Steel Straws Market

The steel straws market sits at the intersection of sustainability-led consumption and practical foodservice hygiene. Stainless-steel variants - predominantly 304 and 316 grades - are favored for durability, heat resistance, and dishwasher safety, with product lines spanning straight, bent, wide (smoothie/boba), and telescopic/collapsible formats. Top applications include home use, cafés/QSRs and full-service restaurants, corporate gifting and promotional merchandise, travel/outdoor, and institutional catering. Recent trends emphasize silicone mouthpieces for comfort, PVD-coated colors, laser-engraved branding for B2B, and retail “starter kits” bundled with cleaning brushes and pouches. Demand is reinforced by bans or discouragement of single-use plastics, corporate ESG procurement policies, and retailer private labels. Competition comes from paper, glass, bamboo, silicone, and “sippable” lid designs; steel’s edge is longevity and perceived premium positioning, though it faces cost sensitivity in mass-market hospitality. Supply chains concentrate tube forming, cutting, deburring, passivation, ultrasonic cleaning, and polishing in Asian manufacturing hubs, with growing near-shoring for branded sets. E-commerce marketplaces and D2C brands drive discoverability, while B2B distributors and hospitality suppliers anchor repeat volumes. Quality assurance focuses on food-contact compliance (e.g., LFGB/FDA), heavy-metal limits, weld integrity, and consistent passivation to reduce corrosion risk. Strategic priorities include price hedging for stainless input costs, anti-counterfeit packaging, and circularity programs (scrap buy-back/recycling). Looking ahead, differentiated finishes, ergonomic designs, and co-branded corporate kits will underpin premiums, while value lines target catering and education segments seeking robust, washable alternatives as part of broader reuse initiatives.Steel Straws Market Key Insights

- Policy & ESG pull-through: Single-use plastic restrictions and corporate ESG mandates convert trials into steady B2B orders. Hospitality and workplace cafés increasingly standardize steel options or mixed “reusables” sets to meet sustainability KPIs and reduce recurring consumables.

- Format diversification wins: Beyond classic straight/bent designs, wide and telescopic straws serve smoothies/boba and on-the-go use. Multi-diameter kits and silicone tips enhance comfort and inclusivity (hot/cold beverages), broadening household and gifting appeal.

- Branding & customization as margin levers: Laser engraving, PVD colors, and bespoke packaging turn functional items into promotional merchandise. Corporate gifting, events, and influencer boxes sustain higher ASPs versus unbranded commodity packs.

- Retail mix shift to e-commerce: Marketplaces accelerate entry for niche brands and private labels, while subscription “refill/replace brush” add-ons lift lifetime value. Brick-and-mortar prioritizes curated kits and seasonal colorways for gifting peaks.

- Hospitality adoption cycles: QSRs test stainless primarily for on-premise consumption with controlled returns; full-service and boutique cafés deploy table-stock or bar-back models. Success hinges on inventory controls, cleaning SOPs, and loss mitigation.

- Quality & compliance moat: Food-grade declarations, surface passivation, weld smoothness, and ultrasonic cleaning differentiate reputable manufacturers. Documented LFGB/FDA compliance and third-party audits reduce retailer risk and returns.

- Input-cost management: Stainless price volatility and freight costs pressure entry-level SKUs. Larger players hedge material, optimize tube yields, and standardize components (tips/brushes) to protect margins and maintain competitive price tiers.

- Design for hygiene & durability: Rounded edges, polished interiors, and included brushes improve user experience and reduce breakage/loss. Dishwasher safety messaging and storage pouches matter for travel/outdoor cohorts.

- Circularity & end-of-life: Take-back/scrap credit programs and recycled-content messaging resonate with retailers and corporates. Clear guidance on cleaning and longevity supports claims of waste reduction versus single-use alternatives.

- Competitive substitutes: Paper and molded-fiber straws win where reusables are impractical; glass and bamboo appeal to niche aesthetics. “Sippable lids” in QSRs partially bypass straw needs - steel vendors counter with experiential and premium positioning.

Steel Straws Market Reginal Analysis

North America

Adoption is propelled by municipal/state plastic-straw restrictions, sustainability commitments by national café/QSR chains, and corporate procurement programs. Retailers emphasize multi-pack kits with silicone tips and giftable packaging. Loss control and cleaning SOPs are crucial for hospitality; dishwashing capacity, brush availability, and staff training influence repeat orders. E-commerce drives discovery for niche colors and engraved personalization, while wholesale distributors supply education and workplace cafés. Competition from “no-straw” lids and paper straws persists in high-throughput QSRs; steel wins in premium cafés, bars, and home use. Private labels and promotional suppliers increasingly source from audited Asian plants with quick-ship U.S. inventory.Europe

EU single-use plastics policies and retailer sustainability playbooks sustain steady demand, particularly in DACH, Nordics, Benelux, and the UK. Buyers prioritize LFGB compliance, documentation traceability, and high-grade 18/8 or 18/10 finishes. Hospitality integrates steel within broader reuse schemes (deposit/return or table-service), often paired with glassware standards. Design aesthetics matter - matte PVD coatings and minimalist branding play well in specialty retail. Logistics strategies include regional warehousing to minimize lead times and carbon footprint. Paper straws remain common for large events/QSRs; steel straws position as durable, premium complements, with corporate gifting and tourism retail (museum shops, airports) providing incremental volumes.Asia-Pacific

APAC is both manufacturing hub and a growing demand center. China, India, and Southeast Asia host tube-forming and finishing clusters, enabling cost-effective OEM/ODM programs and rapid customization. Urban consumers in Japan, Korea, Australia, and tier-1 Chinese cities adopt steel for home and specialty café use, aided by online marketplaces. Boba/smoothie culture supports wide-diameter variants, while travel/outdoor segments buy collapsible kits. Brands lean on quality differentiation (passivation quality, weld smoothness) to avoid corrosion complaints in humid climates. Regional regulations are mixed; city-level pilots on reuse spur hospitality trials. Export-oriented suppliers maintain audit readiness and multilingual compliance dossiers.Middle East & Africa

Demand is emerging via premium hospitality, tourism, and corporate gifting linked to sustainability initiatives. Hotel and resort chains deploy reusable programs in bars and beach venues where durability and easy cleaning are vital. Climate and saline environments elevate requirements for 316-grade, polished surfaces, and robust passivation. Retail growth concentrates in GCC modern trade and e-commerce; engraving and gift sets align with event-driven purchasing. Regulatory momentum on single-use plastics varies by country, so education on hygiene, storage, and lifecycle benefits supports adoption. Local distribution partnerships and inventory availability improve service levels for F&B groups and event caterers.South & Central America

Adoption tracks urban sustainability agendas and hospitality upgrades in Brazil, Chile, Colombia, Mexico, and Caribbean tourist hubs. Specialty cafés and bars lead, favoring colorful PVD finishes and branded sets for merchandise walls. Import duties and freight costs favor consolidated sourcing and private-label programs, with regional distributors bundling steel straws into broader barware/F&B catalogues. Paper straws remain prevalent in high-volume QSRs; steel gains in premium venues and home kits sold online. Retailers seek clear compliance documentation and corrosion-resistant finishes suited to tropical humidity. Event-driven demand peaks around holidays and tourism seasons, with corporate gifting providing off-season stability.Steel Straws Market Segmentation

By Type

- 12 mm

- 9 mm

- 6 mm

- Others

By Application

- Supermarkets/Hypermarkets

- Independent Retailers

- Convenience Stores

- Online Retailers

- Others

Key Market players

FinalStraw, Klean Kanteen, YETI, Hydro Flask, Stanley, OXO, Bambaw, Ever Eco, Cheeki, Hiware, StrawExpert, Onyx Containers, EcoVessel, S'well, Greens SteelSteel Straws Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Steel Straws Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Steel Straws market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Steel Straws market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Steel Straws market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Steel Straws market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Steel Straws market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Steel Straws value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Steel Straws industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Steel Straws Market Report

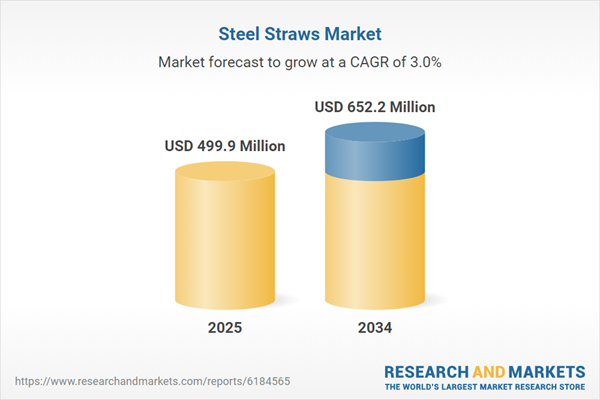

- Global Steel Straws market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Steel Straws trade, costs, and supply chains

- Steel Straws market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Steel Straws market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Steel Straws market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Steel Straws supply chain analysis

- Steel Straws trade analysis, Steel Straws market price analysis, and Steel Straws supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Steel Straws market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- FinalStraw

- Klean Kanteen

- YETI

- Hydro Flask

- Stanley

- OXO

- Bambaw

- Ever Eco

- Cheeki

- Hiware

- StrawExpert

- Onyx Containers

- EcoVessel

- S'well

- Greens Steel

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 499.9 Million |

| Forecasted Market Value ( USD | $ 652.2 Million |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |