Industrial Vending Machine Market

The Industrial Vending Machine Market addresses persistent needs in factories, warehouses, utilities, and field services to control consumption of tools, PPE, spares, and MRO items while improving uptime and safety. The market integrates secure dispensing hardware with cloud software, user authentication, and ERP links to govern who uses what, when, and how often, turning point-of-use access into auditable data that drives cost avoidance and continuous improvement. Top applications include PPE compliance, cutting tools and abrasives, batteries and consumables, calibration and test gear, maintenance spares, chemicals and adhesives, and high-value asset tracking via lockers and RFID. Key trends encompass AI-assisted replenishment, dynamic min-max settings, closed-loop supplier managed inventory, mobile credentialing, and ESG aligned reporting that evidences waste reduction and safer work practices. Drivers include skilled labor shortages, rising downtime costs, stricter EHS obligations, and the shift from bulk stockrooms to line-side access that protects throughput. Competitive differentiation pivots on breadth of machine formats, sensor fidelity, open APIs, cybersecurity posture, and analytics depth including variance alerts, usage benchmarking, and digitized approvals. Distribution models blend OEMs, MRO distributors, and integrated service providers who bundle installation, planogram design, and replenishment as outcome-based contracts. Adoption barriers - change management, IT integration, and SKU rationalization - are countered by pilots that quantify shrink reduction and time saved in walk-and-wait. The next phase emphasizes multi site orchestration, interoperable data lakes, and role based dashboards for operations, EHS, and finance, extending the platform into mobile issue-return, tool life analytics, and closed loop maintenance that ties consumption to asset performance.Industrial Vending Machine Market Key Insights

- From access control to operational intelligence. Best-in-class programs treat vending as a data platform, not just a cabinet, mapping consumption to shifts, cells, and work orders to reveal hidden drivers of scrap, rework, and downtime. By correlating item usage with takt variance, teams target the few SKUs and processes that create outsized cost, enabling precise Kaizen and faster payback without blunt spending caps.

- Right format for the right SKU. Coils, carousels, lockers, weight-sensing shelves, and smart drawers each suit distinct profiles across size, value, hazard, and custody. Mature fleets mix formats at line side to minimize walk time while protecting calibration and traceability. Modular designs future-proof layouts as SKUs and packaging evolve, avoiding stranded assets and preserving service levels during line reconfiguration.

- Supplier-enabled replenishment as a service layer. Distributors and OEMs bundle planogram engineering, truck-to-bin replenishment, and SLA-based stock assurance. Closed-loop signals trigger totes, kitting, or micro-fulfillment, shifting planners from reactive expediting to exception management. The result is fewer stockouts, fewer emergency buys, and a measured reduction in carrying costs without risking production.

- Tighter governance without user friction. Badge, PIN, or mobile SSO aligns dispenses to training status, certifications, and task codes. Granular quotas and time-boxed overrides maintain flexibility while keeping consumption within defined envelopes. Simple user flows and reliable hardware are crucial, since poor ergonomics can drive workarounds and erode program credibility.

- Integration is the multiplier. Open APIs into ERP, EAM, CMMS, MES, and e-procurement unify master data and automate three-way match, chargebacks, and cost center allocation. Linking to maintenance records ties tool and spare usage to asset MTBF and PM compliance, turning vending telemetry into predictive insights rather than standalone reports.

- Analytics that move the needle. Beyond usage logs, leaders deploy anomaly detection, peer benchmarking, and dynamic min-max tuned by seasonality, shift mix, and engineering changes. Dashboards for supervisors, EHS, and finance surface the few actionable deltas each week, sustaining executive sponsorship and frontline adoption long after initial rollout enthusiasm fades.

- Change management defines success. Programs win by co-designing policies with operators, piloting in a visible value stream, and publishing before-after walk time, shrink, and stockout metrics. Clear governance on substitutions, returns, and broken packs reduces friction, while recognition for teams hitting compliance and waste targets locks in cultural buy-in.

- Security and compliance by design. Tamper detection, audit trails, and custody features support QA, EHS, and regulated industries. Chemical and battery controls, expiration prompts, and blocked combinations prevent unsafe usage. Cybersecurity hardening, role segregation, and encrypted telemetry satisfy IT risk reviews and smooth multi-site scaling.

- Total cost of ownership over sticker price. Hardware durability, field service coverage, spares availability, and remote diagnostics determine lifecycle economics. Flexible financing, refresh paths, and upgradeable controllers protect investments as software capabilities expand, ensuring fleets remain current without forklift swaps.

- Beyond MRO to tool life and sustainability. Pairing vending with tool condition monitoring and regrind loops extends consumable life and reduces landfill. ESG reporting quantifies avoided waste, PPE compliance, and safer usage patterns, helping manufacturers meet customer and regulatory expectations while funding programs through verified savings.

Industrial Vending Machine Market Reginal Analysis

North America

Large installed base with strong involvement of MRO distributors and integrated service providersHigh emphasis on ERP and EAM integration, cybersecurity reviews, and outcome based contracts

Adoption driven by labor constraints, EHS rigor, and line side availability to protect throughput

Preference for mixed formats including lockers and smart drawers for high value and calibrated items

Analytics and executive dashboards widely used to sustain post pilot gains

Europe

Focus on compliance, traceability, and sustainability metrics embedded in procurement criteriaStrong demand in automotive, aerospace, pharmaceuticals, and machinery clusters with multi site rollouts

Tight integration to MES and quality systems to align dispenses with batch and lot genealogy

Energy efficient hardware and recyclable packaging highlighted in vendor selection and reporting

Local language support and data residency influence partner choice for cross border programs

Asia Pacific

Rapid greenfield deployments in electronics, automotive, and contract manufacturing hubs

Stickiness achieved through vendor managed inventory and high service level replenishment models

Mobile credentials and compact footprints favored for dense shop floors and shared workcells

Emphasis on fast installation, modular expansion, and SKU rationalization to match high mix operations

Growing interest in AI assisted min max and predictive spare consumption linked to CMMS

Middle East & Africa

Adoption aligned to capital projects, utilities, mining, and energy with remote site needsRuggedized lockers and climate aware enclosures prioritized for harsh environments

Distributor networks crucial for install, training, and SLA backed field service coverage

Compliance with site access controls and bilingual interfaces supports workforce diversity

Pilot first approaches quantify stockout reduction and PPE compliance to unlock budgets

South & Central America

Penetration led by multinational plants and regional champions upgrading MRO controlValue engineered fleets and financing options improve affordability and scale up cadence

Local service partners and spare parts availability drive uptime and user satisfaction

Integration with ERP and e procurement streamlines chargebacks and audit readiness

Industrial Vending Machine Market Segmentation

By Type

- Carousel Vending Machine

- Coil Vending Machine

- Cabinet Vending Machine

- Others

By Product

- MRO Tools

- PPE

- Others

By End-User

- Manufacturing

- Oil & Gas

- Construction

- Aerospace

- Others

Key Market players

Fastenal, Grainger (KeepStock), MSC Industrial Supply, Würth Industrie Service (ORSYmat), Airgas, Motion Industries, Applied Industrial Technologies, Snap-on (AutoCrib), Stanley Black & Decker (CribMaster), SupplyPoint, SupplyPro, IVM Inc., Intelligent Dispensing Solutions (IDS), Apex Supply Chain Technologies, SecuraStock, Hoffmann Group (GARANT Tool24), Kennametal (ToolBOSS), ISCAR (Matrix Tool Management), Rubix Group (Brammer Buck & Hickman), RS Group (RS Components)Industrial Vending Machine Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Industrial Vending Machine Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Industrial Vending Machine market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Industrial Vending Machine market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Industrial Vending Machine market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Industrial Vending Machine market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Industrial Vending Machine market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Industrial Vending Machine value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Industrial Vending Machine industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Industrial Vending Machine Market Report

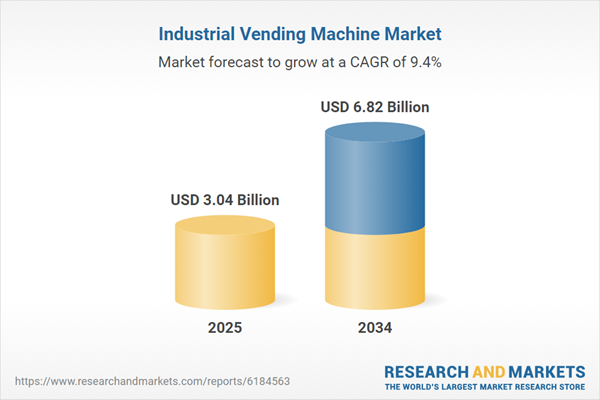

- Global Industrial Vending Machine market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Industrial Vending Machine trade, costs, and supply chains

- Industrial Vending Machine market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Industrial Vending Machine market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Industrial Vending Machine market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Industrial Vending Machine supply chain analysis

- Industrial Vending Machine trade analysis, Industrial Vending Machine market price analysis, and Industrial Vending Machine supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Industrial Vending Machine market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Fastenal

- Grainger (KeepStock)

- MSC Industrial Supply

- Würth Industrie Service (ORSYmat)

- Airgas

- Motion Industries

- Applied Industrial Technologies

- Snap-on (AutoCrib)

- Stanley Black & Decker (CribMaster)

- SupplyPoint

- SupplyPro

- IVM Inc.

- Intelligent Dispensing Solutions (IDS)

- Apex Supply Chain Technologies

- SecuraStock

- Hoffmann Group (GARANT Tool24)

- Kennametal (ToolBOSS)

- ISCAR (Matrix Tool Management)

- Rubix Group (Brammer Buck & Hickman)

- RS Group (RS Components)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.04 Billion |

| Forecasted Market Value ( USD | $ 6.82 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |