Biodegradable Foodservice Disposables Market

The biodegradable foodservice disposables market spans hot/cold cups and lids, clamshells, plates, bowls, trays, cutlery, stirrers, straws, napkins, and takeaway containers designed to break down through composting or natural processes. Core substrates include molded fiber/bagasse, kraft paper and paperboard, bamboo and palm leaf, and bioplastics such as PLA, CPLA, PHA, and starch blends; water-based or bio-coatings increasingly replace legacy fluorochemistries. Demand is led by quick-service and fast-casual chains, coffee shops, bakeries, institutional catering (corporate, healthcare, education), stadiums/venues, airlines, hotels, and the fast-growing delivery/takeaway ecosystem (including cloud kitchens). Procurement is shaped by brand sustainability pledges, municipal restrictions on single-use plastics, extended producer responsibility schemes, PFAS phase-outs, and retailer/aggregator packaging standards. Innovation priorities include heat/oil/oxygen barrier performance, home-compostable certifications, improved lid fit/stackability for delivery, microwave/freezer safety, printability, and end-of-life traceability via labeling. Competitive dynamics feature global packaging majors expanding molded fiber and compostable lines, specialist brands focused on plant-based packaging, and distributor/private-label programs that bundle SKUs and logistics. Cost volatility in pulp, fibers, and specialty resins, plus variable access to industrial composting and food-waste collection, remain structural constraints. Nevertheless, broader organics diversion programs, corporate scope-3 targets, and standardization of compostable specifications are improving adoption. Stakeholders increasingly use life-cycle assessment to compare materials and prioritize true end-of-life outcomes over “green” claims, driving consolidation, vertical integration from fiber/resin to finished goods, and partnerships across operators, haulers, and composters to close the loop.Biodegradable Foodservice Disposables Market Key Insights

- Policy pull and retailer standards. City/state bans on select plastics, SUP directives, plastic taxes, PFAS restrictions, and EPR frameworks are tightening packaging specs. Large retailers and delivery platforms now publish approved-item lists and recyclability/compostability criteria, accelerating SKU rationalization and compliance-driven switching in foodservice networks.

- End-of-life practicality beats claims. Buyers prioritize certifications (e.g., industrial/home compostability) and clear labeling to reduce contamination. Contracts increasingly require proof of breakdown in local systems and partnerships with composters/haulers, shifting attention from material names to verified outcomes within organics programs.

- Materials shift toward fiber and PFAS-free barriers. Molded fiber/bagasse gains on heat and rigidity; water-based, clay, and bio-based coatings supplant fluorinated barriers. For lids/clear items, PLA/CPLA persist while PHA and next-gen blends target higher-heat and grease performance without legacy chemicals of concern.

- Delivery and thermal performance. Growth in takeaway raises requirements for stackability, lid security, venting, anti-sog features, and condensation control. Specifications increasingly include dwell-time performance from kitchen pass to doorstep and stress testing for hot/fried items, soups, and high-moisture foods.

- Total cost of ownership perspective. While unit costs can exceed conventional plastics, buyers evaluate waste-handling savings, contamination penalties, brand risk, and compliance exposure. Multi-year agreements with distributors and composters, plus SKU consolidation, narrow the effective cost gap.

- Infrastructure is the gatekeeper. Adoption correlates with organics collection coverage, contamination thresholds, and tip fees. Where composting access is limited, operators trial reuse in back-of-house and prioritize widely accepted fiber items to avoid landfill lock-in, balancing portfolios by geography.

- Certification and labeling clarity. Standardized marks and on-item cues (colorways, embossing) improve front-of-house sorting. Mislabeling/greenwashing scrutiny is rising; procurement teams demand chain-of-custody documentation, PFAS-free declarations, and harmonized SKUs that meet multiple regional requirements.

- Consolidation and vertical integration. Global packaging majors expand molded-fiber capacity, acquire specialists, and backward-integrate into pulp/fiber and specialty coatings. Distributors scale private labels, offering spec-compliant assortments, data on diversion rates, and inventory resilience across regions.

- Design for circularity. Operators co-design with suppliers to reduce materials, eliminate mixed structures that hinder composting, and improve nesting to cut transport emissions. Growing use of LCA and scope-3 accounting informs substrate selection and drives portfolio shifts to fewer, higher-performing SKUs.

- Adjacent competition from reusables. In closed environments (campuses, venues, corporate dining) reusable programs challenge disposables. Many operators pursue hybrid strategies - reusables where logistics allow, compostables elsewhere - creating demand for durable, event-ready compostable formats and return-to-bin education.

Biodegradable Foodservice Disposables Market Reginal Analysis

North America

Municipal and state-level rules (plastic restrictions, PFAS phase-out, and emerging EPR) shape specifications, while certification schemes guide procurement. Access to industrial composting remains uneven; contamination fees and landfill costs influence TCO analyses. Stadiums, universities, tech campuses, and national QSRs anchor multi-site rollouts linked to organics diversion. Distributors and private labels standardize assortments and ensure supply resilience. Data-driven contracts increasingly tie packaging choices to diversion KPIs and brand reporting.Europe

The SUP Directive, plastic levies, and national transpositions drive rapid material shifts, supported by broader organics collection in several countries. EN-compliant compostability, PFAS restrictions under chemicals policy, and eco-labeling converge to accelerate fiber-first designs and fluorine-free barriers. Retailer/foodservice alliances streamline SKUs and embed end-of-life claims verification. Cross-border chains demand harmonized specs, while high waste-management maturity enables credible circularity pilots in horeca and events.Asia-Pacific

Diverse policy regimes - from single-use bans to voluntary targets - combine with fast-growing takeaway and convenience formats. Strong regional fiber and bagasse supply underpins cost competitiveness; innovation activity in PHA/biopolymer capacity is rising. Australia’s packaging targets and Japan’s biomass initiatives influence requirements, while enforcement variability in parts of South and Southeast Asia impacts scale. Large QSRs and delivery platforms set common specs across markets, encouraging supplier localization.Middle East & Africa

Tourism, aviation catering, and large venues catalyze early adoption, often via international operator standards. Policy frameworks are nascent but tightening, with city-level pilots on organics diversion. Imports dominate in many markets, favoring suppliers that can guarantee spec compliance and logistics reliability. Premium hospitality leans toward high-aesthetics molded fiber and palm-leaf formats, while infrastructure development will determine broader penetration and consistent end-of-life outcomes.South & Central America

Sugarcane regions provide advantageous access to bagasse, supporting local molded-fiber growth and cost stability. National packaging policies and extended producer responsibility are advancing, with organics collection pilots in major cities. Hospitality, ecotourism, and event catering drive visible early wins; distributors curate portfolios suited to humidity and hot-fill use cases. Education on sorting and partnerships with composters/haulers are key to scaling beyond metropolitan cores.Biodegradable Foodservice Disposables Market Segmentation

By Type

- Pla-based

- Starch-based

- Others

By Material

- Pulp and Paper

- Biopolymers

- Leaves

- Wood

By Application

- Household

- foodservice providers

- Others

Key Market players

Eco-Products, Vegware, BioPak, Huhtamaki, Pactiv Evergreen, Sabert, Genpak, Dart Container, World Centric, Stora Enso, WinCup, Duni Group, Graphic Packaging International, Lollicup (Karat Earth), Detmold Group (Detpak)Biodegradable Foodservice Disposables Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Biodegradable Foodservice Disposables Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Biodegradable Foodservice Disposables market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Biodegradable Foodservice Disposables market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Biodegradable Foodservice Disposables market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Biodegradable Foodservice Disposables market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Biodegradable Foodservice Disposables market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Biodegradable Foodservice Disposables value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Biodegradable Foodservice Disposables industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Biodegradable Foodservice Disposables Market Report

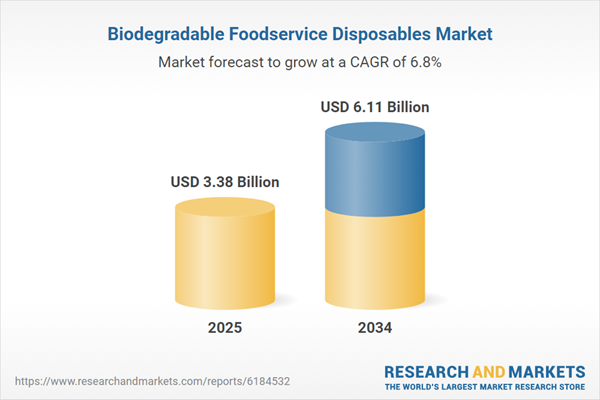

- Global Biodegradable Foodservice Disposables market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Biodegradable Foodservice Disposables trade, costs, and supply chains

- Biodegradable Foodservice Disposables market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Biodegradable Foodservice Disposables market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Biodegradable Foodservice Disposables market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Biodegradable Foodservice Disposables supply chain analysis

- Biodegradable Foodservice Disposables trade analysis, Biodegradable Foodservice Disposables market price analysis, and Biodegradable Foodservice Disposables supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Biodegradable Foodservice Disposables market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Eco-Products

- Vegware

- BioPak

- Huhtamaki

- Pactiv Evergreen

- Sabert

- Genpak

- Dart Container

- World Centric

- Stora Enso

- WinCup

- Duni Group

- Graphic Packaging International

- Lollicup (Karat Earth)

- Detmold Group (Detpak)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.38 Billion |

| Forecasted Market Value ( USD | $ 6.11 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |