on corn/soy with mycotoxin variability drive combined eubiotic-toxin control strategies. Technical partnerships with integrators streamline rotation plans through grow-out cycles. Local regulatory processes and currency dynamics influence sourcing and pricing. Adoption is strengthened by field data from large complexes demonstrating stable conversion and livability.Poultry Food Animal Eubiotics Market Segmentation

By Type

- Probiotics

- Prebiotics

- Organic Acids

- Essential Oils

By Application

- Cubs Chicken

- Adult Chicken

Key Market players

dsm-firmenich, Novonesis (Chr. Hansen & Novozymes), BASF, Evonik Animal Nutrition, Adisseo, Kemin Industries, Cargill (incl. Delacon), Alltech, Nutreco (Trouw Nutrition), IFF - Danisco Animal Nutrition & Biosciences, Lallemand Animal Nutrition, Phibro Animal Health, Huvepharma, Anpario, EW NutritionPoultry Food Animal Eubiotics Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Poultry Food Animal Eubiotics Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Poultry Food Animal Eubiotics market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Poultry Food Animal Eubiotics market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Poultry Food Animal Eubiotics market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Poultry Food Animal Eubiotics market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Poultry Food Animal Eubiotics market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Poultry Food Animal Eubiotics value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Poultry Food Animal Eubiotics industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Poultry Food Animal Eubiotics Market Report

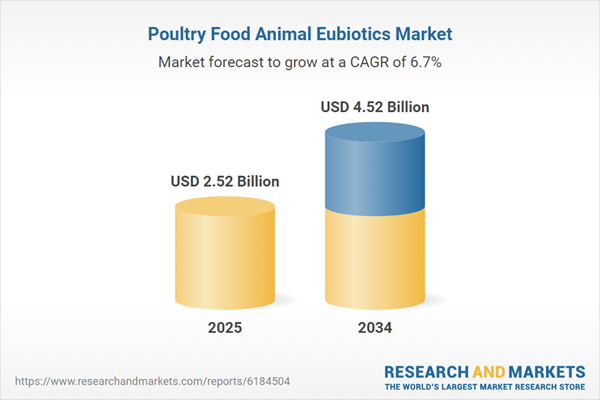

- Global Poultry Food Animal Eubiotics market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Poultry Food Animal Eubiotics trade, costs, and supply chains

- Poultry Food Animal Eubiotics market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Poultry Food Animal Eubiotics market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Poultry Food Animal Eubiotics market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Poultry Food Animal Eubiotics supply chain analysis

- Poultry Food Animal Eubiotics trade analysis, Poultry Food Animal Eubiotics market price analysis, and Poultry Food Animal Eubiotics supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Poultry Food Animal Eubiotics market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- dsm-firmenich

- Novonesis (Chr. Hansen & Novozymes)

- BASF

- Evonik Animal Nutrition

- Adisseo

- Kemin Industries

- Cargill (incl. Delacon)

- Alltech

- Nutreco (Trouw Nutrition)

- IFF – Danisco Animal Nutrition & Biosciences

- Lallemand Animal Nutrition

- Phibro Animal Health

- Huvepharma

- Anpario

- EW Nutrition

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.52 Billion |

| Forecasted Market Value ( USD | $ 4.52 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |